Brazil IT Training Market

Brazil IT Training Market Size, Share, and COVID-19 Impact Analysis, By Application (IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, and Others), By End User (Corporate, Schools and Colleges, and Others), and Brazil IT Training Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil IT Training Insights Forecasts to 2035

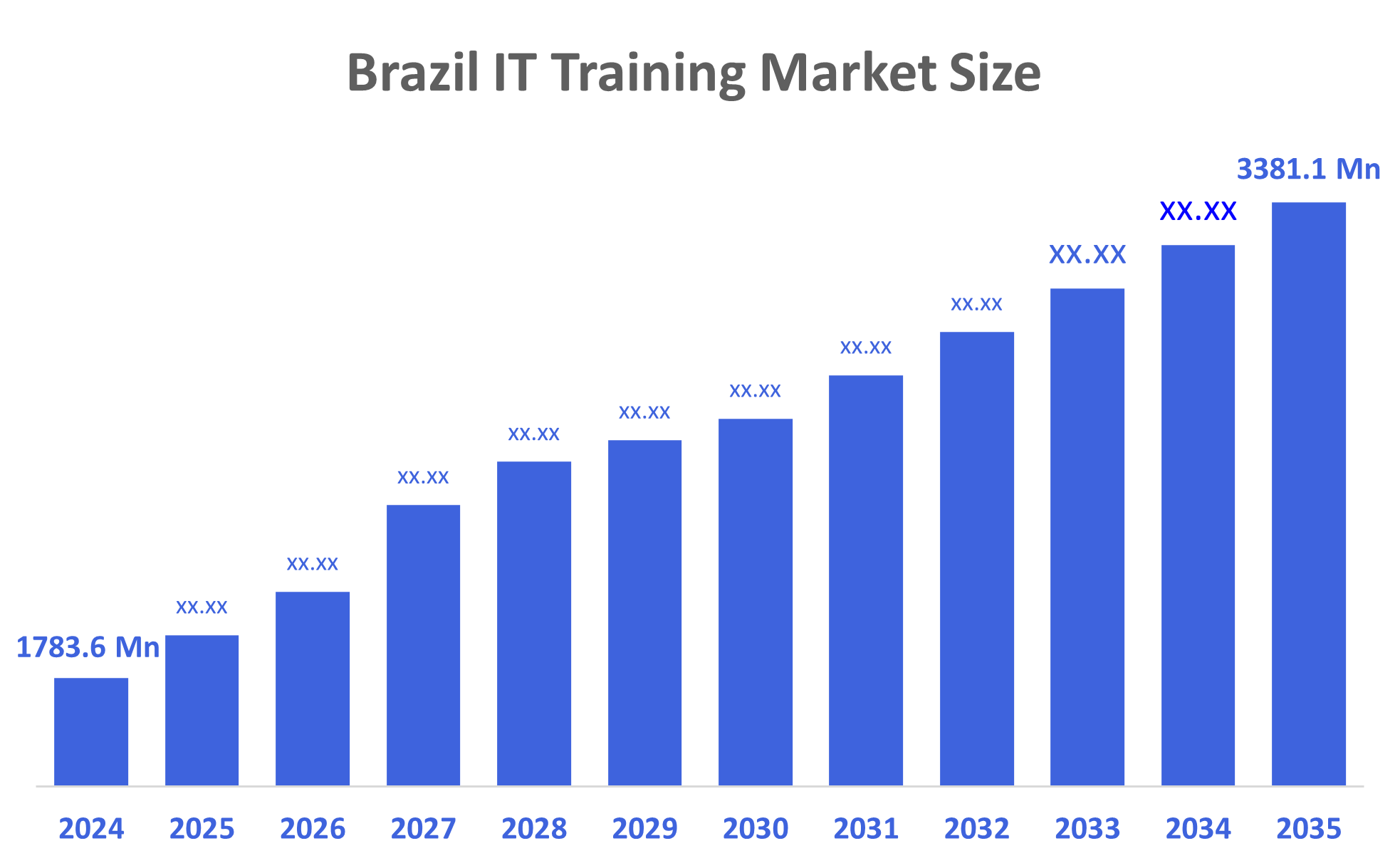

- The Brazil IT Training Market Size was estimated at USD 1783.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.99% from 2025 to 2035

- The Brazil IT Training Market Size is Expected to Reach USD 3381.1 Million by 2035

According to a research report published by Decisions Advisors, The Brazil IT Training Market Size is Anticipated to Reach USD 3381.1 Million by 2035, Growing at a CAGR of 5.99% from 2025 to 2035. The Brazil IT training market is driven by increasing disparity between the number of available IT workers, due to both location and education, is contributing to a growing skills deficiency in traditional industries such as banking, healthcare and retail; therefore, many employers are making significant investments in retraining current employees into certified IT roles through certification programs or specific IT courses so that they can stay competitive in the ever-increasingly digitized world.

Market Overview

The IT training market is a global industry that provides education and skills training on information technology from basic computer skills to more advanced areas such as artificial intelligence, cloud computing, and cyber security for individuals and organisations, who need to fill the ever-growing need for individuals with technology skills in an ever-changing digital environment. Additionally, market Has significant opportunities like digital transformation, cloud computing, ai adoption, cybersecurity, digital initiatives by various governments, increase in remote learning & increasing demand for skilled workers across all industries. Brazil government supports higher education through tax incentives for training, in addition to support for startups' policies, public and private partnerships, and investments in digital skills, innovation, and worker upskilling.

Report Coverage

This research report categorizes the market for the Brazil IT training market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil IT training market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil IT training market.

Driving Factors

The Brazil IT training market is driven by the as the need for skilled professionals continues to rise, Brazil's IT training industry has also experienced tremendous growth because of the rapid digital transformation taking place in the country due to the widespread use of cloud computing, artificial intelligence, and cybersecurity. The government has made efforts to promote digital literacy through various initiatives, while the creation of technology hubs and partnerships between multinational companies and local tech startups have created opportunities for growth and development. The continued shift toward remote work and the increasing popularity of online learning platforms and joint academic-industry ventures have contributed to a strong demand for IT training in the Brazilian marketplace.

Restraining Factors

The Brazil IT training market is restrained by the high course prices, the absence of facilities or access to training locations in rural areas, language barriers, inconsistent training quality, low levels of digital infrastructure around Brazil, and a lack of funding for individuals or small companies looking to improve their IT capabilities.

Market Segmentation

The Brazil IT Training Market share is classified into application and end user.

- The cyber security training segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil IT training market is segmented by application into IT infrastructure training, enterprise application and software training, cyber security training, database and big data training, and others. Among these, the cyber security training segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to increasing cyber threats, stricter regulations concerning data protection, greater digital transformation across industries, an increase in the adoption of Cloud and Internet of Things (IoT) technologies by organizations, an increased focus on IT Security in Businesses today and a serious shortage of qualified Cybersecurity Professionals in Brazil.

- The corporate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil IT training market is segmented by end-user into corporate, schools and colleges, and others. Among these, the corporate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to many businesses are investing in their employees through the various mechanisms available to upskill, including digital transformation projects, the adoption of new technologies, and the requirements related to complying with regulations and maintaining a competitive edge by keeping their workforce technologically adept.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil IT training market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Microlins

- CESAR (Recife Center for Advanced Studies and Systems)

- IMTK Group

- Plurall

- Movile

- Cogna Educacao

- Hotmart

- Senac (Serviço Nacional de Aprendizagem Comercial)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil IT Training Market based on the below-mentioned segments:

Brazil IT Training Market, By Application

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

Brazil IT Training Market, By End User

- Corporate

- Schools and Colleges

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |