Brazil Parkinson's Disease Treatment Market

Brazil Parkinson?s Disease Treatment Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Carbidopa-Levodopa, Dopamine Agonists, Monoamine Oxidase Type B (MAO-B) Inhibitor, Catechol-O-Methyltransferase (COMT) Inhibitors, and Others), By Route of Administration (Oral, Subcutaneous, Transdermal, and Others), By Distribution Channels (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Brazil Parkinson disease treatment Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Parkinson Disease Treatment Market Size Insights Forecasts to 2035

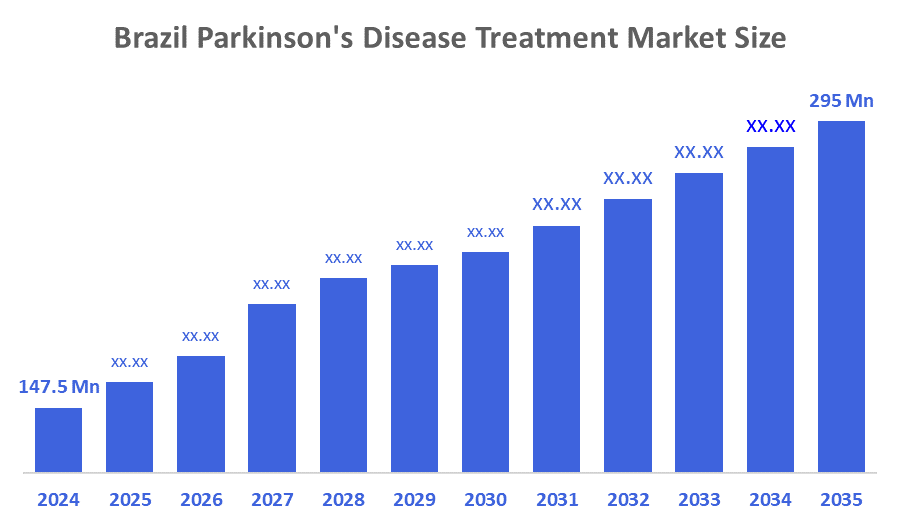

- The Brazil Parkinson Disease Treatment Market Size Was Estimated at USD 147.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.5% from 2025 to 2035

- The Brazilian Parkinson Disease Treatment Market Size is Expected to Reach USD 295 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Parkinson's Disease Treatment Market Size size is anticipated to Reach USD 295 Million by 2035, Growing at a CAGR of 6.5% from 2025 to 2035. The need for Parkinson's disease treatments has increased due to evolving environmental factors and genetic predisposition. Parkinson's disease prevalence rises with an aging population, which is expected to boost market expansion. In addition, key players' launch of new drugs is expected to drive the market’s growth.

Market Overview

Parkinson's disease is a neurological condition that primarily results in unintentional and uncontrollable movement, including stiffness, shaking, lack of balance, and coordination. Because the precise cause of nerve cell degeneration is unknown, genetics and exposure to environmental risk factors are thought to be likely causes. The symptoms start mildly and get worse with time. As the illness progresses, consumers may experience difficulty in moving and communicating. In addition, market growth is the availability of effective treatments for Parkinson's disease and growing patient and physician awareness of the ailment. Market participants are engaged in the development of novel medications that could decrease the symptoms of Parkinson's disease, even though there is no known cure for the illness. Rapid increase in geriatric population and rise in awareness about Parkinson's disease and anticipated launch of emerging therapies are driving the Parkinson's disease therapeutics market growth. Moreover, an increase in access and availability of several supportive therapies and medications for Parkinson’s treatment is estimated to propel market development in the forecast period.

Report Coverage

This research report categorizes the market for the Brazil Parkinson disease treatment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazilian Parkinson disease treatment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil Parkinson disease treatment market.

Driving Factors

The rapid aging of the population, increased public awareness of Parkinson's disease, and the anticipated release of novel treatments are propelling the market for Parkinson's disease treatments. The growing accessibility and availability of various supporting therapies and pharmaceuticals for the treatment of Parkinson's disease will drive market growth. Moreover, the number of patients visiting hospitals to receive a diagnosis of Parkinson's disease is being driven by the expansion of diagnostic laboratory availability.

Restraining Factors

The Brazil Parkinson disease treatment is restrained by Limited healthcare funding, scarce specialists, unequal access, delayed diagnosis, poor multidisciplinary care, regional disparities, an aging population, and inconsistent policy implementation.

Market Segmentation

The Brazil Parkinson disease treatment market share is categorized by drug class, route of administration, and distribution channel.

The carbidopa-levodopa segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil Parkinson disease treatment market is segmented by drug class into carbidopa-levodopa, dopamine agonists, monoamine oxidase Type B (MAO-B) Inhibitors, catechol-O-methyltransferase (COMT) inhibitors, and others. Among these, the carbidopa-levodopa segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The carbidopa-levodopa segment dominates because it remains the gold standard for Parkinson’s disease treatment, offering superior symptom control, proven efficacy, and widespread physician preference. Its affordability, availability in multiple formulations, and inclusion in public healthcare programs further drive its market leadership. The combination of carbidopa-levodopa is one of the best ways to treat Parkinson's disease. It is frequently utilized as a second line of treatment since it is the most effective.

The oral segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil Parkinson disease treatment market is segmented by route of administration into oral, subcutaneous, transdermal, and others. Among these, the oral segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The oral segment holds the largest share because it offers convenient, non-invasive, and cost-effective drug delivery. Patients prefer oral medications for ease of self-administration and long-term adherence. Additionally, the broad availability of oral formulations, established dosing flexibility, and inclusion in standard treatment protocols further strengthen its dominance in Parkinson’s disease therapy.

The hospital pharmacy segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil Parkinson disease treatment market is segmented by distribution channel into hospital pharmacy, retail pharmacy, and online pharmacy. Among these, the hospital pharmacy segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The main distribution route for both branded and generic anti-Parkinson's medications is through hospital pharmacies. The reasons expected to propel the segment's expansion include the increase in the number of patients with Parkinson's disease and the convenience with which different types of dosage forms may be obtained at hospital pharmacies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil Parkinson disease treatment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novartis AG

- Teva Pharmaceutical Industries Ltd

- Merck & Co., Inc.

- AbbVie, Inc.

- GlaxoSmithKline plc (GSK)

- H. Lundbeck A/S

- Apneal Pharmaceuticals LLC

- Supernus Pharmaceuticals, Inc.

- Caravel Therapeutics

- Boehringer Ingelheim International GmbH

- UCB S.A.

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, the European launch of prodopa was announced by AbbVie. When advanced Parkinson's disease is present, L-DOPA can help with hyperkinesia or dyskinesia, significant motor fluctuations, and other symptoms.

- In August 2023, Acorda Therapeutics, Inc. declared the opening of a new website and marketing campaign for INBRIJA (levodopa inhalation powder). The For the Fighters campaign is based on firsthand comments from Parkinson's disease patients (PWPS).

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Parkinson disease treatment market based on the following segments:

Brazil Parkinson Disease Treatment Market, By Drug Class

- Carbidopa-Levodopa

- Dopamine Agonists

- Monoamine Oxidase Type B (MAO-B) Inhibitor

- Catechol-O-Methyltransferase (COMT) Inhibitors

- Others

Brazil Parkinson Disease Treatment Market, By Route of Administration

- Oral

- Subcutaneous

- Transdermal

- Others

Brazil Parkinson Disease Treatment Market, By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 263 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |