Brazil Smart Manufacturing Market

Brazil Smart Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Deployment (Cloud and On-Premises), By Enterprise Size (Large Enterprises and Small & Medium Enterprises), and Brazil Smart Manufacturing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Smart Manufacturing Market Size Insights Forecasts to 2035

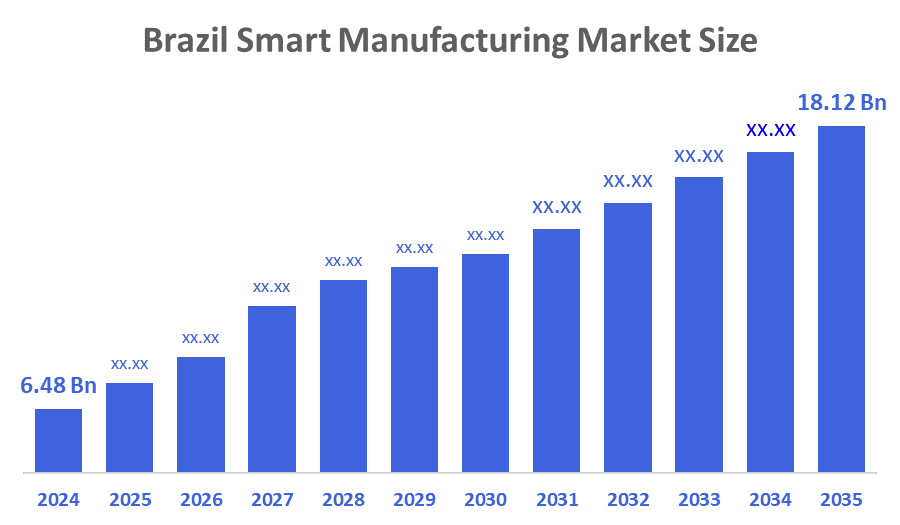

- The Brazil Smart Manufacturing Market Size Was Estimated at USD 6.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.8% from 2025 to 2035

- The Brazil Smart Manufacturing Market Size is Expected to Reach USD 18.12 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Smart Manufacturing Market Size is anticipated to Reach USD 18.12 Billion by 2035, Growing at a CAGR of 9.8% from 2025 to 2035. In Brazil, smart manufacturing will be stimulated by the rapid growth of Industrial Automation; Government initiatives to promote Industry Fourth Industrial Revolution; increasing adoption of Internet Of Things (IoT) and Artificial Intelligence (AI) technologies to support operational improvements; increased focus on providing operational efficiency; increased costs associated with labor, continuing growth of Automotive and Electronics Industries, and the use of data collected in real time for optimizing production.

Market Overview

In Brazil, the smart manufacturing sector is expanding due to technology adoption by businesses to help with production processes, operational effectiveness, and making better managerial decisions. Smart Manufacturing merges the Internet of Things (IoT), Artificial Intelligence (AI), Robotics, Big Data, and Cloud Computing so that all Manufacturing processes can be accessed & monitored in real time (production equipment, products & materials, etc.) and allows for predictive maintenance and real-time control as well as automation. The growth of smart manufacturing reflects the need for improved efficiency, reduced downtime, and better product quality, while also transforming existing manufacturing facilities into intelligent, agile & flexible manufacturing facilities. Brazil's industrial base relies heavily on digital technology; 69% of all Brazilian industrial companies utilize at least one type of digital technology. However, only 7% of industrial companies in Brazil are utilizing ten or more types of technology. As an instance, approximately 16.9% of all large manufacturing corporations use AI technology. Given that the manufacturing sector represents 21.6% of Brazil's GDP, this indicates that the government is taking an active role in supporting smart manufacturing initiatives.

Smart Manufacturing has been heavily invested in Brazil as more companies utilize technology to improve their production processes, increase productivity, and enhance managerial decisions. In Brazil Smart Manufacturing combines IoT, AI, Robotics, BIG DATA, and Cloud Computing, allowing manufacturers to monitor and access all aspects of their production process in Real-Time (machines, products, etc.) and perform Predictive Maintenance, Control Operations, Automate Processes, etc. Brazilian Smart Manufacturing is growing because of the need for increased Efficiency, less Equipment Downtime, and Higher Quality Products, while also transforming Existing Manufacturing Locations into Intelligent, Flexible, and Adaptive Manufacturing Locations. Furthermore, digital technology is critical to the overall Brazilian Industrial Base; therefore, a large percentage (69%) of all Industrial Companies in Brazil utilize at least one form of Digital Technology. Nevertheless, only 7% of the Brazilian Industrial Companies are using ten (10) or more types of Technological Systems. Approximately 16.9% of all Large Manufacturing Firms use AI Systems, another illustration that the Brazilian Government supports and invests in Smart Manufacturing and associated Technologies since they represent 21.6% of Brazil's Gross Domestic Product (GDP).

Report Coverage

This research report categorizes the market for the Brazil smart manufacturing market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil smart manufacturing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil smart manufacturing market.

Driving Factors

Brazil's smart manufacturing market is driven by attributed to an increase in the use of Industrial IoT (Internet of Things) technologies and artificial intelligence (AI) innovations for real-time monitoring of equipment and production performance, predicting equipment failures through predictive maintenance, and optimizing manufacturing processes. In particular, increased automation in the automotive, electronics, and consumer goods (CG) sectors has increased productivity and decreased labor costs. Additionally, government support through funding programs to develop Industry 4.0 capabilities and a digital economy, funding to support the development of new infrastructure in the industrial sector (such as factories and workshops), and investment into creating additional industrial infrastructure will lead to continued growth. As the world demands more flexible, efficient, and data-driven production capabilities, the utilisation of robotics, collaborative robots (CR), and energy-efficient solutions will continue to drive the growth of Brazil's smart manufacturing market, thereby improving the overall competitiveness of Brazil's manufacturing sector.

Restraining Factors

The Brazilian smart manufacturing market is restrained by factors such as the cost of automation, IoT, and AI technologies, as well as a shortage of skilled personnel and digital knowledge. The ability to integrate legacy systems with new technology, cybersecurity, and poor Internet connectivity slows the implementation of Smart Manufacturing in Brazil. Furthermore, the lack of financial resources for small and medium enterprises creates barriers to full-scale digital transformation and impedes market growth.

Market Segmentation

The Brazil smart manufacturing market share is categorized by component, deployment, and enterprise size.

- The solution segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil smart manufacturing market is segmented by component into solution, services. Among these, the solution segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the high demand for Industrial IoT platforms, automation software, AI-driven analytics, robotics, and control systems that enable real-time monitoring, predictive maintenance, and process optimization. Companies prioritize investing in these technologies to enhance productivity, efficiency, and competitiveness, while services like consulting, integration, and maintenance remain secondary in revenue contribution.

- The cloud segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil smart manufacturing market is segmented by deployment into cloud and on-premises. Among these, the cloud segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the growing demand for scalable, flexible, and cost-effective solutions that enable real-time data access, remote monitoring, predictive analytics, and collaboration across multiple sites. Cloud platforms reduce upfront infrastructure costs, simplify maintenance, and support rapid deployment of Industrial IoT, AI, and automation applications, making them more attractive to manufacturers compared with traditional on-premises systems.

- The large enterprises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil smart manufacturing market is segmented by enterprise size into large enterprises and small & medium enterprises. Among these, the large enterprises segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to they possess the financial capacity and technical expertise required for implementing advanced technologies like Industrial IoT, AI, robotics, and automation platforms. These companies operate complex, high-volume production lines where efficiency, predictive maintenance, and real-time data insights directly impact profitability and competitiveness. In contrast, small and medium enterprises (SMEs) often face budget limitations, lack skilled personnel, and struggle with infrastructure upgrades, delaying adoption. Consequently, large enterprises drive the majority of market growth, investments, and technology deployment in Brazil’s smart manufacturing sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil smart manufacturing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens AG

- ABB Ltd.

- Rockwell Automation, Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Emerson Electric Co.

- FANUC Corporation

- Omron Corporation

- Robert Bosch GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, Mitsubishi Electric Corporation has initiated its operations at a newly developed smart manufacturing facility for the development of advanced factory automation systems. This facility will prompt strong growth projections for the company in the market.

- In October 2023, ABB announced the launch of its smart manufacturing solutions for application in process industries and digital electrification products. These recent launches will help the company to have more product diversification and increase its presence in the market

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil smart manufacturing market based on the below-mentioned segments:

Brazil Smart Manufacturing Market, By Component

- Solution

- Services

Brazil Smart Manufacturing Market, By Deployment

- Cloud

- On-Premises

Brazil Smart Manufacturing Market, By Enterprise Size

- Large Enterprises

- Small

- Medium Enterprises

FAQ’s

Q1: What is smart manufacturing?

- Smart manufacturing integrates digital technologies like Industrial IoT, AI, robotics, and data analytics into manufacturing processes to improve efficiency, flexibility, and productivity.

Q2: What are the key drivers of the Brazil smart manufacturing market?

- Adoption of IIoT and AI, government Industry 4.0 initiatives, demand for operational efficiency, rising labor costs, and growth in the automotive and electronics sectors.

Q3: Which segment dominates the market by component?

- The solution segment dominates over services due to higher investment in technologies like IoT platforms, automation software, AI, and robotics.

Q4: Which deployment type is more popular?

- Cloud-based solutions dominate over on-premises due to scalability, cost-effectiveness, real-time access, and ease of deployment.

Q5: Which enterprise size leads adoption?

- Large enterprises dominate as they have the resources and expertise to implement advanced technologies, while SMEs face budget and skill limitations.

Q6: What are the major restraining factors?

- High initial costs, a limited skilled workforce, integration challenges, cybersecurity risks, and limited adoption by SMEs.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 163 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |