Brazil Plastic Bottles Market

Brazil Plastic Bottles Market Size, Share, and COVID-19 Impact Analysis, By Resin (Polyethylene, Polyethylene Terephthalate, Polypropylene, Other), By End-use Industries (Food, Beverage, Pharmaceuticals, Personal Care & Toiletries, Industrial, Household Chemicals, Paints & Coatings, Other End-use Industries), and Brazil Plastic Bottles Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Plastic Bottles Market Insights Forecasts to 2035

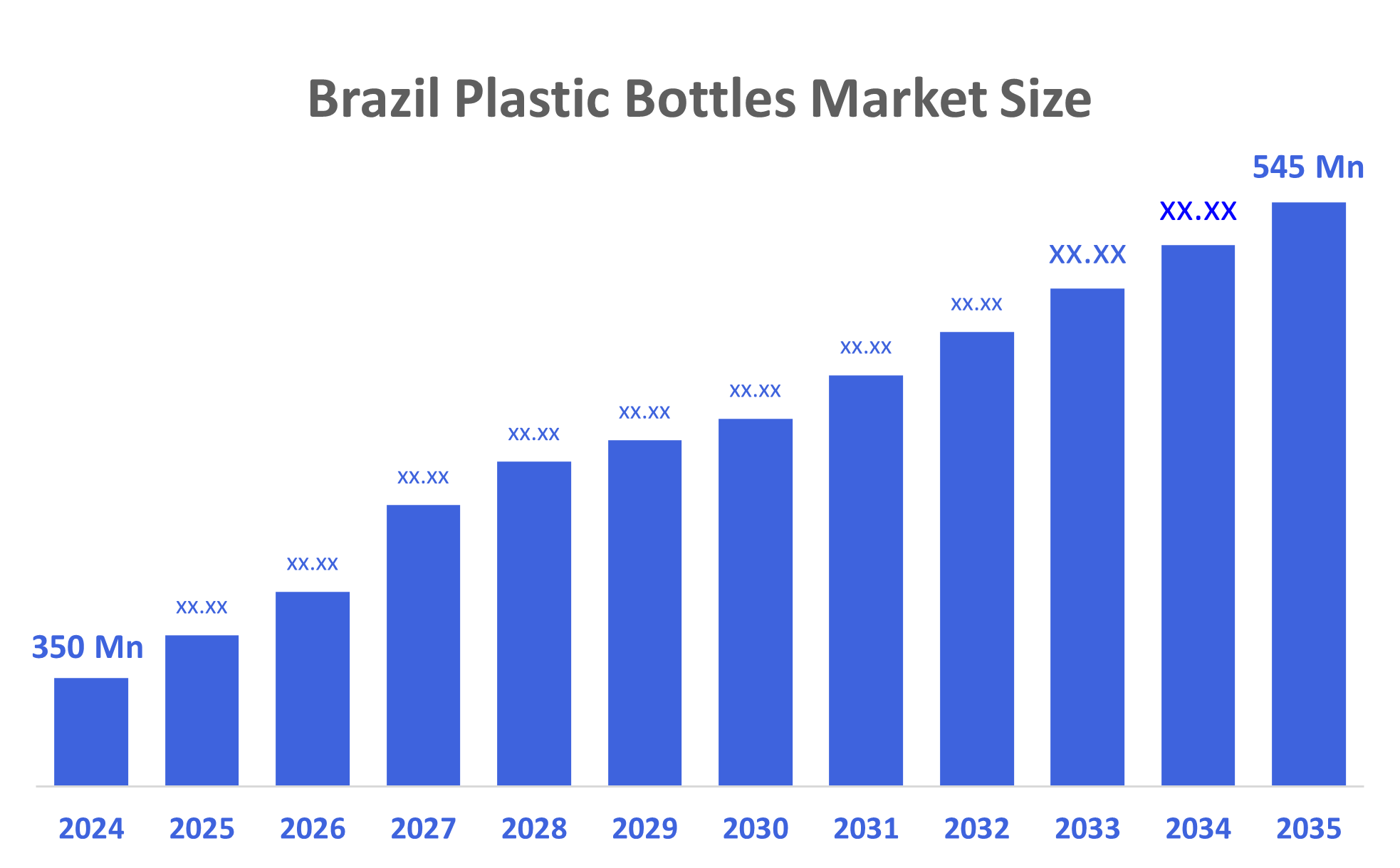

- The Brazil Plastic Bottles Market Size Was Estimated at USD 350 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.1% from 2025 to 2035

- The Brazil Plastic Bottles Market Size is Expected to Reach USD 545 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Plastic Bottles Market Size is Anticipated to Reach USD 545 Million by 2035, Growing at a CAGR of 4.1% from 2025 to 2035. The Brazil plastic bottles market is growing due to increasing demand from the food, beverage, personal care, and pharmaceutical industries. Urbanization, e-commerce growth, and the preference for convenient, durable, and recyclable packaging are driving the market. Technological advancements in plastic manufacturing further support this expansion.

Market Overview

Plastic bottles are containers made from plastic to store liquids, and liquid containers designed from Plastics are generally referred to as 'plastic bottles', as this type of container can hold many types of liquids, including water, juice, milk, soft drinks, etc. The main features of plastic bottles are light weight, strength, and ease of use when carrying them anywhere daily. Also available in many shapes, sizes, and colours, many can also be reused and recycled to help reduce waste. Widely used within households, by businesses, and while travelling due to their low cost and practicality, the growth of the Brazilian market for plastic bottles is largely being driven by the increasing consumer and industry demand for eco-friendly and biodegradable plastic packaging. The vast majority of the Brazilian plastic bottle industry growth is due to a gradual shift by consumers and businesses towards more sustainable forms of packaging to help protect the environment.

This shift has created many opportunities for innovation in the production of bio-based and recyclable bottles, and makes Brazil unique compared to the majority of other markets that primarily manufacture plastic bottles with traditional forms of plastic, for a variety of reasons. The rapid growth of the Brazilian market for plastic bottles can also be attributed to advances in polymers (especially PET and HDPE), expanding applications in food and beverage, personal care, and household prepared food and feed products (among others). PET bottles are demanded for their clarity, recyclability, barrier properties, etc, and consumer awareness of the environmental benefits associated with using traditionally produced plastic bottles will continue to drive increased demand for more sustainable packaging options. Plastic bottles are commonly made from polymer types S1 (PET), S2 (Polypropylene), and S3 (Polyethylene) and therefore are typically lightweight, low-cost, recyclable, and preferred by a wide variety of businesses. All of these factors contribute to the strong demand for these products.

Report Coverage

This research report categorizes the market for the Brazil plastic bottles market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil plastic bottles market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil plastic bottles market.

Driving Factors

Brazil’s plastic bottles market is a rising focus on sustainable and innovative packaging solutions. Companies are introducing biodegradable, recyclable, and lightweight bottles to meet growing environmental concerns. Additionally, demand for specialized packaging, such as child-resistant and tamper-evident bottles in pharmaceuticals and herbal products, is increasing. Technological advancements in polymers like PET and HDPE allow better durability, clarity, and barrier properties, expanding applications across food, beverage, personal care, and healthcare sectors. This combination of sustainability and innovation distinguishes Brazil’s market from others.

Restraining Factors

Brazil’s plastic bottles market is restrained by environmental regulations targeting single-use plastics, which limit production and increase compliance costs. Additionally, growing consumer preference for alternative packaging materials like glass or metal for sustainability reasons slows market growth. High raw material price fluctuations and limited recycling infrastructure in some regions further challenge manufacturers, making Brazil’s market dynamics different from other countries, where regulations and consumer preferences may be less stringent.

Market Segmentation

The Brazil plastic bottles market share is categorized by resin and end-use industries.

- The polyethylene terephthalate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil plastic bottles market is segmented by resin into polyethylene, polyethylene terephthalate, polypropylene, and other. Among these, the polyethylene terephthalate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its superior properties compared to other resins. PET is strong, lightweight, and provides excellent clarity, making it ideal for beverages and food packaging where product visibility is important. Its excellent barrier properties help preserve freshness and prevent contamination. PET is also highly recyclable, aligning with growing environmental and sustainability concerns among consumers and manufacturers. Additionally, its versatility allows use in various industries, including personal care and pharmaceuticals, making PET the most preferred and widely adopted resin in Brazil.

- The beverage segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil plastic bottles market is segmented by end-use industries into food, beverage, pharmaceuticals, personal care & toiletries, industrial, household chemicals, paints & coatings, and other end-use industries. Among these, the beverage segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the country’s high consumption of bottled drinks, including water, soft drinks, juices, and alcoholic beverages. Plastic bottles, particularly PET, are preferred for their lightweight, durable, and recyclable properties, making them ideal for packaging and transportation. Convenience and on-the-go consumption trends further boost demand. Additionally, increasing urbanization, rising disposable incomes, and expanding retail and e-commerce channels support the widespread use of plastic bottles in beverages, making this segment the largest and fastest-growing in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil Plastic bottles market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ALPLA Group

- Sidel Group

- Berry Global Inc.

- Amcor Group

- Velaplast

- Graham Packaging

- Gerresheimer AG

- Logoplaste

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

May 2024: ALPLA, a specialist in plastic packaging, is introducing a safe, affordable, and sustainable recyclable PET wine bottle. Weighing just an eighth of a traditional glass bottle, this innovation cuts the carbon footprint by as much as 50% and offers potential cost savings of up to 30%. The bottle can be produced entirely from recycled PET (rPET). Currently, the packaging solution is available in 0.75-liter and 1-liter sizes.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil plastic bottles market based on the below-mentioned segments:

Brazil Plastic Bottles Market, By Resin

- Polyethylene

- Polyethylene Terephthalate

- Polypropylene

- Other

Brazil Plastic Bottles Market, By End-use Industries

- Food

- Beverage

- Pharmaceuticals

- Personal Care & Toiletries

- Industrial

- Household Chemicals

- Paints & Coatings

- Other End-use Industries

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |