Brazil Sweet Potato Market

Brazil Sweet Potato Market Size, Share, and COVID-19 Impact Analysis, By Nature (Organic and Conventional), By Product Type (Fresh, Frozen, Dried, and Others), and Brazil Sweet Potato Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Sweet Potato Market Insights Forecasts to 2035.

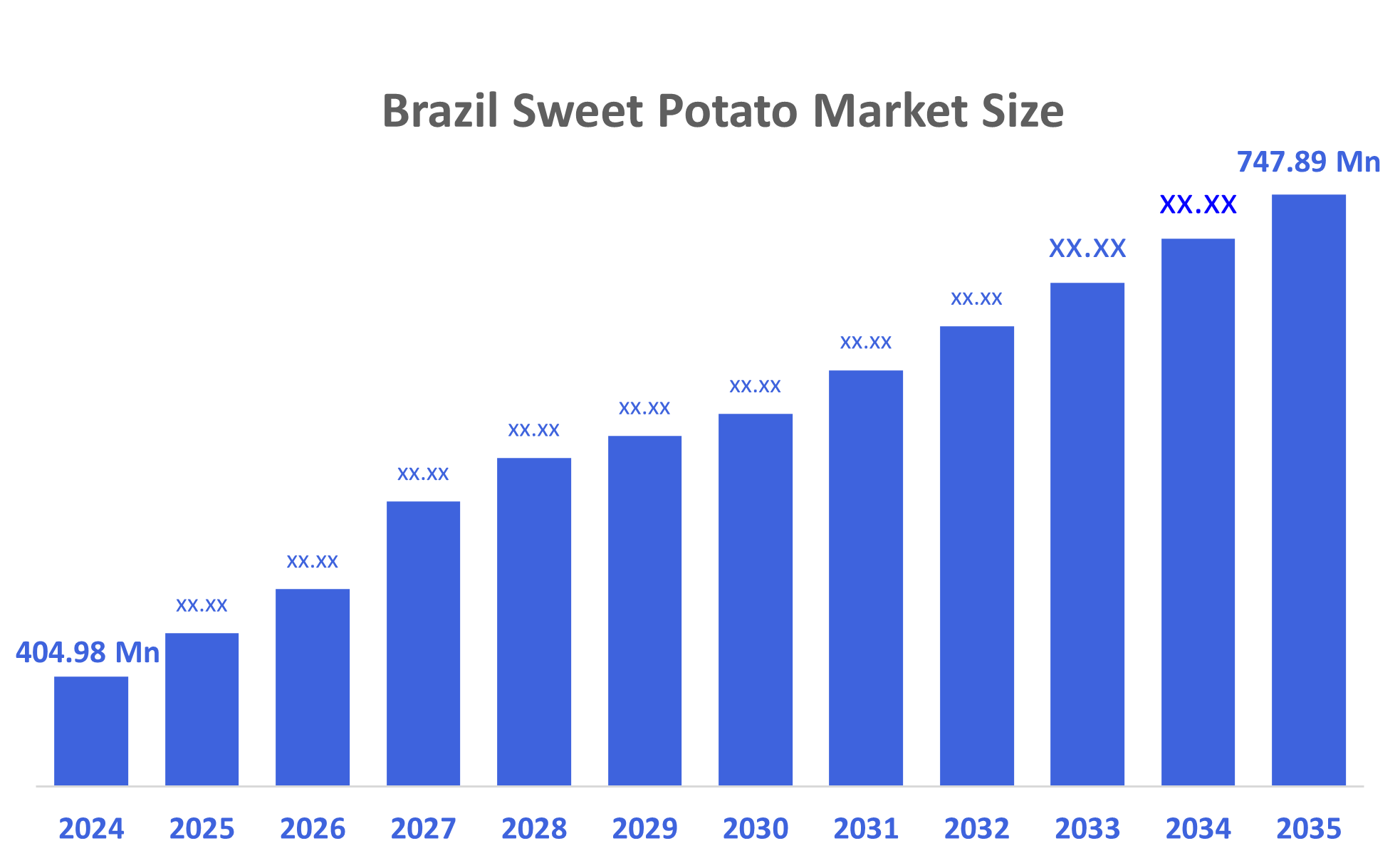

- The Brazil Sweet Potato Market Size was estimated at USD 404.98 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.73% from 2025 to 2035

- The Brazil Sweet Potato Market Size is Expected to Reach USD 747.89 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Sweet Potato Market Size is Anticipated to Reach USD 747.89 Million by 2035, Growing at a CAGR of 5.73% from 2025 to 2035. The Brazil sweet potato market is driven by as consumers seek healthier, plant-based foods rich in vitamins, minerals, antioxidants, and fibre, sweet potatoes are versatile ingredients used in soups, desserts, snacks, and smoothies. Due to the growing demand for healthy and gluten-free foods, Brazil has significant opportunities in value-added sweet potato products. Due to year-round production capacity, competitive costs, and expanding opportunities for premium and organic varieties in urban retail channels, there is also significant potential in export markets.

Market Overview

The term sweet potato market describes all sales related to sweet potatoes, including fresh roots, processed, and other products. Demand by consumers for healthy, versatile & plant-based food products continues to grow, driving steady growth in the Brazilian sweet potatoes products market as well as strong growth in the food & beverage industry. Emerging economies have a growing middle class and growing awareness about health - create new innovations in product lines based on sweet potatoes Increase exposure to the production of organic sweet potatoes non-GMO. The Brazilian government support to the sweet potato industry through research, developing the sweet potato industry and providing programs to meet the needs of farmers and consumers in Brazil. The Brazilian Agricultural Research Company (Embrapa) plays a large role to improve farmers through farmers' expertise, access to new varieties of sweet potatoes developed by Embrapa and supporting farmers who are interested in biofortification. In addition to the work done by Embrapa, the Brazilian government’s agricultural support program for smallholder farmers, called Fomento, develops and provides training, technical assistance, and market linkages for smallholder farmers training, technical assistance, and market linkages provide farmers with many tools to become better producers, increasing the ability of Brazilian sweet potato producers to compete in both domestic and global markets.

Report coverage

This research report categorizes the market for the Brazil sweet potato market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil sweet potato market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil sweet potato market.

Driving Factors

The Brazil sweet potato market is now rapidly growing as the leading market for healthy foods due to its numerous vitamins, minerals, antioxidants, and fibre. As people continue to transition towards plant-based diets, the versatility and flavour profile of the sweet potato have made it an excellent ingredient for vegetarian and vegan cuisine. The use of the sweet potato covers a wide spectrum from soups to desserts and snacks to smoothies, which has increased demand from customers. With the increasing awareness of celiac disease and gluten sensitivity, sweet potatoes have become recognized as gluten-free foods, as they naturally do not contain gluten. Increased availability of processed and convenience food options has led to a continuous expansion and success of this market, along with the growing popularity of sweet potatoes used as a part of various world cuisine has led to increased consumer demand. With health advantages such as the improvement of immune function and the reduction of inflammation, sweet potatoes are being recognized as a functional food. Marketing efforts such as consumer education campaigns, associations with influencers have helped to develop positive consumer perceptions and contribute to the market growth.

Restraining Factors

Brazil's sweet potato sector has challenges preventing market growth, including pressures from pests via weevils and stem borers, which ultimately result in yield reductions, as well as severe quarantine restrictions that prevent access to some parts of Brazil from exporting sweet potatoes. Much of the current supply chain situation exists due to smallholder farmers having limited access to labour, technical expertise and more importantly being poorly integrated into the marketing structure, which brings on price fluctuations and inconsistent supply and demand fluctuations. Additionally, climatic risks such as excessive heat, frost and other seasonal weather events lead to market unavailability and a slowing down of the value-added product development process, leading to a lack of awareness from consumers to purchase processed foods.

Market Segmentation

The Brazil sweet potato market share is classified into nature and product type.

- The conventional segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The Brazil sweet potato market is segmented by nature into organic and conventional. Among these, the conventional segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its resilience, high nutritional value, and versatility in various applications, sweet potato has been an expanding segment of Brazil’s conventional sweet potato industry. Agriculturally, sweet potato is well adapted physiologically to wide climatic variations, requires minimal input, provides multiple harvests to support food security, and is receiving significant support from various government policies that promote sustainability and diversification of agriculture. The strategic geographic location of Brazil will only continue to increase the potential for exportation and therefore contribute significantly to the overall expansion of the market for sweet potatoes in Brazil.

- The fresh segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil sweet potato market is segmented by product type into fresh, frozen, dried, and others. Among these, the fresh segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to demand for healthy, natural, and multi-purpose foods has increased. Consumers perceive sweet potatoes to be healthy foods, containing ample amounts of nutritious ingredients, dietary fibre, anti-oxidants, and vitamin A. As consumers increasingly favour plant-based diets and minimally processed products, the growth of the Brazilian sweet potato market is further enhanced.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil sweet potato market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players

- Agrícola Plantar

- KB Foods Comércio de Alimentos

- Expobraz Export Import e Agropecuária

- LOS NIETITOS S.A.

- B M Logistica International LTDA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Sweet Potato Market based on the below-mentioned segments:

Brazil Sweet Potato Market, By Nature

- Organic

- Conventional

Brazil Sweet Potato Market, By Product Type

- Fresh

- Frozen

- Dried

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 198 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |