Brazil Food Preservatives Market

Brazil Food Preservatives Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural and Synthetic) and Application (Beverages, Dairy and Frozen Products, Bakery, Meat, Poultry, Seafood Products, Confectionery, and Other) By Function Type (Anti-oxidant, Anti-microbial, Others), and Brazil Food Preservatives Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Food Preservatives Market Size Insights Forecasts to 2035

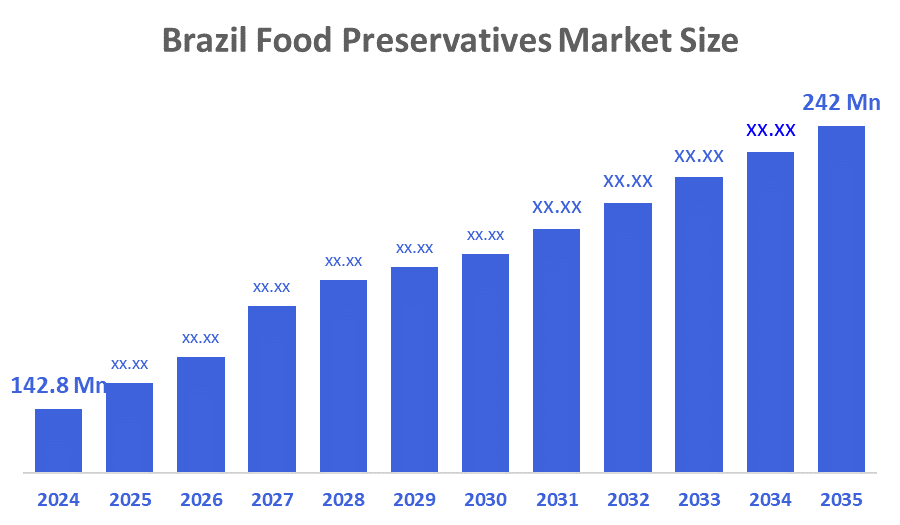

- The Brazil Food Preservatives Market Size Was Estimated at USD 142.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.9% from 2025 to 2035

- The Brazil Food Preservatives Market Size is Expected to Reach USD 242 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Food Preservatives Market Size is anticipated to Reach USD 242 Million by 2035, Growing at a CAGR of 4.9% from 2025 to 2035. The Brazil food preservatives market share is growing because of the increasing preferences for packaged and processed foods, driven by evolving consumer requirements for convenience. Advancements in food preservation technologies are enhancing product safety and shelf life, catering to both domestic and export markets. Additionally, regulatory emphasis on quality standards and rising awareness about food safety are supporting the market growth.

Market Overview

Food preservatives are substances added to food to prevent spoilage caused by bacteria, molds, and yeast. They help extend shelf life, maintain freshness, preserve color and flavor, and ensure food safety by slowing down chemical changes and microbial growth in food products. Additionally, the Brazil food preservatives market is driven by rising demand for processed and packaged foods, rapid urbanization, changing lifestyles, growing population, increasing working-class consumers, expanding food and beverage industry, longer shelf-life requirements, improved cold chain infrastructure, and heightened awareness about food safety and quality standards. Moreover, technological innovations in the development of natural and synthetic preservatives are enhancing their effectiveness while addressing the rising demand for clean-label and healthier food options. These advancements ensure better safety standards, longer shelf life, and improved taste preservation, which are critical for meeting both regulatory requirements and consumer expectations.

Additionally, the incorporation of advanced technologies like smart packaging and precision blending of preservatives is improving the efficiency and effectiveness of preservation methods. These innovations ensure longer shelf life and better food quality, supporting the Brazil food preservatives market growth. For instance, in 2024, Brazil implemented RDC No. 843/2024 and IN No. 281/2024, establishing a new regulatory framework for food products. These rules streamline processes for lower-risk foods while setting distinct pathways for product registration, notification, and compliance with ANVISA.

Report Coverage

This research report categorizes the market for the Brazil food preservatives market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil food preservatives market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil food preservatives market.

Driving Factors

The Brazil food preservatives market is driven by rising demand for processed and ready-to-eat foods, growing urban population, and changing lifestyles. Increasing focus on food safety and longer shelf life also supports market growth. Innovation in natural and clean-label preservatives, such as plant-based antioxidants and fermentation-derived ingredients, is boosting adoption. Technological advancements in food processing, encapsulation techniques, smart packaging, and controlled-release systems help improve preservative effectiveness. Expansion of the food and beverage industry, strong retail networks, and export-oriented food production further accelerate market growth in Brazil.

Restraining Factors

The Brazil food preservatives market faces restraints due to growing consumer preference for fresh and organic foods, strict government regulations, and concerns about the health effects of synthetic additives. High costs of natural preservatives, limited awareness among small manufacturers, clean-label pressures, and reformulation challenges also restrict market growth and product adoption.

Market Segmentation

The Brazil food preservatives market share is categorized by type, application, and function.

- The synthetic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil food preservatives market is segmented by type into natural and synthetic. Among these, the synthetic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its strong antimicrobial and antioxidant performance at a lower cost than natural alternatives. Food manufacturers prefer synthetic preservatives to achieve consistent shelf-life extension, stable taste, and uniform product quality in mass production. These preservatives are easier to source, have longer storage stability, and work effectively across a wide range of food products such as baked goods, beverages, meat, and dairy. Additionally, established regulatory approvals and well-developed supply chains make synthetic preservatives more practical for large-scale food processing in Brazil.

- The bakery segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil food preservatives market is segmented by application into beverages, dairy and frozen products, bakery, meat, poultry, seafood products, confectionery, and other. Among these, the bakery segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to strong and consistent consumer demand for packaged bread, cakes, biscuits, and snack products across urban and semi-urban areas. These products are highly sensitive to moisture and microbial growth, making preservatives essential for preventing mold and extending shelf life. The rapid growth of supermarkets and convenience stores in Brazil increases the need for longer product durability during transportation and storage. In addition, large-scale commercial bakeries depend on preservatives to maintain product freshness, texture, taste, and food safety in high-volume manufacturing and distribution.

- The anti-microbial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil food preservatives market is segmented by function type into anti-oxidant, anti-microbial, and others. Among these, the anti-microbial segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to these preservatives are essential for inhibiting the growth of bacteria, molds, and yeasts in a wide range of food products. High consumption of bakery, dairy, meat, and packaged foods in Brazil increases the need for antimicrobial agents to ensure food safety and extend shelf life. Additionally, food manufacturers rely on these preservatives to maintain product quality, prevent spoilage during transportation and storage, and comply with regulatory standards. Their effectiveness, versatility, and cost-efficiency make them the most widely used preservative type in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil food preservatives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Corbion

- Brenntag

- Celanese

- Chr. Hansen

- Cargill

- Kerry Group

- DSM

- Tate & Lyle

- BASF

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, Prinova Europe is introducing a new plant-based antimicrobial called PlantGuard AM, which inhibits yeasts, molds, and bacteria, addressing the growing demand for natural preservatives. This proprietary blend of natural plant extracts possesses antioxidant properties and is effective in extending freshness and shelf life, delaying rancidity, inhibiting microbial growth, and preserving flavor and color. Preservatives that are heat-stable and have a neutral taste outperform synthetic alternatives in various foods and beverages. In a variety of product categories, including dairy, fish, meat, fruit, vegetables, cereals, and juices, PlantGuard AM can take the place of artificial preservatives. Prinova's technical team works with customers to select the optimal solution for their brands, and its low dose rate and cost-in-use enable economies of scale.

- In June 2022, Chinova Bioworks developed Chiber, a natural preservative for processed food and drink products. Chitosan, a dietary fibre obtained from white button mushrooms, prevents processed foods from microbial deterioration caused by mold. Chinova Bioworks conducted a study using accurate food models to understand the antimicrobial properties of the Chiber ingredient and determine the optimal amounts needed for a shelf life comparable to synthetic preservatives. The cost-effective solution makes Chiber an affordable solution for food and beverage processors. Chinova developed a market-ready product to replace synthetic preservatives in Canada, providing data and evidence for potential clients.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil food preservatives market based on the below-mentioned segments:

Brazil Food Preservatives Market, By Type

- Natural

- Synthetic

Brazil Food Preservatives Market, By Application

- Beverages

- Dairy and Frozen Products

- Bakery

- Meat

- Poultry

- Seafood Products

- Confectionery

- Other

Brazil Food Preservatives Market, By Function Type

- Anti-oxidant

- Anti-microbial

- Others

FAQ’s

Q1: What are food preservatives?

- Food preservatives are substances added to food to prevent spoilage, inhibit microbial growth, and extend shelf life while maintaining quality, taste, and safety.

Q2: Which segment dominates the Brazil food preservatives market by type?

- The synthetic preservatives segment dominates due to cost-effectiveness, stability, and widespread use in processed foods.

Q3: Which application segment is the largest in Brazil?

- Bakery products are dominant due to high consumption and the need for extended shelf life.

Q4: Which function type is most used?

- Antimicrobial preservatives are most used to prevent bacterial, yeast, and mold growth.

Q5: What are the key driving factors of the market?

- Growing processed food consumption, urbanization, changing lifestyles, technological innovation, natural preservative development, and a focus on food safety.

Q6: What are the major restraints?

- Consumer preference for fresh/organic foods, health concerns over synthetic additives, strict regulations, and higher costs of natural preservatives.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 148 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |