Brazil Payment Processing Solutions Market

Brazil Payment Processing Solutions Market Size, Share, By Payment Method (Credit Card, Debit Card, E-Wallet, and Other), By End Use (Hospitality, retail, Utilities & Telecommunication, and Others), Brazil Payment Processing Solutions Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Payment Processing Solutions Market Insights Forecasts to 2035

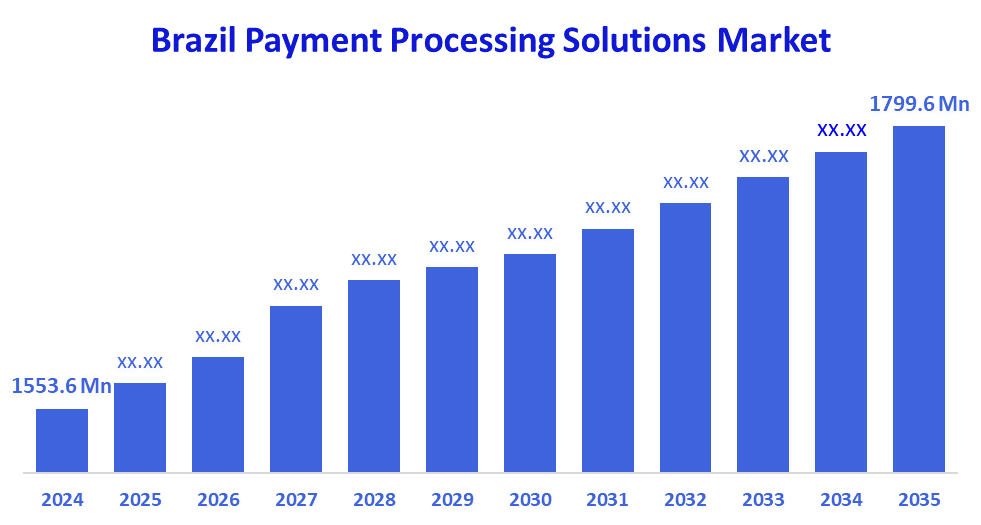

- Brazil Payment Processing Solutions Market Size 2024: USD 1553.6 Mn

- Brazil Payment Processing Solutions Market Size 2035: USD 1799.6 Mn

- Brazil Payment Processing Solutions Market CAGR 2024: 15.83%

- Brazil Payment Processing Solutions Market Segments: Payment Method and End Use

The Brazil comprises a sector made up of a variety of payment processing solutions that provide secure, fast & efficient means for conducting electronic payment transactions across multiple business sectors, including retail, eCommerce, banking services, health care services, and many State governments. To this end these solutions provide support for authorization, clearing & settlement, fraud detection, & regulatory compliance related to electronic transactions to enable consumers the ability to conduct online transactions seamlessly and securely on a national basis, enabling them to conduct business without travelling and using cash as a means of transacting business.

The payment processing solutions are growing in Brazil due to the tremendous growth being experienced in shop-at-home shopping, the rise in the number of internet users in Brazil, increasing number of consumers who prefer to conduct their transactions using digital means, and the continuing demand for e-payments, as such the continued growth of the number of instant payment systems coming to market, the increase of innovative Fintech's who are bringing into existence the new methods of payment in Brazil, and by the entrance of global merchants & global payment providers who have entered into Brazilian payments processing marketplace; will continue to enhance demand for more advanced payment processing solutions.

The Brazil has an expansive & growing e-payments infrastructure ecosystem, it is supported by governmental & regulatory initiatives being led by the central bank of Brazil, regarding educating & supporting financial inclusion, open banking, real-time payments, the introduction of several regulatory frameworks into the Brazilian marketplace, the introduction of the Brazilian data protection Laws, which encourages transparency, security, competition, and in turn will allow financial institutions & fintech to layer digital financial infrastructure on top of their existing systems, which in return allows financial institutions to improve their transaction processing efficiency compliance laws, while also enabling individuals utilizing the digital financial infrastructure's ecosystem to be more accessible to the market as it pertains to both electronic transaction processing & access to the market.

Market Dynamics of the Brazil Payment Processing Solutions Market:

The Brazil payment processing solutions market is driven by the surge in electronic commerce Additional factors include the increased use of digital payment services such as pix, progress made by innovative fintech, consumer preference for non-cash and remote payments as well as favourable government policies, open banking initiatives, financial inclusion initiatives and an increase in merchant requirements for secure, scalable, and fraud-resistant payment processing platforms, increasing levels of digital banking usage, and the proliferation of smartphone and internet users.

The Brazil payment processing solutions market is restrained by the cybersecurity risk, fraud, data privacy concerns, and a host of other factors. High initial implementation costs impose a barrier for small- to mid-size merchants that wish to implement sophisticated payment systems. Additionally, regulatory complexities, compliance obligations, integration challenges, and the absence of adequate digital infrastructure throughout Brazil's rural and remote areas will also pose significant obstacles to widespread market growth and adoption.

Brazil's payment processing solutions market is expected to experience solid growth in the future, because of technological advancements such as artificial intelligence (AI)-based fraud detection, Blockchain-based Security (BC) Systems, cloud computing platforms (CPs), and data analytics will create opportunities for the market due to their rapid expansion. All these advanced technologies will enhance efficiency in transactions, improve the level of security of transactions, create a better user experience, and provide compliance with regulatory requirements as they evolve over time.

Market Segmentation

The Brazil Payment Processing Solutions Market share is classified into payment type and end use.

By Payment Type:

The Brazil payment processing solutions market is divided by payment type into credit card, debit card, e-wallet, and other. Among these, the credit card segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The credit card segment holds the highest share of payment processing solutions in Brazil. The acceptance of credit cards in retail, e-commerce, and service sectors is very broad, and credit cards have a strong preference among consumers because of their instalment payment capabilities, large reward programs, and availability of consumer credit. In Brazil, the popularity of credit card usage is further supported by a strong urban consumer base, an advanced secure processing network, and significant support for credit cards from both banks and fintech.

By End Use:

The Brazil payment processing solutions market is divided by end use into hospitality, retail, utilities & telecommunication, and others. Among these, the retail segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The retail segment dominates because retail has the greatest number of transactions from consumers using digital payment options in convenience stores, supermarkets, shopping malls, etc. The rapid rise in online shopping combined with higher levels of consumer foot traffic, omnichannel retailing, and increased acceptance of cards, pix and mobile wallets allow for retail to dominate the rest of the sectors in the Brazil payment processing solutions market.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil payment processing solutions market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Payment Processing Solutions Market:

- Apple Inc

- Alibaba Group Holding Ltd ADR

- Alphabet Inc Class A

- Amazon.com Inc

- Prosus NV ADR

- Adyen NV

- PayPal Holdings Inc

- Others

Recent Developments in Brazil Payment Processing Solutions Market:

In December 2025, Apple agreed with Brazil’s antitrust regulator (CADE) to allow third-party app stores and alternative payment processing options on iOS in Brazil, which enhanced competition and expanded digital payment choices for consumers and merchants.

In August 2025, Stripe expanded its services in Brazil by partnering with EBANX to enable Pix acceptance for Stripe merchants, allowing businesses to process Brazil’s instant payments directly at checkout.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil payment processing solutions market based on the below-mentioned segments:

Brazil Payment Processing Solutions Market, By Payment Method

- Credit Card

- Debit Card

- E-Wallet

- Other

Brazil Payment Processing Solutions Market, End Use

- Hospitality

- Retail

- Utilities & Telecommunication

- Others

FAQ

Q: What is the Brazil payment processing solutions market size?

A: Brazil Payment Processing Solutions Market is expected to grow from USD 1553.6 million in 2024 to USD 1799.6 million by 2035, growing at a CAGR of 15.83% during the forecast period 2025-2035.

Q: How is the market segmented by End Use?

A: The market is segmented into hospitality, retail, utilities & telecommunication, and others.

Q: Who are the key players in the Brazil payment processing solutions market?

A: Key companies include Apple Inc, Alibaba Group Holding Ltd ADR, Alphabet Inc Class A, Amazon.com Inc, Prosus NV ADR, Adyen NV, PayPal Holdings Inc, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 207 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |