Brazil Heat Pump Market

Brazil Heat Pump Market Size, Share, and COVID-19 Impact Analysis, By Type (Air-Source, Water-Source, and More), By Application (Space Heating, Space Cooling, and More), and Brazil Heat Pump Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Heat Pump Market Insights Forecasts to 2035

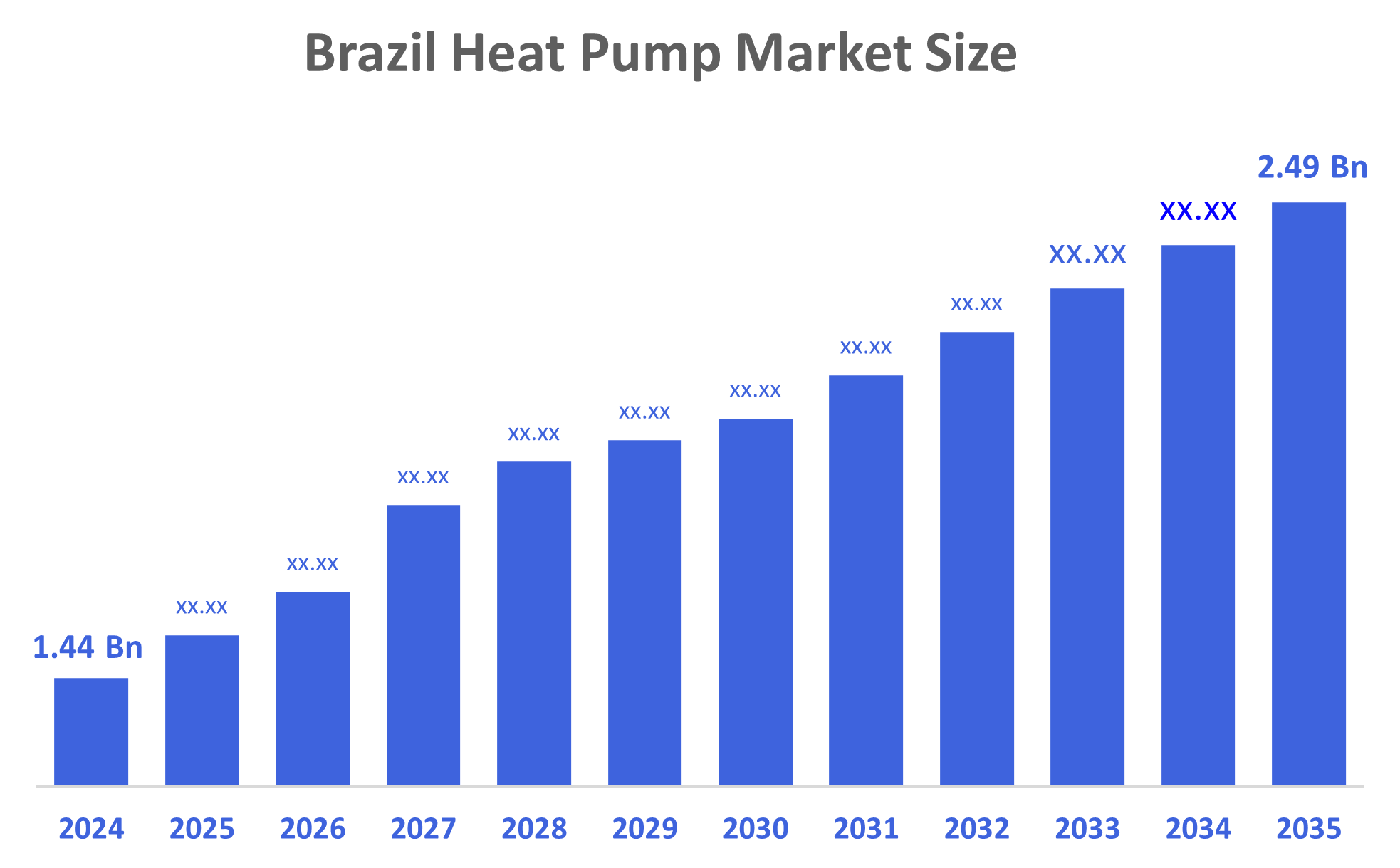

- The Brazil Heat Pump Market Size Was Estimated at USD 1.44 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The Brazil Heat Pump Market Size is Expected to Reach USD 2.49 Billion by 2035

According to a research report published by Decisions Advisors, The Brazil Heat Pump Market Size is Anticipated to Reach USD 2.49 Billion by 2035, Growing at a CAGR of 5.1% from 2025 to 2035. Brazil heat pump market is driven by rising energy efficiency regulations, increasing electricity costs, growing demand for sustainable heating and cooling, government incentives for renewable technologies, expanding residential and commercial construction, and rising awareness of carbon emission reduction initiatives nationwide.

Market Overview

A heat pump is an energy-efficient system that transfers heat from one place to another using electricity. It can extract heat from air, water, or ground to provide heating, cooling, and hot water for homes and buildings, reducing energy consumption compared to traditional heating systems. Additionally, heat pump market growth is driven by increasing energy efficiency standards, rising electricity and fuel costs, growing environmental concerns, government incentives for renewable technologies, rapid urbanization, expanding residential and commercial construction, technological advancements, and higher consumer awareness of sustainable and low-carbon heating and cooling solutions. Furthermore, government regulations play a crucial role in the Brazil heat pumps market.

The Brazilian government has implemented various regulations and policies to encourage the use of heat pumps as an environmentally friendly alternative to traditional heating and cooling systems. For instance, the National Plan for Energy Efficiency (PNEf) aims to reduce energy consumption by 10% by 2031 through the promotion of more efficient technologies, including heat pumps. In addition, the Brazilian Development Bank (BNDES) offers financing options and incentives for the installation of heat pumps, making them more accessible for consumers. Moreover, the Ministry of Mines and Energy has set a target to increase the share of renewable energy in Brazil's energy mix to 45% by 2031, creating a favourable market environment for heat pump adoption.

Report Coverage

This research report categorizes the market for the Brazil heat pump market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil heat pump market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil heat pump market.

Driving Factors

The Brazil heat pump market is primarily driven by the country’s increasing focus on energy efficiency and renewable energy adoption. Rising electricity costs encourage the use of energy-saving heating and cooling solutions, while growing residential, commercial, and industrial construction fuels demand for modern HVAC systems. Government incentives and policies promoting low-carbon technologies further support market growth. Additionally, technological advancements in heat pump efficiency, coupled with heightened environmental awareness, are encouraging consumers and businesses to adopt sustainable heating and cooling solutions, boosting the overall market expansion in Brazil.

Restraining Factors

The Brazil heat pump market faces restraints due to high initial installation costs and limited consumer awareness about the technology. Complex installation requirements and the need for skilled technicians can deter adoption. Additionally, the availability of conventional, lower-cost heating and cooling systems, along with inconsistent government incentives in some regions, slows widespread market growth.

Market Segmentation

The Brazil heat pump market share is categorized by type and application.

- The air-source segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil heat pump market is segmented by type into air-source, water-source, and more. Among these, the air-source segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its cost-effectiveness and simpler installation compared to water-source or ground-source systems. It is highly adaptable to diverse residential and commercial applications, providing both heating and cooling efficiently. Brazil’s moderate climate in many regions makes air-source systems particularly suitable, reducing the need for complex infrastructure. Additionally, increasing awareness of energy-efficient solutions and government incentives for renewable technologies encourages adoption. In contrast, water-source and ground-source heat pumps involve higher installation costs and technical complexity, limiting their market penetration.

- The space cooling segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil heat pump market is segmented by application into space heating, space cooling, and more. Among these, the space cooling segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the country’s warm and tropical climate, which creates a high demand for effective cooling solutions in homes, offices, and commercial establishments. Rising temperatures, urbanization, and increased construction of residential and commercial buildings further drive the need for efficient air conditioning systems. Heat pumps provide energy-efficient cooling compared to conventional systems, lowering electricity costs and environmental impact. Additionally, growing awareness of sustainable technologies and government incentives for energy-efficient appliances encourage adoption of heat pumps primarily for space cooling purposes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil heat pump market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daikin Industries Ltd.

- Mitsubishi Electric Corporation (Brazil)

- Carrier Global Corporation (Carrier Brasil)

- Bosch Thermotechnology (Brazil)

- Trane Technologies plc (Brasil)

- Rheem Brasil

- LG Electronics Brasil Ltda.

- Gree Electric Appliances (Brasil)

- Electrolux do Brasil S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In September 2024, Samsung Electronics launched the Bespoke AI Laundry Combo in the European market. Equipped with AI-powered controls, advanced heat pump technology, and a 7-inch display, the appliance is designed to offer a convenient, engaging, and energy-efficient laundry experience.

In October 2023, Panasonic introduced the Interior 1.5 Ton Central Heat Pump, a residential central heat pump system designed to heat and cool indoor spaces.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil heat pump market based on the below-mentioned segments:

Brazil Heat Pump Market, By Type

- Air-Source

- Water-Source

- More

Brazil Heat Pump Market, By Application

- Space Heating

- Space Cooling

- More

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |