Brazil Spinal Surgery Devices Market

Brazil Spinal Surgery Devices Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Spinal Decompression, Spinal Fusion, Fracture Repair Devices, and Others), By Application (Degenerative Disc Disease, Spinal Trauma, Spinal Tumors, Scoliosis), and Brazil Spinal Surgery Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Spinal Surgery Devices Market Size Insights Forecasts to 2035

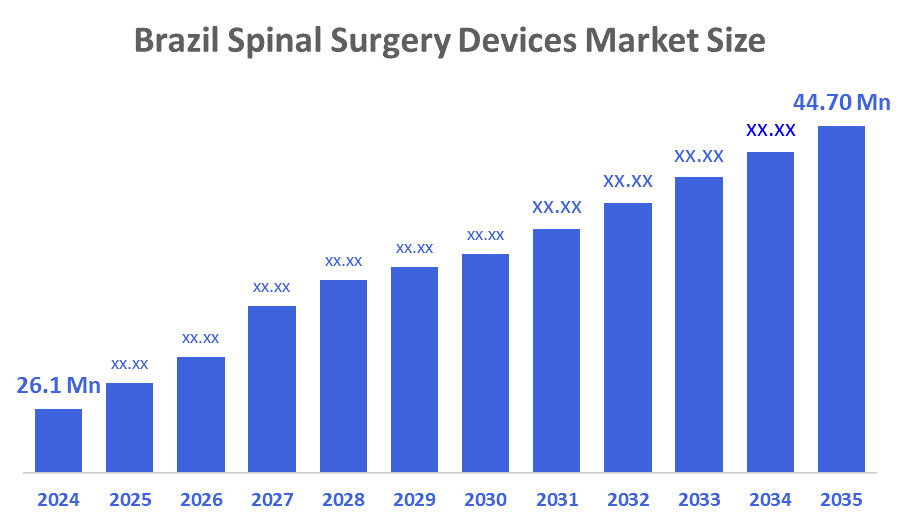

- The Brazil Spinal Surgery Devices Market Size Was Estimated at USD 26.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The Brazil Spinal Surgery Devices Market Size is Expected to Reach USD 44.70 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Spinal Surgery Devices Market Size is anticipated to Reach USD 44.70 Million by 2035, Growing at a CAGR of 5.1% from 2025 to 2035. The market is witnessing significant growth due to the rising prevalence of spinal disorders and increasing investments in healthcare infrastructure. Moreover, the rising use of minimally invasive surgical procedures, the greater incorporation of cutting-edge technologies, and the growth of private healthcare sectors are contributing to the market's expansion.

Market Overview

Spinal surgery devices are medical tools, implants, and technologies designed to support surgeons in treating spinal disorders. These devices aid in stabilizing vertebrae, correcting deformities, decompressing nerves, and facilitating spinal fusion. They include screws, rods, cages, bone graft systems, and advanced navigation tools, ensuring precise, safe, and effective spinal surgical procedures for improved patient outcomes. An important driver of the Brazil spinal surgery devices market is the rising instances of spinal disorders. Degenerative disc disease, spinal stenosis, herniated discs, and scoliosis are all becoming more common, driven by an aging population and lifestyle changes. For example, in 2024, Brazil, covering around 200 million people (IBGE census), has six disorders in its national newborn screening program, while pilot studies are exploring the possibility of adding SMA. With the rising elderly population, the incidence of age-related spinal disorders that are age-related increases exponentially, leading to an increased need for surgery. Sedentary lifestyles and poor ergonomics among the young population are also a cause for musculoskeletal problems, hence increasing the target patient population. Enhanced investments in Brazil’s healthcare infrastructure are significantly boosting the spinal surgery devices market. The government and private sector are allocating resources to improve hospital facilities, surgical capabilities, and access to advanced medical technologies. These investments are particularly focused on equipping healthcare institutions with the tools necessary for complex procedures, including spinal surgeries. For instance, an article published in the World Neurosurgery Journal in November 2021 indicated that the neurooncological practice was one of the most affected by the pandemic due to restricted elective procedures and new triage protocols.

Report Coverage

This research report categorizes the market for the Brazil spinal surgery devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil spinal surgery devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil spinal surgery devices market.

Driving Factors

Spinal surgery devices are specialized medical instruments, implants, and equipment used to diagnose, stabilize, correct, or support the spine during surgical procedures. These devices include fixation systems, interbody cages, decompression tools, navigation systems, and minimally invasive instruments. They help restore spinal alignment, relieve pressure on nerves, and improve mobility, ensuring safer and more effective surgical outcomes for patients. For instance, in July 2023, the Brazilian government proposed a multibillion-dollar investment in hospital infrastructure, which is likely to include funds for modern surgical equipment and technologies, increasing demand for spinal surgery solutions. In September 2023, Medtronic expanded its operations in Brazil, with the goal of improving access to its innovative spinal technologies. This expansion emphasizes the growing trust in the Brazilian market, supported by favorable healthcare investments and an expanding demand for high-quality medical solutions.

Restraining Factors

The Brazil spinal surgery devices market faces restraints such as high procedure costs, limited reimbursement coverage, and unequal access to advanced technologies across regions. Shortage of skilled spine surgeons, regulatory delays, and reliance on imported devices also hinder market growth. Economic fluctuations further affect hospital budgets and purchasing capacity.

Market Segmentation

The Brazil spinal surgery devices market share is categorized by device type and application.

- The spinal fusion segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil spinal surgery devices market is segmented by device type into spinal decompression, spinal fusion, fracture repair devices, and others. Among these, the spinal fusion segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven due to its critical role in treating a wide range of conditions, including degenerative disc disease, scoliosis, trauma, and spinal instability. Fusion procedures rely heavily on implants such as pedicle screw systems, rods, plates, cages, and bone graft substitutes, creating strong and consistent demand. Additionally, advancements in minimally invasive fusion techniques, improved biomechanical implant designs, and wider availability of navigation and robotic assistance make fusion surgeries more effective, reinforcing this segment’s market leadership.

- The degenerative disc disease segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil spinal surgery devices market is segmented by application into degenerative disc disease, spinal trauma, spinal tumors, and scoliosis. Among these, the degenerative disc disease segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to its high prevalence among middle-aged and elderly populations. As ageing increases, so do issues like disc degeneration, herniation, and chronic lower-back pain, leading to more surgical interventions. This segment requires frequent use of fusion systems, interbody cages, decompression instruments, and motion-preserving devices. Improved diagnostic capabilities, strong surgeon familiarity with DDD procedures, and expanding access to advanced spine care further reinforce this segment’s market leadership.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil spinal surgery devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic

- Zimmer Biomet

- DePuy Synthes

- Stryker

- NuVasive

- Globus Medical

- Orthofix

- MDT

- GMReis

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2022, CMR Surgical launched its Versius Surgical Robotic System in Brazil to enable surgeons to perform complex surgical procedures through keyhole surgery.

- In January 2022, Spinologics Inc. and Importek launched Cervision, an upper-extremity patient positioning device for cervical spine surgery, in Brazil.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil spinal surgery devices market based on the below-mentioned segments:

Brazil Spinal Surgery Devices Market, By Device Type

- Spinal Decompression

- Spinal Fusion

- Fracture Repair Devices

- Others

Brazil Spinal Surgery Devices Market, By Application

- Degenerative Disc Disease

- Spinal Trauma

- Spinal Tumors

- Scoliosis

- Other

FAQ

1. What are spinal surgery devices?

- They are implants, instruments, and tools used to treat spinal disorders through surgical procedures.

2. What drives the market growth in Brazil?

- Rising spinal disorders, ageing population, and demand for minimally invasive surgeries.

3. Which device segment dominates the market?

- The spinal fusion segment dominates due to high usage in degenerative conditions.

4. Which application segment leads the market?

- Degenerative disc disease is the leading application segment.

5. What recent developments impact the market?

- Introduction of advanced robotic-assisted spine systems and growing local manufacturing.

6. What challenges does the market face?

- High procedure costs, limited reimbursement, and uneven access to advanced technology.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 270 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |