Brazil Soy Beverage Market

Brazil Soy Beverage Market Size, Share, and COVID-19 Impact Analysis, By Type (Soy Milk and Soy-Based Drinkable Yogurt), By Flavor (Plain Soy Beverages and Flavored Soy Beverages), By Distribution Channel (Supermarkets/ Hypermarkets, Online Retail Stores, Convenience Stores, and Others), and Brazil Soy Beverage Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Soy Beverage Market Insights Forecasts to 2035

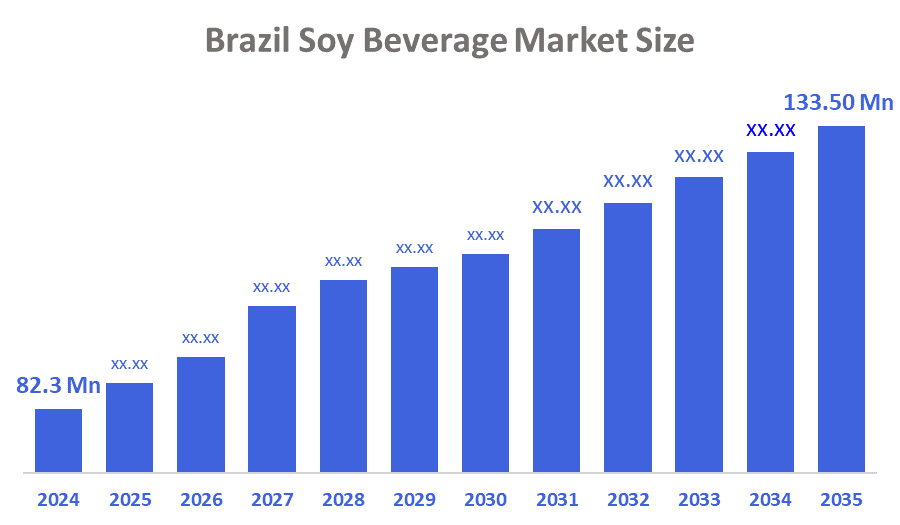

- The Brazil Soy Beverages Market Size Was Estimated at USD 82.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.5% from 2025 to 2035

- The Brazil Soy Beverages Market Size is Expected to Reach USD 133.50 Million by 2035

According to a research report published by Decision Advisor & Consulting, The Brazil Soy Beverages Market Size is Anticipated to reach USD 133.50 Million by 2035, Growing at a CAGR of 4.5% from 2025 to 2035. The Brazil soy beverage market is driven by increasing health-conscious consumers, rising demand for plant-based and lactose-free alternatives, growing awareness of sustainable diets, expanding distribution channels, and innovation in flavors and fortified products, boosting market growth rapidly.

Market Overview

The Brazil soy beverages market refers to the production, distribution, and consumption of drinks made from soy, including plain, flavored, and fortified varieties. These plant-based beverages serve as alternatives to dairy, catering to health-conscious, vegan, and lactose-intolerant consumers, while reflecting growing trends in sustainable and functional nutrition within Brazil’s food and beverage industry. Furthermore, the growth of the Brazil soy beverage market is fueled by increasing health awareness, rising lactose intolerance, demand for plant-based diets, product innovation, expanding retail and online distribution, and consumer preference for sustainable, protein-rich, and functional beverages.

The Brazil soy beverage market is witnessing key trends driving growth. Functional and Fortified Beverages are increasingly popular as consumers seek soy drinks enriched with probiotics, vitamins, and antioxidants for heart health, immunity, and digestion. Ready-to-Drink and Convenient Formats cater to busy urban lifestyles, offering portable, healthy options for professionals and students. Growth in Foodservice Channels is evident as cafés, restaurants, and juice bars include soy beverages in coffees, smoothies, and desserts, with customization boosting adoption. Finally, Plant-Based and Sustainable Choices attract eco-conscious and vegan consumers, reflecting rising environmental awareness and preference for dairy alternatives.

Technology advancement in the Brazil soy beverage market includes improved extraction methods, fortification with nutrients and probiotics, innovative flavor formulations, enhanced shelf-life through pasteurization, and ready-to-drink packaging for convenience. Furthermore, Fortification technology, enhancing soy beverages with probiotics, vitamins, and minerals, drives Brazil’s market most, meeting consumer demand for functional, health-focused drinks, while extraction, flavor, and packaging technologies support quality and convenience.

Report Coverage

This research report categorizes the market for the Brazil soy beverages market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil soy beverages market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil soy beverages market.

Driving Factors

The Brazil soy beverage market is driven by several key factors. Rising health consciousness and demand for functional beverages encourage the consumption of soy drinks rich in isoflavones, fiber, and antioxidants, supporting heart health, immunity, and digestion. Urbanization and busy lifestyles increase preference for ready-to-drink, convenient products. Expanding foodservice channels, including cafés, restaurants, and juice bars, enhances visibility and adoption. Additionally, growing interest in plant-based and sustainable diets, along with fortification technologies that add probiotics, vitamins, and minerals, further propel market growth, making soy beverages a popular, healthy, and eco-friendly choice among Brazilian consumers.

Restraining Factors

The Brazil soy beverage market faces restraints from high product prices compared to regular dairy, limiting affordability for some consumers. Additionally, taste preferences, limited awareness of soy benefits in certain regions, and competition from other plant-based and dairy alternatives hinder widespread adoption, slowing market growth despite increasing health and sustainability trends.

Market Segmentation

The Brazil soy beverage market share is classified into type, flavor, and distribution channel.

- The soy milk segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil soy beverage market is segmented by type into soy milk and soy-based drinkable yogurt. Among these, the soy milk segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Soy milk dominates the market because it is widely recognized as a versatile and convenient dairy alternative. Consumers prefer it for daily use in cereals, coffee, smoothies, and cooking. Its availability in flavored, fortified, and functional variants appeals to health-conscious, vegan, and lactose-intolerant individuals. In contrast, soy-based drinkable yogurt caters to a niche audience and has limited adoption. Strong marketing, easy accessibility in retail and online channels, and alignment with wellness trends further reinforce soy milk’s leading position.

- The flavored soy beverages segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil soy beverage market is segmented by flavor into plain soy beverages and flavored soy beverages. Among these, the flavored soy beverages segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Flavored soy beverages dominate the Brazil market because they offer a more enjoyable taste, appealing to children, young adults, and consumers transitioning from dairy milk. Chocolate, vanilla, and fruit variants enhance palatability, encouraging regular consumption. These options are also often fortified with vitamins and minerals, adding functional benefits. In contrast, plain soy beverages have a more neutral or beany taste, limiting appeal. Strong marketing, product innovation, and consumer preference for tasty yet healthy options further reinforce the dominance of flavored soy beverages in Brazil.

- The supermarkets/ hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil soy beverage market is segmented by distribution channel into supermarkets/ hypermarkets, online retail stores, convenience stores, and others. Among these, the supermarkets/ hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Supermarkets and hypermarkets dominate the market because they provide extensive product variety, including plain, flavored, and fortified options, catering to diverse consumer preferences. These outlets offer competitive pricing, promotions, and bulk purchase options, making soy beverages more accessible. Their widespread presence in urban and suburban areas ensures convenience for regular shoppers. In contrast, online stores and convenience stores have limited reach or selection. Strong visibility, in-store marketing, and consumer trust further reinforce supermarkets and hypermarkets as the leading distribution channel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil soy beverage market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hain Celestial Group

- Danone S.A.

- The Coca-Cola Company

- Jussara S.A.

- Lactalis

- Kikkoman Corporation

- Campbell Soup Company

- Pureharvest

- Mupy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

April 2023, Herbalife launched 106 new product SKUs across 95 markets in Q1 2023, targeting various wellness categories. The company introduced new products like Active Mind Complex and China Youth Shake, as well as new flavors for existing products.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Brazil soy beverages market based on the below-mentioned segments:

Brazil Soy Beverages Market, By Type

- Soy Milk

- Soy-Based Drinkable Yogurt

Brazil Soy Beverages Market, By Flavor

- Plain Soy Beverages

- Flavored Soy Beverages

Brazil Soy Beverages Market, By Distribution Channel

- Supermarkets/ Hypermarkets

- Online Retail Stores

- Convenience Stores

- Others

FAQ’s

1. What is driving Brazilian consumers toward soy beverages?

Health, wellness, and plant-based lifestyle choices are encouraging Brazilians to choose soy beverages over traditional dairy, especially functional and fortified options.

2. Which soy beverage type is most preferred in Brazil?

Soy milk is most popular due to its everyday versatility, nutritional value, and availability in multiple flavors and fortified varieties.

3. Why are flavored soy beverages gaining popularity in Brazil?

Flavored options like chocolate or vanilla make soy drinks more enjoyable, especially for younger consumers, while still providing health benefits.

4. How do consumers mainly buy soy beverages in Brazil?

Supermarkets and hypermarkets lead because they offer variety, accessibility, promotions, and convenience for regular purchases.

5. How are foodservice channels impacting the market?

Cafés, juice bars, and restaurants introducing soy beverages as coffee alternatives or smoothies expand exposure and encourage trial among new consumers.

6. What technological innovations are influencing the Brazil soy beverage market?

Fortification with vitamins, minerals, probiotics, and ready-to-drink formats drives growth, making beverages functional, convenient, and appealing to health-conscious consumers.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |