Brazil Liquid Dietary Supplements Market

Brazil Liquid Dietary Supplements Market Size, Share, By Type (OTC And Prescribed), By Ingredients (Vitamins, Minerals, Calcium, Botanicals, Proteins & Amino Acids, And Others), By Application (Bone & Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Diabetes, Anti-Cancer, And Others), By End Use (Infants, Children, Adults, And Geriatric), And Brazil Liquid Dietary Supplements Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Liquid Dietary Supplements Market Size Insights Forecasts to 2035

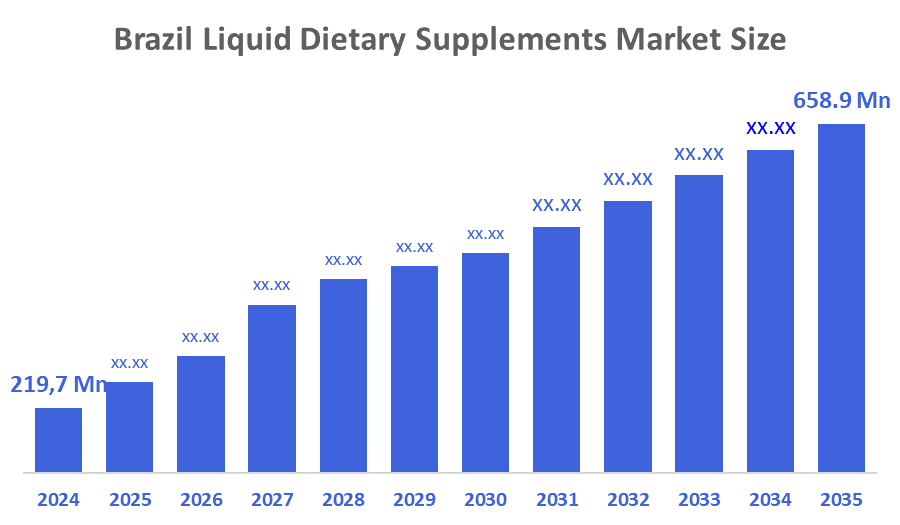

- Brazil Liquid Dietary Supplements Market Size 2024: USD 219.7 Mn

- Brazil Liquid Dietary Supplements Market Size 2035: USD 658.9 Mn

- Brazil Liquid Dietary Supplements Market CAGR 2024: 10.5%

- Brazil Liquid Dietary Supplements Market Segments: Type, Ingredients, Application, and End Use

The Brazil Liquid Dietary Supplements Market Size refers to the supply of powdered or concentrated dietary supplements to the end-user in liquid form, including syrups, oral solutions, and functional food or beverage products. Many of the products sold in this market are nutraceuticals designed to provide nutrients and contain bioactive compounds. There has been an increase in demand for liquid dietary supplements in Brazil, primarily because they provide the convenience of being able to take a liquid form of the product directly into the mouth. Compared to solid dietary supplements, such as capsules or pills, liquid supplements are absorbed faster, have a greater bioavailability, and are easier to use for many groups of consumers, including children, older individuals, athletes, and people who experience trouble swallowing due to digestive issues.

The liquid dietary supplements in Brazil are backed by government support, including the National Food and Nutrition policy promotes proper nutrition, prevention of nutritional deficiencies, monitoring of the health of a population through the Unified Health System and encouragement of a healthier diet. There are over 37 million people aged over 60 which represent more than 17% of Brazil's population, and that using an increasing volume of liquid dietary supplements for maintaining healthy bones and joints, supporting their immune systems, improving digestion, and maintaining healthy cognitive function.

As technology advances, Brazil’s liquid dietary supplements providers are now using advanced formulation methods, such as enhanced bioavailability systems, nano-emulsion systems, improved solubility systems, natural flavour masking technologies, sugar-free and low-calorie formulations, and clean label ingredients as well to satisfy today's changing demands for customers. Innovations in the field of packaging, including aseptic packaging, one-dose bottles, and shelf-life extension technologies, will also continue to enhance the stability, convenience, and efficiency of product distribution in Brazil market.

Market Dynamics of the Brazil Liquid Dietary Supplements Market:

The Brazil liquid dietary supplements market is driven by the rise of health awareness, increased incidence of chronic diseases, increase in preventive health care behaviour, an ageing population, increase in urbanisation and disposable income, rise in demand for convenient nutrition, fitness and immune health, especially after the COVID-19 pandemic, rise in e-commerce platform, technological innovations and government support increase the consumption of liquid dietary supplements

The Brazil liquid dietary supplements market is restrained by the price sensitivity among consumers, stringent regulations, complex product registration requirements, restrictions on health claims, high compliance and labelling costs, and intense competition from both domestic and multinational brands.

The future of Brazil liquid dietary supplements market is bright and promising, with versatile opportunities emerging from the rise of personal nutrition, condition-specific nutrition, plant-based and organic liquid supplements, new product development for pediatric and geriatric populations, clinical nutrition and medical nutrition, as well as rapidly growing e-commerce and direct-to-consumer channels have all contributed to an increasing demand for immunity, digestive health, energy, and mental wellness products in the Brazilian liquid dietary supplement industry. The Brazilian liquid dietary supplements market is well-positioned for sustained long-term growth due to increasing demand for personal nutrition and condition-specific nutrition; the growth of new product development; and, the introduction of new products in underserved geographical areas.

Market Segmentation

The Brazil Liquid Dietary Supplements Market share is classified into type, ingredient, application, and end use.

By Type:

The Brazil liquid dietary supplements market is divided by type into OTC and prescribed. Among these, the OTC segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Increase in consumer self-awareness, high product accessibility, government policies and regulatory improvements in OTC type, and a strong trend towards preventive healthcare all contribute to the OTC segment's largest share and higher spending on liquid dietary supplements when compared to other type.

By Ingredient:

The Brazil liquid dietary supplements market is divided by ingredient into vitamins, minerals, calcium, botanicals, proteins & amino acids, and others. Among these, the botanicals segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The botanicals segment dominates because of Brazil’s rich biodiversity, strong cultural preference for natural remedies, rise in health consciousness, and demand for clean labels, making them effective for energy, performance, and overall wellness.

By Application:

The Brazil liquid dietary supplements market is divided by application into bone & joint health, gastrointestinal health, immunity, cardiac health, diabetes, anti-cancer, and others. Among these, the immunity segment held the largest market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Increase in consumer self-awareness following the COVID-19 pandemic, strong consumer focus on preventive healthcare, and a high prevalence of infectious diseases and nutritional deficiencies in the population all contribute to the immunity segment's largest share and higher spending on liquid dietary supplements when compared to other application.

By End Use:

The Brazil liquid dietary supplements market is divided by end use into infants, children, adults, and geriatric. Among these, the adult segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The adults segment dominates because of their significant population size, increased health consciousness regarding immune health, and specific health needs related to lifestyle and aging has led to high demand for supplements that support energy level.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil liquid dietary supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Liquid Dietary Supplements Market:

- Abbot Laboratories

- ADM

- Amway do Brasil Ltda.

- Atlhetica Nutrition

- Bayer AG

- Duas Rodas

- Glanbia PLC

- Herbalife Nutrition Ltd.

- Integralmedica

- MixNutri

- Nature Lab

- Nestle S.A.

- Nutri Mix

- Pronutrition

- Vitafor Industria e Comercio de Alimentos Ltda.

- Others

Recent Developments in Brazil Liquid Dietary Supplements Market:

In February 2025, Sabinsa strategically acquired Nature’s Formulary to bolster its wellness product offerings, which will integrate Ayurvedic expertise with Sabinsa’s R&D capabilities, potentially leading to new liquid formulations.

In October 2024, Duas Rodas, a Brazilian company, launched new ingredients at an industry event, including AnthoPower for athlete performance and other natural products like Vitamin-Ace and Yuzu, which can be used in liquid applications.

In January 2024, Brazil’s National Health Surveillance Agency approved Curcumin C3 Reduct for use in food and supplements including liquid forms in Brazil, opening the door for new innovation curcumin-derived products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil liquid dietary supplements market based on the below-mentioned segments:

Brazil Liquid Dietary Supplements Market, By Type

- OTC

- Prescription

Brazil Liquid Dietary Supplements Market, By Ingredient

- Vitamins

- Minerals

- Calcium

- Botanicals

- Proteins & Amino Acids

- Others

Brazil Liquid Dietary Supplements Market, By Application

- Bone & Joint Health

- Gastrointestinal Health

- Immunity

- Cardiac Health

- Diabetes

- Anti-Cancer

- Others

Brazil Liquid Dietary Supplements Market, By End Use

- Infants

- Children

- Adults

- Geriatric

FAQ

Q: What is the Brazil liquid dietary supplements market size?

A: Brazil liquid dietary supplements market is expected to grow from USD 219.7 million in 2024 to USD 658.9 million by 2035, growing at a CAGR of 10.5% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the increasing health and wellness awareness, rising incidence of lifestyle-related and chronic diseases, micronutrient deficiencies, growing shift toward preventive healthcare and self-care practices, aging population, increasing urbanization, rising disposable income, rise in demand for convenient nutrition solutions, growing influence of fitness culture, sports nutrition, and immunity-boosting trends, especially post-pandemic, has further accelerated the adoption of liquid supplements.

Q: What factors restrain the Brazil liquid dietary supplements market?

A: Constraints include the price sensitivity among consumers, stringent regulations, complex product registration requirements, restrictions on health claims, high compliance and labelling costs, and intense competition from both domestic and multinational brands.

Q: How is the market segmented by type?

A: The market is segmented into OTC and prescription.

Q: Who are the key players in the Brazil liquid dietary supplements market?

A: Key companies include Abbot Laboratories, ADM, Amway do Brasil Ltda., Atlhetica Nutrition, Bayer AG, Duas Rodas, Glanbia PLC, Herbalife Nutrition Ltd., Integralmedica, MixNutri, Nature Lab, Nestle S.A., Nutri Mix, Pronutrition, Vitafor Industria e Comercio de Alimentos Ltda., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 155 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |