Brazil Needle Coke Market

Brazil Needle Coke Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Petroleum-Based Needle Coke and Coal-Tar Pitch-Based Needle Coke), Application (Graphite Electrodes, Lithium-Ion Batteries, and Other), and Brazil Needle Coke Market Size Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Needle Coke Market Size Insights Forecasts to 2035

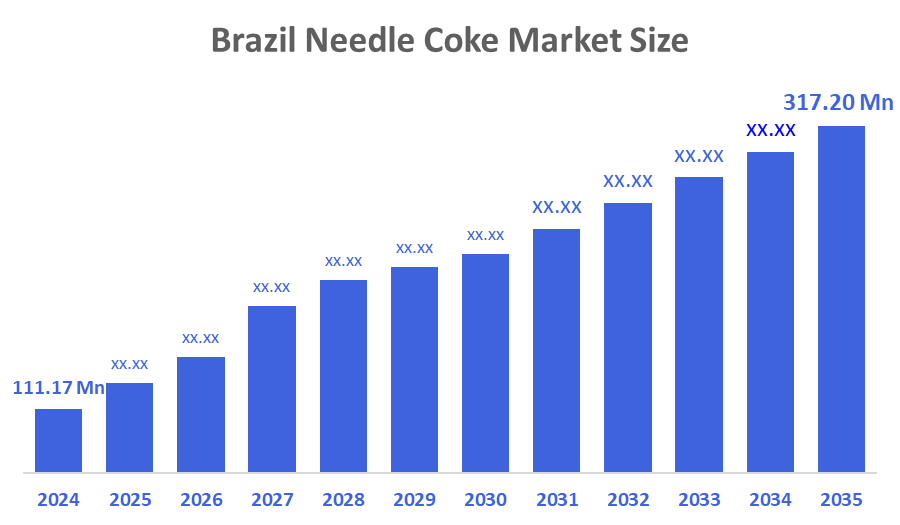

- The Brazil Needle Coke Market Size Was Estimated at USD 111.17 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10% from 2025 to 2035

- The Brazil Needle Coke Market Size is Expected to Reach USD 317.20 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Needle Coke Market Size is Anticipated to Reach USD 317.20 Million by 2035, Growing at a CAGR of 10% from 2025 to 2035. The Brazil needle coke market is driven by rising steel production, growing demand for electric arc furnaces, expanding aluminum smelting activities, increasing graphite electrode consumption, infrastructure development, and industrial growth supported by favorable manufacturing and energy sector investments.

Market Overview

Needle?????? coke is a special, top-of-the-line carbon material that comes from either petroleum or coal tar. The reason for its popularity is the unique needle-like crystalline structure, low thermal expansion, and high electrical conductivity qualities that are combined in one material. These are the most important properties of graphite electrodes made of needle coke that are used in electric arc furnaces in the steel and aluminum industries. Finally, its purity attribute makes it the best of the industrial performances. Moreover, the Brazil market is expanding due to the growing factors increasing steel and aluminum production, growing demand for graphite electrodes, expanding industrial infrastructure, adoption of electric arc furnaces, and government support for manufacturing, which is resulting in the consumption of high-quality needle coke. Besides that, the trends in the needle coke market in Brazil are: the move to high-purity and low-ash needle coke, increased usage of the electric arc furnace, investment in sustainable and eco-friendly production processes, the aluminum and steel industries as the major sectors for needle coke consumption, and the domestic manufacturing expansion for import ??????substitution.

The?????? trends in the market of Brazil needle coke demonstrate changes in the material specifications towards high-purity and low-ash needle coke, a rising use of the product in electric arc furnaces, spending on green and eco-friendly production methods, demand creation by the aluminum and steel industries and domestic manufacturing growth to cut off the import ??????dependence.

Report Coverage

This research report categorizes the market for the Brazil needle coke market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil needle coke market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil needle coke market.

Driving Factors

The?????? market for Brazil needle coke is driven by the increased production of steel and aluminum, which in turn raises the demand for high-quality graphite electrodes. The market is growing as the electric arc furnace technology is getting more widely used, there is a rise in the industrial infrastructure investments, and governments are supporting the manufacturing sector with various initiatives. Besides that, the preference for low-ash, high-purity needle coke as a source of efficient and long-lasting electrode performance is promoting the use of the product, whereas the increase in local production is making the market less dependent on imports and thus more stable and developing ??????further.

Restraining Factors

The?????? Brazil needle coke market is restrained by various factors such as the high production and raw material costs, the scarcity of high-quality feedstock in the local area, and the need for import dependency. The environmental rules and strict emission standards are the major factors that are contributing to the increase in the operational costs of the factory. The fluctuation of the market, the variations of the prices, as well as the competition from alternative carbon materials, are the main obstacles to the needle coke market in Brazil that limit the possibility of expanding it on a large scale and influence the profits of the ??????manufacturers.

Market Segmentation

The Brazil needle coke market share is categorized by product type and application.

- The petroleum-based needle coke segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil needle coke market is segmented by product type into petroleum-based needle coke and coal-tar pitch-based needle coke. Among these, the petroleum-based needle coke segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its higher purity, superior crystallinity, and low sulfur content, making it ideal for producing high-performance graphite electrodes used in electric arc furnaces for steel and aluminum production. It offers better thermal and electrical conductivity compared to coal-tar pitch-based needle coke, driving stronger demand.

- The graphite electrodes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil needle coke market is segmented by application into graphite electrodes, lithium-ion batteries, and others. Among these, the graphite electrodes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to the country’s growing steel and aluminum production, which relies heavily on electric arc furnaces. Needle coke’s high purity, low thermal expansion, and excellent conductivity make it essential for durable, high-performance graphite electrodes, resulting in strong demand compared to lithium-ion battery and other applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil needle coke market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Phillips?66?Company

- Mitsubishi?Chemical?Corporation

- GrafTech?International?Ltd.

- Sumitomo?Chemical?Company

- Indian?Oil?Corporation?Ltd.

- Asbury?Carbons?Inc.

- Seadrift?Coke?L.P.

- China National Petroleum Corporation (CNPC)

- Baosteel Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Phillips?66 announced that its Humber (UK) and Lake Charles (Louisiana) refineries began commercial production of specialty petroleum coke designed for lithium-ion battery anodes, offering a lower?carbon precursor for EV batteries and electronics. This initiative positions the company as a key supplier for synthetic graphite anode feedstocks in both Europe and North America.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil needle coke market based on the below-mentioned segments:

Brazil Needle Coke Market, By Product Type

- Petroleum-Based Needle Coke

- Coal-Tar Pitch-Based Needle Coke

Brazil Needle Coke Market, By Application

- Graphite Electrodes

- Lithium-Ion Batteries

- Other

FAQ’s

1. What is needle coke?

- Needle coke is a high-purity, crystalline carbon material used to manufacture graphite electrodes for steel and aluminum production.

2. What are the main types of needle coke?

- The market is primarily segmented into petroleum-based needle coke and coal-tar pitch-based needle coke.

3. What drives the Brazil needle coke market?

- Growth is driven by increasing steel and aluminum production, electric arc furnace adoption, and rising demand for high-quality graphite electrodes.

4. Which application dominates the market?

- Graphite electrodes dominate, due to their extensive use in steel and aluminum electric arc furnaces.

5. Who are the key players in the market?

- Major companies include Phillips 66, Mitsubishi Chemical, GrafTech International, Sumitomo Chemical, and Brazilian steel producers like Gerdau and CSN.

6. What are the market restraints?

- High production costs, limited feedstock availability, environmental regulations, and competition from alternative carbon materials.

7. What trends are shaping the market?

- Trends include the demand for low-ash, high-purity needle coke, sustainable production methods, and expanding domestic manufacturing to reduce imports.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 185 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |