Brazil Optical Transceiver Market

Brazil Optical Transceiver Market Size, Share, By Protocol (Ethernet, Fibre Channel Including FTTx, CWDM/DWDM, and Other), By Data Rate (Less Than 10 Gbps, 10-40 Gbps, and More), By Application (Data Center, Telecommunication, Enterprise and HPC Networks, and More), Brazil Optical Transceiver Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Optical Transceiver Market Size Insights Forecasts to 2035

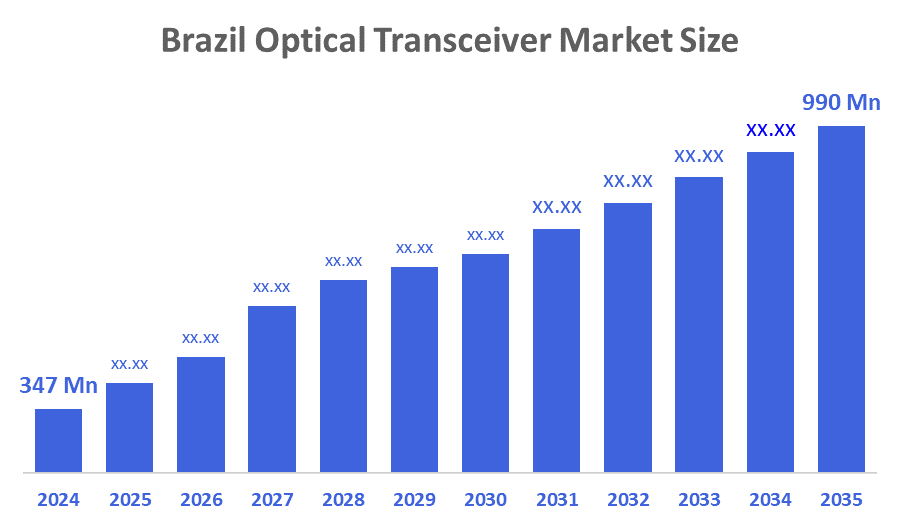

- Brazil Optical Transceiver Market Size 2024: USD 347 Mn

- Brazil Optical Transceiver Market Size 2035: USD 990 Mn

- Brazil Optical Transceiver Market CAGR 2024: 10%

- Brazil Optical Transceiver Market Segments: Protocol, Data Rate, Application.

An Optical Transceiver is a compact device that both transmits and receives optical signals over fiber optic networks. It converts electrical signals into light for transmission and converts incoming light signals back into electrical signals. Used in data communication and telecommunications, it enables high-speed, long-distance data transfer, supporting technologies like Ethernet, Fiber Channel, and optical networking systems. Furthermore, the Brazil optical transceiver market is growing due to expanding telecom infrastructure, rising internet penetration, increased demand for high-speed data transmission, adoption of 5G networks, and investments in cloud and data center services, boosting overall market development and opportunities.

In light of global supply chain disruptions, the Brazil government may implement policies to strengthen the resilience of the semiconductor supply chain. These policies may include measures to diversify supply sources, enhance domestic production capabilities, and mitigate risks associated with supply chain vulnerabilities, ensuring the availability and reliability of semiconductor components.

The Brazilian optical transceiver market is experiencing a transformative period driven by several interconnected trends. The relentless demand for increased bandwidth from data centers, fueled by cloud computing, AI, and big data analytics, is a primary driver. This necessitates a shift towards higher data rates, with 400 Gbps and beyond transceivers becoming increasingly critical for hyperscale facilities. Furthermore, the ongoing expansion and modernization of telecommunication networks, particularly the rollout of 5G, is creating substantial demand for high-performance optical transceivers capable of supporting denser networks and lower latency. The growing adoption of optical networking solutions for enterprise connectivity, moving beyond traditional copper-based infrastructure, is also contributing to market expansion. Within these trends, a key development is the increasing focus on compact form factors and pluggable modules, such as QSFP-DD and OSFP, which offer greater flexibility and scalability in network deployments.

Market Dynamics of the Brazil Optical Transceiver Market:

The Brazil optical transceiver market is driven by rapid digitalization and increasing demand for high-speed internet across urban and rural areas. Expansion of fiber optic networks, growing adoption of 5G technology, and rising data traffic from cloud computing, streaming services, and IoT devices further boost demand. Investments by telecom operators in network upgrades and modernization, along with the growing need for reliable and efficient data transmission solutions, are key factors propelling market growth in Brazil.

The Brazil optical transceiver market faces restraints from the high installation and maintenance costs of fiber optic networks. Limited skilled workforce, complex technology integration, and challenges in rural infrastructure development also hinder growth. Additionally, market fluctuations, regulatory hurdles, and competition from alternative communication technologies can slow adoption and impact overall market expansion.

The Brazil optical transceiver market presents significant opportunities due to increasing digital transformation across industries and rising demand for high-speed data communication. Expansion of 5G networks, growing cloud computing adoption, and deployment of advanced data centers create new growth avenues. Additionally, government initiatives supporting telecom infrastructure development, rising internet penetration in remote areas, and the shift toward IoT and smart city applications offer substantial potential for market players to introduce innovative, high-performance optical transceiver solutions and capture emerging market segments.

Market Segmentation

The Brazil Optical Transceiver Market share is classified into protocol, data rate, and application

By Protocol:

The Brazil Optical Transceiver market is divided by protocol into ethernet, fibre channel including FTTx, CWDM/DWDM, and other. Among these, the ethernet segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance of the Ethernet segment in the Brazil optical transceiver market is driven by its widespread use in enterprise, telecom, and data center networks. Ethernet offers high-speed data transmission, scalability, and cost-effectiveness, making it ideal for growing internet traffic and cloud computing needs. Additionally, increasing adoption of 5G networks, digitalization across industries, and demand for reliable, interoperable networking solutions further reinforce Ethernet’s preference over other protocols like Fibre Channel and CWDM/DWDM, supporting market growth.

By Data Rate:

The Brazil Optical Transceiver market is divided by data rate into less than 10 Gbps, 10-40 Gbps, and more. Among these, the 10-40 Gbps segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The 10–40 Gbps segment dominates because it meets the growing demand for high-speed, reliable data transmission in telecom networks, data centers, and enterprise applications. It provides an optimal balance between cost and performance, making it more accessible than ultra-high-speed (>40 Gbps) solutions. Increasing adoption of 5G networks, cloud services, and digital infrastructure upgrades further drives preference for this data rate, supporting widespread implementation across both urban and emerging regions in Brazil.

By Application:

The Brazil Optical Transceiver market is divided by application into data center, telecommunication, enterprise, and HPC networks, and more. Among these, the data center segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The data center segment dominates due to the rapid expansion of cloud computing, big data analytics, and digital services, which drive high demand for fast, reliable data transmission. Growing deployment of hyperscale and enterprise data centers, along with increasing internet penetration and 5G adoption, further fuels the need for high-performance optical transceivers. These factors make data centers the primary application, surpassing telecommunication, enterprise, and HPC networks in market share and growth potential.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil optical transceiver market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Optical Transceiver Market:

- Cisco Systems Inc.

- Huawei Technologies Co., Ltd.

- Arista Networks

- Broadcom Inc.

- Lumentum Holdings Inc.

- II?VI Incorporated

- Fujitsu Optical Components Ltd.

- Accelink Technologies Co., Ltd.

- Intel Corporation

- Others

Recent Developments in Brazil Optical Transceiver Market:

In March 2022, Fujitsu Optical Components Ltd. announced the development of the CFP2-DCO unity transceiver for 400Gbps DWDM open systems in March 2022, and sales began to increase in the second half of 2021.

In November 2021, Lumentum Operations LLC purchased NeoPhotonics, an established developer and manufacturer of optoelectronic and laser technologies, in November 2021 for US$ 16.00 per share in cash, for a total equity value of about US$ 918 million.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil optical transceiver market based on the below-mentioned segments:

Brazil Optical Transceiver Market, By Protocol

- Ethernet

- Fibre Channel Including FTTx

- CWDM/DWDM

- Other

Brazil Optical Transceiver Market, By Data Rate

- Less Than 10 Gbps

- 10-40 Gbps

- More

Brazil Optical Transceiver Market, By Application

- Data Center

- Telecommunication

- Enterprise and HPC Networks

- More

FAQ

Q1: What is the Brazil optical transceiver market about?

It involves devices that convert electrical signals to optical signals and vice versa, supporting high-speed data transfer across telecom, enterprise, and data center networks in Brazil.

Q2: What is fueling market growth in Brazil?

Growth is driven by rising fiber optic network deployment, cloud computing expansion, 5G adoption, and increasing demand for reliable, high-speed data communication.

Q3: Which protocol segment leads the market?

The Ethernet segment leads due to its cost-effectiveness, scalability, and widespread use in data transmission and enterprise networks.

Q4: What limits market expansion?

Challenges include high infrastructure costs, technical complexity, and limited skilled professionals for installation and maintenance.

Q5: What opportunities exist in this market?

Opportunities lie in 5G networks, data center upgrades, IoT applications, and increased internet penetration in remote areas.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 179 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |