Brazil Premium Chocolate Market

Brazil Premium Chocolate Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Dark Chocolate, Milk Chocolate, White Chocolate, Others), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Retail, Others), By Application (Personal Consumption, Gifting, Foodservice Industry, Others), and Brazil Premium Chocolate Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Premium Chocolate Market Insights Forecasts to 2035

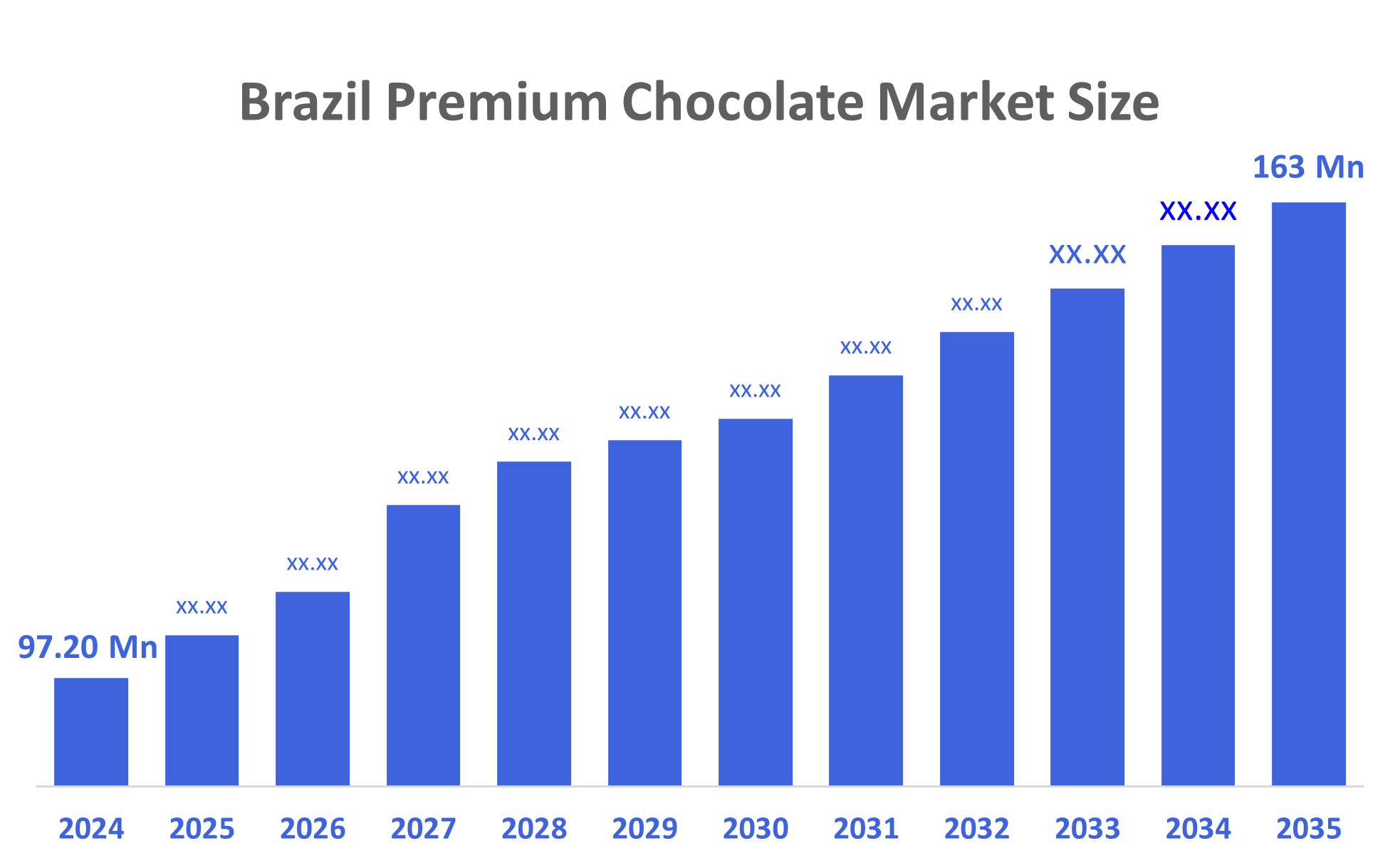

- The Brazil Premium Chocolate Market Size Was Estimated at USD 97.20 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.8% from 2025 to 2035

- The Brazil Premium Chocolate Market Size is Expected to Reach USD 163 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Premium Chocolate Market Size is Anticipated to Reach USD 163 Million by 2035, Growing at a CAGR of 4.8% from 2025 to 2035. The market is growing due to rising demand for high-quality, artisanal chocolates, increasing disposable income, and a shift toward healthier options like dark chocolate. Urban consumers are increasingly exposed to global gourmet trends, driving demand for premium choices. Innovation in flavors, sustainable sourcing, attractive packaging, and expansion of supermarkets, specialty stores, and online channels further support market growth.

Market Overview

Premium chocolate is created using high-quality ingredients, including pure cocoa butter, the finest cocoa beans, etc. Premium chocolate also tends to be richer in taste, smoother in texture, and less sweet than standard chocolates. Many premium chocolates are also handmade, using only natural ingredients, and tend to offer unique flavor profiles, and are beautifully packaged, giving them a more luxurious feel. Additionally, the market is expanding as Brazilian consumers increasingly value locally sourced fine cocoa, boosting demand for chocolates made with premium Brazilian cacao. Tourism growth is also helping premium chocolate sales in the gift and souvenir segments. Rising interest in bean-to-bar craftsmanship, limited-edition products, and chocolates with sustainable certifications is further driving the market. The rise in interest among consumers about how premium chocolate is produced, limited-edition premium chocolate, and chocolates produced with sustainable practices has driven premium chocolate sales growth. The increase in premium chocolate sales as gifts during festivals has also contributed to the overall premium chocolate sales growth.

Changes in chocolate-making production, including new developments in premium chocolate printing, candy-making, and mixing flavors through dipping, are also being adopted by the Brazilian chocolate manufacturing industry. Furthermore, chocolate companies are targeting niche consumers who are looking for healthy alternatives to their traditional chocolate product lines. Chocolate companies are using new and innovative marketing strategies to create brand awareness, increase brand presence in the marketplace, and create growth opportunities for their companies.

Report Coverage

This research report categorizes the market for the Brazil premium chocolate market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil premium chocolate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil premium chocolate market.

Driving Factors

Brazil’s premium chocolate market is driven by rising demand for artisanal, high-quality products made from fine Brazilian cocoa. Growing health awareness supports the shift toward dark, organic, and low-sugar premium options. New technologies in cocoa processing, flavor extraction, and sustainable farming improve product consistency and appeal. Innovation in flavors, packaging, and bean-to-bar production enhances consumer interest. Government and industry support for cocoa farming strengthens supply quality. Expanding premium cafés, tourism-driven gifting, and strong digital marketing further accelerate market growth.

Restraining Factors

The market faces challenges due to the limited availability of specialty cocoa varieties, which restricts consistent premium production. High import costs of certain gourmet ingredients also increase final prices, reducing affordability for many consumers. Premium chocolate brands struggle with temperature-controlled logistics, especially in warmer regions. Additionally, low consumer awareness in rural areas and competition from cheaper mass chocolates slow the expansion of premium offerings across the country.

Market Segmentation

The Brazil premium chocolate market share is categorized by product type, distribution channel, and application.

- The dark chocolate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil premium chocolate market is segmented by product type into dark chocolate, milk chocolate, white chocolate, and others. Among these, the dark chocolate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by consumers increasingly preferring healthier and more natural indulgence options. Its higher cocoa content, rich flavor, and antioxidant benefits make it attractive to health-conscious buyers seeking quality over quantity. Premium brands often highlight fine cocoa origins and artisanal production, which aligns strongly with dark chocolate offerings. Growing interest in bean-to-bar products, ethical sourcing, and reduced sugar also supports dark chocolate’s leadership. Additionally, chefs, cafés, and gourmet stores frequently promote dark chocolate in desserts, gifting, and specialty collections, boosting its overall market share.

- The supermarkets and hypermarkets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil premium chocolate market is segmented by distribution channel into supermarkets and hypermarkets, specialty stores, convenience stores, online retail, and others. Among these, the supermarkets and hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to their offering a wide product variety, strong brand visibility, and consistent availability in one convenient location. These stores provide attractive shelf displays, in-store promotions, and frequent discounts that encourage consumers to explore premium options. Their extensive nationwide coverage allows premium chocolate brands to reach both urban and semi-urban shoppers. Additionally, consumers prefer buying premium chocolates from trusted retail chains where product authenticity, quality control, and proper storage conditions are ensured, making supermarkets and hypermarkets the most influential sales channels.

- The personal consumption segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil premium chocolate market is segmented by application into personal consumption, gifting, foodservice industry, and Others. Among these, the personal consumption segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to consumers increasingly preferring high-quality, indulgent chocolates for everyday treats and wellness-oriented snacking. Rising awareness of fine cocoa varieties, clean-label ingredients, and artisanal production has boosted demand for premium products in daily life. Urban millennials and middle-income groups are driving frequent purchases through supermarkets, specialty stores, and online platforms. The trend of “affordable luxury” encourages consumers to buy premium chocolate for self-enjoyment rather than only for special occasions, making personal consumption the largest and fastest-growing application segment in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil premium chocolate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lindt & Sprüngli

- Ferrero International S.A.

- Mondelez International

- Godiva Chocolatier

- Ghirardelli Chocolate Company

- Valrhona

- Hotel Chocolat Group

- Theo Chocolate, Inc.

- Nestlé (Grupo CRM)

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Ferrero introduced its popular Ferrero Rocher chocolate bars to the Brazilian market, adding a new product format under an already well-known brand.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil premium chocolate market based on the below-mentioned segments:

Brazil Premium Chocolate Market, By Product Type

- Dark Chocolate

- Milk Chocolate

- White Chocolate

- Others

Brazil Premium Chocolate Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

- Others

Brazil Premium Chocolate Market, By Application

- Personal Consumption

- Gifting

- Foodservice Industry

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |