Brazil Soft Covering Flooring Market†

Brazil Soft Covering Flooring Market Size, Share, and COVID-19 Impact Analysis, By Product (Carpet Tiles and Broadloom), By Application (Residential and Commercial), and Brazil Soft Covering Flooring Market†Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Soft Covering Flooring Market Size Insights Forecasts to 2035

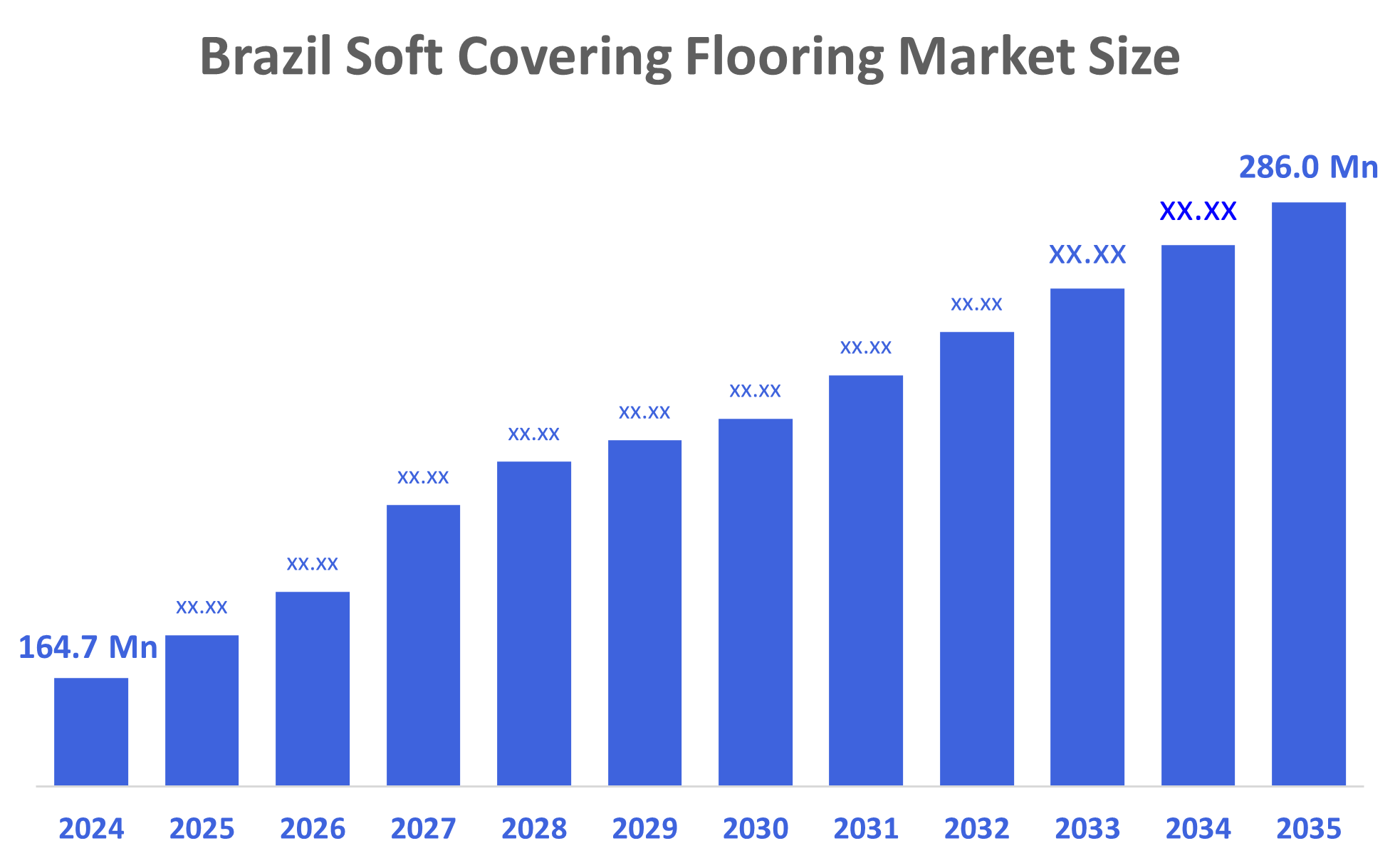

- The Brazil Soft Covering Flooring Market Size was estimated at USD 164.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.14% from 2025 to 2035

- The Brazil Soft Covering Flooring Market Size is Expected to Reach USD 286.0 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Soft Covering Flooring Market Size is Anticipated to Reach USD 286.0 Million by 2035, Growing at a CAGR of 5.14% from 2025 to 2035. The Brazil soft covering flooring market is driven by the increasing demand for modular carpet tiles, increase in usage of eco-friendly recycled materials, growing awareness of indoor air quality, technological developments in stain resistant fibres, expansion of organised retail flooring store formats, and supportive green building certification programs driving adoption of soft covering floors across Brazil.

Market Overview

The market for soft surface flooring includes the manufacture, distribution, and installation of soft or cushioned floor coverings. Products produced in this category include carpeting, rugs, carpet tiles, and mats. Soft surface floors are used in many kinds of structures including residences, offices, schools, hospitals etc. The soft floor coverings provide comfort and thermal insulation; noise control; and decorative appeal. Additionally, the rapid growth of construction and renovation activity has resulted in significant opportunity for soft covering flooring. There is a push to develop more sustainable products utilizing recyclable materials. New product types being developed include stain-resistant and antimicrobial fibre carpets, modular carpet tiles, and smart flooring with embedded sensors.

Further the support from the government includes green building incentives, sustainability standards, regulations regarding using eco-friendly materials in construction, taxes and other benefits for the construction of energy-efficient buildings, training programs to increase skill levels of contractors and builders, and policies to develop infrastructure to support labour and capital needed for the deliverability of quality, safe and sustainable soft cover floor coverings to both the residential, commercial and public sectors of business.

Report Coverage

This research report categorizes the market for the Brazil soft covering flooring market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil soft covering flooring market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil soft covering flooring market.

Driving Factors

The Brazil soft covering flooring market is driven by the upward trend in new residential and commercial construction projects, a continuously increasing number of renovations and remodels performed within homes and businesses, an increasing consumer interest in comfort, insulation, and sound reduction qualities of flooring. Growth is supported by expanding urban populations, improving overall interior aesthetics of buildings and implementation of less-costly, more efficient flooring solutions. Likewise, the rise of hospitality-related industries, office environments, and institutional building expansion further enhances demands placed upon the market for eco-friendly, long-lasting, and low maintenance products.

Restraining Factors

The Brazil soft covering flooring market is restrained by the volatile material prices, growing environmental awareness regarding synthetic fibres, new and stricter regulations for volatile organic compound emissions, increased replacement costs from higher wear and tear rates, limited acceptance among allergy-sensitive users, and increased competition from new innovations in hard surface flooring related to durability, maintenance, and performance.

Market Segmentation

The Brazil soft covering flooring market share is classified into product and application.

- The carpet tiles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil soft covering flooring market is segmented by product into carpet tiles and broadloom. Among these, the carpet tiles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to ease of installation, flexibility in design, and ease of replacement, the cost of maintaining carpet tiles is lowered significantly. The large amount of carpet tile sales is being driven by a demand from office buildings, hotels, and other commercial facilities and the growing popularity of modular and environmentally friendly flooring products, which has led to increased sales of carpet tiles compared to broadloom carpeting products.

- The commercial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil soft covering flooring market is segmented by application into residential and commercial. Among these, the commercial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to the high volume of foot traffic found in offices, hotels, retail stores, and other types of institutions, there is a larger demand for flooring that is durable with low maintenance requirements and modular, these qualities are often associated with carpet tiles. Because of this, commercial application accounts for a much greater portion than does resident application of the overall amount of carpet tiles sold in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil soft covering flooring market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key companies

- Beaulieu

- Forbo

- Shaw Industries Group

- Mohawk Industries Inc

- Mapei

- MUHU

- The Dixie Group

- Ashland Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Soft Covering Flooring Market based on the below-mentioned segments:

Brazil Soft Covering Flooring Market, By Products

- Carpet Tiles

- Broadloom

Brazil Soft Covering Flooring Market, By Applications

- Residential

- Commercial

FAQ’s

Q: What is the Brazil soft covering flooring market size?

A: Brazil soft covering flooring market size is expected to grow from USD 164.7 million in 2024 to USD 286.0 million by 2035, growing at a CAGR of 5.14% during the forecast period.

Q: Who are the key players in the Brazil soft covering flooring market?

A: Forbo, Shaw Industries Group, Mohawk Industries Inc, Mapei, MUHU, The Dixie Group, Ashland Inc, and Others are the key players in the Brazil soft covering flooring market.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |