Brazil Industrial Safety Gloves Market

Brazil Industrial Safety Gloves Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Latex, Nitrile, Vinyl, and More), By Product Type (Disposable Gloves, Reusable Gloves), and Brazil Industrial Safety Gloves Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Industrial Safety Gloves Market Insights Forecasts to 2035

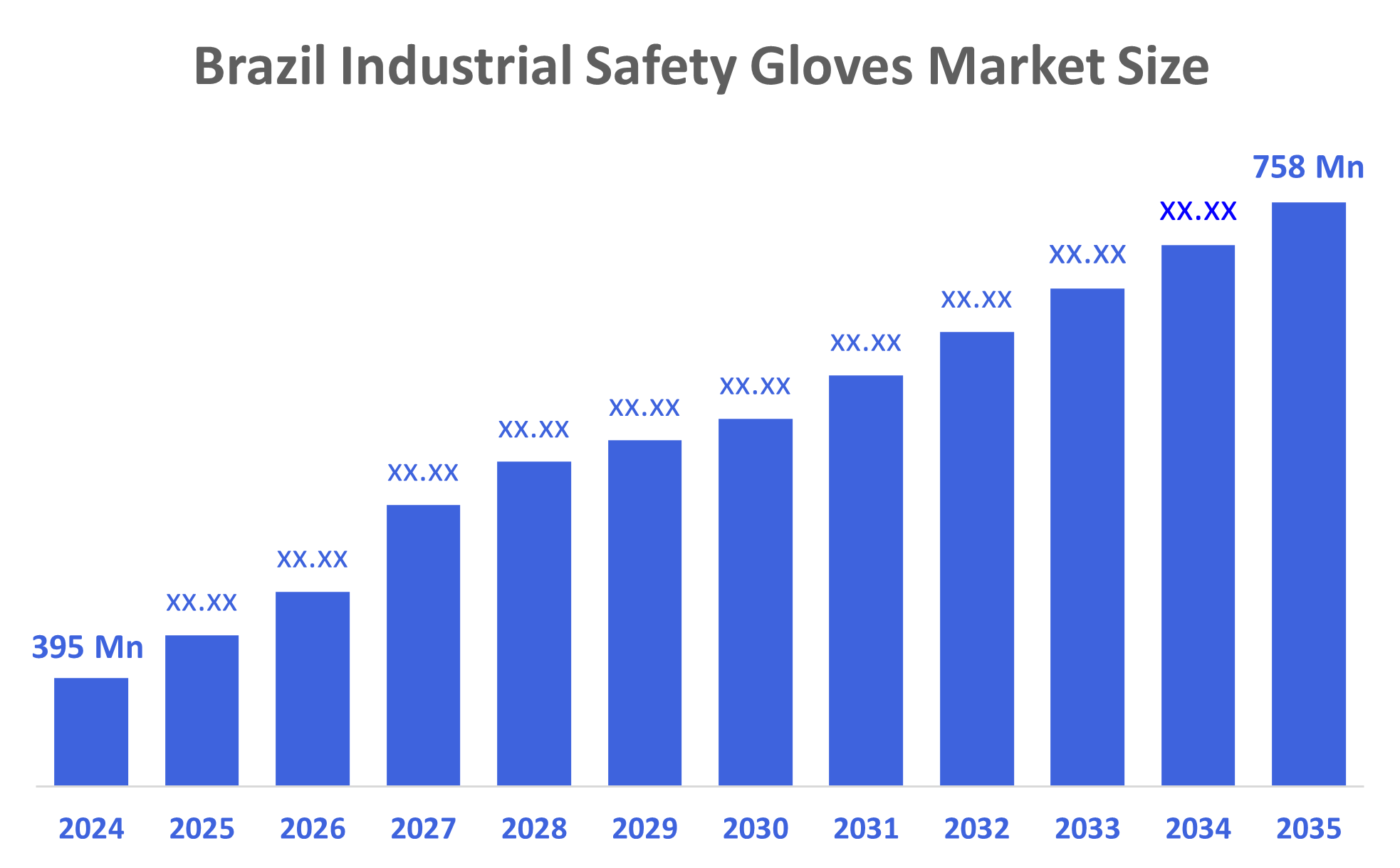

- The Brazil Industrial Safety Gloves Market Size Was Estimated at USD 395 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Brazil Industrial Safety Gloves Market Size is Expected to Reach USD 758 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Industrial Safety Gloves Market Size is Anticipated to Reach USD 758 Million by 2035, Growing at a CAGR of 6.1% from 2025 to 2035. Brazil’s industrial safety gloves market is driven by strict workplace safety regulations, INMETRO certification requirements, rapid industrial expansion in construction, manufacturing, and mining, rising awareness of worker protection, and growing demand for cut-resistant, chemical-resistant, and durable gloves. Innovation in materials and ergonomic designs further boosts adoption across industries.

Market Overview

Industrial safety gloves are protective handwear designed to safeguard workers from hazards such as cuts, abrasions, chemicals, heat, impacts, and punctures in industrial environments. Made from materials like nitrile, latex, leather, and specialized fibers, they help prevent injuries, ensure compliance with safety standards, and enhance worker comfort and productivity. Additionally, Brazil’s industrial safety gloves market grows due to strict occupational safety regulations, expansion of manufacturing, construction, and mining sectors, rising awareness of workplace hazards, and increasing demand for high-quality PPE. Technological advancements in cut-resistant, chemical-resistant, and ergonomic gloves further boost adoption as companies prioritize worker protection and regulatory compliance. Furthermore, advancements in materials technology have played a pivotal role in expanding the market.

The development of innovative materials such as Kevlar, nitrile, neoprene, and thermoplastic elastomers has resulted in gloves that offer superior protection, comfort, and durability. These technological improvements encourage industries to adopt more effective safety solutions, thereby driving market growth, and one of the most significant trends is the integration of advanced materials and smart technology into glove manufacturing. Innovations such as nanotechnology, touchscreen-compatible fabrics, and enhanced chemical resistance are enabling gloves to offer superior protection while maintaining dexterity and comfort.

Report Coverage

This research report categorizes the market for the Brazil industrial safety gloves market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil industrial safety gloves market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil industrial safety gloves market.

Driving Factors

Brazil’s industrial safety gloves market is driven by strict occupational safety regulations that require certified PPE across industries, encouraging companies to invest in high-quality hand protection. Expansion in manufacturing, construction, mining, oil & gas, and chemical sectors increases glove consumption. Growing awareness of workplace hazards and efforts to reduce injuries further boost demand. Technological advancements, such as improved cut-resistant, chemical-resistant, and impact-resistant materials, enhance product performance and comfort. Additionally, rising employer focus on compliance, productivity, and worker well-being supports steady market growth across Brazil’s diverse industrial landscape.

Restraining Factors

Brazil’s industrial safety gloves market faces restraints such as high costs of advanced protective materials, making premium gloves less affordable for small businesses. Limited awareness in smaller industries, inconsistent enforcement of safety regulations, and the presence of low-quality, uncertified products also hamper market growth. Supply chain fluctuations and import dependency further create pricing and availability challenges.

Market Segmentation

The Brazil industrial safety gloves market share is categorized by material type and product type.

- The nitrile segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil industrial safety gloves market is segmented by material type into latex, nitrile, vinyl, and more. Among these, the nitrile segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by it provides superior resistance to chemicals, oils, solvents, and abrasions, making it ideal for heavy industrial applications. Unlike latex, nitrile is hypoallergenic, eliminating allergy risks among workers. Its durability, strong grip, and flexibility enhance safety and comfort in manufacturing, construction, mining, and oil & gas sectors. Additionally, the growing demand for high-performance PPE and stricter safety regulations encourages industries to adopt nitrile gloves over latex and vinyl, strengthening their market leadership across Brazil’s industrial landscape.

- The reusable gloves segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil industrial safety gloves market is segmented by product type into disposable gloves, reusable gloves. Among these, the reusable gloves segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to they offer higher durability, stronger protection, and better resistance to cuts, chemicals, heat, and mechanical hazards compared to disposable gloves. Heavy industries such as construction, mining, manufacturing, and oil & gas rely on robust, long-lasting gloves for daily operations. Their reusability reduces long-term costs for employers, making them more economical for large workforces. With stricter safety regulations and rising workplace hazard awareness, companies prefer reliable, high-performance gloves, driving stronger adoption of reusable gloves across Brazil’s industrial environments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil industrial safety gloves market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ansell

- Honeywell

- Supermax

- Hartalega

- Kossan Rubber Industries

- Lakeland Industries

- PIP Global

- MCR Safety

- SHOWA Group

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Ansell had launched the MICROFLEX Mega Texture 93-256, an ultra-textured nitrile disposable glove. This orange glove ensured industrial workers enjoyed a confident grip alongside durable protection. Auto shop workers, in particular, found it ideal due to its tear resistance, high visibility, and enhanced grip. The MICROFLEX 93-256 acted as a crucial barrier for automotive workers, shielding them from everyday hazards like oils, grime, chemicals, and even carcinogens.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil industrial safety gloves market based on the below-mentioned segments:

Brazil Industrial Safety Gloves Market, By Material Type

- Latex

- Nitrile

- Vinyl

- More

Brazil Industrial Safety Gloves Market, By Product Type

- Disposable Gloves

- Reusable Gloves

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 198 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |