Brazil Real Estate Market

Brazil Real Estate Market Size, Share, By Type (Sales, Rental, And Lease), By Property (Residential, Commercial, Industrial, Land, And Others), And Brazil Real Estate Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Real Estate Market Insights Forecasts to 2035

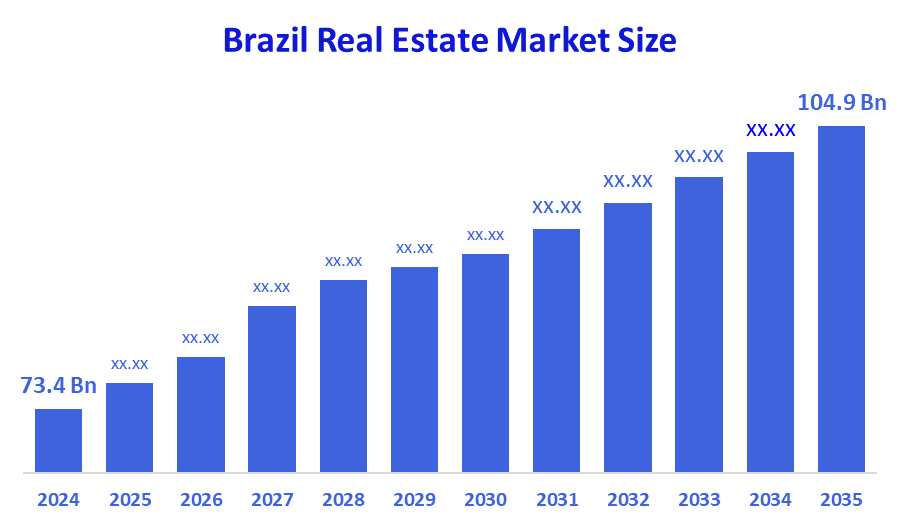

- Brazil Real Estate Market Size 2024: USD 73.4 Billion

- Brazil Real Estate Market Size 2035: USD 104.9 Billion

- Brazil Real Estate Market CAGR 2024: 3.3%

- Brazil Real Estate Market Segments: Type and Property

Brazil real estate market is comprised of Brazilian economic activity related to creating, selling, developing and leasing in any form of property; whether it is a physical piece of land, residential dwelling, an office building, or an industrial facility. Real estate is a set of assets representing both the physical structure of a buildings and land associated with its operation and the legal rights of ownership for the landlord or property owner. Real estate is critical to urban growth, wealth creation, and long-term investment; connecting home buyers, builders, financial institutions, and institutional investors both locally and globally.

The real estate in Brazil are backed by government support, including the Minha Casa, Minha Vida (My House, My Life) affordable housing program, relaunched and expanded to help low- and moderate-income families own homes through subsidies, financing and targeted support. Furthermore, government outlays for housing under this initiative total around USD 4.52 billion, anchoring new construction pipelines and reducing the friction of high mortgage costs for buyers, thereby stimulating overall market activity.

As technology advances, Brazilian real estate providers are now using PropTech (property technology) to buy and sell real estate, property search, value, negotiation, closing, finance, and management have all been simplified by using PropTech solutions. Innovations such as online listing sites, AI-driven personal home recommendation systems, e-mortgages, blockchain-supported contract processing, and the use of electrical devices to improve energy efficiency, provide security, and enhance resident comfort are transforming the real estate industry and are leading to increased transaction volume and a younger buyer demographic. PropTech enables the ability to transact more efficiently and transparently.

Market Dynamics of the Brazil Real Estate Market:

The Brazil real estate market is driven by the increasing numbers of urban dwellers and urban residents, increased net worth, rise in investment by the government in housing, infrastructure, and its population size, demand for both residential and commercial real estate, increased access to financing, favourable tax incentives for real estate investments and growth, and rise in investment by institutional and private investors.

The Brazil real estate market is restrained by the high levels of interest rates, economic uncertainty decreased buyer demand, increased construction costs due to continued inflation, ongoing supply chain issues, and complex government regulations.

The future of Brazil real estate market is bright and promising, with versatile opportunities emerging from the demand for affordable and mid-market housing to meet the needs of new residents moving into metropolitan areas. In addition, as the PropTech industry continues to grow, there are additional opportunities for the creation of value add projects through the development of PropTech and Smart Housing Solutions which appeal to today’s consumers, also significant opportunities for foreign investment in both the residential and commercial sectors based on the direction of e-commerce growth and improvement of infrastructure.

Market Segmentation

The Brazil Real Estate Market share is classified into type and property.

By Type:

The Brazil real estate market is divided by type into sales, rental, and lease. Among these, the sales segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Strong cultural preference for homeownership, significant government incentives, and housing programs, and the use of real estate as an inflation badge all contribute to the sales segment's largest share and higher spending on real estate when compared to other type.

By Property:

The Brazil real estate market is divided by property into residential, commercial, industrial, land, and others. Among these, the residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The residential segment dominates because of rapid urbanization, growing middle class seeking homeownership, low interest rates boosting affordability, and government housing programs creating immense demand for residential property in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil real estate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Real Estate Market:

- MRV&CO

- Brascan Shopping Centers

- Paulo Octavio

- Even Construtora

- Incorporadora Borges Landeiro

- JLL Brazil

- Hines

- Alianza

- Icon Realty

- Loft

- Caparao

- Foxter Cia Imobiliaria

- Porte Engenharia e Urbanismo

- Others

Recent Developments in Brazil Real Estate Market:

In April 2025, MRV&CO announced plans to strategically cut paid land inventory to protect margins rather than launch a specific major new project.

In April 2025, Multiplan launched seven expansion projects, totalling BRL 1.5 billion. These projects targeted luxury retail and gourmet dining sectors.

In October 2024, Guardian Real Estate Investment Fund acquired 15 Atacadao properties for BRL 725 million through a sale-leaseback model.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil real estate market based on the below-mentioned segments:

Brazil Real Estate Market, By Type

- Sales

- Rental

- Lease

Brazil Real Estate Market, By Property

- Residential

- Commercial

- Industrial

- Land

- Others

FAQ

Q: What is the Brazil real estate market size?

A: Brazil real estate market is expected to grow from USD 73.4 billion in 2024 to USD 104.9 billion by 2035, growing at a CAGR of 3.3% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the rapid urbanization, rising disposable incomes that support higher home ownership rates, continued government investment in housing and infrastructure, Brazil’s large population and growing middle class sustain long-term demand for residential and commercial property, and improved access to financing and tax incentives for real estate investment further stimulate sector growth and investor interest.

Q: What factors restrain the Brazil real estate market?

A: Constraints include the high interest rates and economic volatility, reduce affordability and dampen buyer demand, construction costs and supply chain disruptions raise project expenses, regulatory and tax complexities, and increase operating burdens for developers.

Q: How is the market segmented by type?

A: The market is segmented into sales, rental, and lease.

Q: Who are the key players in the Brazil real estate market?

A: Key companies include MRV&CO, Brascan Shopping Centers, Paulo Octavio, Even Construtora, Incorporadora Borges Landeiro, JLL Brazil, Hines, Alianza, Icon Realty, Loft, Caparao, Foxter Cia Imobiliaria, Porte Engenharia e Urbanismo, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |