Brazil Luxury Goods Market

Brazil Luxury Goods Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Clothing and Apparel, Footwear, Jewelry, Watches, Leather Goods, Other), By Distribution Channel (Offline Retail Stores, Online Retail Stores), and Brazil Luxury Goods Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Luxury Goods Market Insights Forecasts to 2035

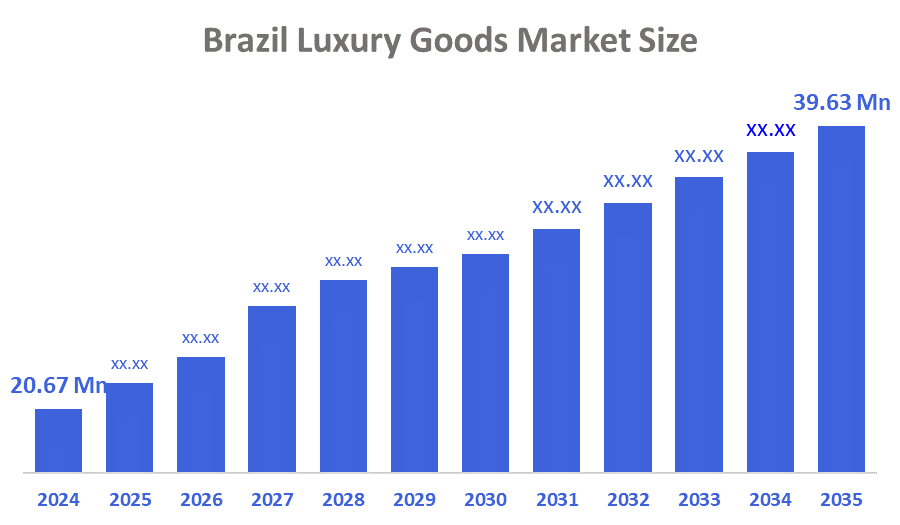

- The Brazil Luxury Goods Market Size Was Estimated at USD 20.67 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Brazil Luxury Goods Market Size is Expected to Reach USD 39.63 Billion by 2035

According to a research report published by Decision Advisor & Consulting, The Brazil luxury Goods Market Size is anticipated to reach USD 39.63 billion by 2035, growing at a CAGR of 6.1% from 2025 to 2035. The Brazil luxury goods market is driven by rising disposable incomes, increasing consumer preference for premium and branded products, growing influence of social media, tourism growth, expanding e-commerce platforms, and the demand for exclusive, high-quality fashion, accessories, and lifestyle products.

Market Overview

The Brazil luxury goods market refers to the sale of high-end, premium products such as luxury apparel, footwear, accessories, watches, jewelry, cosmetics, fragrances, and personal luxury services targeted at affluent and aspirational consumers. This market is shaped by strong brand value, exclusivity, quality craftsmanship, and premium pricing. The growth of the market is mainly driven by rising disposable incomes among high-net-worth individuals, expansion of the upper-middle-class population, increasing brand consciousness, and growing domestic consumption of luxury products. Additionally, urbanization, tourism recovery, and the shift from overseas luxury shopping to local retail channels support sustained market expansion.

The major trends are shaping the Brazil luxury goods market. First, digital and omnichannel luxury retailing is gaining momentum as brands integrate physical boutiques with online platforms to enhance customer experience. Second, growing demand for sustainable and ethical luxury is influencing purchasing decisions, with consumers preferring eco-friendly materials, transparent sourcing, and responsible brands. Third, personalization and experiential luxury are becoming important, as customers seek customized products and exclusive in-store experiences. Fourth, younger consumer influence, particularly from Millennials and Gen Z, is increasing, driven by social media exposure, influencer marketing, and a preference for modern, expressive luxury brands.

Technology and government policy play a vital role in market development. Advanced technologies such as AI-driven customer analytics, virtual try-ons, blockchain for supply chain transparency, and data-driven personalization are improving brand engagement and operational efficiency. E-commerce platforms and secure digital payment systems further strengthen luxury retail accessibility. On the policy side, government initiatives aimed at improving retail infrastructure, supporting digital transformation, and encouraging foreign direct investment positively impact the market. However, high import duties and complex tax structures remain challenges, pushing brands to adopt localized strategies and strengthen domestic supply chains to sustain growth.

Report Coverage

This research report categorizes the market for the Brazil luxury goods market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil luxury goods market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil luxury goods market.

Driving Factors

The Brazil luxury goods market is driven by rising disposable incomes among high-net-worth individuals, the expansion of the affluent middle class, and growing brand awareness influenced by social media and global fashion trends. Increasing urbanization, tourism recovery, and preference for premium lifestyle products support demand. The shift toward domestic luxury purchasing, the expansion of flagship stores, and the growing acceptance of online luxury retail platforms further accelerate market growth across major Brazilian cities.

Restraining Factors

The Brazil luxury goods market faces restraints from high import duties and complex tax structures that increase product prices and limit affordability. Currency volatility impacts pricing stability, while economic uncertainty affects consumer spending. Additionally, logistical challenges, counterfeit products, and strong competition from overseas luxury shopping and duty-free markets restrict overall market growth.

Market Segmentation

The Brazil luxury goods market share is classified into product type and distribution channel.

- The clothing and apparel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil luxury goods market is segmented by product type into clothing and apparel, footwear, jewelry, watches, leather goods, and other. Among these, the clothing and apparel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The clothing and apparel segment dominates the market due to its broad consumer appeal and frequent purchasing cycles compared to other luxury products. Luxury fashion is closely linked to social identity, status display, and lifestyle trends, driving consistent demand. Strong brand visibility through flagship stores, fashion events, and social media marketing further boosts sales. Additionally, the availability of seasonal collections and collaborations encourages repeat purchases, supporting higher revenue generation.

- The offline retail stores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil luxury goods market is segmented by distribution channel into offline retail stores and online retail stores. Among these, the offline retail stores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Offline retail stores dominate the market because luxury consumers value physical experiences, including personalized service, product trial, and brand ambience. High-end boutiques and premium shopping malls provide trust, exclusivity, and authenticity, which are critical for luxury purchases. In-store consultations, customization services, and immediate product availability further encourage offline buying. Additionally, high-value items such as apparel, jewelry, and watches are often preferred to be purchased in person.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil luxury goods market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kering Group

- Prada Holding S.P.A.

- LVMH Moët Hennessy Louis Vuitton SE

- Compagnie Financière Richemont SA

- Burberry Group plc

- Dolce & Gabbana S.r.l.

- Tiffany & Co.

- Michael Kors (Capri Holdings Ltd.)

- Luxottica Group S.p.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In May 2024, Loewe launched a jewelry collection in collaboration with artist Lynda Benglis, featuring 20 unique designs inspired by wearable sculptures, combining artistic expression with luxury craftsmanship for a distinctive and collectible range.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Brazil luxury goods market based on the below-mentioned segments:

Brazil Luxury Goods Market, By Product Type

- Clothing and Apparel

- Footwear

- Jewelry

- Watches

- Leather Goods

- Other

Brazil Luxury Goods Market, By Distribution Channel

- Offline Retail Stores

- Online Retail Stores

FAQ’s

Q1. What is the Brazil luxury goods market?

The Brazil luxury goods market refers to the industry that deals with high-end products such as luxury apparel, accessories, watches, jewelry, leather goods, and premium lifestyle items targeted at affluent consumers in Brazil.

Q2. What are the key growth drivers of the Brazil luxury goods market?

The Brazil luxury goods market is driven by rising disposable incomes, growth of the upper-middle-class population, increased brand awareness, tourism growth, urbanization, and the expansion of online and offline luxury retail channels.

Q3. What are the major product segments in the Brazil luxury goods market?

The Brazil luxury goods market is segmented by product type into clothing and apparel, footwear, jewelry, watches, leather goods, and other premium products, with clothing and apparel being the dominant segment.

Q4. Which distribution channels dominate the Brazil luxury goods market?

Offline retail stores dominate the Brazil Luxury Goods Market, as consumers prefer in-store experiences, personalized services, and authenticity verification. However, online retail is growing rapidly.

Q5. What are the challenges facing the Brazil luxury goods market?

The Brazil luxury goods market faces challenges such as high import duties, currency volatility, economic uncertainty, and strong competition from international duty-free markets.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |