Brazil Generic Drug Market

Brazil Generic Drug Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Oral solids, Injectables, Topical formulations, and Others), By Therapeutic Class (Cardiovascular, Anti-diabetic, Anti-infectives, Oncology, CNS, Respiratory, and Others), and Brazil Generic Drug Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Generic Drug Market Size Insights Forecasts to 2035

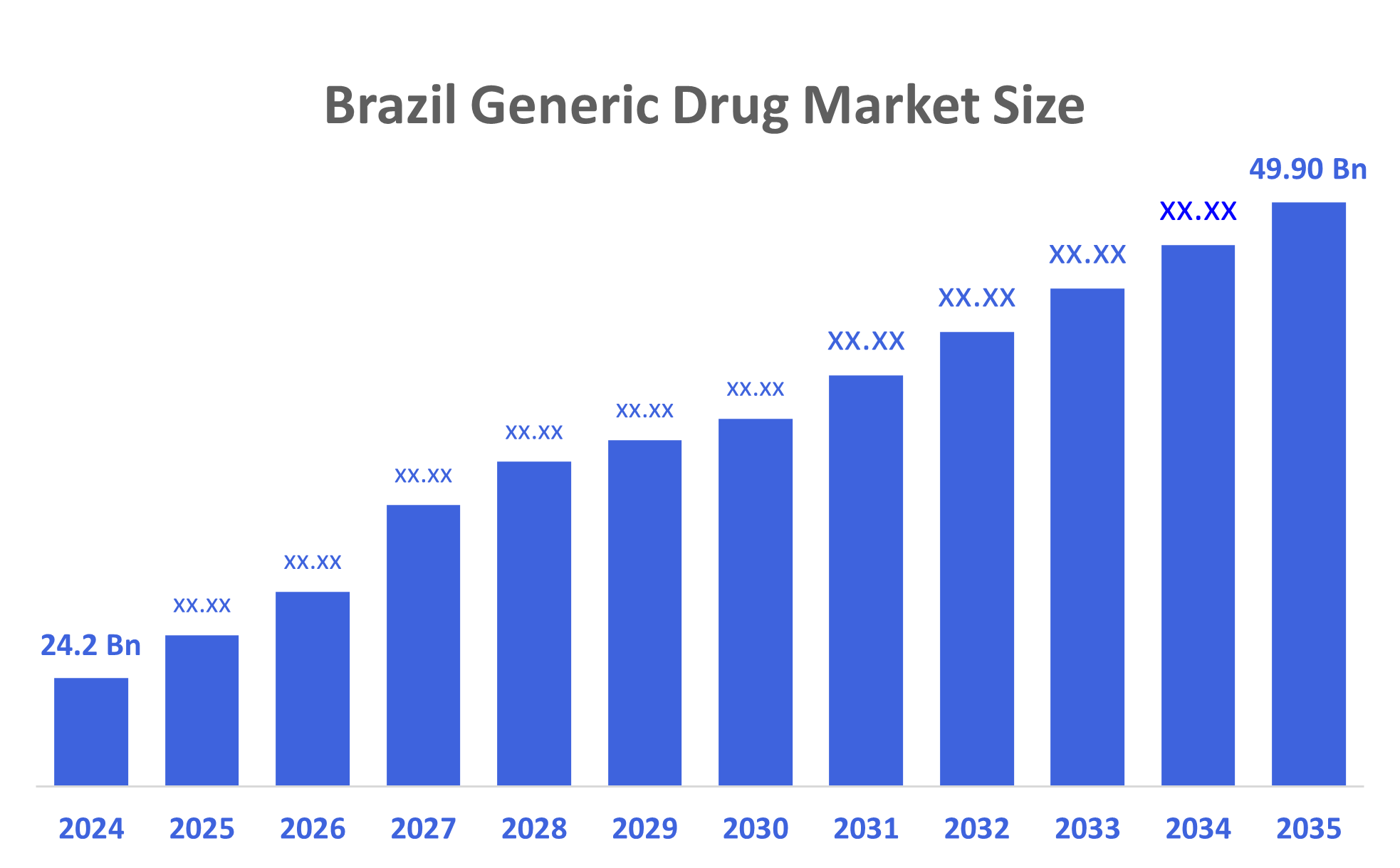

- The Brazil Generic Drug Market Size was estimated at USD 23.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.45% from 2025 to 2035

- The Brazil Generic Drug Market Size is Expected to Reach USD 45.93 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Generic Drug Market Size is anticipated to Reach USD 45.93 Billion by 2035, Growing at a CAGR of 6.45% from 2025 to 2035. The Brazil generic drug market is driven by the increased physician confidence in generics, competitive pricing, improved access to generics via expanded distribution and continued growing use of generics across rural areas, all contribute to increasing growth in the marketplace. Furthermore, significant investment in R&D along with improved regulatory approval processes for generics will continue to drive the long-term growth and expansion of this marketplace.

Market Overview

Generic drugs are produced and sold in the pharmaceutical industry as bioequivalents to branded drugs regarding dosage form, strength, quality, safety, performance, and intended use, however, generic drugs are produced after the patent on the original product expires. Additionally, the Brazil’s generic drug market gives opportunity through growing digital healthcare ecosystem and the impending digital transformation of the healthcare sector will support Brazilian-made medicines, whether generic or advanced. Furthermore, the Brazilian government is supportive of generic versions of medicines because of ANVISA’S requirement for bioequivalence, the requirement for price regulation and the national policy of generic medicines aimed at increasing affordability and access to generic products while allowing brand substitution in the public health care system.

Report Coverage

This research report categorizes the market for the Brazil generic drug market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil generic drug market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil generic drug market.

Driving Factors

The Brazil generic drug market is driven by the increased incidence of chronic diseases, growing amounts spent on health care, significant government incentives to purchase more affordable pharmaceuticals and the constant expiration of patents of existing branded pharmaceutical products. The growing acceptance of generics has also been driven by a growing awareness of the improved quality standards available for generics, as well as the ability for more patients to purchase generics due to expanded health insurance coverage and better access through retail pharmacies and hospital pharmacies to these products. Furthermore, introduction of new technology in drug manufacturing along with greater regulatory support also enhances the market growth of generics across multiple therapeutic areas.

Restraining Factors

The Brazil generic drug market is restrained by the labour-intensive timelines for getting through the regulatory approvals, low levels of general awareness in certain areas, excessive competition from both brand-name and biosimilar medications, supply chain issues related to the movement of product. Price-cutting initiatives, hurdles sending out reimbursement payments, coupled with the resulting need to purchase raw materials from outside of Brazil, serve to further inhibit continued growth in generics drug sales.

Market Segmentation

The Brazil generic drug market share is classified into drug type and therapeutic class.

- The oral solids segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil generic drug market is segmented by drug type into oral solids, injectables, topical formulations, and others. Among these, the oral solids segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to high level of patient compliance, cost effective, a high rate of chronic illness in many countries, expanding availability of generics, efficient manufacturing processes, and ease of distribution via retail pharmacy, and the growing need for convenient and simple to administer medications with long shelf-life.

- The cardiovascular segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil generic drug market is segmented by therapeutic class into cardiovascular, anti-diabetic, anti-infectives, oncology, CNS, respiratory, and others. Among these, the cardiovascular segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to increasing incidence of hypertension and cardiovascular diseases, increased knowledge regarding cardiovascular well-being, government initiatives for healthcare, expanded health insurance coverage, the use of generics for treatment, advances in technology for the treatment of cardiovascular ailments, and the shift toward urban living have all contributed to the rise in demand for effective ways to treat these conditions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil generic drug market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- EMS / Grupo NC

- Prati?Donaduzzi

- Eurofarma

- Hypera Pharma

- Ache Laboratorios

- Teuto Brasileiro

- Sandoz

- Medley (Sanofi)

- Neo Quimica

- Others

Recent Developments:

- In May 2025: Lipocine signed a licensing deal with Aché to sell TLANDO in Brazil, focusing on the expanding testosterone replacement therapy market. The agreement highlighted Aché's strength in generics, changed the pharmaceutical industry in Brazil by broadening low-cost treatment alternatives for hypogonadism, and increased market competition.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Generic Drug Market based on the below-mentioned segments:

Brazil Generic Drug Market, By Drug Type

- Oral solids

- Injectables

- Topical formulations

- Others

Brazil Generic Drug Market, By Therapeutic Class

- Cardiovascular

- Anti-diabetic

- Anti-infectives

- Oncology

- CNS

- Respiratory

- Others

FAQ’s

Q: What is the Brazil generic drug market size?

A: Brazil Generic Drug Market size is expected to grow from USD 23.1 billion in 2024 to USD 45.93 billion by 2035, growing at a CAGR of 6.45% during the forecast period.

Q: Who are the key players in the Brazil generic drug market?

A: EMS / Grupo NC, Prati?Donaduzzi, Eurofarma, Hypera Pharma, Ache Laboratorios, Teuto Brasileiro, Sandoz, Medley (Sanofi), Neo Química, and Others are the key players in the Brazil generic drug market.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |