Brazil Petrochemicals Market

Brazil Petrochemicals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Ethylene, Propylene, Benzene, Xylene, Methanol, Butadiene, Aromatics, Polymers, and Others), By End-User (Industrial, Residential, and Commercial), and Brazil Petrochemicals Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Petrochemicals Market Size Insights Forecasts to 2035

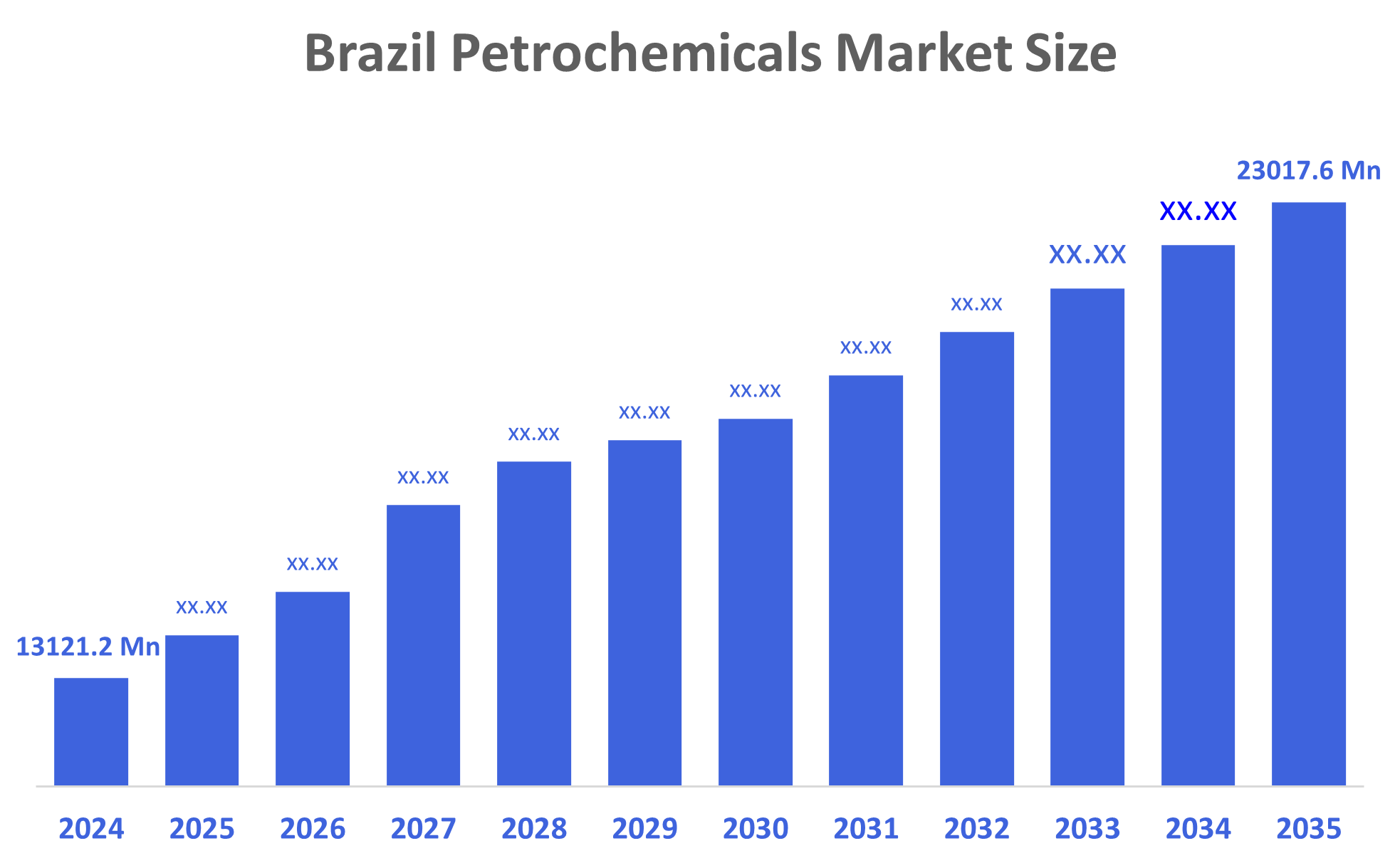

- The Brazil Petrochemicals Market Size was estimated at USD 13121.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.24% from 2025 to 2035

- The Brazil Petrochemicals Market Size is Expected to Reach USD 23017.6 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Petrochemicals Market Size is Anticipated to Reach USD 23017.6 Million by 2035, Growing at a CAGR of 5.24% from 2025 to 2035. The Brazil petrochemicals market is driven by the an increase in foreign direct investment, expanding reserves of oil and gas, supportive government policies, capacity increases of jumbo's, improved exporting infrastructure, regional trade integration, and the increasing use of bio-based feedstocks in place of traditional feedstocks to lower carbon intensity and to have a wider source of raw materials are all factors contributing to research and development expenditures on enhanced oil recovery and enhanced coalbed methane production.

Market Overview

The Petrochemicals Industry is a huge sector whose focus is on producing, distributing, and selling chemicals, which are made from the process of extracting and utilizing crude oil and natural gas as raw materials. Petrochemicals are used in the manufacturing of many products across many industries. Additionally, the opportunities for growth within Brazil's petrochemical industry found through integrated refinery & petrochemical complexes, increased demand for packaging and plastics, the growth of automotive and construction applications, and an increase in sustainable, bio-based & recyclable petrochemical applications being developed.

The Brazilian Government is promoting investment in refining and petrochemical infrastructure through various government policies. These policies, which support energy independence and industrial development, have encouraged both local and foreign companies to invest in Brazil. Furthermore, the Brazilian government has created public-private partnerships to assist with increasing the amount of capacity that will be added to the petrochemical industry and to create avenues for companies to transfer technology. Additionally, through tax incentives and subsidies, the Brazilian government has enabled companies to economically develop large-scale petrochemical projects. The proactive support of the government is a key driver for the long-term growth of the Brazil Petrochemical Market.

Report Coverage

This research report categorizes the market for the Brazil petrochemicals market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil petrochemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil petrochemicals market.

Driving Factors

The Brazil petrochemicals market is driven by the increasing consumer demands for plastics & packages, fast increasing industries & infrastructure development, along with a growing number of downstream industries such as fertiliser & pharmaceutical products as well as textile industries. Additionally, Brazil is using innovative methods to produce more efficiently through automation, more advanced technology used in cracking petroleum, as well as using less environmentally harmful or damaging ways to manufacture petrochemicals. All these developments are allowing Brazil to be globally competitive with petrol-based chemicals and to have long-term sustainability.

Restraining Factors

The Brazil petrochemicals market is restrained by increased regulatory and environmentally sustainable pressures, volatility with principal feedstocks such as crude oil & natural gas, capital-intensive investments required, complex regulatory barriers between countries - the above factors combine to decrease some profitability growth opportunities and to limit flexible operations due to intense competitive market forces associated with bioplastics & recycled products.

Market Segmentation

The Brazil Petrochemicals Market share is classified into product type and end-user.

- The polymers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil petrochemicals market is segmented by product type into ethylene, propylene, benzene, xylene, methanol, butadiene, aromatics, polymers, and others. Among these, the polymers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to an increase in demand for packaging and plastic products, an expanding building and automotive market, rapid urban population growth, increasing consumer goods consumption, more affordable lightweight materials, continued growth of eCommerce, as well as many emerging applications for the healthcare and the infrastructure development industries.

- The industrial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil petrochemicals market is segmented by end-user into industrial, residential, and commercial. Among these, the industrial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to an increase in production of construction, automobile, and packaging products, a developing agricultural chemical and pharmaceutical market, massive investment in infrastructure and industrialization, and an expanding volume of exports from Brazil. Additionally, the use of advanced and cost-effective petrochemical processing technologies will improve the sector's overall growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil petrochemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- China National Petroleum Corporation

- ExxonMobil

- INEOS

- SABIC

- Dow Inc

- China Petroleum & Chemical Corp Class H

- LyondellBasell Industries NV Class A

- Chevron Corp

- Shell PLC

- Others

Recent Developments:

- In February 2025: Braskem announced a strategic shift in its feedstock strategy, committing to transition production from naphtha to ethane. The move aimed to lower production costs, reduce carbon emissions, and enhance the company’s competitiveness in Brazil’s domestic petrochemical market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Petrochemicals Market based on the below-mentioned segments:

Brazil Petrochemicals Market, By Product Type

- Ethylene

- Propylene

- Benzene

- Toluene

- Xylene

- Methanol

- Butadiene

- Aromatics

- Polymers

- Others

Brazil Petrochemicals Market, By End-User

- Industrial

- Residential

- Commercial

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |