Brazil Mobile Virtual Network Operator Market

Brazil Mobile Virtual Network Operator Market Size, Share, and COVID-19 Impact Analysis, By Type (Media and Entertainment, Discount, Business, Cellular M2M, Migrant, Retail, Telecom, Roaming), By Operational Model (Reseller MVNO, Service Operator MVNO, Full MVNO), By Service Type (Postpaid, Prepaid), and Brazil Mobile Virtual Network Operator Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Mobile Virtual Network Operator Market Size Insights Forecasts to 2035

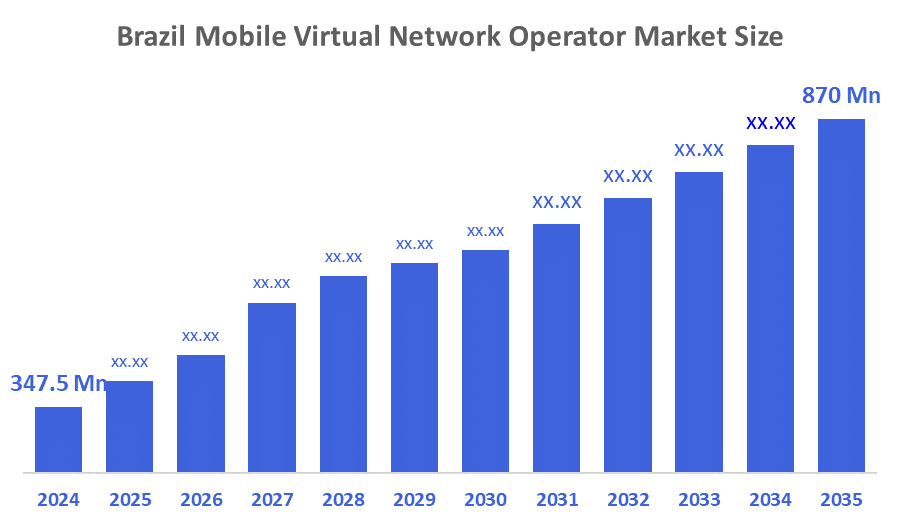

- The Brazil Mobile Virtual Network Operator Market Size Was Estimated at USD 347.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.7% from 2025 to 2035

- The Brazil Mobile Virtual Network Operator Market Size is Expected to Reach USD 870 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Mobile Virtual Network Operator Market Size is anticipated to Reach USD 870 Million by 2035, Growing at a CAGR of 8.7% from 2025 to 2035. Brazil's smartphone Industry is characterized by a growing number of consumers using smartphones, a growing interest in more affordable mobile service options, and an increase in the use of digital platforms. As well as these trends, e-commerce, continued development of Internet of Things (IoT) Apps, regulatory changes, and competition among telecom Companies to offer Better Quality and Coverage continue to drive the growth of this sector.

Market Overview

Mobile Virtual Network Operators (MVNOs) are a type of service provider that delivers mobile communication services via wireless service providers who own their own infrastructure. By leasing the network capacity of established Wireless Service Providers (WSPs), MVNOs are able to focus on marketing their product, customer service, billing, and value-added services. Additionally, The growth of the Brazil MVNO market is being driven by the increasing penetration of mobile internet; the increasing adoption of smartphones; consumers shifting away from high-priced contracts; the increasing demand for both low rates and flexibility in mobile plans; a growing demand for digital services such as FinTech; an increased demand for connected devices via the Internet of Things (IoT); an increased number of regulations supporting the telecommunications industry; and the increase in competition between different telecommunications providers.

Mobile Virtual Network Operators (MVNOs) can now offer superior customer service and higher data speed offerings than traditional Wireless Service Providers (WSPs). Furthermore, MVNOs can provide premium quality services at lower prices than WSP's allowing them to effectively compete with the largest WSPs in the industry. MVNOs are now able to introduce new products such as ultra-low-latency gaming plans and enterprise connectivity solutions. Furthermore, 5G is revolutionizing how MVNOs (Mobile Virtual Network Operators) are perceived in the telecommunications industry; moreover, MVNOs operating in Brazil have begun partnering with various types of technology-based businesses such as FinTech companies, application developers, and Cloud Service Providers (CSPs) to create bundled offerings. This allows the MVNO to not only provide data connectivity but also a variety of other products and services, including mobile wallets, Cloud storage, and entertainment packages. The result of these collaborations is an increase in the overall value proposition for subscribers and a greater opportunity for the MVNOs to diversify their revenue streams. By partnering with technology-centric companies, MVNOs are establishing stronger market positions than they would otherwise be able to in what is becoming an increasingly competitive and rapidly changing digital marketplace.

Report Coverage

This research report categorizes the market for the Brazil mobile virtual network operator market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil mobile virtual network operator market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil mobile virtual network operator market.

Driving Factors

Brazil's mobile virtual network operator (MVNO) market is driven by a variety of factors, including the growing popularity of smartphones and mobile internet, the increasing demand for affordable and personalized mobile plan options, the rise of digital payment methods and FinTech solutions, the rapid growth of e-commerce and digital entertainment, and the growing adoption of IoT devices. In addition to these trends, new laws that support competition, the improvements to 4G service availability, and the continued introduction of 5G networks have contributed to the growth of the MVNOs in various ways by creating greater access to improved services, innovations, and quality among urban and semi-urban locations.

Restraining Factors

The Mobile Virtual Network Operator (MVNO) marketplace in Brazil is constrained primarily by its heavy dependence on host network operators for all network services, limiting an MVNO's ability to manage network quality, pricing competition among its competitors, low profit margins, and high turnover rates for customers. In addition, regulatory hurdles, expensive spectrum leases, lack of brand recognition, and a lack of infrastructure in rural areas are significant barriers to service reliability and market growth for MVNOs in Brazil.

Market Segmentation

The Brazil mobile virtual network operator market share is categorized by type, operational model, and service type.

- The discount segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil mobile virtual network operator market is segmented by type into media and entertainment, discount, business, cellular M2M, migrant, retail, telecom, and roaming. Among these, the discount segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by a large portion of the population is price-sensitive and seeks affordable mobile services. Many consumers prefer prepaid plans with low-cost voice and data options, making budget-friendly MVNO offers highly attractive. Discount MVNOs also benefit from simple plan structures, wide retail distribution, and strong demand from low- and middle-income users. Additionally, economic fluctuations in Brazil encourage customers to switch from premium telecom services to cheaper MVNO alternatives to reduce monthly communication expenses.

- The reseller MVNO segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil mobile virtual network operator market is segmented by operational model into reseller MVNO, service operator MVNO, and full MVNO. Among these, the reseller MVNO segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the lowest entry barriers and requires minimal capital investment compared to service operator and full MVNO models. These operators do not need to build complex network infrastructure, allowing faster market entry and quicker service launches. Reseller MVNOs can focus mainly on branding, marketing, and customer acquisition, which suits Brazil’s highly competitive and price-sensitive telecom environment. Additionally, partnerships with major mobile network operators allow resellers to offer reliable coverage while maintaining cost efficiency and operational simplicity.

- The prepaid segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil mobile virtual network operator market is segmented by service type into postpaid, prepaid. Among these, the prepaid segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to most consumers prefer flexible, contract-free mobile services that allow better control over spending. Prepaid plans are more affordable and accessible, especially for low- and middle-income users and people working in the informal economy. These plans are easy to activate, widely available through retail outlets, and do not require credit checks, making them attractive to a broad customer base. In addition, frequent promotional offers, bonus data packages, and simple recharge options further boost the popularity of prepaid MVNO services across urban and rural areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil mobile virtual network operator market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Datora

- Surf Telecom

- Porto Seguro Conecta

- America Net

- Vecto Mobile

- Veek Telecom

- Correios Celular

- Laricel

- Mais ADVCel

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, KDDI collaborated with Rakuten Mobile to launch KDDI Rakuten Mobile Business, an MVNO service targeting businesses. This venture aimed to offer tailored mobile plans to meet the diverse needs of businesses, enhancing their communication infrastructure

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil mobile virtual network operator market based on the below-mentioned segments:

Brazil Mobile Virtual Network Operator Market, By Type

- Media and Entertainment

- Discount

- Business

- Cellular M2M

- Migrant

- Retail

- Telecom

- Roaming

Brazil Mobile Virtual Network Operator Market, By Operational Model

- Reseller MVNO

- Service Operator MVNO

- Full MVNO

Brazil Mobile Virtual Network Operator Market, By Service Type

- Post-paid

- Prepaid

FAQ’s

1. What is an MVNO?

- An MVNO is a mobile service provider that does not own network infrastructure and instead leases network capacity from traditional operators.

2. How does the MVNO model work in Brazil?

- MVNOs partner with major telecom operators to sell mobile services under their own brand.

3. Which segment dominates the Brazil MVNO market?

- The prepaid and discount MVNO segments dominate the market.

4. What is driving growth in this market?

- Growth is driven by rising smartphone usage, affordable data plans, digital services expansion, and regulatory support.

5. What are the main challenges?

- High dependence on host networks, low margins, strong competition, and customer churn.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 153 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |