Brazil Pet Food Market

Brazil Pet Food Market Size, Share, and COVID-19 Impact Analysis, By Pet Food Product (Pet Food, Pet Nutraceuticals/Supplements, Pet Treats, and Pet Veterinary Diets), By Pets (Cats, Dogs, and Other), By Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and Other), and Brazil Pet Food Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Pet Food Market Insights Forecasts to 2035

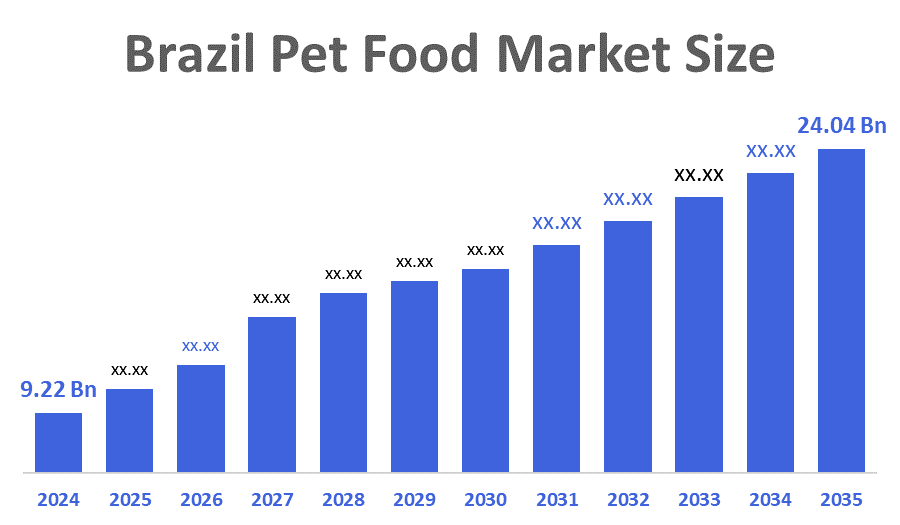

- The Brazil Pet Food Market Size Was Estimated at USD 9.22 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.1% from 2025 to 2035

- The Brazil Pet Food Market Size is Expected to Reach USD 24.04 Billion by 2035

According to a research report published by Decision Advisior & Consulting, the Brazil Pet Food Market size is anticipated to reach USD 24.04 Billion by 2035, growing at a CAGR of 9.1% from 2025 to 2035. The Brazil pet food market is driven by rising pet humanization, increasing pet ownership, growing awareness of pet nutrition and health, higher disposable incomes, urbanization, demand for premium and functional pet food, and strong expansion of organized retail and e-commerce channels.

Market Overview

Pet?????? food is the term that defines a commercial or homemade food product formulated specially to meet the nutritional needs of domestic animals such as dogs, cats, birds, and fish. The product comes in dry, wet, and semi-moist forms and provides balanced nutrients for growth, health, and general well-being. Besides that, the pet food market in Brazil is expanding due to increased pet ownership, the trend of treating pets as family members, a rise in spending on pet care, better awareness of pet nutrition, and easy availability of pet food through supermarkets, pet stores, and online shopping platforms. On top of that, humanization trends are growth in functional pet food, such as grain-free, organic, and high-protein products. The growth of e-commerce and subscription models is making premium brands more available. Among other reasons, concerns about pet health and recommendations by vets are also leading to the purchase of fortified and therapeutic diets.

The pet food market is evolving with the ingredient revolution, including new proteins and superfoods, to enhance nutrition and sustainability in the pet food market in Brazil. One of them is insect-based proteins, such as black soldier fly larvae, which are very digestible and have a lower environmental footprint. For example, Sumitomo Corporation invested in Brazilian biotech company Cyns in January 2024 to promote the production of black soldier fly protein for animal nutrition in Latin America. This investment will enable Cyns to build a new plant and broaden their presence in the markets of dog and cat food, aquaculture, and livestock, thus contributing to the adoption of sustainable practices in the face of growing demand. As another example, in February 2023, PremieRpet, a leading Brazilian pet food manufacturer, made an announcement of its decision to invest in the largest solar power plant in São Paulo and hence be the first industry player to implement solar energy in the production ??????process.

Report Coverage

This research report categorizes the market for the Brazil pet food market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil pet food market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil pet food market.

Driving Factors

The Brazil pet food market is driven by rising pet ownership, strong pet humanization trends, and growing awareness of pet health and nutrition. Increasing disposable incomes encourage spending on premium and specialized pet food. Urban lifestyles, busy schedules, expansion of organized retail and e-commerce, and demand for natural, functional, and high-quality products further support steady market growth across the country. Furthermore, in January 2023, special dog co. Brazil's sixth-largest pet food company announced its plans to invest USD1.54 million in a new 7,000-square-meter distribution center in Extrema. The facility will enhance logistics supporting the weekly distribution of 600 tons.

Restraining Factors

The Brazil pet food market faces restraints such as high prices of premium pet food, rising raw material and production costs, and economic fluctuations affecting consumer spending. Limited awareness in rural areas, dependence on imports for certain ingredients, and price sensitivity among middle- and low-income households also restrict market growth.

Market Segmentation

The Brazil pet food market share is categorized by pet food product, pet, and distribution channel.

- The pet food segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil pet food market is segmented by pet food product into pet food, pet nutraceuticals/supplements, pet treats, and pet veterinary diets. Among these, the pet food segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by an essential daily necessity for pets, especially dogs and cats. Dry and wet food are widely consumed due to convenience, balanced nutrition, long shelf life, and affordable pricing. Strong distribution through supermarkets, pet stores, and online platforms further supports high sales volumes compared to specialized products like supplements or veterinary diets.

- The dogs segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil pet food market is segmented by pets into cats, dogs, and others. Among these, the dogs segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the country’s large dog population and higher food consumption per dog compared to other pets. Dog owners prioritize regular feeding with nutritionally balanced commercial food. A wide range of affordable and premium dog food products, strong brand presence, and extensive distribution through supermarkets, pet shops, and online platforms further drive higher demand and sales volume for dog food across Brazil.

- The supermarkets/hypermarkets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil pet food market is segmented by distribution channel into convenience stores, online channel, specialty stores, supermarkets/hypermarkets, and other. Among these, the supermarkets/hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to their wide geographic presence, ability to offer bulk and value packs, competitive pricing, and a wide variety of products. Consumers prefer these channels for convenience, reliability, and one-stop shopping. In contrast, specialty stores, convenience stores, and online platforms cater to niche or premium segments and have limited reach, making them less dominant in overall market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil pet food market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mars, Incorporated

- Nestlé Purina

- BRF Pet SA

- PremieRpet

- Hill’s Pet Nutrition

- Special Dog

- Adimax

- Premier Pet

- Total Alimentos

- Grandfood

- Mogiana Alimentos

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- March 2023, PremieRpet launched a line of superpremium, "Protein-packed" meal toppers/treats for dogs and cats under the brand Natoo. These are produced at PremieRpet's facility in Brazil.

- In May 2025, Adimax opened a new USD 140 million pet food plant in Mandirituba, Brazil, increasing its production capacity by 7,000 tons per month. This expansion solidified Adimax's position as Brazil's largest pet food producer, enhancing supply and boosting exports across South America, impacting market competition and growth.

- In April 2025, Petfood Forum launched Petfood Forum Brazil, a new portal providing original content in Portuguese for Brazil's pet food industry. The initiative aims to support the growing demand for local and global pet food insights, enhancing education, trends, and market development across Brazil.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Brazil pet food market based on the below-mentioned segments:

Brazil Pet Food Market, By Pet Food Product

- Pet Food

- Pet Nutraceuticals/Supplements

- Pet Treats

- Pet Veterinary Diet

Brazil Pet Food Market, By Pets

- Cats

- Dogs

- Other

Brazil Pet Food Market, By Distribution Channel

- Convenience Stores

- Online Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Other

FAQ’s

Q1. What is pet food?

- Pet food is specially formulated food for domestic animals like dogs, cats, birds, and fish, available in dry, wet, or semi-moist forms to provide balanced nutrition and support overall health.

Q2. What are the main product segments in Brazil?

- Pet food, pet nutraceuticals/supplements, pet treats, and veterinary diets. The pet food segment dominates.

Q3. Which pets dominate the market?

- Dogs dominate due to their larger population, higher food consumption, and strong owner spending.

Q4. What are the main distribution channels?

- Supermarkets/hypermarkets, specialty stores, online channels, convenience stores, and others. Supermarkets/hypermarkets dominate the market.

Q5. Who are the key companies?

- Mars, Nestlé Purina, BRF Pet SA, PremieRpet, Hill’s Pet Nutrition, Special Dog, Adimax, Premier Pet, Total Alimentos, Grandfood, and Mogiana Alimentos.

Q6. What drives the Brazil pet food market?

- Rising pet ownership, humanization of pets, increasing disposable incomes, awareness of pet nutrition, and expansion of retail and e-commerce.

Q7. What restrains market growth?

- High prices of premium products, rising raw material costs, economic fluctuations, and limited awareness in rural areas.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 206 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |