Brazil Hospitality Market

Brazil Hospitality Market Size, Share, and COVID-19 Impact Analysis, By Type (Chain Hotels, Independent Hotels, Service Apartments), By Service Level (Luxury Hotels, Mid-Range Hotels, Budget Hotels), By Ownership (Independent, Franchise, Management Contract), and Brazil Hospitality Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Hospitality Market Insights Forecasts to 2035

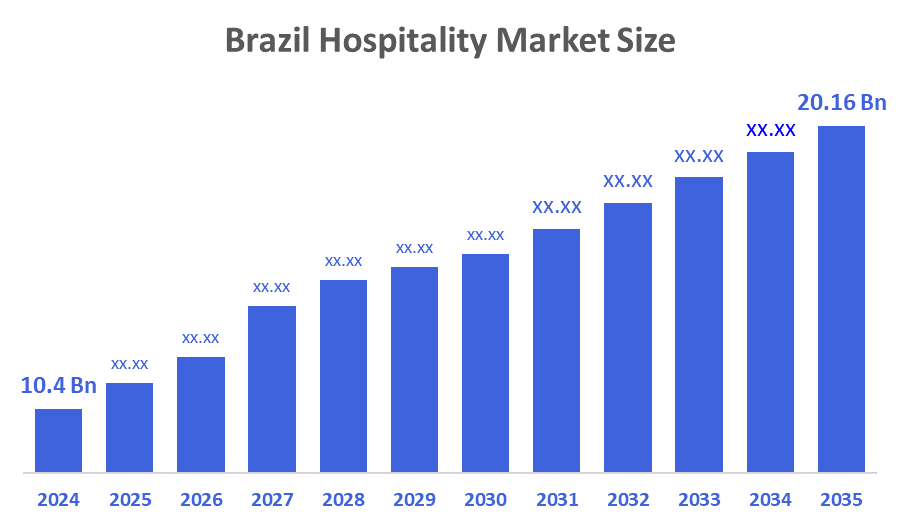

- The Brazil Hospitality Market Size Was Estimated at USD 10.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.2% from 2025 to 2035

- The Brazil Hospitality Market Size is Expected to Reach USD 20.16 Billion by 2035

According to a research report published by Decision Advisor & Consulting, The Brazil Hospitality Market Size is Anticipated to reach USD 20.16 Billion by 2035, Growing at a CAGR of 6.2% from 2025 to 2035. The Brazil hospitality market is driven by growing domestic tourism, international visitor inflows, major events and festivals, expanding business travel, rising middle-class income, improved air connectivity, and increased investments in hotels, resorts, and alternative accommodation platforms across key tourist destinations.

Market Overview

The Brazil hospitality market refers to the industry that provides accommodation, food, and beverage services, and related tourism experiences across the country. It includes hotels, resorts, hostels, serviced apartments, and short-term rentals, catering to domestic and international travelers for leisure, business, and events. Furthermore, the growth of the market is supported by rising domestic tourism, increasing international arrivals, the expansion of low-cost airlines, government tourism promotion, the growth of online booking platforms, and higher investments in hotels and alternative accommodations across major cities and tourist destinations.

Key trends in the hospitality industry of Brazil are increasingly invested in betterment, usually characterized by rising domestic and international capital inflows for newer hotels, sustainable and digital solutions, and secondary city expansion, improving both service quality and competitiveness. However, a rise in occupancy rates is indicative of strong domestic tourism, post-pandemic recovery, increasing MICE and medical tourism, and the use of online booking platforms, along with dynamic pricing to optimize room utilization. Improved air connectivity, modernization of airports, and promotional efforts at the global level have supported tourism growth and increased foreign visitors, thereby driving demand for eco-tourism, cultural experience holidays, and a wide array of accommodation options across the nation.

The Brazil hospitality market benefits from strong government support and technology adoption. Government initiatives focus on promoting tourism, improving airport and transport infrastructure, easing visa policies, and supporting public-private partnerships for hotel development. At the same time, technology is transforming the sector through online booking platforms, mobile check-ins, digital payments, smart room systems, and data-driven pricing strategies. These advancements enhance guest convenience, improve operational efficiency, reduce costs, and help hotels better manage demand, making the Brazilian hospitality industry more competitive and resilient in the global tourism market.

Report Coverage

This research report categorizes the market for the Brazil hospitality market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil hospitality market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil hospitality market.

Driving Factors

The Brazil hospitality market is driven by rising domestic tourism, supported by a growing middle class and increasing disposable income. Strong international tourist inflows, boosted by improved air connectivity and global tourism promotions, further support market growth. Government initiatives to enhance tourism infrastructure, including airport modernization and transport development, are also key drivers. In addition, increased investments by domestic and international hotel chains, expansion of MICE and medical tourism, and growing adoption of digital booking, payment, and smart hospitality technologies continue to strengthen demand and improve operational efficiency across the Brazilian hospitality industry.

Restraining Factors

The Brazil hospitality market faces restraining factors such as high operational costs, including labor, energy, and maintenance expenses, which impact profitability. Economic fluctuations and currency volatility can reduce international travel demand. Additionally, regulatory complexities, infrastructure gaps in some regions, and intense competition from alternative accommodation platforms limit consistent growth across the hospitality industry.

Market Segmentation

The Brazil hospitality market share is classified into type, service level, and ownership.

- The chain hotels segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil hospitality market is segmented by type into chain hotels, independent hotels, and service apartments. Among these, the chain hotels segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Chain hotels dominate the market because they offer consistent service standards, strong brand credibility, and extensive distribution networks. Their partnerships with global booking platforms and loyalty programs attract both domestic and international travelers. Chain hotels are well-positioned to serve business travelers, MICE events, and large tourist groups. Additionally, greater financial strength allows them to invest in technology, sustainability, and property upgrades, enhancing guest experience and maintaining high occupancy rates across major Brazilian cities and tourist destinations.

- The mid-range hotels segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil hospitality market is segmented by service level into luxury hotels, mid-range hotels, and budget hotels. Among these, the mid-range hotels segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Mid-range hotels dominate the market due to their balance of comfort, quality, and affordability, making them attractive to a wide range of travelers, including domestic tourists, business visitors, and middle-class families. This segment benefits from rising disposable incomes, urban expansion, and increased domestic travel. Mid-range properties also adapt quickly to trends such as digital bookings, smart room technologies, and wellness or eco-friendly amenities, allowing them to meet evolving customer expectations while maintaining high occupancy and profitability across Brazil’s major cities and tourist destinations.

- The franchise segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil hospitality market is segmented by ownership into independent, franchise, and management contract. Among these, the franchise segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The franchise segment dominates the market because it combines the advantages of brand recognition, proven operational standards, and access to global distribution and reservation systems, which attract both domestic and international travelers. Franchise models enable rapid expansion with lower capital investment and operational risk for owners, while maintaining service consistency and quality across multiple locations. Additionally, franchised hotels can leverage marketing support, loyalty programs, and technology solutions from the parent brand, giving them a competitive edge over independent properties and management contract-based hotels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil hospitality market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Accor SA

- Marriott International Inc.

- Hilton Worldwide Holdings Inc.

- InterContinental Hotels Group (IHG)

- Wyndham Hotels & Resorts

- Louvre Hotels Group

- Atlantica Hotels International

- Intercity Hotels

- Brazil Hospitality Group (BHG)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News:

In August 2025, Brazil advanced its hospitality industry development by launching the official COP30 accommodation platform in Belém. The initiative added 2,700 rooms across apartments and private residences, yet highlighted challenges with inflated prices, underscoring the strain on infrastructure and demand during major international events.

In July 2025, Marriott advanced Brazil’s hospitality market development by announcing seven City Express hotels across Pernambuco, Rio Grande do Norte, and Ceará. This marked its entry into the economy and midscale segments, challenging Accor’s dominance and expanding Marriott’s footprint through localized design and strategic partnerships.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil hospitality market based on the below-mentioned segments:

Brazil Hospitality Market, By Type

- Chain Hotels

- Independent Hotels

- Service Apartments

Brazil Hospitality Market, By Service Level

- Luxury Hotels

- Mid-Range Hotels

- Budget Hotels

Brazil Hospitality Market, By Ownership

- Independent

- Franchise

- Management Contract

FAQ’s

1. What is the Brazil hospitality market?

The Brazil hospitality market refers to the industry providing accommodation, food, beverage, and tourism services across hotels, resorts, serviced apartments, and alternative lodging in Brazil.

2. What are the key segments of the Brazil hospitality market?

The Brazil hospitality market is segmented by type (chain hotels, independent hotels, service apartments), service level (luxury, mid-range, budget), and ownership (independent, franchise, management contract).

3. Which segment dominates the Brazil hospitality market by type?

Chain hotels dominate the Brazil hospitality market due to brand recognition, consistent service, and strong distribution networks.

4. Which service level segment is dominant in the Brazil hospitality market?

Mid-range hotels dominate the Brazil hospitality market, offering a balance of affordability and quality for domestic and business travelers.

5. Which ownership segment leads the Brazil hospitality market?

Franchise hotels dominate the Brazil hospitality market, benefiting from standardized operations, brand reputation, and access to global booking systems.

6. What are the main drivers of the Brazil hospitality market?

The Brazil hospitality market is driven by rising domestic tourism, increasing international visitors, government support, improved infrastructure, and growing investments in hotels and digital services.

7. What restrains growth in the Brazil hospitality market?

High operational costs, regulatory complexities, currency fluctuations, and competition from alternative accommodations restrain growth in the Brazil hospitality market.

8. How is technology influencing the Brazil hospitality market?

Technology in the Brazil hospitality market, such as mobile booking, digital check-ins, smart room systems, and data-driven pricing, improves efficiency, guest experience, and occupancy rates.

9. How does government support impact the Brazil hospitality market?

Government initiatives, including tourism promotion, airport modernization, infrastructure development, and public–private partnerships, positively influence growth in the Brazil hospitality market.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |