Brazil Sealants Market

Brazil Sealants Market Size, Share, and COVID-19 Impact Analysis, By End User Industry (Aerospace, Automotive, Building and Construction, Healthcare) and By Resin (Acrylic, Epoxy, Polyurethane, Silicone), and Brazil Sealants Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Sealants Market Size Insights Forecasts to 2035

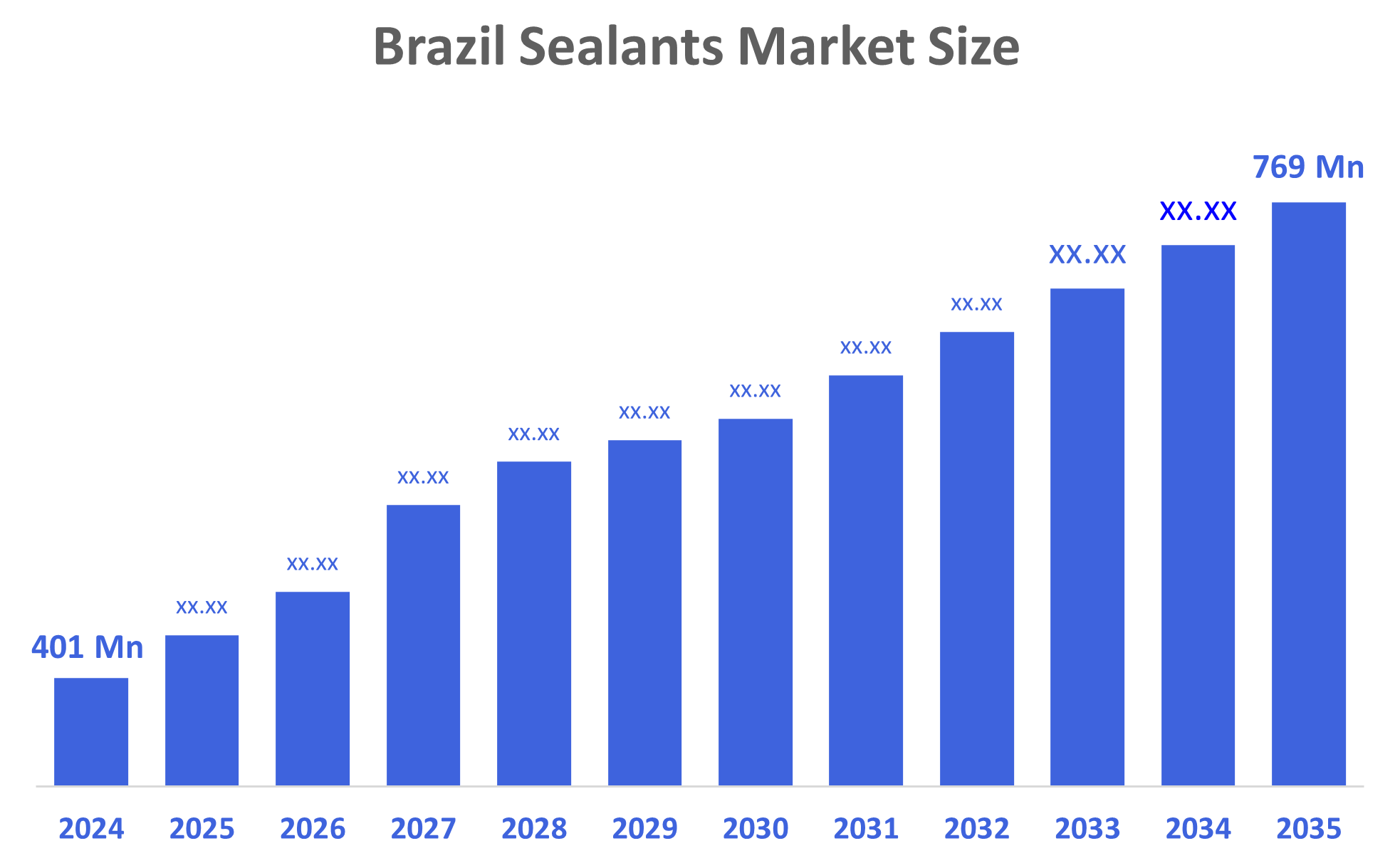

- The Brazil Sealants Market Size Was Estimated at USD 401 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Brazil Sealants Market Size is Expected to Reach USD 769 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Sealants Market Size is Anticipated to Reach USD 769 Million by 2035, Growing at a CAGR of 6.1% from 2025 to 2035. The?????? Brazil sealants market is driven by increased construction activities, larger automotive production, the modernization of the infrastructure, a higher demand for energy-efficient buildings, and a wider use of high-performance sealing solutions in the industrial sector, which is supported by urbanization, technological advancements, and government spending on housing and public ??????works.

Market Overview

Sealants?????? are substances that fill in holes, splits, or seams to stop the flow of air, water, dust, or noise. They remain elastic and form a protective layer between the contact areas. Sealants are the components that make structures, cars, and machines tougher, without leaks, and with a longer lifespan. Besides that, the market expansion is supported by the escalating building activities, the increasing automotive production, the more and more infrastructure works, and the rising demand for durable, energy-efficient sealing solutions. The trend of urbanization and the use of advanced, high-performance sealants also contribute to the market growth. Moreover, technological developments have been the main factors to lift up the sealant market through the continuous process of innovation in the production of very advanced formulations that offer excellent adhesion, flexibility, and resistance to environmental factors in all industry segments, such as construction and ??????automotive.

Governmental?????? regulations and initiatives that aim at promoting sustainable building practices and reducing the overall carbon footprint while increasing building performance have been a major factor in creating a favorable environment for the sealant industry. Therefore, it is expected that manufacturers will be producing environmentally friendly and low-emission sealants that will meet government regulations. In addition to that, the rise in the popularity of do-it-yourself (DIY) projects has been a great factor in the positive development of the sealant market. The demand for sealants in retail channels has gone up as more consumers take on their own self-directed renovation and repair projects. Manufacturers are fulfilling this increasing demand by offering a wide range of sealant products that are specially designed for DIY users, thus leading to the overall market ??????growth.

Report Coverage

This research report categorizes the market for the Brazil sealants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil sealants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil sealants market.

Driving Factors

The?????? Brazil sealants market is primarily driven by the expansion of the building and infrastructure sectors, where the construction of new houses, transportation, and urban development projects has been made possible by the injection of capital from the government. The demand for energy-saving and weather-resistant buildings has led to the increased use of high-performance sealants. The growing automobile and manufacturing industries are, therefore, the main reasons for the increase in consumption of the product, resulting from the need for the most durable bonding and sealing solutions. Besides that, industrial modernization, increasing renovation activities, and the adoption of advanced technologies such as silicone and polyurethane sealants are some of the factors leading to market growth. Moreover, the growing awareness of maintenance and long-term durability also acts as a market demand ??????enhancer.

Restraining Factors

The sealant market in Brazil is hindered by several restraining factors, including fluctuating costs of raw materials, reliance on raw petroleum materials, and international environmental regulations on VOC emissions. Other constraining factors on the growth of the overall Brazilian sealants market include a lack of awareness in rural areas, competition from cheaper alternatives, and the slower rate of adoption of new advanced sealants in smaller industrial companies.

Market Segmentation

The Brazil sealants market share is categorized by end-user industry and resin.

- The building and construction segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil sealants market is segmented by end-user industry into aerospace, automotive, building and construction, and healthcare. Among these, the building and construction segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the country’s continuous urban expansion, large-scale infrastructure projects, and growing demand for durable, weather-resistant structures. Sealants are essential for waterproofing, insulation, glazing, flooring, and joint sealing, making them indispensable across residential, commercial, and industrial construction. Government investments in housing, renovation activities, and increasing adoption of energy-efficient building materials further strengthen this segment’s dominance over automotive, aerospace, and healthcare applications.

- The silicone segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil sealants market is segmented by resin into acrylic, epoxy, polyurethane, and silicone. Among these, the silicone segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to they offer superior flexibility, excellent temperature resistance, and strong adhesion to a wide range of surfaces. Their long-lasting performance in harsh weather conditions makes them ideal for Brazil’s diverse climate. They are widely used in construction, automotive, electronics, and industrial applications. Additionally, silicone’s durability, moisture resistance, and suitability for both indoor and outdoor sealing give it a clear advantage over acrylic, epoxy, and polyurethane alternatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil sealants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Henkel

- Sika AG

- Dow

- Soudal

- BASF

- Arkema (Bostik)

- H.B. Fuller

- Momentive

- Garin Brasil

- Sela Brasil

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In October 2024, Henkel AG & Co. KGaA expanded its Diadema production facility near São Paulo, increasing capacity by 35% for construction-grade sealants. The company also introduced its new Loctite Eco-Seal product line, which is specifically designed to meet Brazil's growing demand for sustainable building solutions and includes low-VOC formulations that comply with the country's most recent environmental regulations.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil sealants market based on the below-mentioned segments:

Brazil Sealants Market, By End User Industry

- Aerospace

- Automotive

- Building and Construction

- Healthcare

Brazil Sealants Market, By Resin

- Acrylic

- Epoxy

- Polyurethane

- Silicone

FAQ’s

1. What are sealants used for in Brazil?

- Sealants are used in construction, automotive, industrial assembly, and maintenance to fill gaps, prevent leaks, and protect surfaces from moisture, dust, and chemicals.

2. Which end-user industry dominates the Brazil sealants market?

- The building and construction sector dominates due to extensive infrastructure projects and urban development.

3. Which resin type is most popular in Brazil?

- Silicone sealants are the most widely used because of their durability, flexibility, and weather resistance.

4. What factors are driving market growth?

- Expansion in construction, rising automotive production, infrastructure modernization, and demand for energy-efficient buildings.

5. What challenges affect the market?

- Fluctuating raw material prices, VOC emission regulations, and competition from low-cost alternatives.

6. Is demand expected to increase in coming years?

- Yes. Urban growth, renovation activities, and the adoption of advanced sealants are expected to boost market demand further.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |