Brazil Mineral Processing Equipment Market

Brazil Mineral Processing Equipment Market Size, Share, and COVID-19 Impact Analysis, By Mineral Mining Sector (Bauxite, Iron, Lithium, Nickel, and Other), By Equipment Type (Crushers, Feeders, Conveyors, Grinding Mills, and Other), By Mining Method (Surface Mining and Underground Mining), and Brazil Mineral Processing Equipment Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Mineral Processing Equipment Market Size Insights Forecasts to 2035

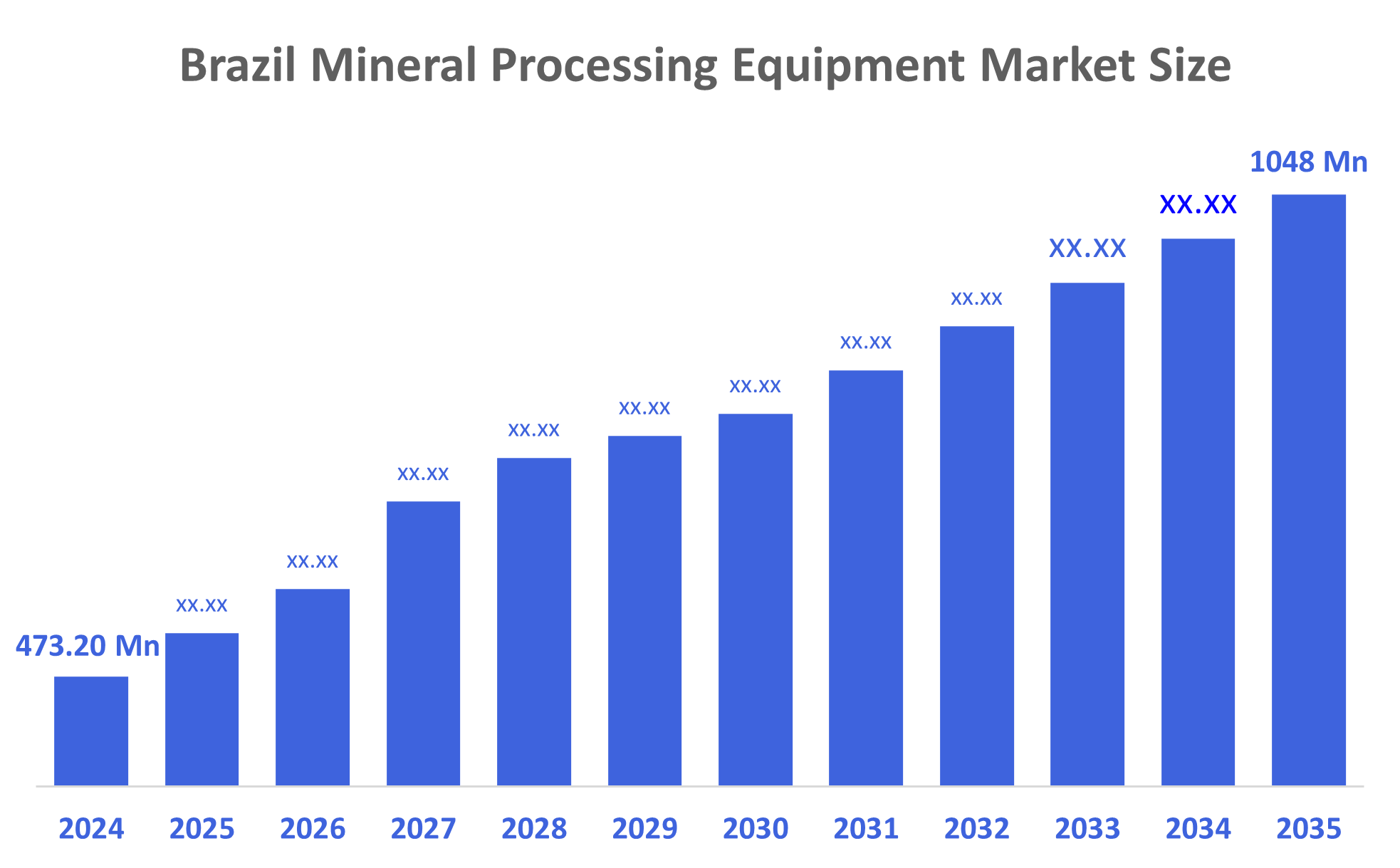

- The Brazil Mineral Processing Equipment Market Size Was Estimated at USD 473.20 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.5% from 2025 to 2035

- The Brazil Mineral Processing Equipment Market Size is Expected to Reach USD 1048 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Mineral Processing Equipment Market Size is Anticipated to Reach USD 1048 Million by 2035, Growing at a CAGR of 7.5% from 2025 to 2035. The Brazil mineral processing equipment market is driven by increasing mining activities, rising demand for metals and minerals, technological advancements in processing equipment, government investments in mining infrastructure, and growing adoption of automated and efficient mineral processing solutions.

Market Overview

Mineral?????? processing equipment is machines and implements that are used to extract, separate, and purify valuable minerals and metals from ores. To mention a few, these are crushers, grinders, screens, magnetic separators, flotation cells, and other such devices that, through mining and mineral beneficiation processes, help to increase efficiency, purity, and recovery rates. Moreover, the Brazil mineral processing equipment market is expanding as a result of the country's abundant mineral resources, increasing industrial demand, mining operations modernization, processing equipment technological advancements, foreign investments inflow, and government initiatives aimed at sustainable and efficient mining practices, which in turn increase production capacity and operational efficiency. Furthermore, besides that, the major trends leading the Brazil mineral processing equipment market are the embracing of automated and IoT-enabled systems, the move to dry and eco-friendly processing, the increasing demand for essential minerals such as lithium and copper, the preference for high-capacity, high-throughput machinery, and the use of advanced flotation, separation, and sensor-based sorting ??????technologies.

Government?????? policy framework pushes equipment deployment faster. The BRL 300 billion Nova Indústria Brazil fund is allocating concessional credit specifically for modern comminution and classification lines as well as local assembly plants, thus local tier-one miners can reduce their payback periods by up to 18 months “Nova Indústria Brazil Policy Decree,” Government of Brazil, gov.br. BNDES has identified 56 strategic mineral projects as a priority for its lending, hence original equipment manufacturers can foresee a long-term business for both brownfield revamps and greenfield hubs, especially in Pará and Minas ??????Gerais.

Report Coverage

This research report categorizes the market for the Brazil mineral processing equipment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil mineral processing equipment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil mineral processing equipment market.

Driving Factors

The Brazil mineral processing equipment industry has a strong growing trend initiated by increased mining activity in the country due to the increased global demand for metals and minerals. Technologies like automation, IoT-enabled monitoring, and high-efficiency machinery have increased production capacity while allowing companies to reduce operational expenditures. The Brazilian government has taken action in promoting clean mining practices, investing in infrastructure development, and encouraging foreign investment to create a favourable environment for the mineral processing equipment industry. Increased demand for equipment is due in part to the increased focus on the need for critical minerals, such as lithium, copper, and rare earth elements, for battery storage and electric vehicle applications. The demand for equipment is further influenced by the need for compliance with environmental laws and optimization of efficiency.

Restraining Factors

The?????? mineral processing equipment market in Brazil is impacted negatively by the risk factors of the area. In particular, the high capital investment requirement, the very high maintenance and operational costs are among the main factors that hinder the development of this market. Furthermore, tough environmental regulations and a complex permitting process can prolong the time it takes to start projects. Besides that, the changes in prices of global commodities, shortage of skilled labor for sophisticated equipment, and poor condition of the transport network in the remote mining areas are some of the factors that slow down the market growth as well as the adoption of the latest mineral processing technologies in the ??????region.

Market Segmentation

The Brazil mineral processing equipment market share is categorized by mineral mining sector, equipment type, and mining method.

- The iron segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil mineral processing equipment market is segmented by mineral mining sector into bauxite, iron, lithium, nickel, and other. Among these, the iron segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the country’s status as one of the largest global iron ore producers, with vast reserves in regions like Minas Gerais. Continuous high demand from domestic and international steel industries necessitates large-scale mining and processing operations. This drives investment in advanced crushing, grinding, separation, and beneficiation equipment to maximize recovery and efficiency. Moreover, technological upgrades and automation in iron ore processing further increase equipment adoption, reinforcing its leading market position over other minerals.

- The crushers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil mineral processing equipment market is segmented by equipment type into crushers, feeders, conveyors, grinding mills, and other. Among these, the crushers segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to its critical role in the initial stage of mineral extraction. Crushers efficiently reduce large ore blocks into manageable sizes, enabling subsequent grinding and separation processes. Brazil’s extensive mining of iron, bauxite, and lithium requires high-capacity, durable crushers to handle massive volumes. Additionally, advancements in crusher technology—such as automation, wear-resistant materials, and energy-efficient designs—enhance operational efficiency, reduce downtime, and lower maintenance costs, making crushers the most sought-after equipment in mineral processing operations.

- The surface mining segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil mineral processing equipment market is segmented by mining method into surface mining and underground mining. Among these, the surface mining segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the country’s abundant shallow mineral deposits, including iron ore, bauxite, and lithium, which are ideally suited for open-pit extraction. Surface mining enables higher production efficiency, easier deployment of heavy machinery, and lower operational and maintenance costs compared to underground methods. It also ensures safer working conditions and simplifies ore transportation to processing facilities. These factors collectively drive greater demand for crushers, grinders, conveyors, and other mineral processing equipment, making surface mining the primary segment in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil mineral processing equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Metso Outotec

- FLSmidth

- Multotec

- Sandvik AB

- Thyssenkrupp Industrial Solutions

- Astec do Brasil

- Weir Minerals

- Outotec Brazil

- Joy Global (now part of Komatsu Mining)

- Schenck Process

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2025, Sandvik continued to fine-tune their battery-electric mining trucks. Specifically, the world's largest battery-electric underground mining truck is the TH665B, which has a 65-ton payload. An entirely autonomous battery-powered drill rig prototype capable of scheduling drilling operations, optimizing power consumption, and returning automatically to charging points is also featured at Sandvik's test mine in Finland.

- In February 2025, TAKRAF released the Automatic Belt Training System (ABTS) that ensures proper tube conveyor belt alignment is maintained at all times. With the ABTS, the twisting chance of the belts is eliminated while conveyor reliability increases by facilitating correct belt overlap on discharge locations utilizing servomotors as well as ultrasonic sensors. The creation facilitates improved efficiency as well as safer operation of mineral processing functions since it ends difficulties experienced when in bulk materials.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil mineral processing equipment market based on the below-mentioned segments:

Brazil Mineral Processing Equipment Market, By Mineral Mining Sector

- Bauxite

- Iron

- Lithium

- Nickel

- Other

Brazil Mineral Processing Equipment Market, By Equipment Type

- Crushers

- Feeders

- Conveyors

- Grinding Mills

- Other

Brazil Mineral Processing Equipment Market, By Mining Method

- Surface Mining

- Underground Mining

FAQ’s

1. What is mineral processing equipment?

- Mineral processing equipment includes machines used to extract, separate, and refine valuable minerals from ores, such as crushers, grinders, conveyors, separators, and flotation cells.

2. What drives the Brazil mineral processing equipment market?

- Key drivers include increasing mining activities, rising demand for metals and minerals, technological advancements, government support, and focus on critical minerals like lithium and copper.

3. Which equipment segment dominates the market?

- The crushers segment dominates due to its critical role in primary ore size reduction.

4. Which mining method dominates in Brazil?

- Surface mining dominates because of shallow mineral deposits, higher production efficiency, and lower operational costs.

5. Who are the key players in the market?

- Metso Outotec, FLSmidth, Multotec, Sandvik AB, Thyssenkrupp Industrial Solutions, Astec do Brasil, Weir Minerals, Epiroc, among others.

6. What are the market trends?

- Adoption of automated and IoT-enabled systems, shift toward dry and environmentally friendly processing, demand for critical minerals, and preference for high-capacity machinery.

7. What are the challenges or restraints in this market?

- High capital and maintenance costs, stringent environmental regulations, fluctuating commodity prices, and limited skilled labor for advanced equipment.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |