Brazil Minimally Invasive Surgery Devices Market

Brazil Minimally Invasive Surgery Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic and Laproscopic Devices, Monitoring and Visualization Devices, Ablation and Laser-Based Devices, Others), by Application (Aesthetic, Cardiovascular, Gastrointestinal, Gynecological, Orthopedic, Urological, Other), and Brazil Minimally Invasive Surgery Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Minimally Invasive Surgery Devices Market Insights Forecasts to 2035

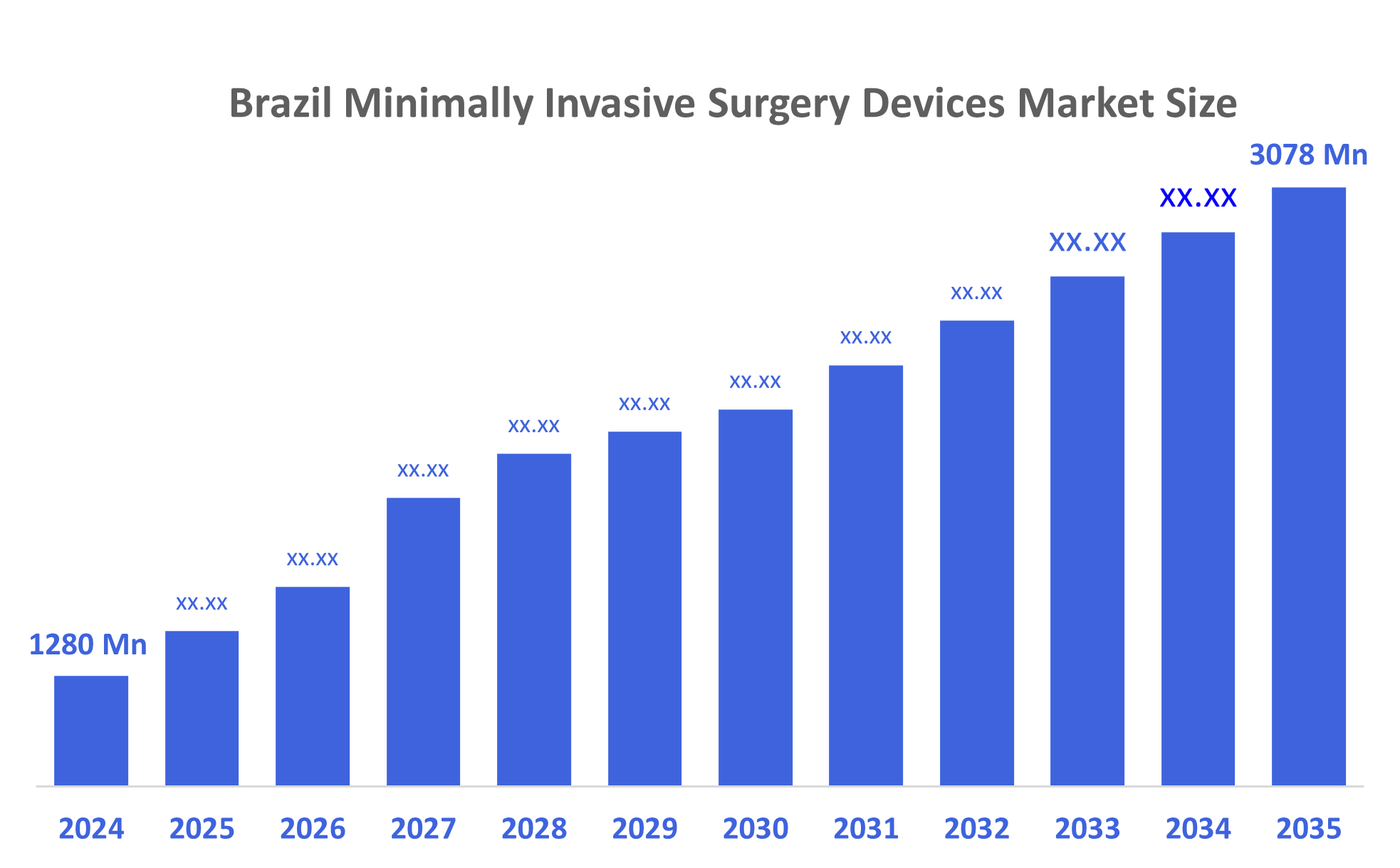

- The Brazil Minimally Invasive Surgery Devices Market Size Was Estimated at USD 1280 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.3% from 2025 to 2035

- The Brazil Minimally Invasive Surgery Devices Market Size is Expected to Reach USD 3078 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Minimally Invasive Surgery Devices Market Size is Anticipated to Reach USD 3078 Billion by 2035, Growing at a CAGR of 8.3% from 2025 to 2035. The market is growing due to rising demand for faster recovery procedures, increasing chronic disease prevalence, expanding adoption of advanced surgical technologies, and a shift toward cost-effective treatments. Growing hospital investments, improved healthcare infrastructure, and greater surgeon preference for minimally invasive techniques further accelerate market expansion.

Market Overview

Minimally invasive surgery devices are specialized medical tools designed to perform surgical procedures through small incisions with minimal tissue damage. They include endoscopes, surgical robots, electrosurgical instruments, and imaging systems. These devices enable faster recovery, reduced pain, shorter hospital stays, and improved precision compared to traditional open surgeries. Additionally, the Brazil minimally invasive surgery devices market is growing due to rising demand for less-painful procedures, increasing chronic disease cases, and expanding adoption of advanced laparoscopic and robotic systems. Improved healthcare infrastructure, higher patient awareness, and greater hospital investment in modern surgical technologies further accelerate market expansion across major medical specialties. Additionally, the advancements in technology and increasing product approvals, along with partnerships and acquisitions by key players, are helping in the market growth. For instance, in September 2020, Sartori, a Brazil-based manufacturer of orthopaedic implants and instruments, acquired SLM Solution's Selective Laser Melting technology. With the acquisition of a new SLM280, the company was expected to address the increased demand for high-quality and affordable medical devices in Brazil.

Report Coverage

This research report categorizes the market for the Brazil minimally invasive surgery devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil minimally invasive surgery devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil minimally invasive surgery devices market.

Driving Factors

The Brazil minimally invasive surgery devices market is driven by the rising preference for procedures that offer reduced pain, shorter recovery time, and fewer complications compared to traditional surgery. Increasing incidences of chronic diseases such as cancer, cardiovascular disorders, and gastrointestinal conditions boost the demand for advanced surgical interventions. Technological advancements, including high-definition endoscopy, surgical robotics, and improved imaging systems, further enhance procedure precision and safety. Growing healthcare investments, expanding private hospitals, and wider availability of trained surgeons also support market adoption. Additionally, greater patient awareness and improved insurance coverage strengthen overall market growth.

Restraining Factors

The Brazil minimally invasive surgery devices market is restrained by high equipment costs, limited reimbursement for advanced procedures, and budget constraints in public hospitals. A shortage of skilled surgeons and technicians slows adoption, while maintenance expenses and training requirements increase operational burdens. Economic fluctuations further restrict investments, limiting the widespread use of advanced minimally invasive surgical technologies.

Market Segmentation

The Brazil minimally invasive surgery devices market share is categorized by product and application.

- The endoscopic and laparoscopic devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil minimally invasive surgery devices market is segmented by product into handheld instruments, guiding devices, electrosurgical devices, endoscopic and laparoscopic devices, monitoring and visualization devices, ablation and laser-based devices, and others. Among these, the endoscopic and laparoscopic devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by they are essential for a wide range of common procedures, making them the backbone of minimally invasive techniques. Their extensive use in general surgery, gynecology, urology, bariatric surgery, and gastrointestinal procedures drives consistent demand. Continuous technological improvements, such as high-definition imaging, 3D visualization, and enhanced flexibility, further strengthen adoption. Hospitals and surgical centers prioritize these devices due to their proven effectiveness, faster patient recovery, and high procedural success rates. Their versatility, reliability, and clinical importance ensure they remain the market’s leading segment.

- The gastrointestinal segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil minimally invasive surgery devices market is segmented by application into aesthetic, cardiovascular, gastrointestinal, gynecological, orthopedic, urological, and other. Among these, the gastrointestinal segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due high burden of digestive disorders, gallbladder diseases, obesity, and colorectal conditions that frequently require minimally invasive surgical intervention. Laparoscopic cholecystectomy, bariatric surgery, and colorectal procedures are among the most performed MIS procedures nationwide. Hospitals prioritize advanced GI surgical equipment due to faster recovery times, reduced complications, and strong clinical outcomes. Growing adoption of laparoscopic and endoscopic technologies, along with increased surgeon training in GI MIS techniques, further strengthens this segment’s leading position.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil minimally invasive surgery devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic

- Olympus Corporation

- Siemens Healthineers

- Smith & Nephew

- Zimmer Biomet

- Johnson & Johnson

- Stryker

- Abbott

- Karl Storz

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In January 2022, Spinologics Inc. and Importek launched Cervision, an upper-extremity patient positioning device for cervical spine surgery, in Brazil. In early January 2022, Cervision was approved by the Brazilian medical device regulatory body Agência Nacional de Vigilância Sanitária (ANVISA).

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil minimally invasive surgery devices Market based on the below-mentioned segments:

Brazil Minimally Invasive Surgery Devices Market, By Product

- Handheld Instruments

- Guiding Devices

- Electrosurgical Devices

- Endoscopic and Laproscopic Devices

- Monitoring and Visualization Devices

- Ablation and Laser-Based Devices

- Others

Brazil Minimally Invasive Surgery Devices Market, By Application

- Aesthetic

- Cardiovascular

- Gastrointestinal

- Gynecological

- Orthopedic

- Urological

- Other

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |