Brazil Popping Boba Market

Brazil Popping Boba Market Size, Share, By Product (Fruit, Tea and Coffee, and Others), By Application (Bubble Tea, Frozen Desserts, Bakery and Confectionery, Retail Toppings, and Others), Brazil Popping Boba Market Insights, Industry Trends, Forecasts to 2035

Report Overview

Table of Contents

Brazil Popping Boba Market Size Insights Forecasts to 2035

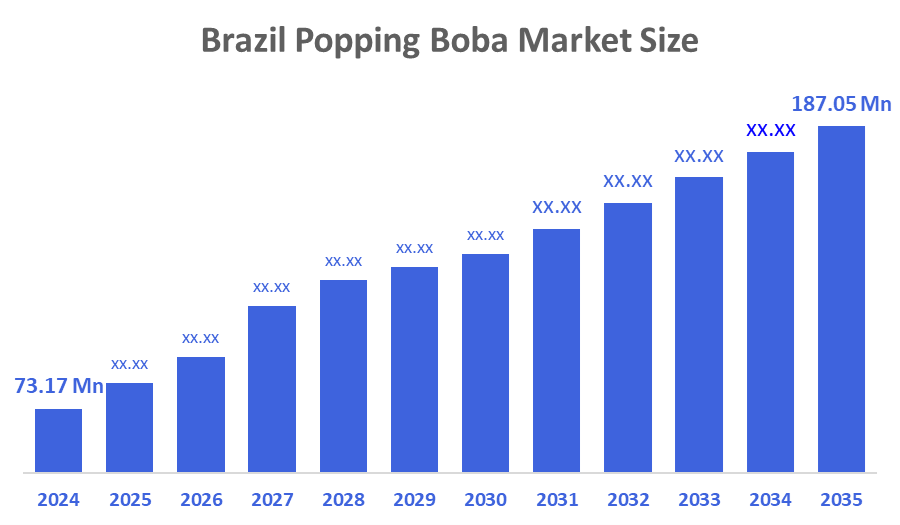

- Brazil Popping Boba Market Size 2024: USD 73.17 Mn

- Brazil Popping Boba Market Size 2035: USD 187.05 Mn

- Brazil Popping Boba Market Size CAGR 2025–2035: 8.91%

- Brazil Popping Boba Market Size Segments: Product and Application

The Brazil Popping Boba Market Size includes flavoured juice-filled spheres that are created using molecular gastronomy techniques, which are often used in beverages and desserts. These pearls burst in the mouth, creating an elevated sensory experience, and come in many different Flavors, including fruit Flavors, tea Flavors, and coffee Flavors. The market is experiencing significant growth due to the increasing interest in innovative beverage ingredients, the growing popularity of bubble tea culture, and the preference among consumers in Brazil for visually stunning and customizable food products.

Furthermore, the growth of the market is supported by the expansion of specialty beverage companies, cafes, and dessert retailers in many of Brazil's major urban centres. Food ingredient manufacturers, distributors, and foodservice operators are increasing their private investment to meet the needs of the growing consumer demand for popping boba, both through retail and foodservice channels. Additionally, Brazil's increased youth population and growing interest in Asian food products are resulting in an increase in the consumption of bubble tea and other novelty types of dessert toppings.

The improvement of popping boba products due to advances in food processing technology, encapsulation technologies and flavour stabilization methods, have increased the shelf life, texture uniformity, and quality of flavour of popping boba products. Manufacturers are now utilizing more advanced manufacturing technologies to meet food safety regulations, lower the number of artificial additives in their products, and offer vegan, sugar-reduced and clean-label popping

Market Dynamics of the Brazil Popping Boba Market Size

The Brazil Popping Boba Market Size is driven by the increasing number of bubble tea stores, cafes, and dessert chains, as well as increased consumer interest in creating an experience with their food and drinks. The rapid pace of urbanization, the impact of social media on food trends, and the desire for fun and photogenic beverage toppings are additional factors propelling the rapid acceptance of popping boba. Additionally, the growth of food service distributors, the variety of flavour offerings available to consumers, rising disposable incomes, and the increasing consumer preference toward customising their beverages contribute to the accelerated growth of the bubbling boba market across Brazil.

The market is restrained by high import dependency on imports to supply raw materials, many smaller cities lack sufficient knowledge of products, food safety and labelling regulations are extremely restrictive, consumers in some areas are price sensitive. shelf life is very limited, quality control throughout distribution is an issue also.

The Brazil popping boba market is set to benefit greatly due to product innovation through the introduction of functional popping boba that contains vitamins, plant-based, and reduced-sugar options, along with continued growth within the bakery and confectionery segment and a growing segment of home-use retail. In addition, e-commerce will play an increasing role in Brazil's popping boba market as it expands into the beverage industry through partnerships with beverage companies and other retail channels.

Market Segmentation

The Brazil popping boba market share is classified into product and application.

By Product

The Brazil popping boba market is divided by product into fruit, tea and coffee, and others. Among these, the fruit segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance of fruit popping boba is as consumers are drawn to fruity drink options. Additionally, fruit popping boba's closeness in relation to bubble tea and desserts, and their increased acceptance by younger consumers will continue to keep fruit popping boba a top selling item.

By Application

The Brazil popping boba market is divided by application into bubble tea, frozen desserts, bakery and confectionery, retail toppings, and others. Among these, the bubble tea segment accounted for the highest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is driven by, wide variety of flavors and ingredients, youths love to customize their bubble tea and enjoy taking pictures of the drink prior to consumption. Additionally, popping boba has become a key element of the bubble tea industry and further increases the popularity of the

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil popping boba market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Popping Boba Market

- Mais Doce

- Mix Alimentos

- Arcolor

- Duas Rodas

- Selecta Chocolates

- Kerry do Brasil

- Saporiti Brasil

- Puratos Brasil

- Jelly Food Brasil

- Bubbly Mix Brasil

- Others

Recent Developments in Brazil Popping Boba Market

In March 2025, Duas Rodas expanded its specialty topping portfolio in Brazil by introducing new fruit-based popping boba flavors targeting bubble tea and dessert chains.

In August 2024, Puratos Brasil partnered with local beverage outlets to supply customized popping boba solutions for frozen desserts and premium drinks.

In January 2025, Mais Doce Brasil invested in upgraded production equipment to improve popping boba texture consistency and shelf stability for nationwide distribution.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil popping boba market based on the following segments:

Brazil Popping Boba Market, By Product

- Fruit

- Tea and Coffee

- Others

Brazil Popping Boba Market, By Application

- Bubble Tea

- Frozen Desserts

- Bakery and Confectionery

- Retail Toppings

- Others

FAQ

Q: What is the Brazil popping boba market size?

A: Brazil Popping Boba Market is expected to grow from USD 73.17 million in 2024 to USD 187.05 million by 2035, at a CAGR of 8.91% during 2025–2035.

Q: What are the key growth drivers of the market?

A: Growth is driven by rising bubble tea consumption, demand for innovative beverage toppings, expanding foodservice outlets, social media-driven food trends, and increasing urban youth population.

Q: What factors restrain the Brazil popping boba market?

A: Key restraints include import dependency, regulatory compliance costs, limited awareness in rural areas, and quality consistency challenges.

Q: How is the market segmented?

A: The market is segmented by product and application.

Q: Who are the key players in the Brazil popping boba market?

A: Key players include Mais Doce Brasil, Duas Rodas, Puratos Brasil, Kerry do Brasil, Selecta Chocolates, and others.

Q: Who are the target audiences for this market report?

A: Market players, investors, end-users, government authorities, consulting firms, venture capitalists, and value-added resellers.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |