Brazil Medical Devices Market

Brazil Medical Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging, In-vitro Diagnostic (IVD), Minimally Invasive Surgery Devices (MIS), Wound Management, Diabetes Care Devices, Ophthalmic Devices, Dental Devices, Nephrology Devices, General Surgery, and Others), By Applications (Hospitals, Ambulatory Surgical Centers, Clinics, Others), and Brazil Medical Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Medical Devices Market Insights Forecasts to 2035

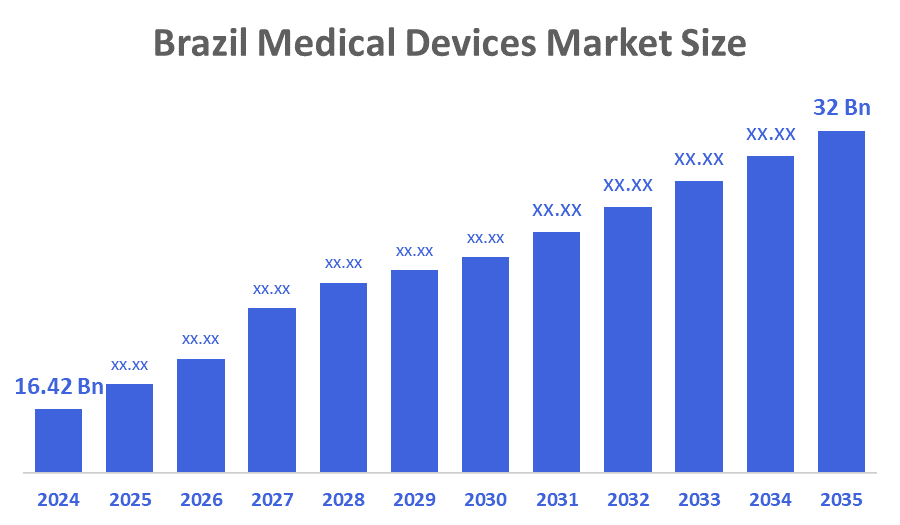

- The Brazil Medical Devices Market Size Was Estimated at USD 16.42 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.25% from 2025 to 2035

- The Brazil Medical Devices Market Size is Expected to Reach USD 32 Billion by 2035

According to a research report published by Decision Advisior & Consulting, the Brazil Medical Devices Market size is anticipated to reach USD 32 billion by 2035, growing at a CAGR of 6.25% from 2025 to 2035. The Brazil medical devices market is driven by rising healthcare expenditure, increasing prevalence of chronic diseases, growing geriatric population, technological advancements, expanding hospital infrastructure, and higher adoption of diagnostic and therapeutic devices across both public and private healthcare sectors.

Market Overview

A medical device (abbreviated as “MD”) can be defined as any single device or combination of devices that can be used, with or without drugs or chemicals, to help diagnose, treat and monitor diseases, injuries and disabilities of people. Devices operate either by means of mechanical or electrical mechanisms (or both), and can range from very simple items to very complex imaging systems. Medical devices are expected to see a dramatic increase in demand due to numerous factors including an aging population, increasing rates of lifestyle diseases such as diabetes and cardiovascular disease and rapidly developing technologies that will revolutionize healthcare. Additionally, the use of diagnostic and monitoring devices is increasing rapidly as the focus of both healthcare providers and patients shifts from being based on traditional definitions of “satisfaction” to more focused definitions of “patient outcomes” and “operational efficiency.” In addition to this, the government has made substantial investments to help transform the healthcare industry and therefore increase demand for both high-quality and cost-effective health technologies in the private and public healthcare sectors.

Brazil?????? is witnessing rapid technological changes, with the country R&D expenditures hitting BRL 2.5 billion. An array of innovations, for instance, minimally invasive surgical tools and smart diagnostic devices, are increasingly being used. Apart from that, the incorporation of AI and machine learning technologies in medical devices is likely to make the diagnostics more accurate and the treatments more effective. This in turn will attract more investment, improve healthcare delivery in the whole country, and eventually spread healthcare to the rural communities as well as the urban ones.

Moreover, in 2023, the Health-regulatory Agency of Brazil (ANVISA) through RDC No. 751/2022 has redefined the regulatory framework for medical devices. Besides streamlining the approval process, the new regulation from ANVISA also brings in risk-based classification and requires increased post-market surveillance. The rule is intended to enhance patient safety as well as speed up the market for new products thus, motivating investment in the medical devices sector. ??????

Report Coverage

This research report categorizes the market for the Brazil medical devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil medical devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil medical devices market.

Driving Factors

The Brazil medical devices market is driven by rising healthcare expenditure, growing prevalence of chronic diseases, and an increasing geriatric population. Expansion of hospital and diagnostic infrastructure, adoption of advanced technologies like imaging and minimally invasive devices, and rising awareness about early disease detection further boost demand. Additionally, government initiatives to improve healthcare access, growing private healthcare services, and increased investment by global and domestic medical device manufacturers are key factors propelling market growth in Brazil.

Restraining Factors

The Brazil medical devices market faces restraints due to high device costs, complex regulatory approvals, and limited reimbursement policies. Additionally, a lack of skilled healthcare professionals, economic fluctuations, and import dependence for advanced devices hinder widespread adoption, slowing overall market growth despite increasing healthcare demand.

Market Segmentation

The Brazil medical devices market share is categorized by type and application.

- The diagnostic imaging segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil medical devices market is segmented by type into orthopedic devices, cardiovascular devices, diagnostic imaging, in-vitro diagnostic (IVD), minimally invasive surgery devices (MIS), wound management, diabetes care devices, ophthalmic devices, dental devices, nephrology devices, general surgery, and others. Among these, the diagnostic imaging segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by increasing demand for early and accurate disease detection, particularly for chronic and lifestyle-related conditions. Hospitals and diagnostic centers are expanding their imaging infrastructure, adopting advanced technologies like MRI, CT, and ultrasound. Rising healthcare awareness, higher patient inflow, and government initiatives to improve diagnostic services further boost adoption. Additionally, both public and private healthcare providers prefer imaging devices for precise diagnostics, making this segment the largest revenue contributor.

- The hospitals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil medical devices market is segmented by application into hospitals, ambulatory surgical centers, clinics, and others. Among these, the hospitals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to their comprehensive healthcare services and high patient volumes, requiring extensive use of diagnostic, therapeutic, and surgical devices. Hospitals have advanced infrastructure and higher budgets, enabling the adoption of modern and specialized equipment. Increasing prevalence of chronic and acute diseases, rising demand for advanced treatments, and government initiatives to enhance hospital capacities further boost device usage. Consequently, hospitals remain the largest end-user segment in the Brazilian market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil medical devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Medtronic

- B. Braun

- Fresenius Medical Care

- Abbott Laboratories

- Boston Scientific

- Stryker

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News

October 2023 – Boston Scientific Corporation announced its plan to establish its first Brazil-based manufacturing site in Shanghai, expanding its footprint in Brazil.

In March 2025, Med Systems, Inc. acquired Vydence Medical, a Brazilian manufacturer of medical aesthetics equipment, to expand its business in the country’s dermatology sector.

In March 2025, Olympus Corporation launched the EVIS X1 endoscopy system in Brazil to improve outcomes from stomach, colon, and oesophagus disorders.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Brazil medical devices market based on the below-mentioned segments:

Brazil Medical Devices Market, By Type

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging

- In-vitro Diagnostic (IVD)

- Minimally Invasive Surgery Devices (MIS)

- Wound Management

- Diabetes Care Devices

- Ophthalmic Devices

- Dental Devices

- Nephrology Devices

- General Surgery

- Others

Brazil Medical Devices Market, By Application

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

FAQ’s

1. What are medical devices?

- Medical devices are instruments, machines, or materials used to diagnose, monitor, treat, or manage diseases or medical conditions in humans, working primarily through physical, mechanical, or electronic means.

2. Which segment dominates the Brazil medical devices market by type?

- The diagnostic imaging segment dominates due to high demand for advanced imaging technologies and growing healthcare infrastructure.

3. Which end-user segment leads the market?

- Hospitals are the largest end-users because of their comprehensive services, large patient volumes, and higher adoption of advanced devices.

4. What factors are driving market growth?

- Rising healthcare expenditure, growing chronic diseases, aging population, technological advancements, and expansion of hospital and diagnostic infrastructure.

5. What are the major restraints?

- High device costs, complex regulatory approvals, limited reimbursement policies, a lack of skilled professionals, and import dependence for advanced devices.

6. Who are the key players in the Brazil medical devices market?

- Major companies include Siemens Healthineers, GE Healthcare, Philips Healthcare, Medtronic, B. Braun, Fresenius Medical Care, Abbott, Boston Scientific, Stryker, Zimmer Biomet, and Johnson & Johnson.

7. What trends are influencing the market?

- Adoption of minimally invasive surgery devices, telemedicine integration, AI-powered diagnostics, and rising demand for home healthcare devices are key trends shaping the market.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 221 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |