Brazil Health and Wellness Market

Brazil Health and Wellness Market Size, Share, and COVID-19 Impact Analysis, By Products Types (Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, and Others), By Functionality (Nutrition and Weight Management, Heart and Gut Health, Immunity, Bone Health, Skin Health, and Others), and Brazil Health and Wellness Market Insights, Industry Trend, Forecasts To 2035

Report Overview

Table of Contents

Brazil Health and Wellness Market Insights Forecasts to 2035

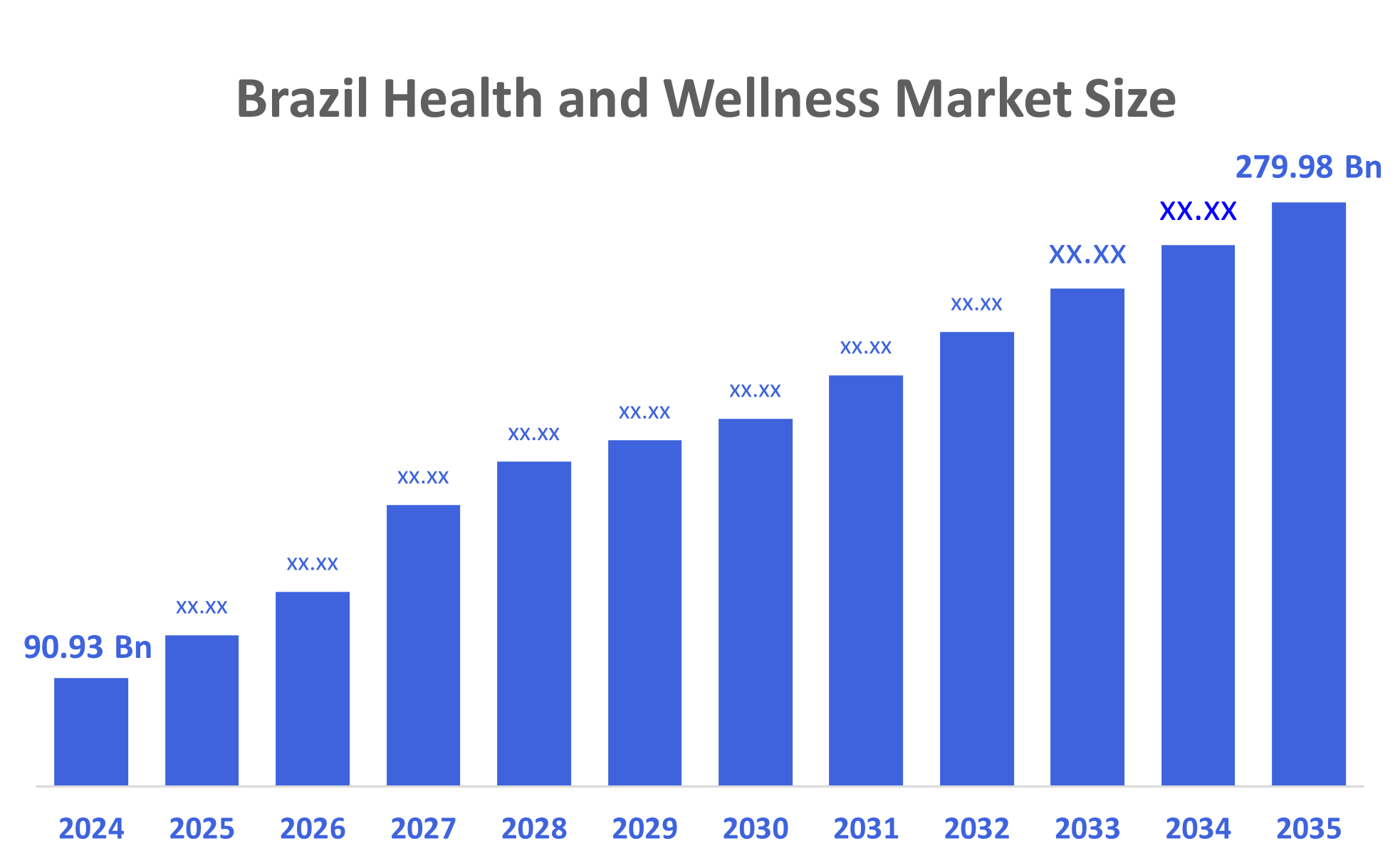

- Brazil Health and Wellness Market Size was estimated at USD 90.93 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.76 % from 2025 to 2035

- Brazil Health and Wellness Market Size is Expected to Reach USD 279.98 Billion by 2035

According to a research report published by Decisions Advisors, The Brazil Health and Wellness Market Size is Anticipated to Reach USD 279.98 Billion by 2035, Growing at a CAGR of 10.76 % from 2025 to 2035. Increasing health consciousness combined with legislative initiatives from governments, as well as increased awareness of chronic disease such as Diabetes, CAD (Coronary Artery Disease), and Obesity, are all some of the main influences driving growth in the marketplace.

Market Overview

The wellness & healthy living market comprises many varied products, services and experiences that offer a person the ability to improve their physical, mental, and emotional well-being. Overall physical and emotional health and wellness are the state of being healthy, as defined, and as determined by the level of your physical, emotional, and social wellness. In Brazil, there are two important trends that determine the Brazilian health and wellness sector. First, Digital Wellness is being driven primarily by Gen Z consumers in their use of apps designed to bring fitness, mindfulness, and nutrition together. Second, companies are expanding their corporate wellness programs by, partnering with Gympass and other similar platforms to expand the services they provide to employees. As a result of the pandemic and the shift from in person work to remote work, the expansion of digital wellness and corporate wellness has accelerated, and for both individuals and organisations, well-being has emerged as one of the most significant priorities.

Report Coverage

This research report categorizes the market for the Brazil health and wellness market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil health and wellness market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil health and wellness market.

Driving Factors

The driving factors of Brazil health and wellness market are increasing consumer awareness and education on prevention-based health care, greater acceptance of fitness, nutritional and mental health applications through internet use, and Generation Z's drive for holistic wellness options. Additionally, the establishment of corporate wellness initiatives, increasing government involvement in health technology, and renewed focus on mental and physical health because of COVID-19 have all increased demand for Brazil's Health and Wellness Market. Lastly, there has been increased demand from Brazilians for natural/organic and functional products that promote wellness.

Restraining Factors

The Restraining Factors for Brazil health and wellness marketplace are the elevated costs associated with accessing wellness services, the inadequate availability of digital health tools for low-income communities and those living in rural areas, and a lack of continuity in the provision of healthcare. In addition, the uncertainty of the economy, the significant level of health illiteracy, regulatory inconsistencies in relation to wellness products, wellness applications and preventative health care solutions further limit the uptake of these types of products and solutions across the country.

Market Segmentation

The Brazil health and wellness market share is classified into products types and functionality.

- The beauty and personal care products segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil health and wellness market is segmented by products types into, functional foods and beverages, beauty and personal care products, preventive and personalized medicinal products, and others. Among these, the beauty and personal care products segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by increase in self-care awareness, need for high-tech and protective skin and hair products and the shift towards natural, organic, and masstige product lines are key growth factors. Additionally, the high value placed on grooming by Brazilian culture, the cultural diversity of the population that requires product customization and frequent product innovation provide further impetus to grow the market. Similarly, the increase in disposable income, social media impact and rapid growth of e-commerce also support the market. The tropical climate creates a constant need for sunscreens, moisturizers Additionally, the nature of Brazil's tropical climate is conducive to constant demand for beauty-care products.

- The nutrition and weight management segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil health and wellness market is segmented by functionality into nutrition and weight management, heart and gut health, immunity, bone health, skin health, and others. Among these, the nutrition and weight management segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to increasing awareness about the connection between diet, body weight, and health is driving consumers to seek nutrition and weight-management solutions to avoid developing lifestyle illnesses, like diabetes, overweight, and heart disease.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil health and wellness market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Herbalife Nutrition

- Amway

- Nestle

- Oya Care

- Predator Sports and Health

- Bloom Care

- Others

Recent Developments:

- In August 2024: Freemotion, a leading fitness equipment brand under iFIT, had partnered with Brazil’s Grupo Multi to expand its presence in the Brazilian fitness sector. The deal had integrated Freemotion’s full cardio and strength lines, plus iFIT content, into Grupo Multi’s offerings. This had positioned Grupo Multi as a top?tier fitness solution provider, delivering advanced, tech?driven equipment and services tailored to all market segments across Brazil.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Health and Wellness Market based on the below-mentioned segments:

Brazil Health and Wellness Market, By Products Types

- Functional Foods and Beverages

- Beauty And Personal Care Products

- Preventive And Personalized Medicinal Products

- Others

Brazil health and wellness market, By Functionality

- Nutrition And Weight Management

- Heart And Gut Health

- Immunity

- Bone Health

- Skin Health

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |