Brazil High-performance Liquid Chromatography Market

Brazil High-performance Liquid Chromatography Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Instruments, Consumables, and Other), By Technology (Conventional HPLC, UHPLC, and Other), By Application (Pharmaceutical Quality-Control, Clinical Research, and Others), and Brazil High-performance Liquid Chromatography Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil High-performance Liquid Chromatography Market Insights Forecasts to 2035

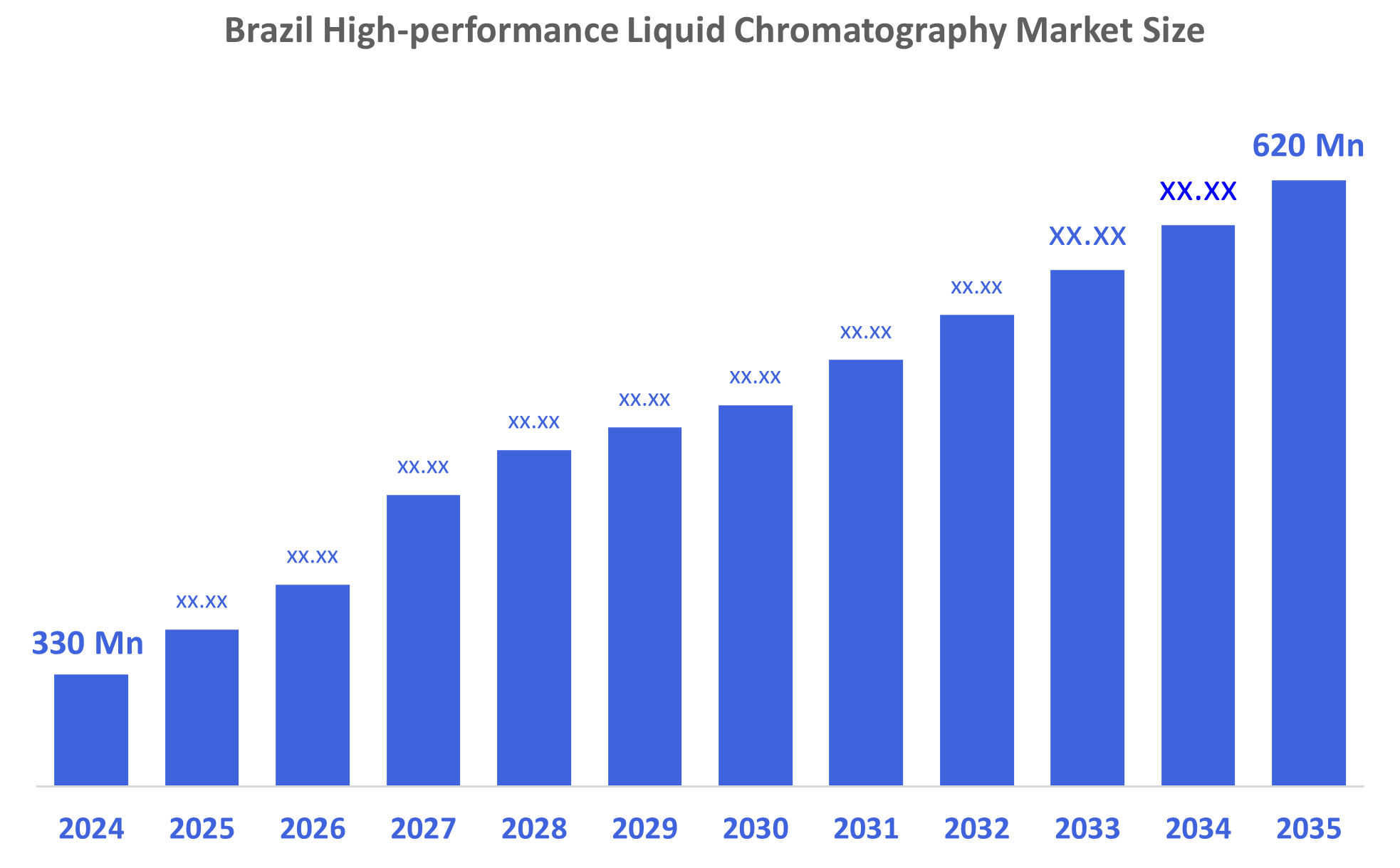

- The Brazil High-performance Liquid Chromatography Market Size Was Estimated at USD 330 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.9% from 2025 to 2035

- The Brazil High-performance Liquid Chromatography Market Size is Expected to Reach USD 620 Million by 2035

According to a research report published by Decisions Advisors, The Brazil High-performance Liquid Chromatography Market Size is Anticipated to Reach USD 620 Million by 2035, Growing at a CAGR of 5.9% from 2025 to 2035. The?????? Brazil high-performance liquid chromatography (HPLC) market is influenced by the increased need for advanced diagnostic testing, the growth of the pharmaceutical and biotech industries, the rising trend of R&D activities, the increased focus on quality control, as well as the broad utilization of analytical instruments in healthcare, food safety, and environmental testing ??????sectors.

Market Overview

High-performance?????? liquid chromatography (HPLC) is a laboratory method that involves the separation and subsequent isolation of various components in a mixture. Liquids are forced through a particularly designed column at high-pressure, therefore, each component gets to move at a different rate. This makes it possible for scientists to identify, quantify, and purity test drugs, foodstuffs, and numerous other chemical samples. Moreover, the Brazil HPLC market is expanding because of increased pharmaceutical research, a rising demand for precise diagnostics, a growing biotechnology sector, the imposition of strict quality control regulations, and a broadening range of applications in food, environmental, and clinical testing. Besides, in the Brazilian market, the trends are that Ultra-high-performance liquid chromatography (UHPLC) is getting more and more preferred because of its shorter time for the analysis and better separation efficiency in comparison with traditional HPLC. Also, AI-driven software solutions are facilitating peak analysis, lowering the number of mistakes, and enhancing workflow automation in HPLC ??????labs.

Technology?????? innovations, like ultra-high-performance liquid chromatography (UHPLC), automated sample processing, and better detection methods, are improving both the efficiency and the accuracy of the processes. Moreover, a few changes have been observed in the Brazil high-performance liquid chromatography (HPLC) market that is experiencing a steady growth due to increased R&D investments, pharmaceutical quality testing, and adoption of advanced HPLC/UHPLC technologies that offer higher resolution and automation. Brazil is expected to be the main driver of the regional growth with the increasing demand in clinical diagnostics, food safety, and environmental analysis. For example, Shimadzu Corporation introduced the Nexera XS inert high-performance liquid chromatograph to the global market in February 2022. By introducing this device, Shimadzu is expanding its business in the biopharmaceuticals market, for instance, antibody drugs and medium-molecule pharmaceuticals, such as nucleic acid drugs. Similarly, Bruker Corporation, in January 2022, bought Prolab Instruments GmbH, which was specialized in low-flow, high-precision liquid chromatography technology and systems, to extend its ??????business.

Report Coverage

This research report categorizes the market for the Brazil high-performance liquid chromatography market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil high-performance liquid chromatography market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil high-performance liquid chromatography market.

Driving Factors

The?????? HPLC market in Brazil is mainly influenced by an increased pharmaceutical and biotechnology research, a rising need for accurate drug quality testing, and an increased use of HPLC for the diagnosis of chronic and infectious diseases. The development of food safety regulations, the increase in environmental monitoring requirements, and the adoption of advanced UHPLC technologies are some of the factors that further extend the market growth in different sectors. For instance, Waters Corporation introduced MaxPeak Premier OBD preparative columns with advanced surfaces aimed at reducing nonspecific binding in small-molecule and oligonucleotide purification processes in May 2025. Another example is when, in April 2024, Waters introduced the Alliance is Bio HPLC System that allowed biopharma QC labs to reduce up to 40% of the common errors, thus increasing the ??????efficiency.

Restraining Factors

The?????? high-performance liquid chromatography market in Brazil is limited by factors such as the expensive instruments and consumables, small laboratories that have limited access to this technology, and the lack of skilled analytical professionals. Slow maintenance and calibration times, as well as the competition with alternative analytical technologies, are the reasons for the low rate of adoption that impedes the overall market ??????growth.

Market Segmentation

The Brazil high-performance liquid chromatography market share is categorized by product type, technology, and application.

- The instruments segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil high-performance liquid chromatography market is segmented by product type into instruments, consumables, and others. Among these, the instruments segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by these systems, which are essential for performing all chromatographic analyses across pharmaceutical, biotechnology, food, and environmental labs. They account for the highest investment due to their advanced features, such as higher resolution, automation, and faster analysis. Growing regulatory emphasis on drug quality, increased diagnostic testing, and the rising adoption of UHPLC systems further drive demand. Continuous technological upgrades and replacement cycles also keep instrument sales strong, reinforcing their leading market share.

- The HPLC segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil high-performance liquid chromatography market is segmented by technology into conventional HPLC, UHPLC, and other. Among these, the HPLC segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to its being more affordable, widely available, and well-established across pharmaceutical, academic, environmental, and food testing laboratories in Brazil. Its compatibility with a broad range of analytical methods and extensive installed base makes it the preferred choice for routine testing. Many labs continue using conventional systems due to lower maintenance costs, existing workflows, and reduced need for highly specialized expertise compared to UHPLC.

- The clinical research segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil high-performance liquid chromatography market is segmented by application into pharmaceutical quality-control, clinical research, and others. Among these, the clinical research segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the increasing demand for drug discovery, development, and clinical trials in the country. Rising investment in biopharmaceutical research, expansion of clinical laboratories, and the adoption of advanced analytical techniques for pharmacokinetics, biomarker analysis, and therapeutic monitoring are driving the need for HPLC systems, fueling revenue growth in this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil high-performance liquid chromatography market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Waters Corporation

- Agilent Technologies

- Thermo Fisher Scientific

- Shimadzu Corporation

- PerkinElmer

- Bio-Rad Laboratories

- Gilson

- JASCO

- Phenomenex

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, Agilent Technologies Inc. launched its second-generation Agilent InfinityLab LC Series portfolio, which includes the 1290 Infinity II LC, 1260 Infinity II Prime LC, and 1260 Infinity II LC systems. All the models are also offered in biocompatible versions, which advance performance and versatility for broad applications of liquid chromatography.

- In April 2024, Waters Corporation introduced the Alliance iS Bio HPLC System, which is specifically created to meet the operational and analytical needs of biopharma quality control (QC) laboratories. The system combines cutting-edge bio-separation technologies with instrument intelligence that is integrated directly into the instrument, providing greater precision and efficiency in analyzing biopharmaceuticals.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil high-performance liquid chromatography market based on the below-mentioned segments:

Brazil High-performance Liquid Chromatography Market, By Product Type

- Instruments

- Consumables

- Other

Brazil High-performance Liquid Chromatography Market, By Technology

- Conventional HPLC

- UHPLC

- Other

Brazil High-performance Liquid Chromatography Market, By Application

- Pharmaceutical Quality-Control

- Clinical Research

- Others

FAQ’s

1.What are the main applications of HPLC in Brazil?

- HPLC is used extensively in pharmaceuticals for drug analysis, biotechnology research, clinical diagnostics, food and beverage testing, and environmental monitoring to ensure quality, safety, and compliance with regulations.

2. How is technology adoption evolving?

- Brazilian laboratories are increasingly adopting UHPLC systems and automated HPLC solutions to improve resolution, analysis speed, and workflow efficiency, particularly in pharmaceutical and clinical sectors.

3. How does the prevalence of chronic diseases impact the market?

- Rising chronic diseases such as cancer and diabetes increase the demand for clinical diagnostics and therapeutic monitoring, directly driving growth in the HPLC market.

4. What future trends are expected in Brazil’s HPLC market?

- Future trends include wider UHPLC adoption, integration of automation and AI for data analysis, expansion in food and environmental testing, and increasing collaborations between instrument manufacturers and research institutions.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |