Brazil Road Freight Transport Market

Brazil Road Freight Transport Market Size, Share, and COVID-19 Impact Analysis, By End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others), by Destination (Domestic, International), and Brazil Road Freight Transport Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Road Freight Transport Market Insights Forecasts to 2035

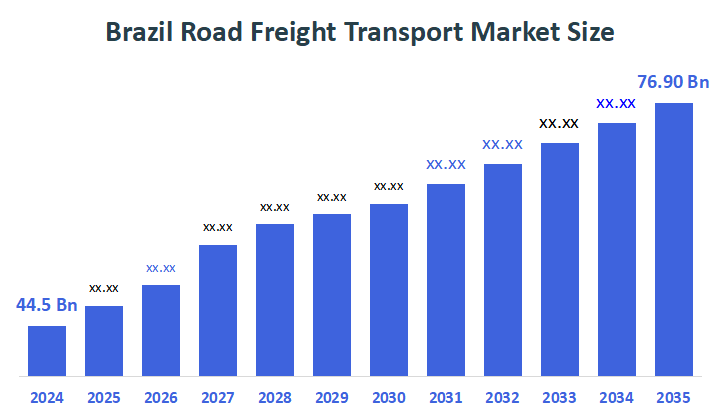

- The Brazil Road Freight Transport Market Size Was Estimated at USD 44.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The Brazil Road Freight Transport Market Size is Expected to Reach USD 76.90 Billion by 2035

According to a research report published by Decisons Advisors, the Brazil Road Freight Transport Market size is anticipated to reach USD 76.90 Billion by 2035, growing at a CAGR of 5.1% from 2025 to 2035. The Brazil road freight transport market is driven by growing e-commerce demand, expanding retail distribution, rising industrial production, and improved highway connectivity. Increased urbanization and the need for fast, flexible deliveries also boost reliance on trucks for short- and long-distance goods movement.

Market Overview

Road freight transport means moving goods from one place to another using trucks, vans, or other road vehicles. It is a simple and flexible way to deliver products directly to homes, shops, and factories. It supports daily trade by ensuring items reach their destinations safely and on time. The market is driven by the country`s vast geographical size and the need to transport goods across long distances, resulting in high demand for road freight services. Key factors influencing the market include infrastructure development, government regulations, fuel prices, and economic fluctuations. With a growing economy and increasing international trade, the road freight transport market in Brazil is expected to continue expanding, presenting opportunities for companies to invest in technology, fleet optimization, and sustainability initiatives to meet the evolving needs of shippers and consumers. Technological integration in Brazil's road freight transport sector focuses on implementing telematics, IoT, and AI to optimize operations.

Telematics systems track vehicle performance, monitor fuel usage, and provide real-time location updates, enhancing fleet management. IoT sensors deliver critical insights into cargo conditions, ensuring safety and quality during transit. AI-driven analytics streamline route planning and predictive maintenance, lowering both downtime and expenditure for operations. Costs. For instance, in 2023, the Brazilian government advanced the National Policy on Logistics and Transport, aimed at improving the efficiency of road freight transport. This policy includes investments in infrastructure, regulatory reforms, and incentives for adopting sustainable practices such as electric vehicles and digitalization, which are expected to enhance the overall performance and sustainability of the logistics sector.

Report Coverage

This research report categorizes the market for the Brazil road freight transport market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil road freight transport market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil road freight transport market.

Driving Factors

Brazil's road freight transport market is driven by expanding domestic trade, strong reliance on highways for cargo movement, and rising demand from agriculture, mining, and manufacturing sectors. Growth in e-commerce and last-mile delivery needs further increases in truck-based transport. Ongoing logistics modernization, warehouse expansion, and digital tools such as GPS tracking and route optimization also support efficiency. Government investments in road maintenance and regional connectivity enable smoother operations. Additionally, the country’s large geographic spread makes road transport essential for reaching rural areas and linking ports, cities, and production zones.

Restraining Factors

Brazil’s road freight transport market faces restraints such as poor road conditions, high logistics costs, and frequent congestion in major cities. Fuel price fluctuations and rising vehicle maintenance expenses reduce profitability. Limited multimodal integration and regulatory complexities create delays. Driver shortages, safety issues, and long travel distances also hinder operational efficiency and slow overall market growth.

Market Segmentation

The Brazil road freight transport market share is categorized by end-user industry and destination.

- The wholesale and retail trade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil road freight transport market is segmented by end-user industry into agriculture, fishing, and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others. Among these, the wholesale and retail trade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the country’s heavy reliance on road networks for distributing consumer goods across vast distances. Growing e-commerce and retail expansion require frequent, timely deliveries from warehouses to stores and directly to consumers. Brazil’s limited rail and inland water transport infrastructure makes road transport the most flexible and reliable option. Additionally, increasing urbanization, rising household consumption, and the need for last-mile delivery solutions further strengthen road freight demand, ensuring continuous growth in this segment over others.

- The domestic segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil road freight transport market is segmented by destination into domestic, international. Among these, the domestic segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the country’s vast geography and dispersed population creates high demand for internal goods movement. Most industries, including agriculture, manufacturing, and retail, rely on trucks to transport products between cities, states, and rural areas. Limited rail connectivity and the importance of last-mile delivery make road transport the most practical and flexible option. Additionally, domestic trade continues to expand with growing urbanization, industrial activity, and e-commerce, ensuring consistent demand for road freight, while international transport often relies more on ports, air, or multimodal solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil road freight transport market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JSL S.A.

- Braspress Transportes Urgentes

- RTE Rodonaves

- VIX Logística

- Expresso Nepomuceno

- Tegma Gestão Logística S.A.

- Translovato

- G7 Logística

- TNT Mercúrio

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News

- In August 2023, DHL Supply Chain and Mondelez integrate four refrigerated electric vehicles into their distribution network for chocolate transport.

September 2023: Maersk conducts pilot programs for electric heavy-duty trucks, supporting supply chain decarbonization.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisons Advisors has segmented the Brazil road freight transport market based on the below-mentioned segments:

Brazil Road Freight Transport Market, By End User Industry

- Agriculture

- Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas

- Mining and Quarrying

- Wholesale and Retail Trade

- Others

Brazil Road Freight Transport Market, By Destination

- Domestic

- International

FAQ’s

Q1: What is road freight transport in Brazil?

- It is the movement of goods across Brazil using trucks and other road vehicles, connecting producers, warehouses, retailers, and consumers.

Q2: Which segment dominates the Brazil road freight market by industry?

- The wholesale and retail trade segment dominates due to high demand for the distribution of consumer goods and e-commerce deliveries.

Q3: Which segment dominates by destination?

- The domestic segment dominates, as most cargo is transported within the country.

Q4: What drives the Brazil road freight transport market?

- Key drivers include e-commerce growth, industrial and agricultural output, urbanization, and improved highway infrastructure.

Q5: What are the main restraints?

Poor road conditions, fuel price fluctuations, driver shortages, congestion, and high logistics costs.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |