Brazil Surgical Sutures Market

Brazil Surgical Sutures Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Absorbable and Non-absorbable), By Application (Gynecology, Cardiology, Orthopedics, General Surgery, and Others), and Brazil Surgical Sutures Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Surgical Sutures Market Insights Forecasts to 2035

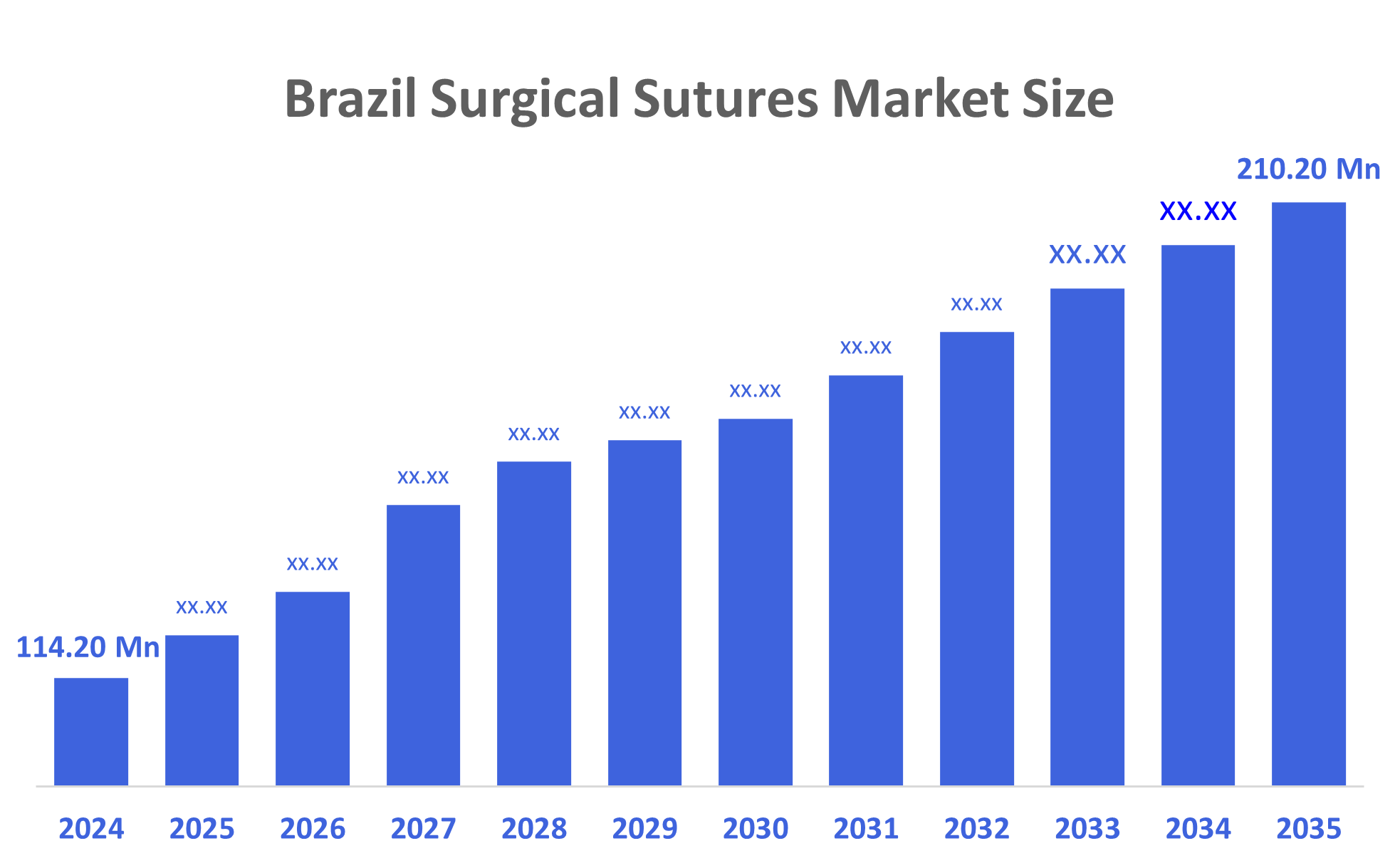

- The Brazil Surgical Sutures Market Size Was Estimated at USD 114.20 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.7% from 2025 to 2035

- The Brazil Surgical Sutures Market Size is Expected to Reach USD 210.20 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Surgical Sutures Market Size is Anticipated to Reach USD 210.20 Million by 2035, Growing at a CAGR of 5.7% from 2025 to 2035. The Brazil surgical sutures market is driven by rising surgical procedure volumes, expanding healthcare infrastructure, growing prevalence of chronic diseases, advancements in wound-closure technologies, and increasing adoption of minimally invasive surgeries. Government investments in public healthcare and the rising demand for high-quality, infection-resistant sutures further support market growth.

Market Overview

Surgical sutures are special medical threads used by doctors to close wounds or surgical cuts, helping the skin and tissues heal properly. They hold the edges of a wound together to prevent bleeding and infection. Sutures can be made of different materials and may dissolve naturally or be removed later. Additionally, the Brazil Surgical Sutures market has witnessed growth driven by the rising number of surgical procedures, advancements in medical technology, and an aging population. Surgical sutures are essential medical devices used for wound closure, and the increasing demand for minimally invasive surgeries further boosts the market. The healthcare sector`s continuous focus on improving patient outcomes and reducing recovery times contributes to the sustained growth of the surgical sutures market. Furthermore, Government policies in Brazil play a crucial role in shaping the Surgical Sutures market, particularly in the healthcare sector.

Policies related to medical device regulation, quality standards, and healthcare infrastructure impact market dynamics. Challenges involve compliance with strict regulatory requirements, addressing public health needs, and ensuring the safety and efficacy of surgical sutures. Adapting to and aligning with government initiatives for healthcare improvement is crucial for market players in the surgical sutures sector. Furthermore, technological advancements in surgical sutures include the development of antibacterial coatings, absorbable materials, barbed sutures for faster closure, and improved synthetic fibers. These innovations enhance wound healing, reduce infection risks, and make surgical procedures quicker, safer, and more efficient for both doctors and patients.

Report Coverage

This research report categorizes the market for the Brazil surgical sutures market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil surgical sutures market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil surgical sutures market.

Driving Factors

The Brazil surgical sutures market is driven by the rising number of surgeries due to aging populations, chronic diseases, and trauma cases. Expanding healthcare infrastructure, especially in public hospitals, boosts demand for reliable wound-closure solutions. Increased adoption of advanced surgical techniques, including minimally invasive and cosmetic procedures, further accelerates market growth. Technological improvements such as antibacterial coatings, absorbable materials, and barbed sutures enhance clinical outcomes and encourage wider usage. Growing awareness of infection control and government investments in healthcare modernization also play a key role in supporting market expansion.

Restraining Factors

The Brazil surgical sutures market faces restraints such as the rising availability of alternative wound-closure methods like staples and tissue adhesives, which can reduce suture demand. High costs of advanced sutures, regulatory delays, and uneven access to healthcare across regions also hinder market growth. Additionally, limited surgeon training in newer suture technologies can slow adoption.

Market Segmentation

The Brazil surgical sutures market share is categorized by product type and application.

- The absorbable segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil surgical sutures market is segmented by product type into absorbable and non-absorbable. Among these, the absorbable segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by they offer greater convenience and improved patient comfort by naturally dissolving in the body, eliminating the need for follow-up removal procedures. Their use reduces infection risks, treatment time, and hospital visits, making them highly suitable for Brazil’s growing volume of general, gynecological, and laparoscopic surgeries. Advances in synthetic absorbable materials with better tensile strength and predictable absorption rates further increase their preference among surgeons. As healthcare systems emphasize efficiency and patient outcomes, absorbable sutures gain stronger adoption across hospitals and clinics.

- The general surgery segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil surgical sutures market is segmented by application into gynecology, cardiology, orthopedics, general surgery, and others. Among these, the general surgery segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to it accounting for the largest share of surgical procedures nationwide, including abdominal, gastrointestinal, trauma, and emergency surgeries. These procedures require frequent and varied use of sutures, both absorbable and non-absorbable. Brazil’s rising cases of chronic diseases, accidents, and age-related conditions further increase general surgical interventions. Public hospitals, which handle a high volume of routine and emergency surgeries, significantly drive suture consumption. Additionally, the growing adoption of minimally invasive techniques still relies on sutures for internal tissue repair, strengthening this segment’s market leadership.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil surgical sutures market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ethicon

- Medtronic

- B. Braun Melsungen AG

- Smith & Nephew

- Boston Scientific Corporation

- CONMED Corporation

- Peters Surgical

- DemeTECH Corporation

- Internacional Farmacéutica S.A. de C.V.

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

March 2022 - Cynosure U.K. Ltd. launched the MyEllevate Surgical Suture System in the U.K. This innovative, minimally invasive surgical suture system helps suture the neck and jawline area.

In September 2024, Meril launched a new suture, named New Edge Suture, specifically for use in open, laparoscopic, and robotic surgeries.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil surgical sutures market based on the below-mentioned segments:

Brazil Surgical Sutures Market, By Product Type

- Absorbable

- Non-absorbable

Brazil Surgical Sutures Market, By Application

- Gynecology

- Cardiology

- Orthopedics

- General Surgery

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |