Brazil Foodservice Market

Brazil Foodservice Market Size, Share, and COVID-19 Impact Analysis, By Foodservice Type (Cafes and Bars, Cloud Kitchens, Full-Service Restaurants, Quick-Service Restaurants), By Location (Leisure, Lodging, Retail, Standalone, Travel), By End-User (Industrial Premises, Commercial and Office Premises, Hospital & Nursing Homes, Educational Premises, In-Transit Food Service, And Sports Centers/Malls), and Brazil Foodservice Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Foodservice Market Insights Forecasts to 2035

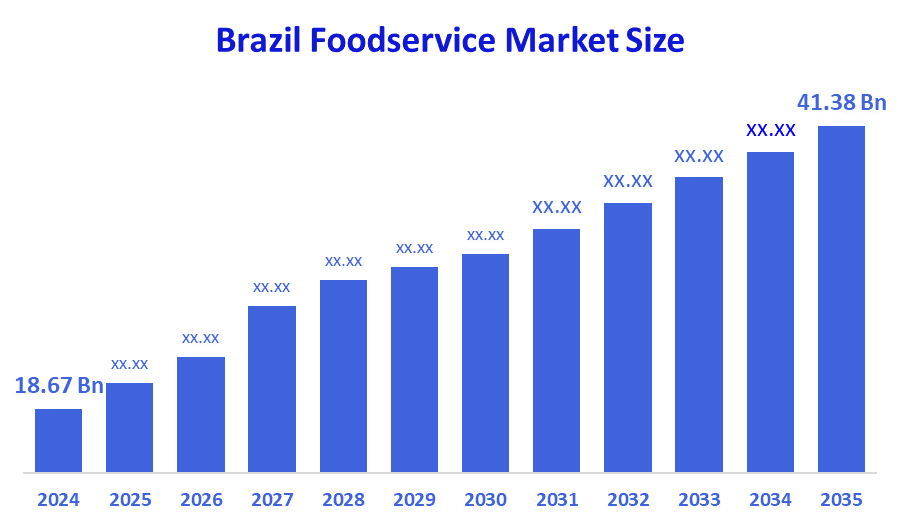

- The Brazil Foodservice Market Size Was Estimated at USD 18.67 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.5% from 2025 to 2035

- The Brazil Foodservice Market Size is Expected to Reach USD 41.38 Billion by 2035

According To A Research Report Published By Decision Advisors, The Brazil Foodservice Market Size Is Anticipated To Reach USD 41.38 Billion By 2035, Growing At A CAGR Of 7.5% From 2025 To 2035. The Brazil Foodservice Market Is Driven By Rising Urbanization, Increasing Disposable Income, Growing Dining-Out Culture, Expansion Of Quick-Service And Casual Dining Chains, Rising Tourism, Digital Food Delivery Platforms, And Evolving Consumer Preferences Toward Convenience, Variety, And Healthier Menu Options.

Market Overview

Foodservice refers to the business of preparing and serving food and beverages to individuals outside their homes. The scope of this industry includes restaurants, cafes, hotels, catering services, educational institutions, hospitals, and food delivery services. In simple terms, the foodservice industry is involved in every meal that is prepared by someone else and consumed by you. The main objective of the foodservice industry is to provide people with delicious, convenient, and ready, to, eat meals. Additionally, the Brazil foodservice market is expanding as a result of various factors such as rising urban population, increasing disposable income, expanding middle class, growing popularity of dining out, digital food delivery adoption, tourism growth, and evolving consumer preferences for convenience, variety, and healthier meal options.

The Brazil Foodservice market is expected to undergo significant change with the influence of the increasing adoption of digital technologies and online ordering platforms. Such a trend may be instrumental in creating a more seamless customer experience, and thus, operational efficiency may be enhanced for foodservice operators. In addition, customers in Brazil will likely opt for healthy menu choices such as plant-based dishes, organic foods, and low-calorie offerings. This trend is anticipated to have a significant impact on restaurant menus and the promotional strategies adopted by them in the future.

Brazilians have adopted a notion of fast and healthy living that has resulted in a demand for convenient and healthy meals. The preference for grocery delivery, pre-packaged meals, plant-based, and locally sourced foods is soaring, which in turn is leading foodservice to grow by responding to the demands of health-conscious consumers.

Brazils diverse cultural heritage serves as an inspiration for unique culinary experiences. Restaurants blend Indigenous, African, European, and Asian traditions, thus presenting revolutionary dishes to customers, while supply firms offering ingredients become enablers for chefs to experiment with and meet the ever, changing tastes of customers. Additionally, the Technology revolution is also impacting Brazilian foodservice. Online ordering, delivery apps, and digital payments are making operations more convenient, efficient, and satisfying for customers, thereby increasing competition and creating new opportunities for the growth of restaurants and foodservice providers.

Report Coverage

This research report categorizes the market for the Brazil foodservice market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil foodservice market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil foodservice market.

Driving Factors

The Brazil foodservice market is driven by changing consumer lifestyles, with growing demand for convenient, healthy, and ready-to-eat meals. Rising disposable income encourages more dining out across urban and middle-class households. Cultural diversity fuels culinary innovation, offering unique dining experiences. Digital transformation, including online ordering, delivery apps, and digital payments, enhances convenience and operational efficiency. Additionally, tourism and large-scale events boost demand for diverse cuisines, creating opportunities for restaurants and foodservice providers to expand, innovate, and cater to both local and international consumers.

Restraining Factors

The Brazil foodservice market faces restraints from economic fluctuations, rising food and labor costs, and supply chain challenges. Additionally, health crises, stringent regulations, and intense competition can limit growth. Changing consumer spending habits during downturns and dependence on technology for delivery services also pose challenges, affecting profitability and slowing expansion for foodservice operators across the country.

Market Segmentation

The Brazil Foodservice market share is classified into foodservice type, location, and end user.

- The quick-service restaurants segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil foodservice market is segmented by foodservice type into cafes and bars, cloud kitchens, full-service restaurants, and quick-service restaurants. Among these, the quick-service restaurants segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Quick-service restaurants (QSRs) dominate due to their convenience, affordability, and wide accessibility, catering to busy urban consumers and time-sensitive lifestyles. The growing adoption of food delivery apps and digital ordering has further boosted their reach. QSRs provide standardized, fast, and reliable meals, attracting both middle- and upper-class consumers. Additionally, the expansion of international and local QSR chains across cities, coupled with marketing strategies targeting younger demographics, reinforces their leading position in the competitive Brazilian foodservice market.

- The standalone segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil foodservice market is segmented by location into leisure, lodging, retail, standalone, and travel. Among these, the standalone segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The standalone segment leads Brazil’s foodservice market because it offers flexibility, accessibility, and diverse menu options to a broad consumer base. Unlike foodservices tied to hotels, malls, or travel hubs, standalone restaurants cater to everyday dining needs, attracting both residents and casual diners. Their independence allows quick adaptation to trends, pricing strategies, and delivery services, enhancing customer reach. Additionally, urbanization and rising disposable incomes drive demand for convenient, affordable, and varied dining experiences, strengthening standalone establishments’ dominance in the market.

- The commercial and office premises segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil foodservice market is segmented by end user into industrial premises, commercial and office premises, hospital & nursing homes, educational premises, in-transit food service, and sports centers/malls. Among these, the commercial and office premises segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The commercial and office premises segment dominates due to the high concentration of urban professionals seeking convenient, quick, and quality meals during work hours. Corporate cafeterias, nearby restaurants, and food delivery services cater to this steady demand, ensuring consistent revenue. Rising disposable incomes and changing work lifestyles encourage employees to spend on dining out or ordering in. Compared to industrial, educational, healthcare, or transit-based services, this segment offers higher frequency, volume, and profitability, reinforcing its market leadership.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil foodservice market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arcos Dorados Holdings

- Burger King Brasil

- Doctor’s Associates (Subway)

- Domino’s Pizza Brasil

- International Meal Company

- Grupo Madero

- Starbucks Brasil

- KFC Brasil

- Wendy’s Brasil

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In March 2023, Sodexo Brazil launched a smart nutrition platform across 120 corporate and educational client sites, integrating AI to personalize meal recommendations based on dietary needs and consumption patterns by enhancing customer retention and aligning with Brazil's growing focus on health-conscious eating.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Brazil foodservice market based on the below-mentioned segments:

Brazil Foodservice Market, By Foodservice Type

- Cafes and Bars

- Cloud Kitchens

- Full-Service Restaurants

- Quick-Service Restaurants

Brazil Foodservice Market, By Location

- Leisure

- Lodging

- Retail

- Standalone

- Travel

Brazil Foodservice Market, By End-User

- Industrial Premises

- Commercial and Office Premises

- Hospital & Nursing Homes

- Educational Premises

- In-Transit Food Service

- Sports Centers/Malls

FAQ’s

1. What is the Brazil foodservice market?

It includes restaurants, cafes, bars, cloud kitchens, catering services, and food delivery platforms serving food and beverages outside the home.

2. Which segment dominates the Brazil foodservice market?

Quick-service restaurants dominate due to affordability, convenience, and strong delivery platform integration.

3. What are the main growth drivers of the market?

Rising disposable income, urbanization, digital food delivery, changing lifestyles, tourism, and increasing demand for convenient dining options.

4. Which location segment leads the market?

Standalone foodservice outlets lead due to their flexibility, accessibility, and ability to serve daily dining needs.

5. What are the key challenges faced by the market?

High operating costs, economic fluctuations, intense competition, regulatory compliance, and supply chain disruptions.

6. How does digitalization impact the market?

Digital ordering, mobile apps, and delivery services enhance customer convenience and improve operational efficiency

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |