Brazil Hand Sanitizer Market

Brazil Hand Sanitizer Market Size, Share, and COVID-19 Impact Analysis, By type (Alcoholic, Non-Alcoholic), By Product (Gel, Liquid, Foam, Spray), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online stores, and Other), and Brazil Hand Sanitizer Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Hand Sanitizer Market Insights Forecasts to 2035

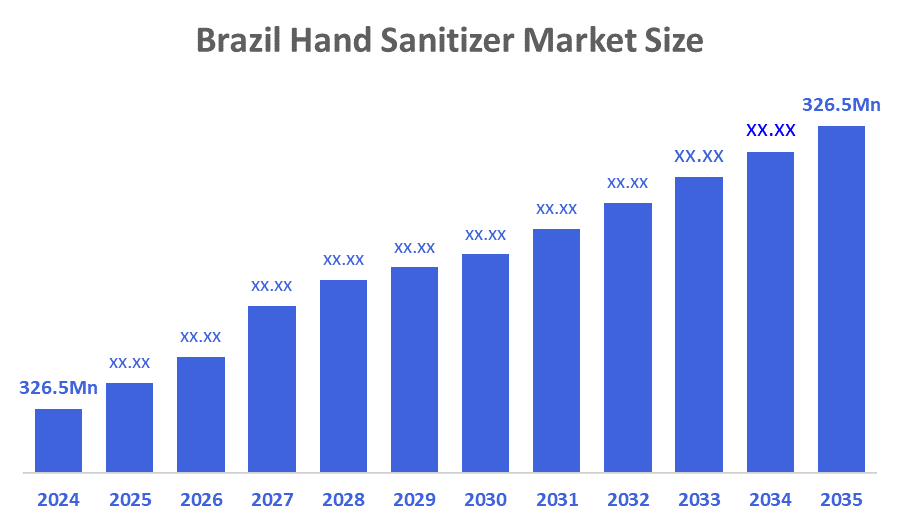

- The Brazil Hand Sanitizer Market Size Was Estimated at USD 326.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.9% from 2025 to 2035

- The Brazil Hand Sanitizer Market Size is Expected to Reach USD 613.20 Million by 2035

According To a Research Report Published By Decisions Advisors & Consulting, The Brazil Hand Sanitizer Market Size Is Anticipated To Reach USD 613.20 Million By 2035, Growing At a CAGR of 5.9% From 2025 to 2035. The Brazil hand sanitizer market is driven by heightened hygiene awareness, frequent outbreaks of infectious diseases, increased government health campaigns, growing urbanization, rising healthcare expenditure, and widespread adoption in households, offices, and public spaces to prevent germ transmission.

Market Overview

An antiseptic liquid called a hand sanitizer, sometimes referred to as a hand rub, is applied to the hands to get rid of germs that might cause illness. It frequently comes in foam, gel, and liquid forms and contains alcohol, water, emollients, polyacrylates, synthetic and organic dyes, and scents. As an alternative to soap and water, hand sanitizer is an antiseptic solution, which is predicted to increase demand as worldwide awareness of sanitation and personal hygiene grows. Additionally, it aids in the prevention of some of the most contagious illnesses, such as COVID-19, norovirus, influenza, meningitis, hand, foot, and mouth disease, pertussis (whooping cough), and methicillin-resistant Staphylococcus aureus (MRSA). Additionally, the Brazilian government, through ANVISA and the Ministry of Health, supports the hand sanitizer market by fast-tracking approvals, setting safety standards, and promoting public hygiene campaigns. Funding initiatives of around BRL 80 million enhance awareness, while regulations ensure sanitizer availability in hospitals, schools, and public places, boosting demand and market growth.

Furthermore, A key trend in the Brazil hand sanitizer market is the shift toward alcohol-free and natural formulations, eco-friendly packaging, and convenient formats like sprays and wipes. Increasing e-commerce sales, rising use in offices and public spaces, and growing consumer preference for premium, dermatologically tested products are also shaping market dynamics. For instance, in 2025, ANVISA updated hand sanitizer regulations through RDC?989/2025 and IN?394/2025, enforcing stricter labeling, packaging, and safety standards. The growth in exports and adoption of eco-friendly, alcohol-free, and dermatologically tested products. Regulatory clarity continues to boost industry expansion

Report Coverage

This research report categorizes the market for the Brazil hand sanitizer market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil hand sanitizer market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil hand sanitizer market.

Driving Factors

The Brazil hand sanitizer market is driven by rising hygiene awareness, frequent viral outbreaks, and strong public-health campaigns encouraging regular hand disinfection. Government regulations by ANVISA ensure product quality, boosting consumer confidence. Increased urbanization, expanding healthcare facilities, and high usage in schools, offices, transportation hubs, and public spaces further accelerate adoption. Growing e-commerce penetration, demand for convenient formats, and preference for natural, skin-friendly formulations also contribute to market growth.

Restraining Factors

The Brazil hand sanitizer market faces restraints such as fluctuating raw material prices, especially ethanol, which increases production costs. Rising competition from low-quality or counterfeit products affects consumer trust. Strict regulatory standards can slow approvals for new formulations. Additionally, reduced post-pandemic urgency and growing dependence on alternative hygiene products limit consistent demand across some consumer groups.

Market Segmentation

The Brazil hand sanitizer market share is categorized by type, product, and distribution channel.

- The alcoholic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil hand sanitizer market is segmented by type into alcoholic, non-alcoholic. Among these, the alcoholic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by alcohol-based formulations that offer rapid and proven effectiveness against bacteria, viruses, and fungi, meeting strict ANVISA guidelines for infection control. Hospitals, clinics, schools, and workplaces consistently prefer these products for their broad-spectrum antimicrobial action. Consumers also trust alcohol-based sanitizers due to their fast-drying time and strong evidence of protection during outbreaks. Furthermore, widespread availability, affordable pricing, and regulatory approval processes that favor well-validated formulations reinforce the dominance of alcoholic sanitizers in both institutional and household settings across Brazil.

- The gel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil hand sanitizer market is segmented by product into gel, liquid, foam, and spray. Among these, the gel segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to they offer a convenient, non-drip texture that is easy to apply and spreads evenly across the hands. Their quick-drying nature and pleasant skin feel make them highly preferred by consumers. Hospitals, schools, offices, and public facilities also rely on gel formats due to controlled dispensing and reduced wastage. Retail penetration is stronger for gels, with a wide variety of sizes and formulations available. Additionally, manufacturers focus more on gel innovations, boosting their visibility and reinforcing their leadership in the Brazilian market.

- The hypermarkets/supermarkets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil hand sanitizer market is segmented by distribution channel into hypermarkets/supermarkets, convenience stores, pharmaceutical and drug Stores, online stores, and others. Among these, the hypermarkets/supermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to most people prefer buying sanitizers during their regular grocery shopping. These stores offer many brands, good discounts, and reliable product quality. Their large nationwide presence makes sanitizers easy to find. Promotions, bulk packs, and high trust in organized retail also encourage customers to choose this channel over others.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil hand sanitizer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Reckitt Benckiser

- 3M

- Procter & Gamble

- GOJO Industries

- Henkel

- Unilever

- Bayer

- Johnson & Johnson

- GlaxoSmithKline (GSK)

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In November 2022, according to Reckitt and Essity, two market leaders in the hygiene and health sectors, the strength of their Dettol, Sagrotan, and Tork brands will be united to develop a range of co-branded disinfection solutions for professional hygiene clients in four European nations.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil hand sanitizer market based on the below-mentioned segments:

Brazil Hand Sanitizer Market, By Type

- Alcoholic

- Non-Alcoholic

Brazil Hand Sanitizer Market, By Product

- Gel

- Liquid

- Foam

- Spray

Brazil Hand Sanitizer Market, By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online stores

- Other

FAQ’s

1. What is driving the Brazil hand sanitizer market?

- Rising hygiene awareness, government health campaigns, and increased demand across public places and healthcare facilities.

2. Which type of hand sanitizer is most popular in Brazil?

- Alcohol-based sanitizers dominate due to their strong germ-killing effectiveness.

3. Which product format leads the market?

- Gel-based sanitizers hold the largest share because they are easy to use and widely available.

4. Which distribution channel is dominant?

- Hypermarkets and supermarkets lead thanks to wide product variety and high consumer footfall.

5. Which end users contribute most to demand?

- Households, healthcare facilities, offices, and schools are major users.

6. What challenges affect market growth?

- Raw material price fluctuations, counterfeit products, and reduced urgency after pandemics.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |