Brazil Smartphone Market

Brazil Smartphone Market Size, Share, And COVID-19 Impact Analysis, By Operating System (Android, iOS, and Others), By Distribution Channel (Online and Offline), and Brazil Smartphone Market Insights, Industry Trend, Forecast To 2035

Report Overview

Table of Contents

Brazil Smartphone Market Insights Forecasts to 2035

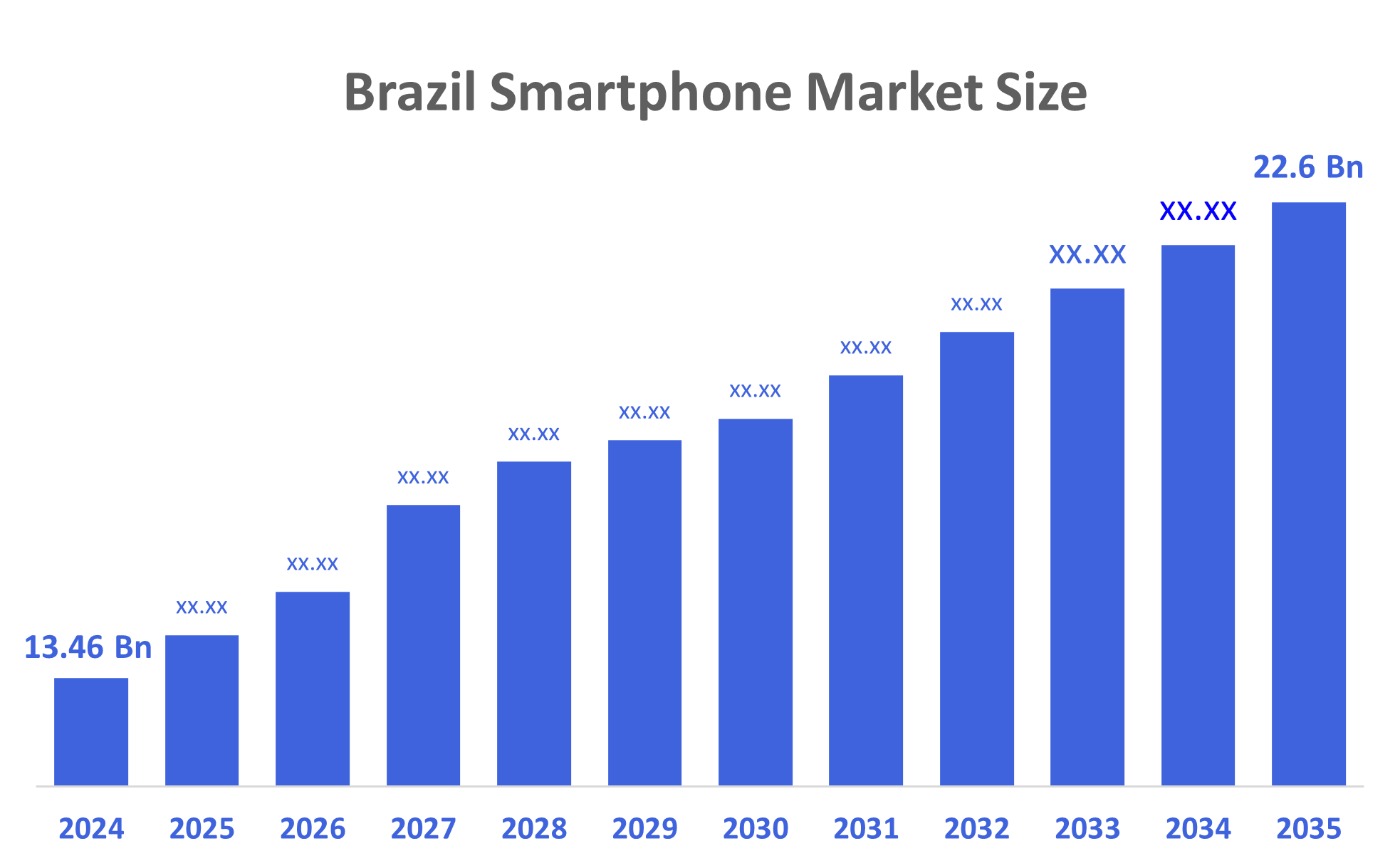

- Brazil Smartphone Market Size Was Estimated at USD 13.46 Billion in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 4.82% from 2025 to 2035.

- Brazil Smartphone Market Size is Expected to Reach USD 22.6Billion by 2035.

According to a research report published by Decisions Advisors, The Brazil Smartphone Market Size is Anticipated to Reach USD 22.6 Billion by 2035, Growing at a CAGR of 4.82% from 2025 to 2035. The market is driven due to Growing 4G and 5G coverage, high demand for mid-range smartphones with lots of features, and appealing financing options that make upgrades more affordable. Device adoption nationwide is further accelerated by growing digitalization, high social media engagement, and a strong offline retail network.

Market Overview

The smartphone market encompasses the global industry that manufactures, sells, and distribution of smartphones. Expansion of e-commerce has revolutionized the way Brazilians purchase mobile phones offering greater accessibility and convenience. These online platforms allow users to search and compare numerous models, check reviews, and access discounts and promotions anywhere and at any time. In addition, The Brazilian government has implemented several policies related to the smart phone market to promote digital inclusion and economic growth. Reducing import tariffs on smartphones is a crucial policy that lowers the cost of devices for consumers. Further, the government has promoted local manufacturing of smartphones through tax incentives and subsidies for companies establishing production facilities in Brazil. The government has imposed rules on data protection and cybersecurity for smartphone manufacturers and service providers in order to address concerns about digital security and privacy.

Report Coverage

This research report categorizes the market for the Brazil smartphone market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil smartphone market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil smartphone market.

Driving Factors

The Brazilian smartphone market is driven by the fast development of both 4G and 5G mobile broadband services which encourages consumers to invest in new high-end smartphones with many different features. The continued success of e-commerce will help drive further access to smartphones through low-cost smartphones, flexible payment plans and the ability to purchase a wide variety of smartphones on numerous different online platforms. Consumers increased purchasing power and smartphone usage in conjunction with their desire for lower-priced refurbished smartphones are driving demand as well. The public's desire for sustainable products combined with emerging technologies like Augmented Reality (AR) is changing buying patterns as well. Finally, local government initiatives to expand rural access to wireless technologies and support domestic businesses provide an encouraging framework for market growth.

Restraining Factors

The high import taxes and operational expenses placed on smartphones, the Brazilian smartphone marketplace is restrictive. Furthermore, the presence of a large grey market and the current economic environment have caused restrictions to consumer spending as well. The intricacy of regulations, the lack of obtainable components in many places, and restricted distribution as a result of inadequate rural infrastructure are further challenges. Lastly, intense price competition and increasing concern over the security of devices result in pressure on brand profitability for brands operating within this market.

Market Segmentation

The Brazil smartphone market share is classified into operating system and distribution channel.

- The Android segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil smartphone market is segmented by operating system into android, iOS, and Others. Among these, the android segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by Brazilian consumers predominantly have an affinity for the Android operating system. This is largely because of android's variety and price point across numerous manufacturers. The android platform appeals to Brazilian consumers because of this wide assortment, as well as the strong market presence of distributors in addition to high customer loyalty for brands, some of which have factories established in Brazil. The android platform integrates seamlessly with the Google services that most consumers in Brazil use daily, so it has become an attractive option.

- The offline segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Brazil smartphone market is segmented by distribution channel into offline and online. Among these, the offline segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to an overwhelming preference for in-person evaluation of products, in-store expert knowledge, and the ability to leave the store with their new device right away. The ability to have products immediately, as opposed to waiting on shipping for purchase, plays a considerable role in the offline distribution sector within Brazil's smartphone market and is the main reason why retailers have maintained their success by providing their consumers with a more reliable way of receiving their product, even in rural areas where logistics are difficult. Additionally, many consumers prefer to take advantage of the financing opportunities available to them in physical stores and continue to have issues with the digital divide, which further enhances the stronghold of offline sales of smartphones.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The Brazil smartphone market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- RealMe

- OPPO

- Vivo

- Motorola

- OnePlus

- Asus Industries

- Others

Recent Developments

- In December 2024: Vivo announced that due to trademark issues preventing use of the Vivo name in Brazil, it would launch phones, tablets and wearables under a new name, JOVI. The first devices introduced under that name were the JOVI V50, JOVI V50 Lite 5G and JOVI Y39 5G which were identical in specifications to vivo’s existing global models.

- In September 2024: Samsung had launched the Galaxy A06 smartphone in Brazil. The phone featured a 6.7?inch HD+ display, a 50 MP main camera, and a side?mounted fingerprint reader. It had been promised two years of operating?system updates and four years of security?patch support.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Smartphone Market based on the below-mentioned segments:

Brazil Smartphone Market, By Operating System

- Android

- iOS

- Others

Brazil Smartphone Market, By Distribution Channel

- Online

- Offline

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |