Brazil Servers Market

Brazil Servers Market Size, Share, and COVID-19 Impact Analysis, By Server Type (Blade Server, Multi-Node Server, Tower Server, Rack-Optimized Server), By Operating System (Linux, Windows, UNIX), By Server Class (High-End Server, Mid-Range Server, Volume Server), By End-User (IT And Telecommunications, BFSI, Manufacturing, Retail, Healthcare, Media and Entertainment), and Brazil Servers Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Servers Market Insights Forecasts to 2035

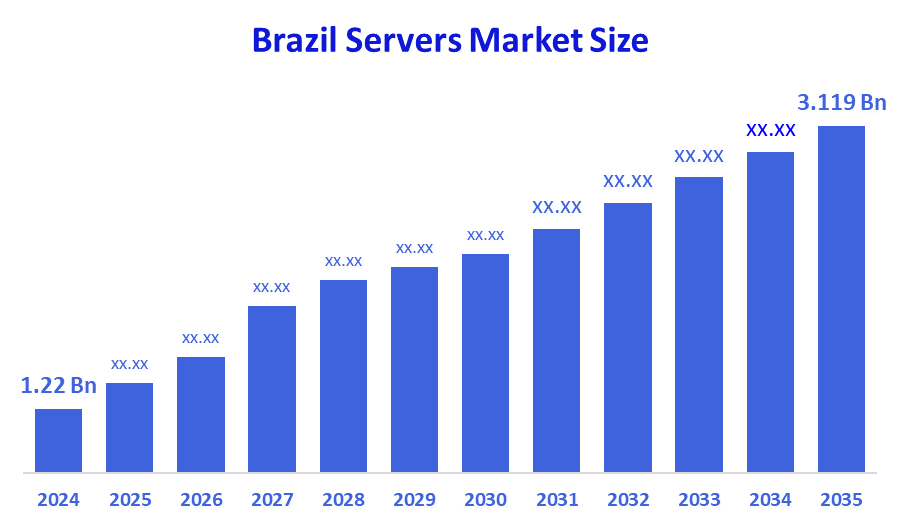

- The Brazil Servers Market Size Was Estimated at USD 1.22 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.91% from 2025 to 2035

- The Brazil Servers Market Size is Expected to Reach USD 3.119 Billion by 2035

According To A Research Report Published By Decision Advisors The Brazil Servers Market Size Is Anticipated To Reach USD 3.119 Billion By 2035, Growing At A CAGR Of 8.91% From 2025 To 2035. The Brazil Servers Market Is Driven By Rapid Digital Transformation, Cloud Adoption, Data Center Expansions, Growing Enterprise IT Infrastructure, Increased Demand For High-Performance Computing, Government Initiatives For Technology Modernization, And The Rising Need For Efficient Storage, Networking, And Virtualization Solutions.

Market Overview

Servers are the backbone of computing that enable a network of computers to function seamlessly. In essence, they store the data, run the programs, and send the data that you consume while using a website, an email, or a mobile app. What makes these servers different from any other computer is that they support many users at once and thus, run in a way that keeps information accessible, secure, and fast, at homes, offices, schools, and businesses in all parts of the world, and almost continuously. The chief factor that is pushing Brazil's server market to such high levels is the growing cloud computing and data centers trend in the country, which is creating an upsurge in demand for performance, scalable server infrastructures to address the digital transformation, data storage, AI workloads, and online services needs across the industries. With the help of advanced server technologies, the potential performance, scalability, and efficiency of servers have been increased by a significant margin, which in turn has been a very influential factor in the recent rapid growth of Brazil's server market. Enterprises are now in a better position to deal with their ever-increasing data volumes and digital workloads, thanks to the adoption of cloud computing, AI, ready servers, virtualization, and software-defined infrastructure. To a great extent, the deployment of high-density servers, energy, efficient hardware, and advanced cooling methods is already offsetting the operating costs, thereby attracting more users. The substantial trend of the expansion of hybrid and multi-cloud environments is fueling the fintech, e-commerce, telecom, and government digital sectors, leading to a sustained demand for modern server infrastructure all over Brazil.

Government policies in Brazil are catalyzing the evolution of the server market by implementing various digital transformation programs, initiating data localization, and making investments at the last mile in broadband and data center infrastructure. Regulations aimed at fostering the use of cloud computing in public services, as well as the birth and growth of fintech and e-government platforms, are driving the demand for server systems with high levels of security. On one side, we have trends such as the expanding number of public, private partnerships, an increasing number of incentives for local data processing, a growing emphasis on cybersecurity compliance, and on the other side, the emergence of sustainability, oriented policies that, by promoting energy, efficient data centers, are collectively enabling the deployment and modernization of servers to continue happening at the pace in Brazil.

Report Coverage

This research report categorizes the market for the Brazil servers market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil servers market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil servers market.

Driving Factors

The Brazil servers market is driven by rapid digital transformation across industries, rising cloud computing adoption, and expanding data center investments. Growth in fintech, e-commerce, telecommunications, and digital government services is increasing demand for secure, high-performance servers. Rising internet penetration, mobile usage, and data-intensive technologies such as AI, big data analytics, and IoT further accelerate server deployment. Additionally, the presence of global cloud providers and the modernization of enterprise IT infrastructure continue to support sustained market growth.

Restraining Factors

The Brazil servers market faces restraints from high initial investment and operational costs associated with advanced server infrastructure and data centers. Energy costs, complex regulatory compliance, and data security requirements add financial pressure. Limited availability of skilled IT professionals and economic volatility can further slow server adoption and large-scale infrastructure expansion.

Market Segmentation

The Brazil servers market share is classified into server type, operating system, server class, and end user.

- The rack-optimized server segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil servers market is segmented by server type into blade server, multi-node server, tower server, and rack-optimized server. Among these, the rack-optimized server segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Rack-optimized servers dominate because they provide high scalability, flexible configuration, and efficient space utilization, making them ideal for data centers and cloud environments. Growing investments in hyperscale and colocation data centers, along with rising demand for cloud computing, virtualization, and AI workloads, favor rack servers due to their compatibility with advanced cooling, power management, and high-density deployments.

- The Linux segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil servers market is segmented by operating system into Linux, Windows, and UNIX. Among these, the Linux segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Linux dominates due to its open-source nature, cost-effectiveness, stability, and strong security features. It is widely preferred by enterprises, cloud providers, and data centers for running high-performance computing, virtualization, and AI workloads. Additionally, Linux supports flexible customization, compatibility with modern server hardware, and efficient resource management, making it the favored operating system for both large-scale enterprise servers and cloud-based infrastructures in Brazil.

- The high-end server segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil servers market is segmented by server class into high-end server, mid-range server, and volume server. Among these, the high-end server segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. High-end servers dominate due to increasing demand from data centers, cloud service providers, and large enterprises requiring high-performance computing, AI processing, and big data analytics. These servers offer superior processing power, memory capacity, scalability, and reliability, making them ideal for mission-critical applications and virtualization. The growth of hyperscale and enterprise data centers, combined with expanding cloud adoption and digital transformation initiatives, drives the preference for high-end servers over mid-range and volume server segments.

- The IT and telecommunications segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil servers market is segmented by end user into IT and telecommunications, BFSI, manufacturing, retail, healthcare, media, and entertainment. Among these, the IT and telecommunications segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The IT and telecommunications segment dominates due to the rapid expansion of data centers, cloud services, and network infrastructure in the country. Telecom companies and IT service providers require high-performance, scalable servers to support growing internet usage, mobile connectivity, and digital services. Increasing adoption of virtualization, AI, big data analytics, and cloud computing further drives server demand in this sector, making it the largest end-user segment compared to BFSI, healthcare, manufacturing, and other industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil servers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dell Technologies Inc.

- Hewlett?Packard?Enterprise?Co. (HPE)

- Lenovo?Group?Limited

- Cisco?Systems,?Inc.

- Positivo?Tecnologia?S/A

- Oracle?Corporation

- Microsoft?Corporation

- Supermicro?Computer,?Inc.

- Huawei?Technologies?Co.,?Ltd.

- Amazon?Web?Services,?Inc. (AWS)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In May 2024, IBM launched the IBM Power S1012, the newest addition to its server portfolio. This revolutionary system, powered by the cutting-edge Power10 CPU, has a one-socket, half-wide design. It is a performance powerhouse, with an astounding 3X increase in performance per core over its predecessor, the Power S812. This improvement boosts AI workloads and smoothly extends its reach from the core to the cloud and even the edge, implying increased business value across a variety of sectors.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Brazil servers market based on the below-mentioned segments:

Brazil Servers Market, By Server Type

- Blade Server

- Multi-Node Server

- Tower Server

- Rack-Optimized Server

Brazil Servers Market, By Operating System

- Linux

- Windows

- UNIX

Brazil Servers Market, By Server Class

- High-End Server

- Mid-Range Server

- Volume Server

Brazil Servers Market, By End User

- IT And Telecommunications

- BFSI

- Manufacturing

- Retail

- Healthcare

- Media and Entertainment

FAQ’s

1. What is driving the growth of the Brazil servers market?

The market is driven by rapid digital transformation, cloud adoption, expansion of data centers, increasing demand for AI and big data processing, and growing enterprise IT infrastructure needs.

2. Which server type dominates the Brazil market?

Rack-optimized servers dominate due to their scalability, space efficiency, and suitability for data centers and cloud environments.

3. Which operating system is most used in Brazilian servers?

Linux is the most widely used operating system because of its cost-effectiveness, stability, security, and compatibility with modern server hardware.

4. Who are the major players in Brazil’s server market?

Key companies include Dell Technologies, HPE, Lenovo, Cisco, IBM, Oracle, Microsoft, Huawei, Supermicro, Positivo Tecnologia, and AWS.

5. Which end-user segment dominates the market?

The IT and telecommunications sector dominates due to high demand from data centers, cloud services, and network infrastructure expansion.

6. What are the key challenges in the Brazil servers market?

High infrastructure costs, energy consumption, regulatory compliance, cybersecurity requirements, and a shortage of skilled IT professionals are major restraints.

7. How is technology advancing in this market?

Advancements include cloud computing, virtualization, AI-ready servers, hybrid and multi-cloud architectures, energy-efficient hardware, and automated server management tools.

8. How are government policies influencing the market?

Government initiatives in digital transformation, data localization, cloud adoption, and energy-efficient data center policies are supporting market growth.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |