Brazil Insulin Drugs and Delivery Devices Market

Brazil Insulin Drugs and Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Long-acting, Rapid-acting, Premixed), By Delivery Devices (Pens, Pumps, Syringes), By End-User (Hospitals, Retail Pharmacies, Online Channels), and Brazil Insulin Drugs and Delivery Devices Market Size Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Insulin Drugs and Delivery Devices Market Size Insights Forecasts to 2035

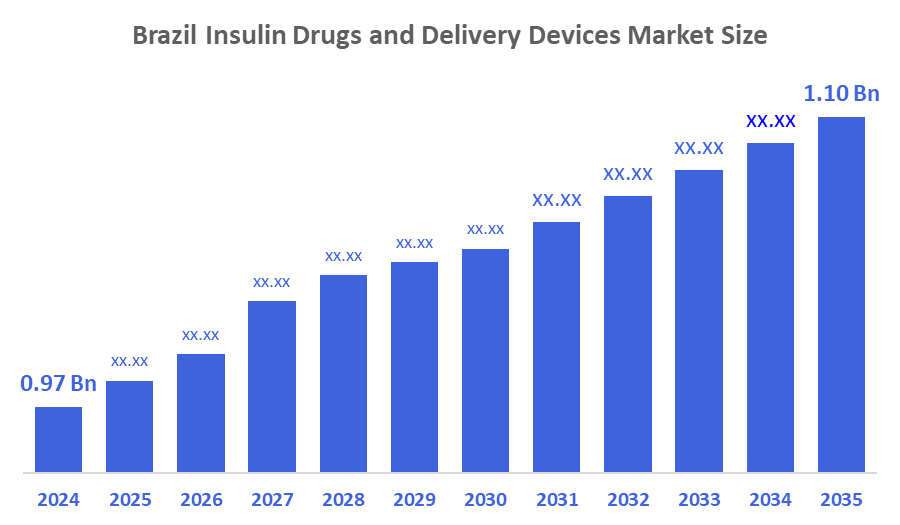

- The Brazil Insulin Drugs and Delivery Devices Market Size Was Estimated at USD 0.97 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 1.15% from 2025 to 2035

- The Brazil Insulin Drugs and Delivery Devices Market Size is Expected to Reach USD 1.10 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Insulin Drugs and Delivery Devices Market Size is Anticipated to Reach USD 1.10 Billion by 2035, Growing at a CAGR of 1.15% from 2025 to 2035. The Brazil insulin drugs and delivery devices market is driven by rising diabetes prevalence, aging population, increasing obesity rates, improved diagnosis, expanding healthcare access, government reimbursement programs, technological advancements in insulin pens and pumps, and growing patient awareness regarding effective diabetes management.

Market Overview

Insulin?????? drugs and delivery devices refer to the medical items that are intended to help diabetics in controlling their blood sugar levels. Among the drug formulations are rapid-acting, long-acting, and premixed insulin. Devices for delivery, such as pens, pumps, and syringes, facilitate accurate and easy administration, and the treatment effectiveness and patient compliance are improved. Additionally, the market in Brazil, besides that, is influenced by the increased prevalence of diabetes; healthcare awareness is getting higher, with government initiatives for affordable insulin; technological advancements in delivery devices, and the growing adoption of insulin therapy by patients who want to manage their blood sugar effectively. Furthermore, the rise in healthcare initiatives in Brazil is propelling the insulin medicines and delivery device market to new heights. With diabetes becoming more common, and 16.8 million adults in the country are estimated to be affected by it, government policies are increasingly focusing on providing easy access to diabetes treatment solutions.

the Brazilian government has implemented several programs to assist the healthcare system, such as subsidies for the necessary diabetes devices and medications. The access and affordability of insulin and delivery devices depend a lot on the Ministry of Health's resource allocation of close to USD 1.5 billion for diabetes-related healthcare projects in 2023. Moreover, apart from encouraging the market to expand, these measures also intend to raise patient access to the most innovative insulin administration pieces of equipment, such as insulin pumps and pens. For example, in 2023, the government of Brazil is expected to put about USD 680 million into healthcare in Rio de Janeiro, part of which will be used for diabetes treatments and therefore, the city is witnessing a growing availability of improved insulin delivery systems, which is leading to a greater demand for such products, and consequently, regional market development is getting ??????accelerated.

Report Coverage

This research report categorizes the market for the Brazil insulin drugs and delivery devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil insulin drugs and delivery devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil insulin drugs and delivery devices market.

Driving Factors

The?????? Brazil insulin drugs and delivery devices market is driven by the increasing cases of diabetes and the awareness raised regarding proper management of the disease. The innovations in insulin pens, pumps, and smart delivery systems make the devices more user-friendly and help patients to stick to their therapy. The government programs, which make insulin cheaper, improve the healthcare facilities, and encourage the use of personalized treatments, are also facilitating the market expansion. Besides that, health problems caused by lifestyle, like being overweight and a lack of physical activity, are major factors that lead to the increased need for insulin ??????therapy.

Restraining Factors

The?????? Brazil insulin drugs and delivery devices market is restrained by the high cost of treatment, limited access to patients in rural areas, and poor healthcare infrastructure in some areas. Besides, the side effects of insulin therapy, a very strict regulatory approval process, and competition from alternative diabetes treatments also act as growth inhibitors for the market and make it difficult for the product to be adopted on a large ??????scale.

Market Segmentation

The Brazil insulin drugs and delivery devices market share is categorized by type, delivery devices, and end user.

- The rapid-acting segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil insulin drugs and delivery devices market is segmented by type into long-acting, rapid-acting, and premixed. Among these, the rapid-acting segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its ability to quickly control post-meal blood glucose levels, which is critical for effective diabetes management. Patients and healthcare providers prefer it for its fast onset and flexibility in dosing. Increasing awareness of tight glycemic control, rising prevalence of diabetes, and the convenience offered by modern rapid-acting formulations, including pens and pumps, further drive its adoption over long-acting and premixed insulin types.

- The pens segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil insulin drugs and delivery devices market is segmented by delivery devices into pens, pumps, and syringes. Among these, the pens segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the insulin pens segment is driven by their ease of use, accurate dosing, and portability, which make daily insulin administration more convenient for patients. Compared to syringes, pens minimize injection errors and discomfort, while being more affordable and simpler than insulin pumps. Additionally, increasing patient preference for user-friendly devices, rising awareness of diabetes management, and higher adoption in urban and semi-urban areas further support their dominance.

- The hospitals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil insulin drugs and delivery devices market is segmented by end user into hospitals, retail pharmacies, and online channels. Among these, the hospitals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to its comprehensive healthcare infrastructure and availability of trained medical professionals. Hospitals manage a large number of diabetes patients, offering prescriptions, monitoring, and education for proper insulin use. They also provide access to advanced insulin therapies and delivery devices. Compared to retail pharmacies and online channels, hospitals ensure accurate treatment, adherence, and patient support, driving their leading position in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil insulin drugs and delivery devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk A/S

- Sanofi S.A.

- Eli Lilly and Company

- Boehringer Ingelheim International GmbH

- Medtronic plc

- Ypsomed AG

- Insulet Corporation

- F. Hoffmann-La Roche Ltd.

- Ascensia Diabetes Care

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In November 2024, Sol-Millennium Medical Group announced the launch of InsuJet™ Needle-free Device, specifically designed for insulin administration in diabetic patients. It uses advanced jet injection technology to deliver precise doses without needles. This product reduces the discomfort associated with insulin delivery and eases anxiety caused by needle injections by making insulin delivery simpler, faster, and needle-free.

In February 2024, Tandem Diabetes Care launched the Tandem Mobi, the world's smallest automated insulin delivery system for diabetes management. Now available to eligible U.S. customers, the Mobi utilizes Control-IQ technology to help prevent blood sugar fluctuations and improve time in range for users. John Sheridan, CEO, expressed enthusiasm about offering this new technology to the diabetes community.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil insulin drugs and delivery devices market based on the below-mentioned segments:

Brazil Insulin Drugs and Delivery Devices Market, By Type

- Long-acting

- Rapid-acting

- Premixed

Brazil Insulin Drugs and Delivery Devices Market, By Delivery Devices

- Pens

- Pumps

- Syringes

Brazil Insulin Drugs and Delivery Devices Market, By End User

- Hospitals

- Retail Pharmacies

- Online Channels

FAQ’s

Q1. What are insulin drugs and delivery devices?

- Insulin drugs are medications used to regulate blood sugar in diabetes patients. Delivery devices, like pens, pumps, and syringes, help administer insulin accurately and conveniently.

Q2. Which type of insulin dominates the Brazil market?

- Rapid-acting insulin dominates due to its quick action in controlling post-meal blood sugar spikes.

Q3. Which delivery device is most used in Brazil?

- Insulin pens are most widely used because of ease of use, portability, and accurate dosing.

Q4. Who are the main end users of insulin devices in Brazil?

- Hospitals dominate as end users due to their infrastructure, trained staff, and access to advanced therapies.

Q5. What factors are driving market growth?

- Rising diabetes prevalence, awareness of disease management, technological advancements, government initiatives, and increasing patient adoption drive market growth.

Q6. What restrains the market?

High costs, limited access in rural areas, regulatory challenges, and side effects of insulin therapy are major restraints.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 235 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |