Brazil Plastic Caps and Closures Market

Brazil Plastic Caps and Closures Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Threaded, Dispensing, Unthreaded, Child-resistant), By Resin (Polyethylene, Polyethylene Terephthalate, Polypropylene, Plastic Materials, Polystyrene, PVC, Polycarbonate, Other), and Brazil Plastic Caps and Closures Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Plastic Caps and Closures Market Size Insights Forecasts to 2035

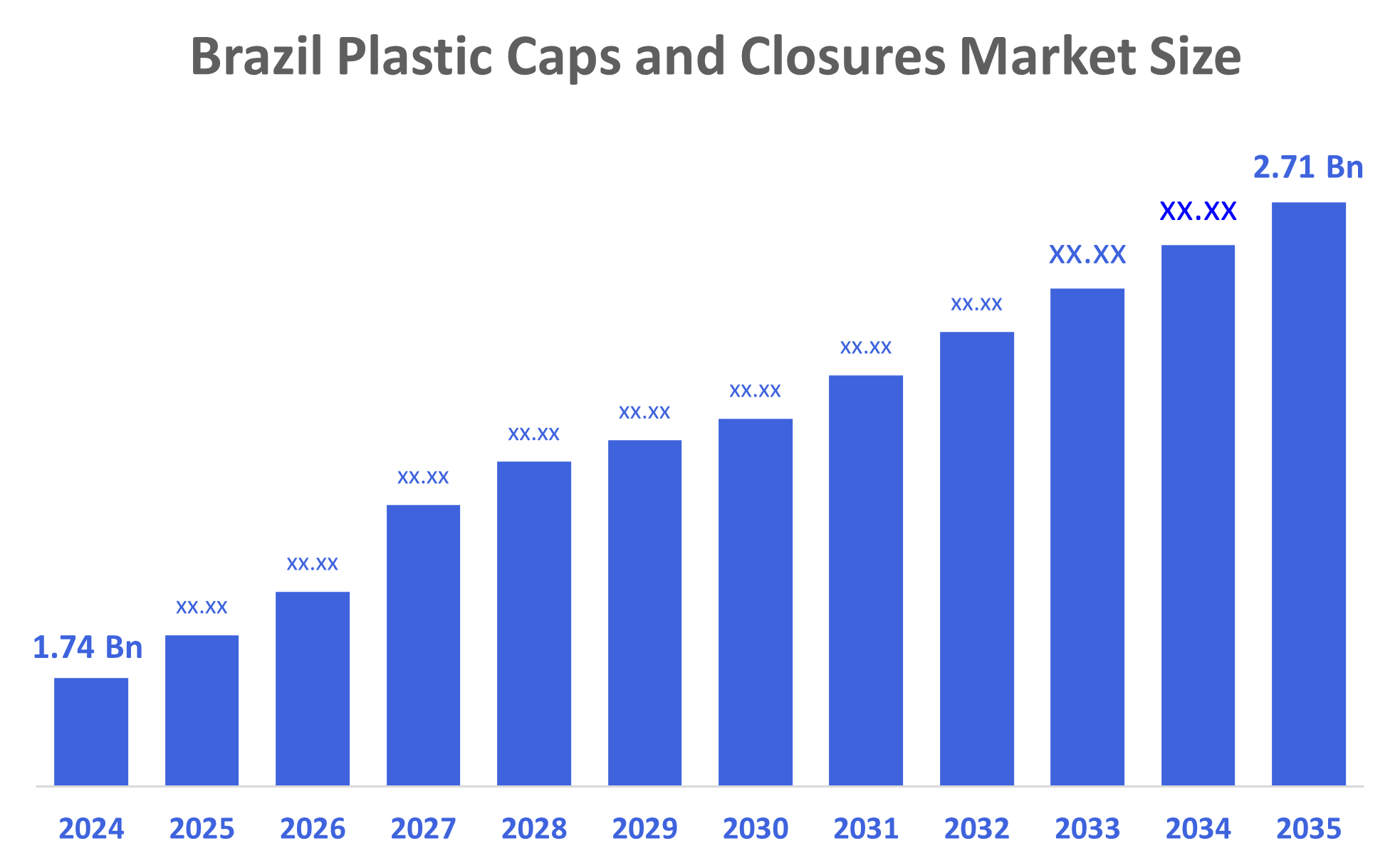

- The Brazil Plastic Caps and Closures Market Size Was Estimated at USD 1.74 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.1% from 2025 to 2035

- The Brazil Plastic Caps and Closures Market Size is Expected to Reach USD 2.71 Billion by 2035

According to a research report published by Decisions Advisors, The Brazil Plastic Caps and Closures Market Size is Anticipated to Reach USD 2.71 Billion by 2035, Growing at a CAGR of 4.1% from 2025 to 2035. The Brazil plastic caps and closures market is driven by rising packaged food and beverage consumption, increasing bottled water demand, growing pharmaceutical packaging needs, urbanization, expanding e-commerce, improved manufacturing technologies, and strong focus on product safety, convenience, and longer shelf life.

Market Overview

Plastic caps and closures are molded plastic sealing devices used to securely close and protect containers, ensuring product integrity, preventing leaks and contamination, and enabling safe storage, transport, convenient opening, and resealing of packaged consumer, pharmaceutical, and industrial products. Additionally, Plastic caps and closures play a crucial role in sealing bottles and safeguarding their contents from contamination or spillage. The Brazilian market for these products is poised for growth, driven by their ability to create airtight seals, ensuring the integrity of stored goods. These closures are prized for their convenience, durability, and versatility, finding applications across food, beverages, personal care, and household products. Furthermore, Brazil's escalating food and ingredient imports, attributed to a growing population, surging tourism, and rising disposable incomes, are noteworthy. Data from the USDA underscores this trend, revealing a 12% increase in 2023, with consumer-oriented imports hitting USD 5.8 billion, up from the previous year.

The rising environmental consciousness surrounding plastic packaging, which contributes significantly to landfill waste and pollution, is dampening the demand for plastic caps and closures. Consequently, many manufacturers are pivoting toward metal alternatives for making caps and closures, a shift that's reshaping the market landscape. Additionally, the Brazil plastic caps and closures market is witnessing trends such as rising demand for sustainable and recyclable materials, lightweight and cost-efficient designs, smart and tamper-evident closures, increased use of flip-top and dispensing caps, and strong growth from beverage, pharmaceutical, and personal care industries.

Report Coverage

This research report categorizes the market for the Brazil plastic caps and closures market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil plastic caps and closures market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil plastic caps and closures market.

Driving Factors

The Brazil plastic caps and closures market is driven by rapid growth in the packaged food and beverage industry, rising bottled water and carbonated drink consumption, expanding pharmaceutical and healthcare sectors, and increasing demand for safe, leak-proof, and tamper-evident packaging. Urbanization and busy lifestyles are boosting demand for convenient, easy-to-use packaging solutions. Advances in injection molding and manufacturing technologies are improving product quality and reducing costs. Additionally, growing awareness of hygiene, product safety, and longer shelf life is supporting strong market growth across retail and e-commerce channels.

Restraining Factors

The Brazil plastic caps and closures market faces restraints such as environmental concerns over plastic waste, strict government regulations on single-use plastics, fluctuating raw material prices, and high recycling and waste management challenges. Growing consumer preference for sustainable and biodegradable packaging alternatives also increases pressure on traditional plastic caps and closures manufacturers.

Market Segmentation

The Brazil plastic caps and closures market share is categorized by product type and resin.

- The threaded segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil plastic caps and closures market is segmented by product type into threaded, dispensing, unthreaded, child-resistant. Among these, the threaded segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by their wide use in beverage bottles, food containers, pharmaceutical packaging, and household products. Threaded caps provide strong sealing, leak prevention, easy opening and resealing, cost-effectiveness, and compatibility with high-speed filling lines, making them the most preferred choice across major end-use industries.

- The polypropylene segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil plastic caps and closures market is segmented by resin into polyethylene, polyethylene terephthalate, polypropylene, plastic materials, polystyrene, PVC, polycarbonate, other. Among these, the polypropylene segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due it offers an ideal balance of strength, flexibility, and lightweight performance, which is essential for durable and leak-proof closures. It has excellent resistance to chemicals and moisture, making it suitable for food, beverage, and pharmaceutical packaging. Polypropylene is also cost-effective and easy to process through injection molding, allowing high-speed mass production. Additionally, it supports recyclable packaging trends, helping manufacturers meet sustainability goals while maintaining product safety and performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil plastic caps and closures market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Silgan Holdings Inc.

- Bericap Holding GmbH

- Amcor Group GmbH

- Innova S/A

- Tetra Pak International S.A.

- Bral Max Tampas Plasticas

- Sonoco Products Company

- Berry Global Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

On September 2020, the top suppliers of plastic closures and packaging solutions, Borealis and MENSHEN, have teamed together to create a line of 10 package closures based on Borcycle, an innovative recycling process that transforms waste streams made of polyolefin into products with added value.

April 2024, Bericap Holding GmbH, a Germany-based company operating in Brazil, announced its investment in a new plant in Kunshan, a city in Jiangsu province in China. The expansion is expected to increase the company's manufacturing capacity by 50% to cater to the growing consumer demand.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil plastic caps and closures market based on the below-mentioned segments:

Brazil Plastic Caps and Closures Market, By Product Type

- Threaded

- Dispensing

- Unthreaded

- Child-resistant

Brazil Plastic Caps and Closures Market, By Resin

- Polyethylene

- Polyethylene Terephthalate

- Polypropylene

- Plastic Materials

- Polystyrene

- PVC

- Polycarbonate

- Other

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 198 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |