Brazil Pharmaceutical Dissolution Testing Services Market

Brazil Pharmaceutical Dissolution Testing Services Market Size, Share, and COVID-19 Impact Analysis, By Method (In vitro, In vivo), By Dosage Form (Capsules, Tablets, Others), By Dissolution Apparatus (Basket, Paddle, Others), and Brazil Pharmaceutical Dissolution Testing Services Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Pharmaceutical Dissolution Testing Services Market Insights Forecasts to 2035

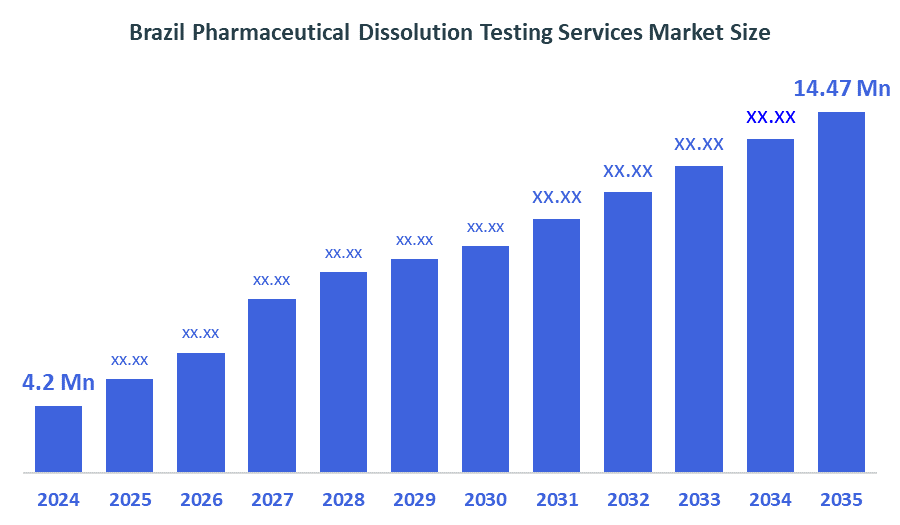

- The Brazil Pharmaceutical Dissolution Testing Services Market Size Was Estimated at USD 4.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.9% from 2025 to 2035

- The Brazil Pharmaceutical Dissolution Testing Services Market Size is Expected to Reach USD 14.47 Million by 2035

T

According to a research report published by Decision Advisors the Brazil Pharmaceutical Dissolution Testing Services Market size is anticipated to reach USD 14.47 Million by 2035, growing at a CAGR of 11.9% from 2025 to 2035. The Brazil pharmaceutical dissolution-testing services market is influenced by strict ANVISA regulations, growth of generics and bioequivalence studies, increasing outsourcing to CROs, rising demand for complex formulation testing, and investment in advanced dissolution technologies. Quality accreditation, automation, and data-integrity requirements further shape service demand and competition.

Market Overview

The Brazil pharmaceutical dissolution testing services market refers to specialized laboratories and CROs that perform dissolution studies to evaluate how quickly and efficiently drug molecules release from solid oral dosage forms. These services support quality control, regulatory submissions, method development, and bioequivalence studies. They ensure compliance with ANVISA standards, helping pharmaceutical companies maintain product performance, safety, and therapeutic consistency. Additionally, Brazil’s pharmaceutical dissolution-testing services market is expected to grow due to the expansion of generics and bioequivalence studies, strict regulatory requirements from ANVISA, and increasing demand for quality-control testing. Increased outsourcing to CROs, growth in complex and modified-release formulations, and advancements in automated dissolution technologies further boost market demand. The overall expansion of Brazil’s pharmaceutical industry also strengthens the need for reliable dissolution-testing services. Technological advancements, such as automated dissolution systems, HPLC/UPLC integration, robotics, and LIMS-based data management, enhance testing accuracy, speed, and regulatory compliance. Government support through strict ANVISA standards, incentives for generics, mandatory bioequivalence requirements, and stronger drug-quality regulations increases demand for reliable dissolution-testing services, driving steady market growth in Brazil.

Report Coverage

This research report categorizes the market for the Brazil pharmaceutical dissolution testing services market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil pharmaceutical dissolution testing services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil pharmaceutical dissolution testing services market.

Driving Factors

Brazil’s pharmaceutical dissolution-testing services market is driven by the rapid expansion of generics, rising demand for bioequivalence studies, and strict ANVISA quality-control regulations that require consistent dissolution profiling. Growing outsourcing to CROs, increased production of complex and modified-release formulations, and adoption of automated, high-precision dissolution technologies further support market growth. Recent developments, such as ANVISA’s strengthened monitoring of generic drug performance and updated regulatory requirements for analytical testing, have increased the need for reliable, accredited dissolution-testing services across the pharmaceutical sector.

Restraining Factors

Brazil’s pharmaceutical dissolution-testing services market faces restraints such as high equipment and technology investment costs, limited availability of skilled analytical professionals, and lengthy regulatory approval timelines. Smaller labs struggle with compliance demands, data-integrity standards, and maintenance of advanced systems. Additionally, pricing pressure, competition among CROs, and variability in pharmaceutical R&D spending can slow market growth.

Market Segmentation

The Brazil pharmaceutical dissolution testing services market share is categorized by method, dosage form, and dissolution apparatus.

- The in vitro segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil pharmaceutical dissolution testing services market is segmented by method into in vitro, in vivo. Among these, the in vitro segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its essential for routine quality control, generic drug approval, and post-approval change evaluations required by ANVISA. In vitro testing is significantly more cost-effective, faster, and easier to standardize than in vivo studies, making it suitable for large-scale pharmaceutical manufacturing and regulatory submissions. It supports method development, stability studies, and bioequivalence predictions without exposing human subjects to risk. Pharmaceutical companies also prefer in vitro methods due to high throughput, reproducibility, and reduced ethical and logistical challenges compared to in vivo testing.

- The tablets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil pharmaceutical dissolution testing services market is segmented by dosage form into capsules, tablets, and others. Among these, the tablets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to they represent the most widely produced and consumed oral dosage form in Brazil’s pharmaceutical market, especially for generics and chronic-disease medications. Their high manufacturing volume creates a strong need for routine dissolution testing to meet ANVISA’s strict quality and performance requirements. Tablets also require detailed dissolution profiling during formulation development, stability studies, and post-approval changes, resulting in greater testing demand compared to capsules and other dosage forms, which are produced in smaller volumes.

- The paddle segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil pharmaceutical dissolution testing services market is segmented by dissolution apparatus into basket, paddle, and other. Among these, the tablets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to it being the most widely used and recommended method for tablets, the dominant dosage form in the country. It offers better reproducibility, simpler setup, and stronger suitability for both immediate-release and modified-release formulations. ANVISA and global pharmacopeias frequently reference the paddle method, making it the preferred choice for quality control, routine testing, formulation development, and bioequivalence support compared to the basket and other apparatus types.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil pharmaceutical dissolution testing services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Intertek Group plc

- Almac Group Ltd

- Technologies, Inc.

- Catalent, Inc.

- Thermo Fisher Scientific Inc.

- SOTAX AG

- Charles River Laboratories International, Inc.

- Boston Analytical, Inc.

- Pace Analytical Life Sciences, LLC

- Albany Molecütar Research Inc.

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Brazil pharmaceutical dissolution testing services Market based on the below-mentioned segments:

Brazil Pharmaceutical Dissolution Testing Services Market, By Method

- In vitro

- In vivo

- Other

Brazil Pharmaceutical Dissolution Testing Services Market, By Dosage Form

- Capsules

- Tablets

- Other

Brazil Pharmaceutical Dissolution Testing Services Market, By Dissolution Apparatus

- Basket

- Paddle

- Other

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |