Brazil Freight and Logistics Market

Brazil Freight and Logistics Market Size, Share, By Logistics Function (Courier Express and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage, and Other Services), By End User Industry (Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), Brazil Freight and Logistics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Freight and Logistics Market Insights Forecasts to 2035

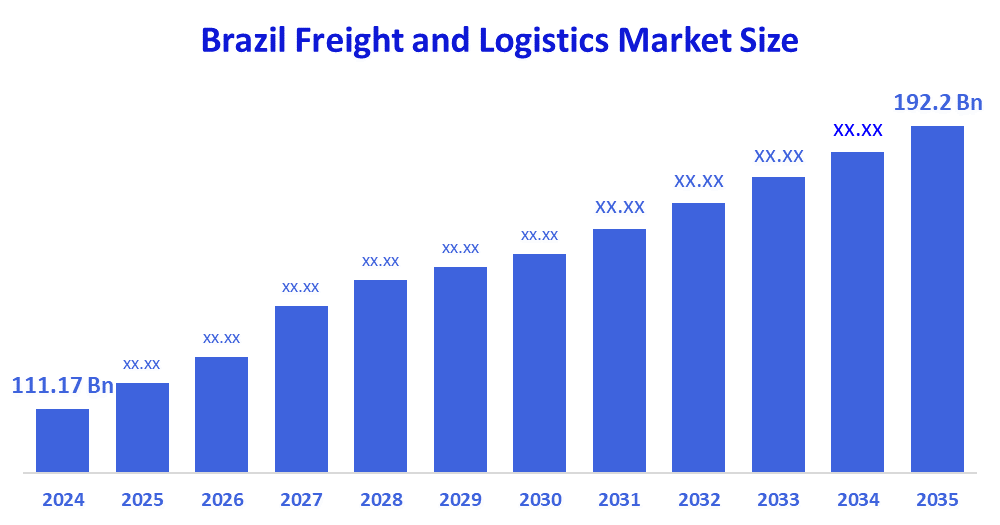

- Brazil Freight and Logistics Market Size 2024: USD 111.17 Bn

- Brazil Freight and Logistics Market Size 2035: USD 192.2 Bn

- Brazil Freight and Logistics Market CAGR 2024: 5.1%

- Brazil Freight and Logistics Market Segments: Logistics Function and End User Industry.

Freight and logistics refer to the planning, management, and execution of transporting goods from origin to destination. It includes freight movement by road, rail, air, and sea, along with warehousing, inventory management, packaging, distribution, and coordination of supply chain activities to ensure timely, cost-efficient, and secure delivery of products. Furthermore, Brazil’s freight and logistics market is growing due to rising domestic trade, increasing agricultural and industrial output, expansion of manufacturing hubs, modernization of transport infrastructure, and higher demand for efficient cargo movement to support exports and regional distribution across the country.

The logistics investment program (PIL) and other government initiatives have played a crucial role in driving the growth of the Brazil freight and logistics market. By attracting private investments and fostering public-private partnerships, the government has accelerated the development of critical infrastructure projects. For instance, the expansion of the Port of Santos, the largest port in Latin America, has increased its capacity to handle larger volumes of cargo, boosting trade and enhancing the efficiency of logistics operations. These initiatives not only improve the logistics infrastructure but also create employment opportunities and stimulate economic growth.

The Brazil freight and logistics market share has been positively impacted by the increasing adoption of digital technologies. The use of IoT devices for real-time tracking and monitoring of shipments has enabled logistics companies to enhance visibility and optimize their operations. For example, leading logistics providers have implemented AI-powered route optimization systems that analyze traffic patterns and weather conditions to determine the most efficient routes for delivery. This has resulted in reduced fuel consumption, lower operational costs, and improved delivery times. Furthermore, blockchain technology is being utilized to enhance supply chain transparency and security, enabling stakeholders to track and verify the authenticity of goods throughout the logistics process.

Market Dynamics of the Brazil Freight and Logistics Market:

Brazil’s freight and logistics market is driven by strong agricultural exports, expanding manufacturing activities, and rising domestic consumption. Growth in e-commerce has increased demand for faster transportation, last-mile delivery, and warehousing services. Government investments in road, port, and rail infrastructure are improving connectivity and reducing logistics costs. Additionally, digital transformation through fleet management systems, automation, and real-time tracking enhances operational efficiency, encouraging logistics providers to expand services and modernize supply chain networks across Brazil.

Brazil’s freight and logistics market faces restraints such as inadequate and uneven transport infrastructure, high logistics and fuel costs, and heavy dependence on road transport. Regulatory complexity, port congestion, and bureaucratic delays increase transit time. Additionally, limited rail and inland waterway integration reduces efficiency and raises overall supply chain costs.

Brazil’s freight and logistics market presents strong opportunities through infrastructure modernization, including the expansion of railways, ports, and inland waterways. Growth in e-commerce and omnichannel retail creates demand for advanced warehousing, cold chain, and last-mile delivery services. Adoption of digital technologies such as AI, IoT, and data analytics offers efficiency gains. Additionally, rising agricultural exports and trade integration with global markets open opportunities for specialized logistics, multimodal transport, and value-added supply chain services across Brazil.

Market Segmentation

The Brazil freight and logistics market share is classified into logistics function and end-user industry.

By Logistics Function:

The Brazil freight and logistics market is divided by logistics function into courier express and parcel (CEP), freight forwarding, freight transport, warehousing and storage, and other services. Among these, the freight transport segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Freight transport dominates because the country relies heavily on road networks to move goods across vast geographic distances. Major industries such as agriculture, mining, and manufacturing require continuous bulk transportation of commodities and raw materials. Limited rail and inland waterway coverage further increases dependence on road freight. Additionally, strong domestic trade and export activities generate high volumes of long-haul cargo movement, making freight transport the most essential and revenue-generating logistics function in Brazil.

By End User Industry:

The Brazil freight and logistics market is divided by end user industry into agriculture, fishing and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others. Among these, the agriculture, fishing, and forestry segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Agriculture, fishing, and forestry dominate because the country is one of the world’s largest producers and exporters of agricultural commodities. Large volumes of soybeans, corn, sugarcane, coffee, meat, and timber require constant transportation from farms to processing units, warehouses, and ports. These activities depend heavily on road, rail, and port logistics, generating higher freight demand than other industries. Seasonal harvest cycles further intensify logistics activity, reinforcing this segment’s market dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil freight and logistics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Freight and Logistics Market:

- JSL S.A.

- Rumo Logística

- Hidrovias do Brasil SA

- EcoRodovias

- Tegma Gestão Logística

- Braspress Transportes Urgentes

- FedEx

- Deutsche Post DHL Group

- Others

Recent News in Brazil Freight and Logistics Market:

In May 2023, Petrobras, Brazil's state-owned oil firm, approved a new gasoline and diesel pricing strategy that decreased expenses by 13%. However, by August 2023, worldwide oil price variations had caused a considerable increase in gasoline prices by 16.3% and diesel by 25.8%. This shift influences the logistics market, as gasoline costs are a major operational expense.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil freight and logistics market based on the below-mentioned segments:

Brazil Freight and Logistics Market, By Logistics Function

- Courier Express Parcel (CEP)

- Freight Forwarding

- Freight Transport

- Warehousing and Storage

- Other Services

Brazil Freight and Logistics Market, By End User Industry

- Agriculture

- Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas

- Mining and Quarrying

- Wholesale and Retail Trade

- Others

FAQ

Q1: What is the Brazil freight and logistics market?

It encompasses the transportation, storage, and distribution of goods across Brazil, including road, rail, air, and waterways, along with warehousing, freight forwarding, and supply chain services.

Q2: Which segment dominates the market?

The freight transport segment dominates due to high demand for moving agricultural, industrial, and export goods across the country.

Q3: Which end-user industry is the largest?

Agriculture, fishing, and forestry are the dominant end-user segments because of Brazil’s large-scale commodity production and exports.

Q4: What drives market growth?

Key drivers include increasing agricultural exports, e-commerce growth, infrastructure development, and the adoption of digital logistics technologies.

Q5: What restrains market growth?

Challenges include inadequate infrastructure, high logistics costs, port congestion, regulatory complexity, and overreliance on road transport.

Q6: What opportunities exist in this market?

Opportunities lie in multimodal transport, modern warehousing, cold chain logistics, digital solutions, and expanding export-oriented freight services.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |