Brazil Sports Apparel Market

Brazil Sports Apparel Market Size, Share, By Sports (Soccer, Basketball, Baseball, Golf, And Other Sports), By Distribution Channel (Specialty Stores, Supermarket, Online Retail Stores, Warehouse Clubs, And Others), By End User (Men, Women, And Children), And Brazil Sports Apparel Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Sports Apparel Market Size Insights Forecasts to 2035

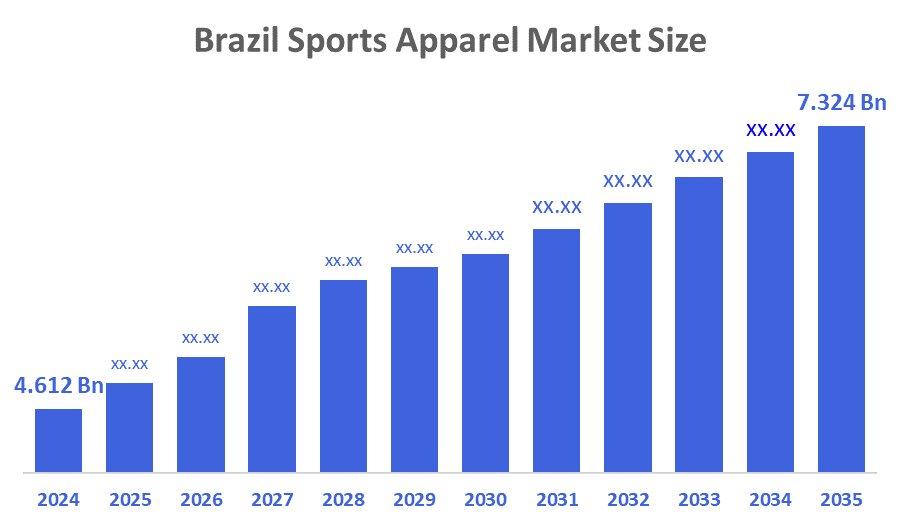

- Brazil Sports Apparel Market Size 2024: USD 4.612 Bn

- Brazil Sports Apparel Market Size 2035: USD 7.324 Bn

- Brazil Sports Apparel Market CAGR 2024: 4.29%

- Brazil Sports Apparel Market Segments: Sports, Distribution Channel, and End User

The Brazil Sports Apparel Market Size includes all companies involved in the design, manufacture, distribution and retail sale of clothing that is used for athletic performance, fitness activities and casual athleisure or lifestyle fashion that combines sports with lifestyle fashion including male and female athletic shirts, compression clothing, training pants, team uniforms and athleisure apparel that can be worn by people not engaged in traditional athletic pursuits. As many consumers are becoming health conscious, the Brazilian marketplace has continued to grow at a steady pace because of this trend and the growing popularity of athleisure as a traditional factor in fashion.

The apparel sports in Brazil are backed by government support, including the National Solid Waste Policy mandates that textiles manufacturers have to disclose and manage the environmental effects they create through waste reduction via eco-friendly materials and processes. By making these changes, they will affect how sport apparel manufacturers do business. The Brazilian Institute of Geography and Statistics has captured the changing consumer engagement trends in Brazil is by documenting an increase of approximately 20% in the amount of people engaged in organized sports and fitness activity. Consequently, this increased participation directly enhances the demand for specialized athletic apparel.

As technology advances, Brazil’s apparel sports providers are now using the integration of new textiles with properties such as moisture wicking, temperature controlling, odour resistancy and breathability into product will dramatically increase both comfort and product performance for consumers. Brands are beginning to build stronger connections with their consumers through digital platforms, e-commerce, social media and the shift to a mobile-first approach. Emerging technology support AI-based trend forecasting, virtual fitting rooms, and intelligent textiles, such as e-textiles with integrated sensors can provide customisation options and performance assessments for brands.

Market Dynamics of the Brazil Sports Apparel Market:

The Brazil sports apparel market is driven by the rising awareness of health and fitness by age group, prevalence of athleisure as a fashion trend, expanding online sales channels that increase convenience and access to apparel, increased disposable income and urbanization, and increased use of social media to promote products and brand images through the visibility of international sporting events as an increase in the number of people adopting sportswear.

The Brazil sports apparel market is restrained by the economic volatility and price sensitivity among consumers, limits spending on premium sportswear, intense competition from global brands and low-cost imports that pressure local manufacturers’ margins.

The future of Brazil sports apparel market is bright and promising, with versatile opportunities emerging from the women participating in fitness and greater interest in specially designed products, there is a growing market opportunity for expanding women's sports apparel. By continuing to innovate sustainable and high-performance textiles and apparel, brands have the opportunity to differentiate themselves. Additionally, utilizing AI as part of creating and designing apparel, along with offering personalized fit options, will provide the added value needed to keep pace with changing consumer attitudes. By using an omnichannel retail strategy that blends the convenience of shopping on the internet with localized marketing initiatives, brands will be able to tap into the growing trend of building stronger relationships with consumers by sponsoring sports events or athletes.

Market Segmentation

The Brazil Sports Apparel Market share is classified into sports, distribution channel, and end user.

By Sports:

The Brazil sports apparel market is divided by sports into soccer, basketball, baseball, golf, and other sports. Among these, the soccer segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. National obsession ingrained in Brazilian culture, massive brands, huge demand for soccer jerseys, scarves and accessories, and forming a core part of the sports merchandise all contribute to the soccer segment's largest share and higher spending on sports apparel when compared to other sports.

By Distribution Channel:

The Brazil sports apparel market is divided by distribution channel into specialty stores, supermarket, online retail stores, warehouse clubs, and others. Among these, the specialty stores segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The specialty stores segment dominates because of established physical presence, personalized service, broader accessibility and competitive pricing, appealing to budget-conscious consumers for everyday sportswear.

By End User:

The Brazil sports apparel market is divided by end user into men, women, and children. Among these, the men segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Higher participation of men traditionally engage in sports and outdoor activities, offer extensive ranges of functional apparel catering specifically to male consumers all contribute to the men segment's largest share and higher spending on sports apparel when compared to other end user.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil sports apparel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Sports Apparel Market:

- Nike, Inc.

- Adidas AG

- Puma SE

- Under Armour, Inc.

- Asics Corporation

- Balance Athletics, Inc.

- Reebok Brasil

- Fila Brasil

- Mizuno Corporation

- Champion

- Olympikus

- Lupo S.A.

- Track & Field Co. Hearing S.A

- Osklen

- Others

Recent Developments in Brazil Sports Apparel Market:

In December 2025, Nike’s new athleisure collection using advanced fabrics, Adidas’s expansion of its eco-friendly line, Puma’s collaboration with local designers, and Under Armour strengthening its digital fitness platform.

In May 2025, the Brazilian Olympic committee (COB) partnered with Adidas, making Adidas the official supplier for the los angles 2028 Olympic missions. New uniforms were set to debut in February 2026 at the Milano Cortina winter Olympics.

In April 2025, Amazon expanded its “Amazon Modal” and “Amazon Sports” marketplace sections, offering a wide range of products including those from local brands.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil sports apparel market based on the below-mentioned segments:

Brazil Sports Apparel Market, By Sports

- Soccer

- Basketball

- Baseball

- Golf

- Other Sports

Brazil Sports Apparel Market, By Distribution Channel

- Specialty Stores

- Supermarket

- Online Retail Stores

- Warehouse Clubs

- Others

Brazil Sports Apparel Market, By End User

- Men

- Women

- Children

FAQ

Q: What is the Brazil sports apparel market size?

A: Brazil sports apparel market is expected to grow from USD 4.612 billion in 2024 to USD 7.324 billion by 2035, growing at a CAGR of 4.29% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the increased health and fitness awareness across age groups the ubiquity of athleisure as a fashion trend, expanding online retail channels that enhance convenience and access, urbanization and rising disposable incomes, social media influence and international sports events boost brand visibility and sportswear adoption.

Q: What factors restrain the Brazil sports apparel market?

A: Constraints include the economic volatility and price sensitivity among consumers, limits spending on premium sportswear, intense competition from global brands and low-cost imports that pressure local manufacturers’ margins.

Q: How is the market segmented by sports?

A: The market is segmented into soccer, basketball, baseball, golf, and other sports.

Q: Who are the key players in the Brazil sports apparel market?

A: Key companies include Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Asics Corporation, Balance Athletics, Inc .New, Reebok Brasil, Fila Brasil, Mizuno Corporation, Champion, Olympikus, Lupo S.A., Track & Field Co. Hearing S.A, Osklen, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 157 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |