Brazil General Anesthesia Drugs Market

Brazil General Anesthesia Drugs Market Size, Share, and COVID-19 Impact Analysis, By Type of Drugs (Propofol, Sevoflurane, Desflurane, Others), By Route of Administration (Intravenous, Inhalation), By Surgery Type (Knee and Hip replacements, Heart surgeries, Cancer surgery, General surgery), and Brazil General Anesthesia Drug Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil General Anesthesia Drugs Market Insights Forecasts to 2035

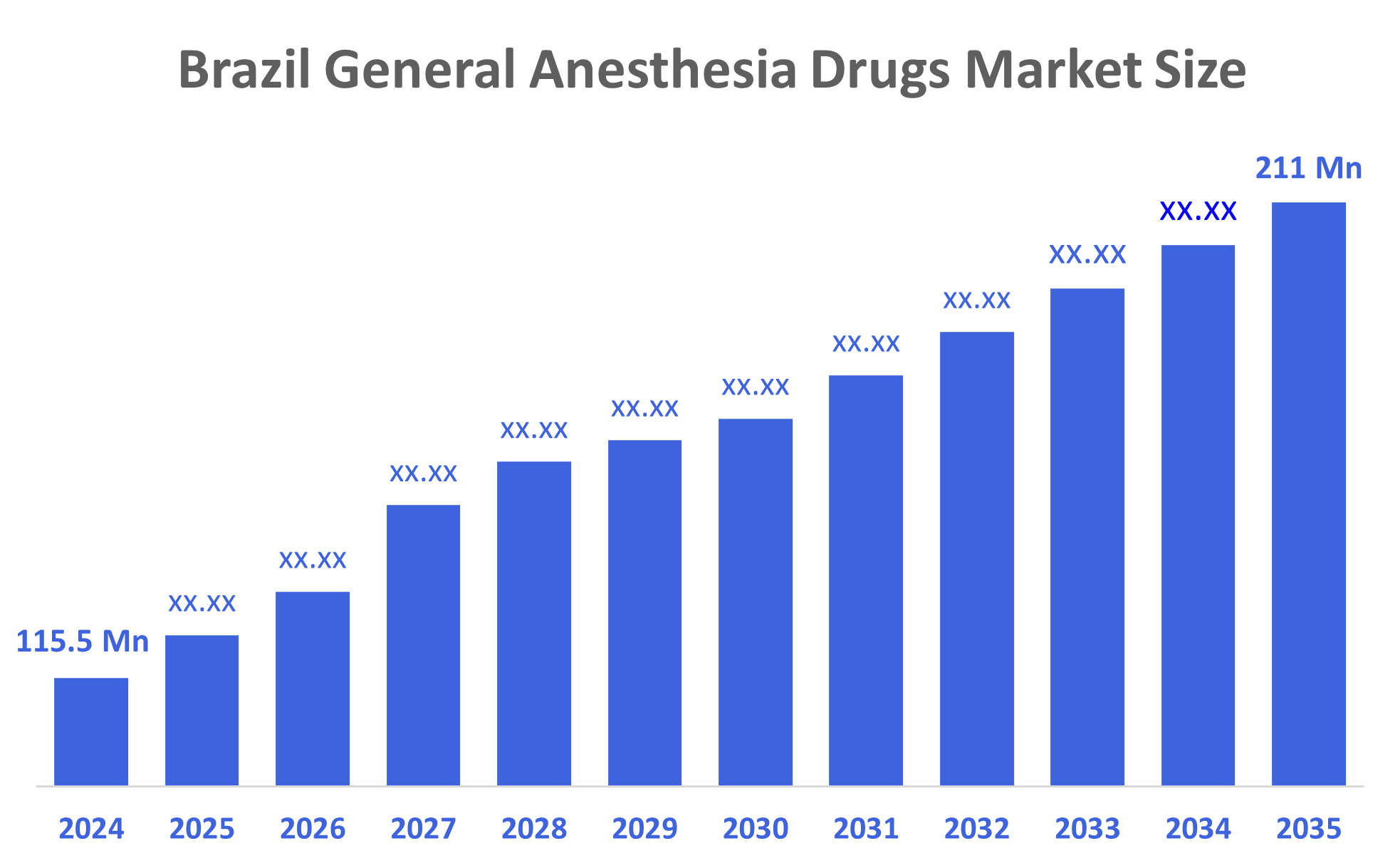

- The Brazil General Anesthesia Drugs Market Size Was Estimated at USD 115.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.6% from 2025 to 2035

- The Brazil General Anesthesia Drugs Market Size is Expected to Reach USD 211 Million by 2035

According to a research report published by Decisions Advisors, The Brazil General Anesthesia Drugs Market size is Anticipated to Reach USD 211 Million by 2035, Growing at a CAGR of 5.6% from 2025 to 2035. This projected growth is driven by several critical factors, including increasing surgical volumes, advancements in anesthesia technology, rising prevalence of chronic diseases, and supportive government initiatives.

Market Overview

General anesthesia drugs are medications used to induce a reversible state of unconsciousness, pain relief, and muscle relaxation during surgical procedures. They prevent patients from feeling pain or awareness during operations and are administered through intravenous injection or inhalation to ensure safe and controlled anesthesia throughout surgery. Moreover, Brazil’s general anesthesia drug market is growing due to more surgeries, better hospital facilities, and rising cases of chronic diseases. Modern anesthesia techniques, improved drug safety, and government focus on healthcare development are also supporting the market’s steady expansion. Additionally, the new technologies in Brazil’s general anesthesia drug market include opioid-free anesthesia, advanced monitoring systems, and modern inhalation delivery methods. These innovations improve patient safety, reduce side effects, enhance precision in drug dosing, and expand anesthesia use beyond traditional surgeries to intensive care settings.

Report Coverage

This research report categorizes the market for the Brazil general anesthesia drugs market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil general anesthesia drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil general anesthesia drugs market

Driving Factors

The Brazil general anesthesia drugs market is growing due to an increasing number of surgical procedures, expanding hospital infrastructure, and rising cases of chronic diseases. In the anesthesia drugs market Propofol remains the leading drug due to its rapid action and safety and boost the Brazil market rapidly. Additionally, recent developments include wider adoption of inhalation anesthesia in ICUs, advanced anesthesia monitoring systems, and investment in modern healthcare technology. The government’s focus on improving surgical care and accessibility, along with technological innovations and new drug formulations, continues to strengthen market growth across Brazil’s healthcare sector.

Restraining Factors

The Brazil general anesthesia drug market is restrained by several challenges, including the high cost of anesthesia drugs, limited access to advanced medicines in rural regions, and dependence on imported formulations. Additionally, a shortage of trained anesthesiologists, strict regulatory requirements for new drug approvals, and concerns over potential side effects such as respiratory issues or allergic reactions further hinder market expansion and slow the adoption of innovative anesthesia solutions across Brazil’s healthcare system.

Market Segmentation

The Brazil general anesthesia drugs market share is categorized by type of drug and route of administration, and surgery type.

The propofol segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil general anesthesia drugs market is segmented by type of drug into propofol, sevoflurane, desflurane, and others. Among these, the propofol segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to it provides rapid onset and recovery, making it highly suitable for various surgical procedures. It allows anesthesiologists to maintain precise control over anesthesia depth and duration. The drug’s favorable safety profile, reduced postoperative side effects such as nausea and vomiting, and widespread hospital availability further enhance its preference and consistent demand across Brazil’s healthcare sector.

The intravenous segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil general anesthesia drugs market is segmented by route of administration into intravenous, inhalation. Among these, the intravenous segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to it providing a quick onset and precise control of anesthesia, allowing doctors to adjust dosage easily during surgery. It ensures smoother induction and faster recovery compared to inhalation methods. IV administration also reduces complications, improves patient safety, and is widely preferred in hospitals and surgical centers across Brazil for its effectiveness and reliability in managing anesthesia.

The knee and hip replacements segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil general anesthesia drugs market is segmented by surgery type into knee and hip replacements, heart surgeries, cancer surgery, and general surgery. Among these, the knee and hip replacements segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to these surgeries being increasingly common among the aging population and patients with arthritis or joint injuries. Such procedures require full anesthesia for pain control and muscle relaxation. Growing orthopedic advancements, improved surgical techniques, and higher healthcare access have further boosted the number of joint replacement surgeries, driving anesthesia drug demand in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within Brazil general anesthesia drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Baxter International Inc.

- Fresenius SE & Co. KGaA

- AbbVie Inc.

- AstraZeneca PLC

- B. Braun Melsungen AG

- Pfizer Inc.

- Hikma Pharmaceuticals PLC

- Aspen Pharmacare Holdings Ltd

- Abbott Laboratories

- Eurofarma Laboratórios S.A.

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In 2024, Cristália submitted a new drug application (NDA) to ANVISA for remimazolam, and Brazil saw growing adoption of inhalation anesthesia and advanced monitoring systems.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil general anesthesia drugs Market based on the below-mentioned segments:

Brazil General Anesthesia Drugs Market, by Type of Drugs

- Propofol

- Sevoflurane

- Desflurane

- Others

Brazil General Anesthesia Drugs Market, by Route of Administration

- Intravenous

- Inhalation

Brazil General Anesthesia Drugs Market, by Surgery Types

- Knee and Hip replacements

- Heart surgeries

- Cancer surgery

- General surgery

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |