Brazil Small Molecule Healthcare Contract Manufacturing Market

Brazil Small Molecule Healthcare Contract Manufacturing Market Size, Share, By Phase (Preclinical & Clinical, Clinical, and Commercial), By Type (API, Development & Scale-up Services, Finished Dose Combination, Packaging), Brazil Small Molecule Healthcare Contract Manufacturing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Small Molecule Healthcare Contract Manufacturing Market Size Insights Forecasts to 2035

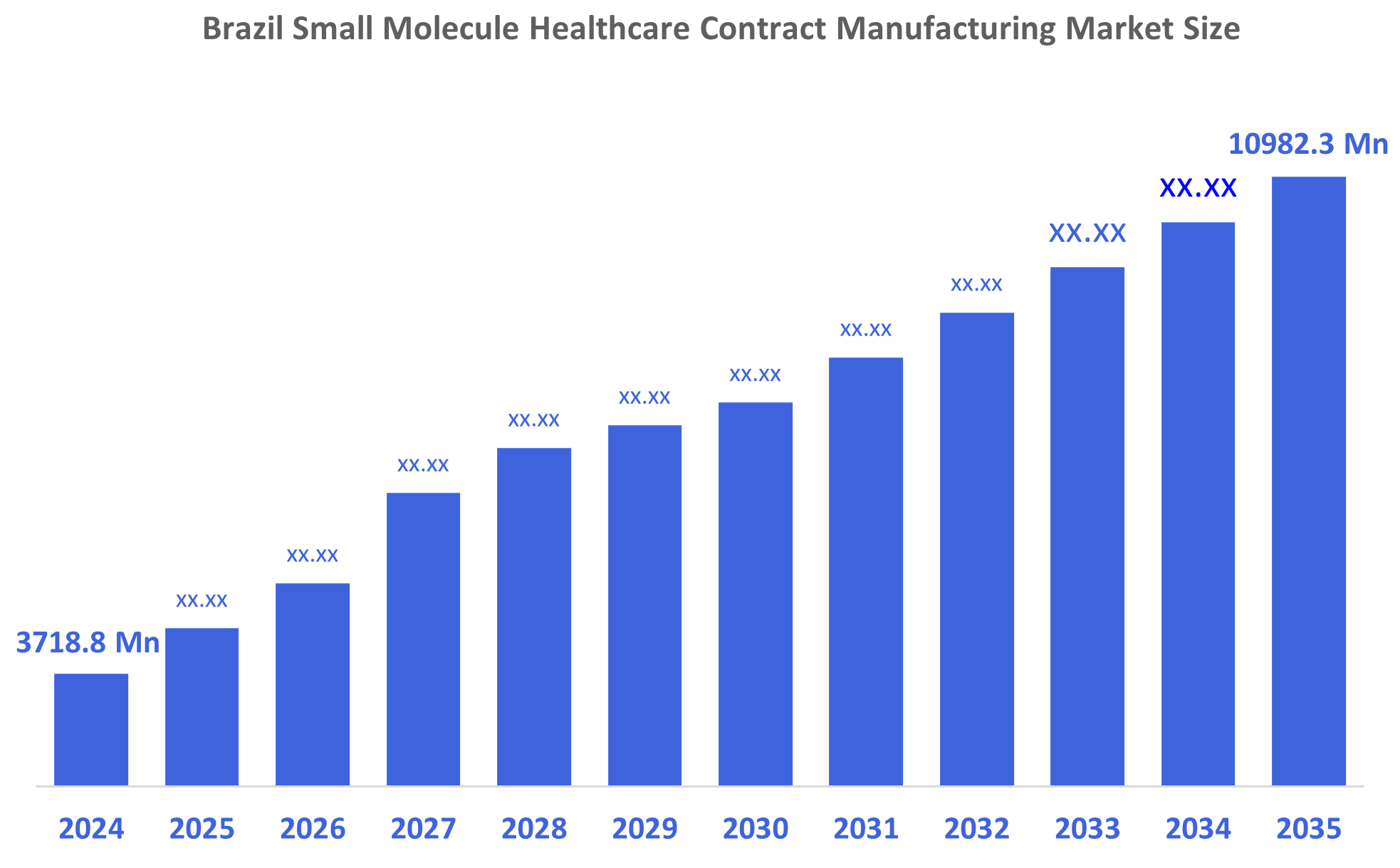

- Brazil Small Molecule Healthcare Contract Manufacturing Market Size 2024: USD 3718.8 Million

- Brazil Small Molecule Healthcare Contract Manufacturing Market Size 2035: USD 10982.3 Million

- Brazil Small Molecule Healthcare Contract Manufacturing Market CAGR: 10.35%

- Brazil Small Molecule Healthcare Contract Manufacturing Market Segments: Phase and Type

Market Overview

The Brazil Small Molecule Healthcare Contract Manufacturing Market Size consists of specialized third-party manufacturing services that support pharmaceutical and biotechnology companies in the development, scale-up, and commercial production of small molecule drugs. These services include active pharmaceutical ingredient (API) production, formulation development, finished dosage manufacturing, and packaging while ensuring regulatory compliance, quality control, and cost efficiency. The market is characterized by increasing outsourcing trends, flexible production capabilities, and growing emphasis on quality and speed-to-market.

The market growth in Brazil is supported by favourable government initiatives and private sector investments aimed at strengthening domestic pharmaceutical manufacturing. Regulatory bodies such as ANVISA encourage local production through streamlined approvals, public–private partnerships, and incentives for technology transfer. Additionally, increasing investments by domestic pharmaceutical companies and multinational firms establishing manufacturing facilities in Brazil are enhancing local contract manufacturing capabilities and reducing dependency on imports.

Technological advancements are transforming the Brazil small molecule healthcare contract manufacturing market, with companies adopting advanced process optimization tools, continuous manufacturing, high-potency API handling, and automation. Digital manufacturing systems, quality-by-design approaches, and data-driven analytics are improving production efficiency, compliance, and scalability. These innovations are enabling contract manufacturers to support complex molecules, accelerate development timelines, and meet global regulatory standards.

Market Dynamics of the Brazil Small Molecule Healthcare Contract Manufacturing Market

The Brazil small molecule healthcare contract manufacturing market is driven by the rising demand for cost-effective drug production, increasing pharmaceutical R&D activities, and growing preference for outsourcing manufacturing operations. The expansion of generic drugs, complex small molecules, and chronic disease treatments further fuels market growth. Additionally, regulatory support for local manufacturing, availability of skilled labour, and increasing collaborations between domestic and global pharmaceutical companies are accelerating the adoption of contract manufacturing services across preclinical, clinical, and commercial phases.

The market is restrained by high capital investment requirements, complex regulatory compliance, and quality assurance challenges associated with small molecule manufacturing. Limited access to advanced raw materials, supply chain disruptions, and pricing pressures from generic drug competition also hinder market growth. Furthermore, operational risks, long technology transfer timelines, and strict environmental regulations can increase production costs and delay manufacturing projects.

The future of the Brazil small molecule healthcare contract manufacturing market presents significant opportunities driven by the rising demand for complex generics, specialty pharmaceuticals, and export-oriented manufacturing. The growth of personalized medicine, increased clinical trial activities, and adoption of advanced manufacturing technologies create new revenue streams. Moreover, Brazil’s strategic position in Latin America offers opportunities for regional expansion and global supply chain integration.

Market Segmentation

The Brazil Small Molecule Healthcare Contract Manufacturing Market share is classified into phase and type.

By Phase:

The Brazil Small Molecule Healthcare Contract Manufacturing Market Size is divided by phase into preclinical & clinical, clinical, and commercial. Among these, the commercial segment dominated the market share in 2024 and is expected to grow at a notable CAGR during the forecast period. The dominance of the commercial segment is attributed to large-scale production volumes, long-term manufacturing contracts, and continuous demand for approved small molecule drugs across domestic and export markets.

By Type:

The market is segmented by type into API, development & scale-up services, finished dose combination, and packaging. The API segment held the largest market share in 2024 due to increasing demand for locally manufactured active pharmaceutical ingredients, rising generic drug production, and strategic initiatives to reduce reliance on imported APIs. The segment benefits from high-value manufacturing contracts and strong regulatory compliance requirements.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil Small Molecule Healthcare Contract Manufacturing Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Small Molecule Healthcare Contract Manufacturing Market

- Eurofarma Laboratórios

- Ache Laboratorios Farmaceuticos

- EMS Pharma

- Cristalia Produtos Quimicos e Farmacêuticos

- Libbs Farmaceutica

- Blau Farmacêutica

- Biolab Farmaceutica

- Prati-Donaduzzi

- Uniao Quimica

- Nortec Quimica

- Others

Recent Developments in Brazil Small Molecule Healthcare Contract Manufacturing Market

- In March 2025, Eurofarma expanded its small molecule manufacturing capacity in Brazil to support commercial-scale API and finished dosage production for domestic and export markets.

- In January 2025, EMS Pharma announced a strategic partnership with a multinational pharmaceutical company to provide contract manufacturing services for complex generic small molecule drugs.

- In August 2024, Cristalia invested in advanced process automation and quality control systems to enhance its contract manufacturing capabilities for clinical and commercial-stage small molecule products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Small Molecule Healthcare Contract Manufacturing Market Size based on the following segments:

Brazil Small Molecule Healthcare Contract Manufacturing Market, By Phase

- Preclinical & Clinical

- Clinical

- Commercial

Brazil Small Molecule Healthcare Contract Manufacturing Market, By Type

- API

- Development & Scale-up Services

- Finished Dose Combination

- Packaging

FAQ

Q: What is the Brazil small molecule healthcare contract manufacturing market size?

A: The market is expected to grow from USD 3718.8 million in 2024 to USD 10982.3 million by 2035, at a CAGR of 10.35% during the forecast period 2025–2035.

Q: What are the key growth drivers of the market?

A: Growth is driven by increasing outsourcing of drug manufacturing, rising pharmaceutical R&D investments, expansion of generic and specialty drugs, and government support for local manufacturing.

Q: What factors restrain the market?

A: High capital investment, regulatory complexity, quality compliance challenges, and supply chain constraints are key restraining factors.

Q: How is the market segmented by phase?

A: The market is segmented into preclinical & clinical, clinical, and commercial phases.

Q: Who are the key players in the market?

A: Major players include Eurofarma, Eurofarma Laboratorios, Ache Laboratorios Farmaceuticos EMS Pharma, Cristalia Produtos Quimicos e Farmaceuticos, Libbs Farmaceutica, Blau Farmaceutica, Biolab Farmaceutica, Prati-Donaduzzi, Uniao Quimica, Nortec Quimica, and Others.

Q: Who are the target audiences for this report?

A: Market players, investors, end-users, government authorities, consulting firms, venture capitalists, and VARs.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |