Brazil POS Terminal Market

Brazil POS Terminal Market Size, Share, and COVID-19 Impact Analysis, By Mode of Payment Acceptance (Contact-Based, and Contactless), By POS Type (Fixed Point-Of-Sale Systems, and Mobile/Portable Point-Of-Sale Systems), By End-User Industry (Retail, Hospitality, Healthcare, Transportation and Logistics, and Other), and Brazil POS Terminal Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil POS Terminal Market Size Insights Forecasts to 2035

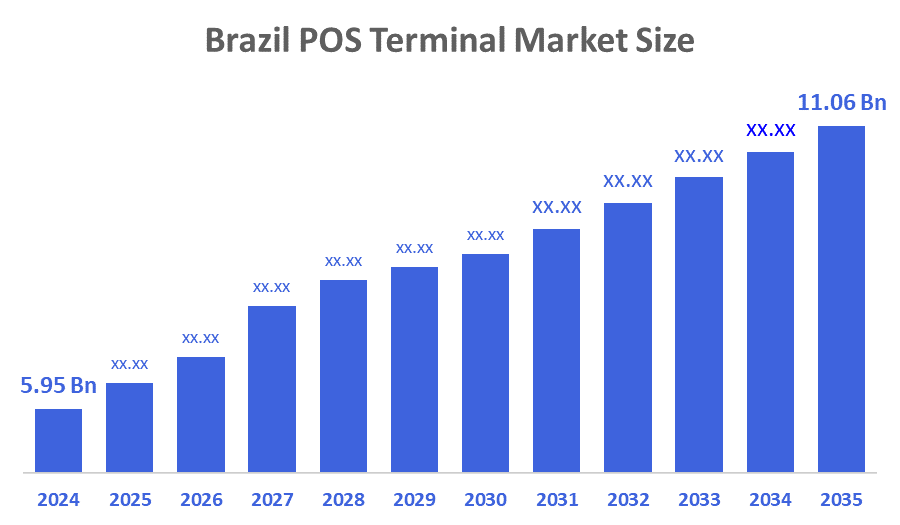

- The Brazil POS Terminal Market Size Was Estimated at USD 5.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.8% from 2025 to 2035

- The Brazil POS Terminal Market Size is Expected to Reach USD 11.06 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil POS Terminal Market Size is anticipated to Reach USD 11.06 Billion by 2035, Growing at a CAGR of 5.8% from 2025 to 2035. The Brazil POS terminal market is driven by increasing digital payments, rising smartphone and internet penetration, growing e-commerce, government initiatives promoting cashless transactions, and demand from retail, hospitality, and banking sectors for fast, secure, and convenient payment solutions.

Market Overview

A POS (Point of Sale) terminal refers to a piece of equipment that businesses use to receive payments from their customers. They can be used to handle debit and credit cards, mobile wallets, or contactless payments. POS terminals are found in stores, restaurants, and even online setups, facilitating the quick, secure, and efficient completion of transactions while also tracking sales and managing inventory. Moreover, a POS terminal market in Brazil is booming as a result of several factors like an increase in digital payments, smartphone penetration, growth of e, commerce, government initiatives to support cashless transactions, rising sectors of retail and hospitality, and the need for secure, fast, and convenient payment solutions not only in urban areas but also in semi, urban areas.

The government's efforts to promote financial inclusion and the rising use of POS terminals among small and medium-sized enterprises (SMEs) are also playing a major role in the overall market growth. In addition, the government regulations that are targeted at raising security levels within the payment processing environment help in the adoption of more advanced, secure, and compliant terminal systems.

Pos terminal technology in Brazil is evolving with the integration of various features such as NFC, enabled devices, QR code payments, PIX integration, cloud-based systems, real-time analytics, mobile POS hardware, and enhanced security features like encryption, tokenization, and biometric authentication for secure transactions.

Some of the notable trends in Brazil's POS terminal market are the increasing use of contactless payments, the rise of mobile POS adoption by small businesses, the growing utilization of cloud POS solutions, a strong inclination towards mobile payments, the proliferation of digital wallets, and the need for quick, smooth, and cashless payment experiences.

Report Coverage

This research report categorizes the market for the Brazil POS terminal market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil POS terminal market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil POS terminal market.

Driving Factors

The Brazil POS terminal market is driven by rapid growth in digital and contactless payments, rising smartphone and internet penetration, and strong adoption of PIX instant payment systems. Expanding retail, hospitality, and e-commerce sectors are increasing demand for efficient payment solutions. Government initiatives promoting cashless transactions, along with consumer preference for fast, secure, and hygienic payments, are encouraging businesses of all sizes to adopt modern POS terminals.

Restraining Factors

The Brazil POS terminal market faces restraints such as high initial installation and maintenance costs, especially for small businesses. Concerns over data security, cyber fraud, and system downtime limit adoption. Limited digital infrastructure and low awareness in rural areas also slow POS terminal penetration.

Market Segmentation

The Brazil POS terminal market share is classified into mode of payment acceptance, POS type, and end-user industry.

- The contactless segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil POS terminal market is segmented by mode of payment acceptance into contact-based and contactless. Among these, the contactless segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The contactless payment segment dominates because people prefer fast and easy payment methods. Contactless cards, mobile wallets, and PIX allow customers to pay without touching the machine, saving time and improving hygiene. During and after COVID-19, many consumers shifted to touch-free payments. Banks and retailers also promote contactless options, and most smartphones support this technology, making it widely accepted across Brazil.

- The mobile/portable point-of-sale systems segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil POS terminal market is segmented by POS type into fixed point-of-sale systems and mobile/portable point-of-sale systems. Among these, the mobile/portable point-of-sale systems segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Mobile and portable POS systems dominate because they are affordable, easy to use, and flexible. Small and medium businesses, street vendors, and delivery services prefer mPOS as it works with smartphones and supports digital payments like cards and PIX. These systems are easy to carry and install, making them ideal for mobile businesses. High smartphone usage and growing digital payments in Brazil further support the strong adoption of mobile POS systems.

- The retail segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil POS terminal market is segmented by end-user industry into retail, hospitality, healthcare, transportation and logistics, and other. Among these, the retail segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The retail segment dominates because retail stores handle a large number of daily customer transactions. Supermarkets, convenience stores, and small shops widely use POS terminals for quick billing and digital payments. The growth of contactless payments, mobile wallets, and PIX has increased POS usage in retail. Retailers also use POS systems for inventory management and sales tracking, making them essential for smooth operations and customer satisfaction.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil POS terminal market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- VeriFone Systems Inc.

- Ingenico (Worldline)

- PAX Technology

- NCR Voyix Corporation

- Gertec Brasil

- Cielo S.A.

- PagSeguro

- StoneCo

- Elgin S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development and News:

In January 2025, Paysafe received approval from Brazil’s Central Bank for a payment institution license, allowing the company to expand its payment services in Brazil's regulated online sports-betting market. This license enables Paysafe to offer tailored payment solutions, including Skrill, NETELLER, and Pix, to iGaming operators and Brazilian merchants, further solidifying its position in the market. With Brazil’s large market potential and projected sports-betting turnover, Paysafe aims to strengthen its presence in the Latin American region and support local industry growth.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil POS terminal market based on the below-mentioned segments:

Brazil POS Terminal Market, By Mode of Payment Acceptance

- Contact-Based

- Contactless

Brazil POS Terminal Market, By POS Type

- Fixed Point-Of-Sale Systems

- Mobile/Portable Point-Of-Sale Systems

Brazil POS Terminal Market, By End-User Industry

- Retail

- Hospitality

- Healthcare

- Transportation and Logistics

- Other

FAQ’s

1.How does the POS terminal market support small businesses in Brazil?

POS terminals help small businesses accept digital payments easily, reduce cash handling, improve transaction speed, and attract customers who prefer cards, mobile wallets, and PIX payments daily.

2.What role does PIX play in POS terminal growth?

PIX enables instant QR-based payments, encouraging merchants to adopt POS terminals that support fast, low-cost, and secure digital transactions across retail and service sectors in Brazil.

3.Why are mobile POS terminals preferred over fixed systems?

Mobile POS terminals are portable, affordable, easy to install, and suitable for street vendors, delivery services, and small shops operating in flexible business environments.

4.How does smartphone usage affect the POS terminal market?

High smartphone penetration supports mobile payments and mPOS usage, allowing businesses to integrate POS systems with apps, wallets, and cloud-based services efficiently.

5.Are POS terminals secure for digital payments?

Modern POS terminals use encryption, tokenization, and secure networks to protect transaction data, reducing fraud risks and increasing customer trust in digital payments.

6.How does the retail sector drive POS terminal demand?

Retail stores process high transaction volumes daily, requiring POS terminals for billing, inventory tracking, and accepting multiple digital payment methods smoothly.

7.What challenges limit POS terminal adoption in Brazil?

High setup costs, maintenance expenses, cybersecurity concerns, and limited digital infrastructure in rural areas slow POS terminal adoption among smaller merchants.

8.How do cloud-based POS systems benefit businesses?

Cloud-based POS systems provide real-time sales data, remote access, inventory management, and analytics, helping businesses improve efficiency and decision-making.

9.Is contactless payment replacing cash in Brazil?

While cash is still used, contactless payments are rapidly growing due to convenience, speed, hygiene benefits, and strong support from banks and government initiatives.

10.What future trends are expected in Brazil’s POS terminal market?

Future trends include greater use of AI analytics, wider PIX integration, advanced security features, and increased adoption of mobile and cloud-based POS solutions.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 177 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |