Brazil Scrap Metal Recycling Market

Brazil Scrap Metal Recycling Market Size, Share, And COVID-19 Impact Analysis, By Metal Type (Ferrous Scrap, Non-Ferrous Scrap), By Source (Industrial & Commercial, Post-Consumer), By Distribution Channel (Domestic Consumption, Exports), By Application (Steelmaking, Foundries, Aluminium Smelters) And Brazil Scrap Metal Recycling Market Insights, Industry Trend, Forecast To 2035

Report Overview

Table of Contents

Brazil Scrap Metal Recycling Market Size Insights Forecasts to 2035

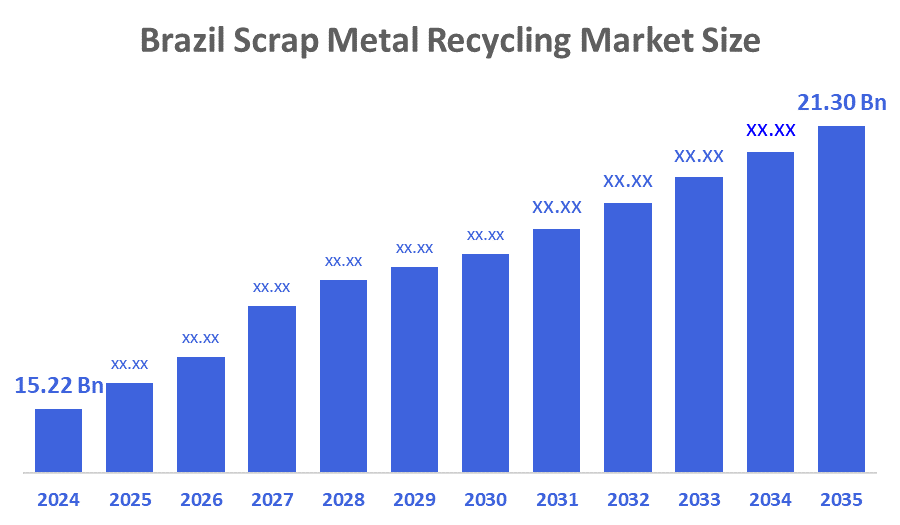

- Brazil Scrap Metal Recycling Market Size Was Estimated at USD 15.22 Billion in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 3.10% from 2025 to 2035.

- Brazil Scrap Metal Recycling Market Size is Expected to Reach USD 21.30 Billion by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Scrap Metal Recycling Market Size is anticipated to Reach USD 21.30 Billion by 2035, Growing at a CAGR of 3.10% from 2025 to 2035. The Brazil scrap metal recycling market is driven by rising export demand, energy and cost advantages of recycled metal over primary production, investments in collection and processing capacity, and circular-economy and decarbonization initiatives.

Market Overview

The Brazil scrap metal recycling market is a rapidly evolving sector focused on collecting, sorting, and processing ferrous and non-ferrous metal waste for reuse in steelmaking, aluminium production, construction, automotive, and industrial machinery. Recycling reduces dependence on virgin raw materials, cuts energy consumption, and supports Brazil’s sustainability goals. Demand is driven by industrial growth, urbanisation, and circular economy initiatives. The sector is strengthened by the National Policy on Solid Waste (Law No.?12.305/2010), which mandates shared responsibility for waste management and reverse logistics, creating formal recycling networks and enabling producers, municipalities, and recyclers to coordinate effectively.

Brazil’s aluminium recycling rate reached 57?% of total consumption in 2023, demonstrating strong collection and recovery systems. National targets aim to increase aluminium packaging recycling to 96?% by 2032. Innovations in automated sorting, mechanised recovery yards, and AI-enabled material classification improve scrap quality and processing efficiency. These advancements, combined with formal infrastructure under PNRS, create significant opportunities to expand recycling capacity, increase domestic value addition, and strengthen Brazil’s position in global metal recycling markets. The sector offers high potential for investors and industrial players looking to benefit from sustainable growth and circular-economy policies.

Report Coverage

This research report categorizes the market for the Brazil scrap metal recycling market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil scrap metal recycling market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil scrap metal recycling market.

Driving Factors

The Brazil scrap metal recycling market is driven by rising exports of ferrous and non-ferrous scrap, with 800,000 tonnes shipped in 2023. Growth is supported by abundant construction and automotive waste and the cost and energy advantages of recycling over primary metals. Investments in collection and processing infrastructure by steelmakers, government support under the National Solid Waste Policy, and innovations like AI sorting and automated shredders further boost efficiency and market expansion.

Restraining Factors

The Brazil scrap metal recycling market is restrained by volatile prices of scrap and primary metals. Fragmented and partly informal collection reduces quality and traceability. Logistical challenges across Brazil increase costs. Potential changes in trade policies or import restrictions in key export markets also limit growth.

Market Segmentation

The Brazil scrap metal recycling market share is categorized by metal type, source, distribution channel and application.

- The ferrous scrap segment accounted for the largest revenue market share in 2024 and is expected to grow at a steady CAGR during the forecast period.

The Brazil scrap metal recycling market is segmented by metal type into ferrous scrap and non?ferrous scrap. Among these, the ferrous scrap segment accounted for the largest revenue market share in 2024 and is expected to grow at a steady CAGR during the forecast period. Ferrous scrap growth is driven by strong export demand. Brazil shipped about 800,000 tonnes of ferrous scrap in 2023, more than double 2022 levels. Domestic steelmakers also absorb large volumes of scrap. Construction, industrial activities, and electric arc furnace usage increase supply. Improved magnetic separation and shredding enhance product quality and recovery.

- The industrial & commercial source segment dominated the market in 2024 and is projected to grow steadily during the forecast period.

The Brazil scrap metal recycling market is segmented by source into industrial & commercial and post?consumer. Among these, the industrial & commercial source segment dominated the market in 2024 and is projected to grow steadily during the forecast period. Industrial & commercial scrap leads because manufacturing offcuts and construction waste are consistent and high?volume sources. These streams are easier to collect, sort, and process. Investments in formal collection systems and partnerships with industrial facilities improve material quality. Reliable supply supports stable demand from major recyclers and steel producers.

- The domestic consumption distribution channel dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil scrap metal recycling market is segmented by distribution channel into domestic consumption and exports. Among these, the domestic consumption segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Domestic consumption growth is driven by local steelmakers and foundries requiring consistent scrap supply. Government incentives promote recycled content usage. Expansion of downstream recycling facilities and ongoing infrastructure projects further strengthen internal demand, while exports continue to supplement growth as an additional revenue stream.

- The steelmaking segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil scrap metal recycling market is segmented by application into steelmaking, foundries & casting, aluminium smelters, and others. Among these, steelmaking segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Steelmaking drives the market because ferrous scrap is a key input in electric arc furnaces. Investment in electric arc steelmaking technology supports higher recycled content use. Brazil’s growing infrastructure and construction sectors maintain steady steel demand, which in turn sustains scrap consumption and segment growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The Brazil scrap metal recycling market, along with a comparative evaluation primarily based on their product/service offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gerdau S.A.

- CSN (Companhia Siderúrgica Nacional)

- ArcelorMittal Brasil

- Usiminas S.A.

- Aperam South America

- Villares Metals S.A.

- Novelis Inc. (Brazil operations)

- Metalúrgica Gerdau Açominas

- Ferbasa

- Local/regional scrap recyclers

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August?2025, Brazil’s aluminium can recycle data from Recicla Latas showed a 97.3?% recycling rate for aluminium beverage cans in 2024, driven by strong reverse logistics and national collection networks that convert collected aluminium scrap into new packaging. This underscores Brazil’s global leadership in sustainable metal reuse and circular supply chains.

- In January?2025, the Brazilian government amended the National Solid Waste Policy (Law?No.?12,305/2010) through Law?No.?15,088, banning the import of solid waste and rejects including metal scrap except for strategic material transformation, increasing focus on domestic collection and recycling. This strengthens local supply chains and supports sustainable scrap processing and circular economy goals.

- In September?2024, S&P Global Platts began daily ferrous scrap export price assessments (Heavy Melting Scrap and Shredded Scrap FOB Brazil), creating transparent pricing benchmarks for Brazil’s growing scrap export flows. These assessments improve market visibility, support exporters, and enhance trade efficiency for Brazilian scrap metal recycling and steelmaking operations.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. The Brazil scrap metal recycling market Decisions Advisors has been segmented based on the below-mentioned segments:

Brazil Scrap Metal Recycling Market, By Metal Type

- Ferrous Scrap

- Non-Ferrous Scrap

- Others

Brazil Scrap Metal Recycling Market, By Source

- Industrial & Commercial

- Post-Consumer

Brazil Scrap Metal Recycling Market, By Distribution Channel

- Domestic Consumption

- Exports

Brazil Scrap Metal Recycling Market, By Application

- Steelmaking

- Foundries & Casting

- Aluminium Smelters

- Others

FAQ’s

Q. What is the projected market size & growth rate of the Brazil scrap metal recycling market?

A. The Brazil scrap metal recycling market was valued at USD 15.22 billion in 2024 and is projected to reach USD 21.30 billion by 2035, growing at a CAGR of 3.10% from 2025 to 2035.

Q. What are the key driving factors for the growth of the Brazil scrap metal recycling market?

A. The market is driven by rising export demand, cost and energy benefits of recycled metals, industrial waste availability, circular-economy policies, and investments in advanced sorting and processing technologies.

Q. What are the top players operating in the Brazil scrap metal recycling market?

A. Gerdau S.A., CSN, ArcelorMittal Brasil, Usiminas S.A., Aperam South America, Villares Metals, Novelis (Brazil), Ferbasa, Metalúrgica Gerdau Açominas, and regional scrap recyclers.

Q. What segments are covered in the Brazil scrap metal recycling market report?

A. The market is segmented by Metal Type (Ferrous, Non-Ferrous, Others), Source (Industrial & Commercial, Post-Consumer), Distribution Channel (Domestic Consumption, Exports), and Application (Steelmaking, Foundries & Casting, Aluminium Smelters, Others).

Q. Which metal type dominates the Brazil scrap metal recycling market?

A. The ferrous scrap segment dominates due to strong export volumes, high steelmaking demand, and improved recovery technologies.

Q. Which source segment leads the Brazil scrap metal recycling market?

A. The industrial & commercial segment leads as manufacturing offcuts and construction waste provide high-volume, consistent, and easily recoverable scrap.

Q. Which application segment holds the largest share in the Brazil scrap metal recycling market?

A. The steelmaking segment holds the largest share because electric arc furnaces rely heavily on ferrous scrap for efficient and cost-effective steel production.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 143 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |