Brazil Paper Packaging Market

Brazil Paper Packaging Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, and Others), By Packaging Level (Primary Packaging, Secondary Packaging, and Tertiary Packaging), and Brazil Paper Packaging Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Paper Packaging Market Size Insights Forecasts to 2035

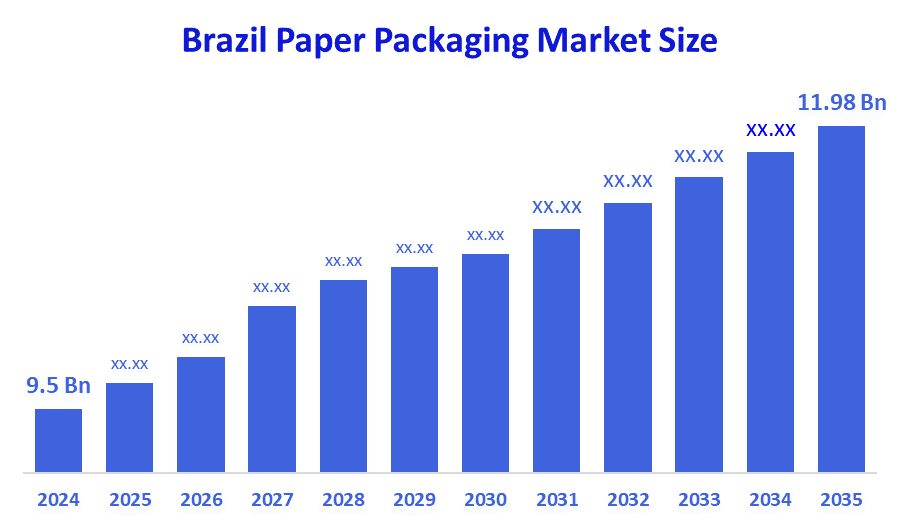

- The Brazil Paper Packaging Market Size was estimated at USD 9.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.13% from 2025 to 2035

- The Brazil Paper Packaging Market Size is Expected to Reach USD 11.98 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Paper Packaging Market Size is anticipated to Reach USD 11.98 Billion by 2035, Growing at a CAGR of 2.13% from 2025 to 2035. The Brazil paper packaging market is driven by an increasing trend towards urban living, increasing size of the retail and supermarket industries, increased exports of food products that are typically shipped overseas, greater usage of sustainable paper versus plastic materials, and outfitting hosts of production equipment with specialised automation tools from new technologies and new processes that facilitate more efficient production and lower levels of waste.

Market Overview

The Paper-Packing Market consists of the process of producing, distributing, and using paper packaging, protecting & branding products within many sectors around the world. It is primarily because of the worldwide focus on the need for more environmentally friendly, recyclable, and biodegradable products that are better options than plastic. Additionally, the Brazil's agribusiness continues to grow, e-commerce continues to expand at an alarming rate, the need for increased sustainability efforts has become prominent and people are more demanding of recyclable materials. In addition, the continued modernization of retail and the introduction of innovative technologies in the lightweight and durable packaging space are creating many excellent opportunities for the food, FMCG, and logistics sectors to grow and improve environmental sustainability. Furthermore, in Brazil, both the National Solid Waste Policy that encourage recycling and producer accountability, and the Green Economy act, promoting the sustainable and renewable use of raw materials to create products, have established a high level of demand for recyclable and eco-conscious forms of packaging throughout Brazilian manufacturing.

Report Coverage

This research report categorizes the market for the Brazil paper packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil paper packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil paper packaging market.

Driving Factors

The rapidly growing agricultural industry and growing e-commerce sector are driving growth in Brazil's paper packaging industry. There is an increasing emphasis on using sustainable and recyclable products among consumers, along with stricter rules set forth by the government concerning policies that promote reduction of waste. There is also a greater modernization of retail along with increased demand for heavier and lighter weight durable packaging. There are ongoing innovations in paper-based solutions that continue to drive growth. Increased environmental awareness and increased commitment by businesses to sustainability will continue to drive growth within the Paper Packaging sector, especially within the areas of Food, Fast Moving Consumer Goods (FMCG), Logistics, and Industrial Applications.

Restraining Factors

The Brazil paper packaging market is restrained by fluctuating raw material costs, increased competition from cheaper plastic options, high production and transport costs, a lack of recycling infrastructure and supply chain disruptions that impact both product quality and the ability to acquire paper.

Market Segmentation

The Brazil paper packaging market share is classified into product type and packaging level.

- The corrugated boxes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil paper packaging market is segmented by product type into corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others. Among these, the corrugated boxes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due increasing agricultural export volume, demand for sturdy and recycled packaging materials, rising retail modernization, development of lightweight packaging solutions, and heightened concern regarding preserving the environment, which encourages companies to implement sustainable practices regarding the development of their packaging goods.

- The secondary packaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil paper packaging market is segmented by packaging level into primary packaging, secondary packaging, and tertiary packaging. Among these, the secondary packaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to an increase in local and export logistics, and the need for product protection when transported. The rise in demand for visually attractive, stackable, branded packages and environmentally friendly, recyclable, and innovative packages creates a greater opportunity to grow within the secondary packaging sector than any other package type.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil paper packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Westrock Company

- Smurfit Kappa Group PLC

- DS Smith PLC

- Georgia-Pacific

- Packaging Corp of America

- International Paper Co

- Sonoco Products Co

- Mondi PLC

- Crown Holdings Inc

- Others

Recent Developments:

- In March 2025: Klabin inaugurated the largest and most modern corrugated board mill in the Americas at its Piracicaba II Unit in Sao Paulo. The plant, which began operations in April 2024, was built with a R$1.56?billion investment and has an annual capacity of 240,000?tons of corrugated board, enhancing the company’s production capabilities and logistical advantages.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Paper Packaging Market based on the below-mentioned segments:

Brazil Paper Packaging Market, By Product Type

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

Brazil Paper Packaging Market, By Packaging Level

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

FAQ’s

Q: What is the Brazil paper packaging market size?

A: Brazil paper packaging market size is expected to grow from USD 9.5 billion in 2024 to USD 11.98 billion by 2035, growing at a CAGR of 2.13% during the forecast period.

Q: Who are the key players in the Brazil paper packaging market?

A: Westrock Company, Smurfit Kappa Group PLC, DS Smith PLC, Georgia-Pacific, Packaging Corp of America, International Paper Co, Sonoco Products Co, Mondi PLC, Crown Holdings Inc, and Others are the key players in the Brazil paper packaging market.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 198 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |