Brazil Probiotics Market

Brazil Probiotics Market Size, Share, By Type (Probiotic Food, Probiotic Drinks, Dietary Supplements, and Animal Feed) By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies and Drug Stores, Convenience Stores, Online Channels, and Other), Brazil Probiotics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Probiotics Market Insights Forecasts to 2035

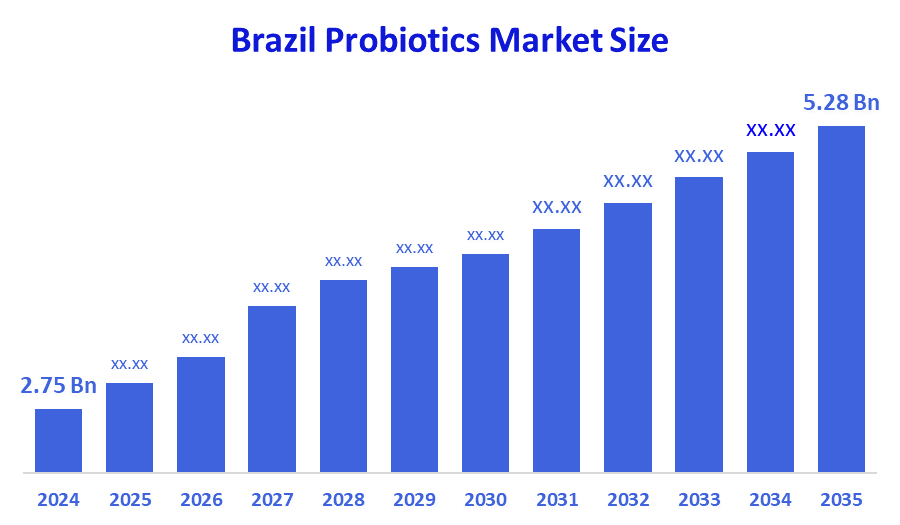

- Brazil Probiotics Market Size 2024: USD 2.75 Billion

- Brazil Probiotics Market Size 2035: USD 5.28 Billion

- Brazil Probiotics Market CAGR 2024: 6.1%

- Brazil Probiotics Market Segments: Type and Distribution Channel

Probiotics are live microorganisms, mainly beneficial bacteria and yeasts, that provide health benefits when consumed in adequate amounts. They help maintain a healthy balance of gut microbiota, improve digestion, enhance nutrient absorption, strengthen the immune system, and support overall gastrointestinal health. Probiotics are commonly found in fermented foods and dietary supplements. Furthermore, The Brazil probiotics market is driven by rising health and gut-care awareness, increasing demand for functional foods and supplements, preference for natural preventive healthcare, expanding retail and e-commerce channels, product innovation, and growing use of probiotics to support immunity and digestive health.

According to Brazilian government authorities, ANVISA has implemented regulatory frameworks for probiotic labeling and health claims to ensure safety, efficacy, and truthful communication. Programs like the “National Food and Nutrition Policy” promote healthier diets and fermented dairy adoption. The Ministry of Agriculture (MAPA) has approved probiotic feed additives to enhance livestock productivity. Additionally, industrial policies and funding from BNDES and EMBRAPA support biotechnology advancements and local fermentation infrastructure development, promoting innovation and sustainable growth in Brazil probiotics sector.

The regulatory environment in Brazil is adapting to accommodate the growing probiotics market. Authorities are establishing guidelines to ensure product safety and efficacy, which may enhance consumer trust. Furthermore, the probiotics market in Brazil is experiencing notable growth, driven by increasing consumer awareness regarding health and wellness. This trend appears to be influenced by a rising interest in natural and functional foods, as individuals seek products that promote digestive health and overall well-being. The Brazilian population is becoming more health-conscious, leading to a surge in demand for probiotic-rich foods and supplements.

Market Dynamics of the Brazil Probiotics Market:

The Brazil probiotics market is driven by increasing consumer awareness of digestive health, immunity, and overall wellness. Rising demand for functional foods, dietary supplements, and natural preventive healthcare solutions supports market growth. Urbanization, changing dietary habits, and higher disposable incomes are encouraging probiotic consumption. In addition, expansion of modern retail and e-commerce platforms, product innovations such as gummies and plant-based probiotics, and growing clinical evidence supporting probiotic benefits are further accelerating market adoption across Brazil.

The Brazil probiotics market faces restraints such as high product costs, limited consumer awareness in rural areas, and confusion over probiotic strains and benefits. Strict regulatory requirements for health claims increase compliance costs. In addition, shelf-life issues, storage challenges, and skepticism about product effectiveness among price-sensitive consumers can limit widespread adoption.

The Brazil probiotics market offers strong opportunities through growing demand for functional foods, personalized nutrition, and preventive healthcare solutions. Expanding middle-class income and rising lifestyle-related digestive disorders support probiotic adoption. Opportunities also exist in plant-based and vegan probiotics, pediatric and elderly nutrition, and innovative formats such as gummies and fortified beverages. Moreover, increasing e-commerce penetration, private-label products, and clinical research-backed formulations can help manufacturers reach underserved regions and build stronger consumer trust across Brazil.

Market Segmentation

The Brazil Probiotics Market share is classified into type and distribution channel.

By Type:

The Brazil Probiotics market is divided by type into probiotic food, probiotic drinks, dietary supplements, and animal feed. Among these, the probiotic food segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Probiotic food dominates because it is widely consumed as part of daily diets, especially yogurts and fermented dairy products. Strong presence of local and multinational food brands, easy availability through supermarkets, and high consumer trust support this segment. Brazilian consumers prefer convenient, natural food-based probiotic sources over supplements. In addition, rising awareness of digestive health, affordability, and acceptance across all age groups further strengthens demand for probiotic foods compared to drinks, dietary supplements, and animal feed.

By Distribution Channel:

The Brazil Probiotics market is divided by distribution channel into supermarkets/hypermarkets, pharmacies and drug stores, convenience stores, online channels, and others. Among these, the supermarkets/hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Supermarkets and hypermarkets dominate because they offer easy access to a wide range of probiotic foods, drinks, and supplements under one roof. Strong cold-chain infrastructure supports probiotic dairy products, while frequent discounts and in-store promotions encourage purchases. Brazilian consumers prefer physical stores for food and health products due to trust, product visibility, and brand familiarity. Additionally, the extensive nationwide presence of large retail chains ensures higher sales volumes compared to pharmacies, convenience stores, and online channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil probiotics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Probiotics Market:

- Danone S.A.

- Yakult Honsha Co., Ltd.

- Nestlé S.A.

- Lallemand Inc.

- Chr. Hansen Holding A/S

- BioGaia AB

- General Mills, Inc.

- Bio-K Plus International Inc.

- Others

Recent Developments in Brazil Probiotics Market:

May 15, 2024: NOVA Easy Kombucha, the sister company of Novo Brazil Brewing, launched a five-year co-branding partnership, gaining exclusive rights to partner with the San Diego Padres with kombucha. Sunset Slam Mango Lime is a part of the collaborations in this five-year partnership, which will be sold throughout Petco Park and at retail locations throughout San Diiego County. The drink will be served at multiple draft stations within the ballpark and in 16-oz cans with the colors of the Padres City Connect uniform.

In January 2024, Mighty Pop, a new fizzy drink, focuses on improving digestion and boosting the immune system by using prebiotics, probiotics, and postbiotics. Beliv, the company behind Mighty Pop, is novel in the soda industry with its innovative approach to incorporating pre-, pro-, and postbiotics, as highlighted by Clayton Santos, the director of R&D. Beliv not only offers Mighty Pop but also a range of other beverages like juices, waters, and functional drinks. In 2023, Beliv acquired the popular ready-to-drink cold brew coffee brand High Brew.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil probiotics market based on the below-mentioned segments:

Brazil Probiotics Market, By Type

- Probiotic Food

- Probiotic Drinks

- Dietary Supplements

- Animal Feed

Brazil Probiotics Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies and Drug Stores

- Convenience Stores

- Online Channels

- Other

FAQ

Q1. What are probiotics?

- Probiotics are beneficial live microorganisms that support digestive health, immunity, and gut balance when consumed in adequate amounts.

Q2. Which segment dominates the Brazil probiotics market?

- Probiotic foods dominate due to the high consumption of yogurts and fermented dairy products in daily diets.

Q3. Which distribution channel leads the market?

- Supermarkets and hypermarkets lead because of wide product availability and strong consumer trust.

Q4. What drives market growth in Brazil?

- Rising health awareness, demand for functional foods, and preference for natural preventive healthcare.

Q5. What are the key challenges?

- High costs, regulatory restrictions on health claims, and limited awareness in rural areas.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |