Brazil Ice Cream Market

Brazil Ice Cream Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Sticks/Bars, Cones and Cups, Tubs and Bricks, Others), By Flavor Type (Chocolate, Vanilla, Tutti Frutti, Blends, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, and Others), and Brazil Ice Cream Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Ice Cream Market Insights Forecasts to 2035

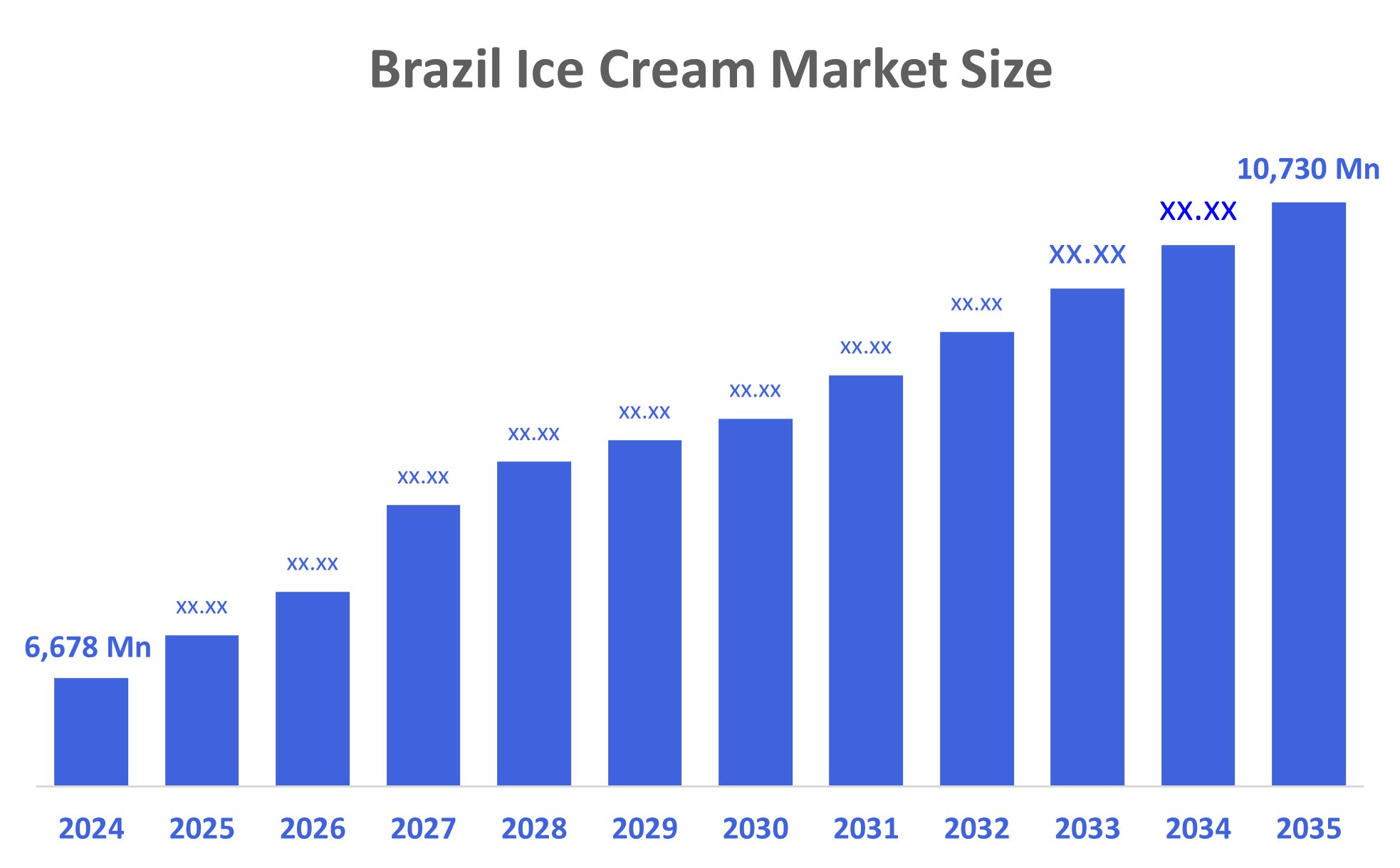

- The Brazil Ice Cream Market Size Was Estimated at USD 6,678 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.4% from 2025 to 2035

- The Brazil Ice Cream Market Size is Expected to Reach USD 10730 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Ice Cream Market Size is Anticipated to Reach USD 10730 Million by 2035, Growing at a CAGR of 4.4% from 2025 to 2035. The Brazil ice cream market is driven by rising consumer demand for indulgent desserts, expanding retail distribution, growing popularity of premium and artisanal flavors, and increasing influence of Western food trends. Urbanization, higher disposable incomes, and year-round warm weather further boost consumption across supermarkets, convenience stores, and specialty ice cream outlets.

Market Overview

Ice cream is a cold, sweet treat made from milk, cream, and sugar. It is mixed and frozen to become smooth and creamy. People enjoy it in many flavors like chocolate, vanilla, and strawberry. Ice cream is eaten for fun, refreshment, and as a delicious dessert. Additionally, the Brazil ice cream market is growing due to rising disposable incomes, expanding supermarket and convenience store networks, and increasing demand for premium and innovative flavors. Warm weather encourages year-round consumption, while social media trends and greater availability of artisanal and healthy options also attract more consumers, boosting overall market growth. Furthermore, the rise of e-commerce is transforming the ice cream market in Brazil. With the increasing penetration of the internet and mobile devices, consumers are turning to online platforms for their ice cream purchases. This shift is particularly evident among younger demographics who prefer the convenience of home delivery. Recent statistics indicate that online sales in the ice cream market have grown by approximately 15% over the past year. Innovation in flavors and ingredients is a crucial driver for the ice cream market in Brazil.

Furthermore, consumers are increasingly seeking unique and exotic flavors, which has prompted manufacturers to experiment with local ingredients. The introduction of flavors such as acai, guava, and passion fruit reflects a growing trend towards incorporating regional tastes. This innovation not only attracts adventurous consumers but also caters to the rising demand for artisanal products. Market data suggests that the segment of the ice cream market focusing on unique flavors has seen a growth rate of around 8% annually. For instance, in January 2022, Ben & Jerry's, Unilever introduced two new plant-based ice cream flavours, starting with the "Chocolate Milk and Cookies" and "Dirt Cake," to hit the shelves in July 2022. Chocolate vegan ice cream features chocolaty milk ganache and fudge chips, including chocolate cookie swirls and chocolate chip cookies.

Report Coverage

This research report categorizes the market for the Brazil ice cream market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil ice cream market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil ice cream market.

Driving Factors

The Brazil ice cream market is primarily driven by increasing consumer disposable income and changing lifestyles, which encourage indulgence in sweet treats. Urbanization and the expansion of retail channels, including supermarkets, convenience stores, and online platforms, make ice cream more accessible. Growing demand for premium, artisanal, and innovative flavors, along with rising health-conscious options like low-fat or sugar-free variants, further fuels market growth. Additionally, year-round warm weather, social media influence, and promotional activities by key brands enhance consumer engagement, making ice cream a popular choice across all age groups.

Restraining Factors

The Brazil ice cream market faces restraints from high production and raw material costs, which can increase retail prices. Seasonal demand fluctuations and intense competition among local and international brands limit profitability. Additionally, growing health awareness and concerns over sugar and fat content may reduce consumption. Supply chain challenges and economic instability can further hinder consistent market growth.

Market Segmentation

The Brazil ice cream market share is categorized by product type, flavor type, and distribution channel.

- The tubs and bricks segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil ice cream market is segmented by product type into sticks/bars, cones and cups, tubs and bricks, and others. Among these, the tubs and bricks segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by their catering to family and group consumption, offering larger quantities at a more affordable price per serving. They are convenient for home storage and consumption, making them popular among households. Supermarkets and retail chains widely stock these formats, ensuring easy availability. Additionally, tubs and bricks allow for a variety of flavors and mix-ins, appealing to diverse consumer preferences. Compared to sticks, cones, and cups, they provide better value, flexibility, and convenience, driving higher sales and making them the leading product segment in the market.

- The chocolate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil ice cream market is segmented by flavor type into chocolate, vanilla, tutti frutti, blends, and others. Among these, the chocolate segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to its universal appeal and strong consumer preference across all age groups. Its rich, indulgent taste makes it a favorite for both children and adults, and it is easily combined with other ingredients like nuts, fruits, caramel, and cookies, enhancing variety. Chocolate-flavored ice creams are widely available in multiple formats such as tubs, cones, cups, and sticks, ensuring accessibility. Marketing campaigns and brand promotions often emphasize chocolate variants, reinforcing consumer demand and solidifying its position as the leading flavor segment in Brazil.

- The supermarkets and hypermarkets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil ice cream market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, ice cream parlors, online stores, and others. Among these, the supermarkets and hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to their providing a wide range of products, including various formats, flavors, and brands, making them a convenient one-stop shopping destination. They attract large footfall, offer promotional discounts, and support bulk purchases, which appeal to families and frequent buyers. The extensive shelf space and strategic product placement increase visibility and influence purchasing decisions. Additionally, these retail channels are widely accessible in urban and semi-urban areas, ensuring consistent availability of ice cream, which strengthens their position as the leading distribution channel in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil ice cream market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unilever Brasil Alimentos Ltda.

- Nestlé Brasil Ltda.

- Sorvetes Jundiá Indústria e Comércio Ltda.

- Sorveteria Creme Mel S.A.

- General Mills Brasil Alimentos Ltda.

- Sorvetes Crème Mel S.A.

- Froneri Brasil Ltda.

- Diletto Sorvetes

- Brasil Foods (BRF)

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News

In June 2024, Specialitá and Selecta, brands of Duas Rodas, unveiled 18 innovative ice cream ingredients at Fispal Sorvetes 2024 in São Paulo. These launches, inspired by global consumer trends, feature unique flavors and textures aimed at enhancing indulgent experiences. Highlights include the Chocolat Chocolate with Marshmallow Paste and White Chocolate Cream with Blackberry, both pioneering concepts in the Brazilian ice cream market.

June 2024, two stand out novelties from Specialitá in the Brazilian market for ice cream: Chocolat Chocolate com Pasta de Marshmallow, chocolate combined irresistibly with marshmallow inclusions liberal and abundant; and White Chocolate Cream with Blackberry, for a taste and texture different from any other version, with the dehydrated fruit itself.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil ice cream market based on the below-mentioned segments:

Brazil Ice Cream Market, By Product Type

- Sticks/Bars

- Cones and Cups

- Tubs and Bricks

- Others

Brazil Ice Cream Market, By Flavor Type

- Chocolate

- Vanilla

- Tutti Frutti

- Blends

- Others

Brazil Ice Cream Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Ice Cream Parlors

- Online Stores

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |