Brazil Real-Time Payments Market

Brazil Real-Time Payments Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Person-to-Person, Business-to-Consumer), By Technology Type (Instant Payment Systems, Real-Time Gross Settlement Systems), and Brazil Real-Time Payments Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Real-Time Payments Market Insights Forecasts to 2035

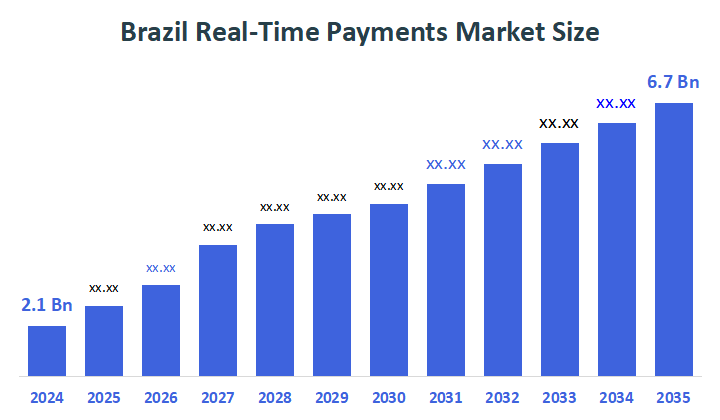

- The Brazil Real-Time Payments Market Size Was Estimated at USD 2.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11% from 2025 to 2035

- The Brazil Real-Time Payments Market Size is Expected to Reach USD 6.7 Billion by 2035

According to a research report published by Decisions Advisors, the Brazil Real-Time Payments Market size is anticipated to reach USD 6.7 billion by 2035, growing at a CAGR of 11% from 2025 to 2035. The Brazil real-time payments market is driven by rapid digital banking adoption, strong government support through PIX, rising smartphone penetration, demand for faster, low-cost transactions, and growth of e-commerce and fintech innovation. Increased financial inclusion efforts and consumer preference for instant, secure, and convenient payment experiences further accelerate market expansion.

Market Overview

Real-time payments are electronic transactions processed and settled instantly, allowing funds to move between accounts within seconds at any time. They provide immediate confirmation, high security, and continuous availability, enabling faster personal, business, and government payments. This system enhances efficiency, transparency, and convenience in modern digital financial ecosystems. Additionally, they enhance financial inclusivity by providing a faster and more accessible means of sending and receiving money. This is particularly impactful in Brazil payments, where innovations like Pix have transformed how consumers interact with financial services. It eliminates the waiting time associated with older payment methods whether it's splitting a restaurant bill with friends, paying bills, or sending funds to family members in numerous parts of the world. Moreover, real-time payments streamline cash flow management, reducing the need for businesses to wait for payments and improving liquidity, which has a positive impact on a company's overall financial health. They also stimulate economic growth and facilitate commerce by enabling seamless online and mobile transactions through platforms such as digital wallets, making it easier for consumers to shop and businesses to sell their products and services. The future real-time payment systems will use advanced technologies like blockchain to improve security. Artificial intelligence will improve transaction routing and fraud detection. As digitalization progresses, real-time payments are projected to take precedence, catering to paperless economies and enabling seamless, frictionless transactions across diverse industries and regions.

Report Coverage

This research report categorizes the market for the Brazil real-time payments market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil real-time payments market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil real-time payments market.

Driving Factors

Brazil’s real-time payments market is driven because PIX allow consumers and businesses to send money instantly, for free, and at any time. As more Brazilians use smartphones and online banking, digital payments become easier and more common. The government encourages cashless transactions and financial inclusion, helping more people access digital financial services. Fintech apps make instant payments simple and secure, while online shopping increases the need for fast transactions. Businesses also choose real-time payments to receive money quickly, lower costs, and give customers a smoother payment experience.

Restraining Factors

Brazil’s real-time payments market faces restraints such as rising fraud risks, cybersecurity concerns, and limited digital literacy among some population groups. Small businesses in remote areas may lack reliable internet access. Data privacy issues, regulatory challenges, and high costs for advanced security tools also slow adoption. Additionally, resistance to shifting from traditional payment methods remains a barrier.

Market Segmentation

The Brazil real-time payments market share is categorized by product type and technology type.

- The person-to-person segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil real-time payments market is segmented by product type into person-to-person, business-to-consumer. Among these, the person-to-person segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to PIX has become the most popular method for everyday money transfers among individuals. Its instant speed, zero fees, and 24/7 availability encourage frequent use for simple daily activities like splitting bills, sending family support, or paying for small services. High smartphone penetration and strong digital banking adoption make P2P transactions easy for all age groups. Government efforts to boost financial inclusion also brought millions into the digital payments ecosystem, strengthening P2P usage far more than business-focused transactions.

- The instant payment systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil real-time payments market is segmented by technology type into instant payment systems, real-time gross settlement systems. Among these, the instant payment systems segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to PIX has become the country’s primary platform for fast, free, and user-friendly transactions. Its widespread adoption by individuals, businesses, and government agencies allows millions of low-values and daily transfers to occur instantly. The system operates 24/7, supports QR codes, and integrates easily with banking apps, boosting convenience. In contrast, real-time gross settlement (RTGS) systems mainly handle high-value institutional transactions, limiting their overall transaction volume. This makes instant payment systems the clear leader in everyday usage and market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil real-time payments market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- EBANX

- Stripe

- Adyen

- PayPal

- Digital River

- Mercado Pago (MercadoLibre)

- PagSeguro

- StoneCo

- PicPay

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, Bunzl Canada announced the recent launch of its new, environmentally preferable cleaning product line under the REGARD brand banner. Utilizing smart, innovative packaging is just one way the new line effectively reduces the environmental impact associated with procurement and delivery.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil real-time payments market based on the below-mentioned segments:

Brazil Real-Time Payments Market, By Product Type

- Person-to-Person

- Business-to-Consumer

Brazil Real-Time Payments Market, By Technology Type

- Instant Payment Systems

- Real-Time Gross Settlement Systems

FAQ’s

1. What are real-time payments?

- Real-time payments are digital transactions that settle instantly, allowing money to move between accounts within seconds, 24/7.

2. What drives the real-time payments market in Brazil?

- PIX adoption, smartphone growth, fintech innovation, and government support for digital payments drive market growth.

3. What is PIX and why is it important?

- PIX is Brazil’s national instant payment system that enables free, fast, and secure transfers, becoming the country’s most used payment method.

4. Which segment dominates the market?

- Person-to-person (P2P) transfers dominate due to high daily usage and widespread adoption of PIX.

5. Which technology leads the market?

Instant payment systems lead because PIX handles most daily transactions across Brazil.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |