Brazil Oral Anti Diabetic Drug Market

Brazil Oral Anti Diabetic Drug Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Biguanides, Alpha-Glucosidase Inhibitors, Dopamine D2 Receptor Agonists, SGLT-2 Inhibitors, DPP-4 Inhibitors, Sulfonylureas, Meglitinides), By Type of Diabetes (Type 1, Type 2), By Distribution Channel (Hospitals, Retail Pharmacies), and Brazil Oral Anti Diabetic Drug Market Size Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Oral Anti Diabetic Drug Market Size Insights Forecasts to 2035

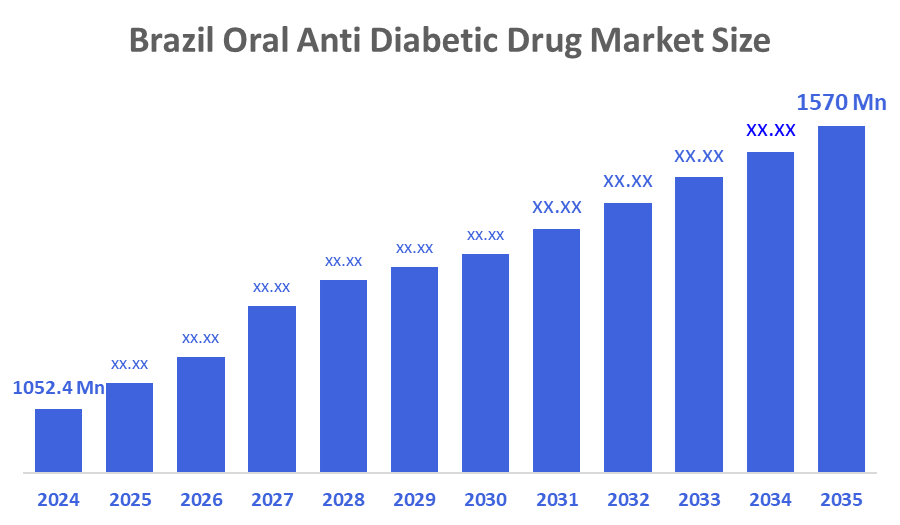

- The Brazil Oral Anti Diabetic Drug Market Size Was Estimated at USD 1,052.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.7% from 2025 to 2035

- The Brazil Oral Anti Diabetic Drug Market Size is Expected to Reach USD 1570 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Oral Anti Diabetic Drug Market Size is Anticipated to Reach USD 1570 Million by 2035, Growing at a CAGR of 3.7% from 2025 to 2035. The Brazil oral anti-diabetic drug market is driven by rising diabetes prevalence, increasing awareness of disease management, growing geriatric population, preference for oral medications over injections, supportive government healthcare initiatives, and expanding access to pharmacies and retail drug channels.

Market Overview

Oral?????? anti-diabetic drugs refer to a class of medicines that are ingested to regulate the sugar level in the blood of individuals suffering from type 2 diabetes. These drugs function through different means, such as by the body to produce more insulin, making the body more responsive to insulin, or by lessening the amount of glucose absorbed. All these methods lead to effective control of high blood sugar and prevention of complications arising from diabetes. In addition, the market for such drugs is expanding due to various factors, including the increase in the number of diabetic patients, the growing awareness of disease management, the preference for oral therapies, the development of healthcare infrastructure, the availability of government support, and the provision of affordable medicines both for the urban and rural ??????populations.

The?????? Brazilian government has been implementing measures to facilitate access to anti-diabetes drugs for the common people. One such measure is the 'Farmacia Popular' program, which aims at providing medicines at a lower price to the population. The program has been a significant factor in the diffusion of anti-diabetes drugs in the country, and hence, it has contributed to the expansion of the market. In addition to these developments, generic drugs are becoming a brand in the market. Because of the lower price of generic drugs compared to brand drugs, they have been preferred in Brazil during the last period. This trend has resulted in more competition between market players, which in turn has resulted in lower prices and anti-diabetes drugs becoming more accessible to patients. Besides this, the trend to use DPP-4 inhibitors more and more is the major reason behind the development of the oral anti-diabetic drug market in Brazil. These drugs are chosen because of the lowest risk of hypoglycemia and other side effects. Market growth is also fueled by the announcement of new SGLT-2 inhibitors, such as Invokana and ??????Jardiance.

Report Coverage

This research report categorizes the market for the Brazil oral anti diabetic drug market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil oral anti diabetic drug market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil oral anti diabetic drug market.

Driving Factors

The?????? oral anti-diabetic drug market in Brazil is driven by the increasing incidence of type 2 diabetes, the rising number of obese people and those leading sedentary lifestyles, and the expanding elderly population. Improved awareness of the importance of early diagnosis and treatment, patients' preference for easy-to-use oral drugs instead of insulin injections, healthcare access extension, government programs for the support of diabetes patients, and a broader availability of low-cost generic drugs are some of the factors that also contribute to the development of the ??????market.

Restraining Factors

The?????? market for oral anti-diabetic drugs in Brazil is restrained by the high costs of treatments with branded drugs, the side effects that occur with long-term use, and limited access to healthcare in remote areas. Moreover, the growth of the market is also being affected by challenges such as stringent regulatory approvals, low patient adherence to therapy, and the increasing preference for insulin or newer injectable ??????therapies.

Market Segmentation

The Brazil oral anti diabetic drug market share is categorized by drug type, type of diabetes, and distribution channel.

- The biguanides segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil oral anti diabetic drug market is segmented by drug type into biguanides, alpha-glucosidase inhibitors, dopamine D2 receptor agonists, SGLT-2 inhibitors, DPP-4 inhibitors, sulfonylureas, and meglitinides. Among these, the biguanides segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the extensive use of metformin as the standard first-line treatment for type 2 diabetes. Metformin is highly effective in lowering blood glucose levels, has a well-established safety profile, and is associated with minimal risk of weight gain or hypoglycemia. Its low cost, wide availability through public healthcare programs, strong physician preference, and high patient compliance further reinforce its market dominance across Brazil.

- The type 2 segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil oral anti diabetic drug market is segmented by type of diabetes into type 1 and type 2. Among these, the type 2 segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the high prevalence of type 2 diabetes in Brazil, driven by obesity, sedentary lifestyles, unhealthy dietary habits, and an aging population. Demand for oral anti-diabetic drugs remains strong. These drugs are the first-line treatment for type 2 diabetes, offering convenient administration, long-term management, affordability, and wide availability through public and private healthcare systems, which further supports market dominance.

- The retail pharmacies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil oral anti diabetic drug market is segmented by distribution channel into hospitals, retail pharmacies. Among these, the retail pharmacies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the chronic nature of diabetes; patients require continuous and convenient access to oral anti-diabetic drugs, which is best provided by retail pharmacies. Retail outlets are widely distributed across urban and semi-urban areas in Brazil, making regular prescription refills easier. They offer a wide range of affordable generic and branded medicines, competitive pricing, and pharmacist support. Additionally, government healthcare programs and private insurance reimbursement further encourage patients to purchase medications through retail pharmacies rather than hospitals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil oral anti diabetic drug market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk

- Merck & Co., Inc. (MSD)

- AstraZeneca

- Sanofi

- Eli Lilly and Company

- Boehringer Ingelheim

- Novartis AG

- Pfizer Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News

- In October 2024, Novo Nordisk announced a R$864.2 million investment in its Nova Lima, Minas Gerais, facility, which produces around 12% of the world's insulin supply. The Danish business is also focusing on its GLP-1 analogs, which are authorized diabetic treatments.

- In October 2024, Eli Lilly confirmed its continued efforts to market Mounjaro in Brazil, competing with Novo Nordisk's Ozempic. The Brazilian Health Regulatory Agency (ANVISA) approved the product in September 2023.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil oral anti diabetic drug market based on the below-mentioned segments:

Brazil Oral Anti Diabetic Drug Market, By Drug Type

- Biguanides

- Alpha-Glucosidase Inhibitors

- Dopamine D2 Receptor Agonists

- SGLT-2 Inhibitors

- DPP-4 Inhibitors

- Sulfonylureas

- Meglitinides

Brazil Oral Anti Diabetic Drug Market, By Type of Diabetes

- Type 1

- Type 2

Brazil Oral Anti Diabetic Drug Market, By Distribution Channel

- Hospitals

- Retail Pharmacies

FAQ’s

1. What are oral anti-diabetic drugs?

- They are medicines taken by mouth to control blood sugar levels in people with type 2 diabetes.

2. Which drug class dominates the market?

- Biguanides, mainly metformin, dominate due to their high effectiveness and affordability.

3. Which type of diabetes drives demand?

- Type 2 diabetes accounts for the majority of market demand.

4. Which distribution channel is dominant?

- Retail pharmacies dominate because of easy access and regular prescription refills.

5. What factors drive market growth?

- Rising diabetes prevalence, lifestyle changes, and improved healthcare access.

6. What are the key challenges?

- Side effects, patient non-adherence, and competition from injectable therapies.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 235 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |